Chapter 1: You have to know where you’re going

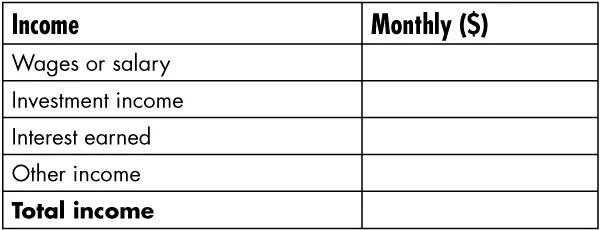

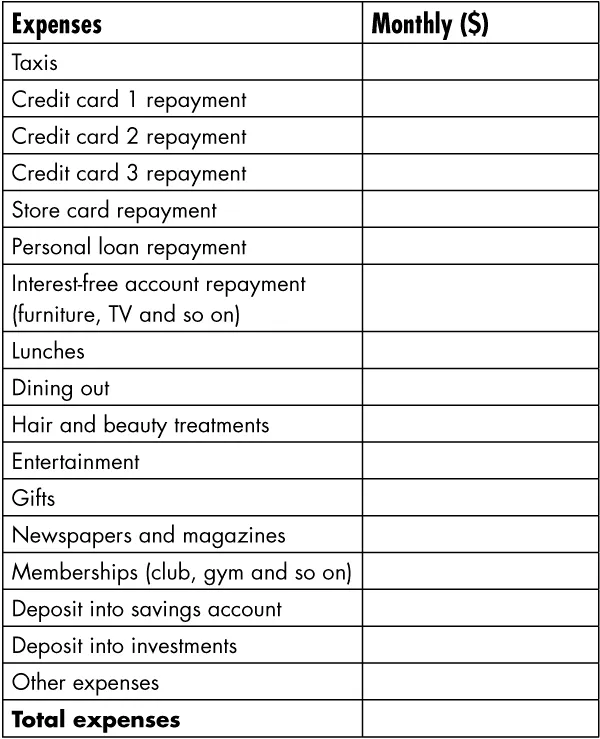

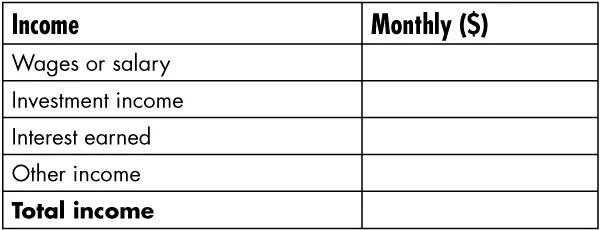

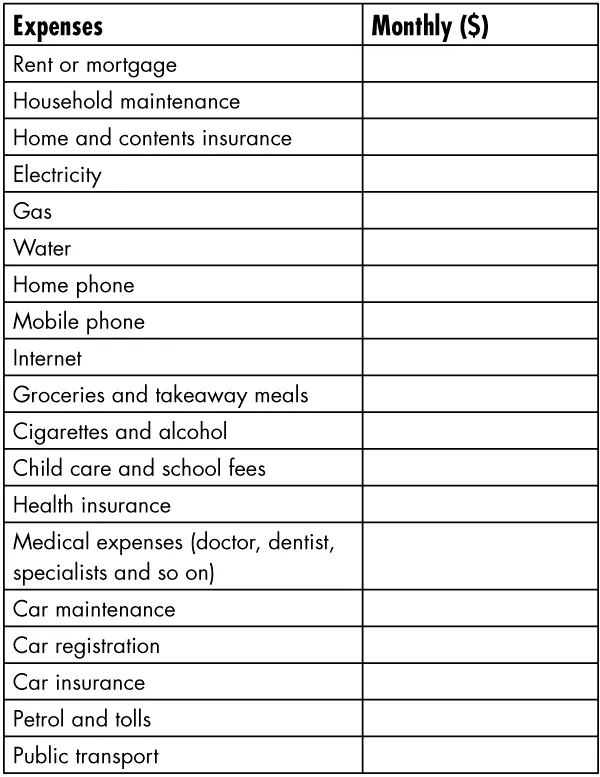

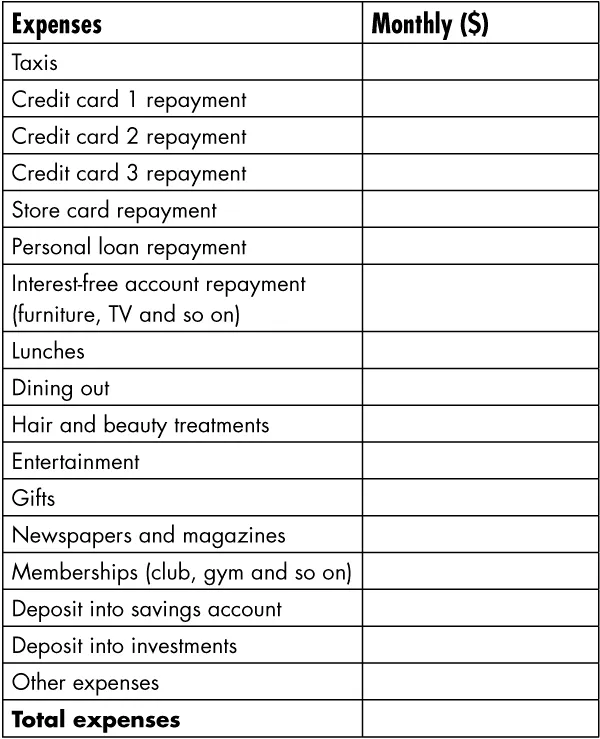

Before you commence a journey you need to know two things: where you are going and where to start. So, we need to find out where you stand financially. To do this you need to take some time now to fill in the budget overleaf to work out how much money is coming in each month and where it’s all going — this is your current cash flow. By completing the budget you will have a clear picture of where you are right now — where you may be overspending, and where you can cut back and divert extra funds to paying off your debt. From that picture you will be able to create your plan to escape from debt.

Total income – total expenses = ______________

Are your expenses more or less than your income? Are you solvent (that is, are you able to pay all your accounts) or are you insolvent (that is, are you unable to pay all your accounts)?

If you were a business, would you be solvent and viable? If you were an investor, would you look at the previous figures and want to invest in yourself? If you are solvent, you should be able to see how much reserve cash you can use to reduce your liabilities. If you suspect you may be insolvent, read on to discover the steps you can take to begin changing that.

Now you know your starting point for this particular journey. The next stage is working out your destination and how you are going to get there. By understanding the marketing techniques credit providers use and the human behaviours and attitudes that the marketing invokes, you will be able to create a plan to avoid these behaviours and patterns. You will also learn about the common mistakes people make with their finances and how they can keep you locked into a system that enjoys receiving your money for nothing.

Where do you want to go?

A power that we all possess is the ability to dream, to imagine. Sometimes we get clouded over by our obligations and forget to use the part of the brain that allows us to be free and create our future. By creating mental pictures of where we want to be we can activate our brains to do something towards making that image a reality. We can use that image to assess whether what we are doing at that particular time is going to help us or hinder us.

All successful people and ‘paths to success’ books talk about goal setting, but what is it? Goal setting is simply defining what you would like to have happen in your life. It’s the process of clarifying your direction.

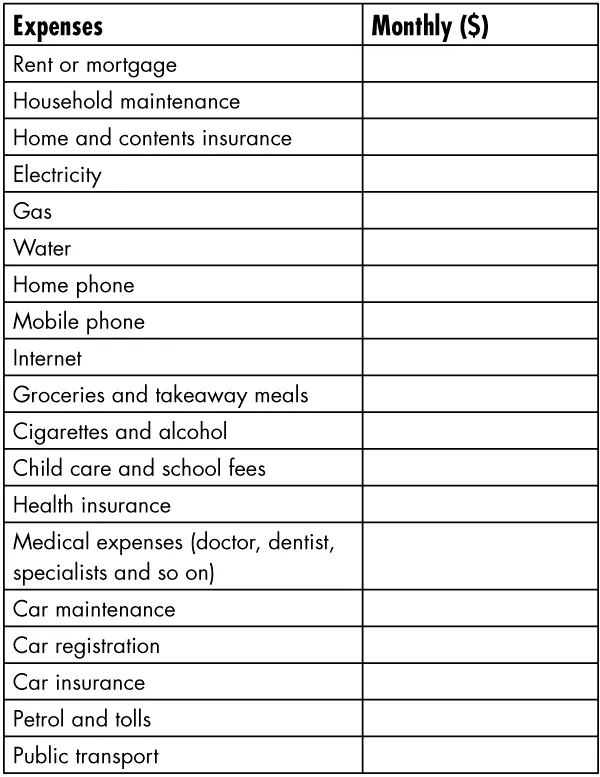

Society at the moment could be pictured in the following way.

Mark where you think you are in this pyramid.

Right now you’re probably like most adults who are working and paying off debts, and are struggling to move up from the base of the triangle.

Come back to this diagram in 12 months and draw another mark showing where you are at that point in time. It might be disheartening to think about a year of paying off debts, but take some time now to consider how you will feel if in two years from now you haven’t made any changes and are still on the base of the pyramid. Imagine what your life will be like if you don’t take action today.

What do you think you might miss out on in that time?

What do you think your life will be like in five years if you don’t take action today?

How about in 10 years?

How will you feel when you can’t afford to keep your house or your car?

Okay, shake out those painful images and breathe deeply. It’s difficult to imagine how your life may be if you continue with your current damaging behaviour, but it is an important part of the process of moving forward. Today is your chance to make a better future for yourself. You can start making the changes you need to get ahead right now.

If you’ve made mistakes in the past that have led you to a position of financial trouble or hardship, you need to look back and forgive yourself for making those mistakes. The power of forgiveness will release the problem from your mind and it will become a position of learning and reflection instead. Forgiveness allows you to own a problem. There is no blame, no putting the problem aside and hoping it will disappear, and there are no excuses. Holding onto a grudge or past hurt will only do more damage to the energy of your thoughts and the potential power of your future planning and abilities.

Forgiveness is a great way to clear out and eliminate the SWC language (should have, would have, could have) from your life. The SWCs will keep you in a limited space in your mind, so get rid of them from your repertoire.

Do you need to forgive someone else for placing you in a difficult financial position?

What can you learn from any past mistakes?

How can you avoid making the same mistakes in the future?

Looking back on the past mistakes, what are you grateful for? Can you be grateful for the fact that they opened your eyes to a damaging behaviour or belief?

Now, think about where you would like to be in the pyramid. Make another mark in the diagram, this time in a different coloured pen.

Why do you want to get there?

What is your motivation?

It is one of my ultimate goals to help more people to gain the knowledge that can put them on the path to regaining control, and as such, see the trend of people in financial difficulty reversed, as shown in the following diagram.

This book is a financial freedom plan and there is some work involved, but I want you to have fun along the way. I’m going to introduce you to several strengths and abilities that we all have. The first is the power of your imagination. The second is the power to focus your thoughts and be clear about what you desire. The third is to take action and set foot on the road to success.

Using your imagination is not just about making pretty pictures in your mind. It is about creating images that are so real and so inspiring that they will cause you to feel the event as though it was actually happening, to feel inspired enough that you will want to take immediate action. The images you create will help remind you of your destination and keep your mind on the task at hand. They will cause your mind to believe that they are already real, already tangible.

By visualising where you want to be, you can ask questions to evaluate your progress. For example, ‘Does buying this new flat-screen TV get me closer to or further away from my desired destination?’

Try this with me now. I want you to read this and the next paragraph, and then close your eyes and imagine. Picture yourself at a beautifully set table in a manicured garden where you are celebrating your freedom from debt with your friends.

What are you wearing? Is there laughter? Can you feel the sun warming your skin? Do you feel relaxed? Are you smiling? Take some time to create your scene and add a lot of detail to it. I want you to make that picture so real that you want to be there right now and you want to feel those feelings. Give your body and mind something to aim for.

This example is to show you that no matter what is happening in your life you can create a feeling of total relaxation and inner peace. The mental visualisation allows you to physically generate a slower heartbeat, muscular relaxation, deep diaphragmatic breathing and reduced blood pressure. From your mind you can contol your physical body.

In his 1905 findings Albert Einstein wrote the formula E=mc², which demonstrates the relationship between energy and matter. The formula shows that the two are interchangeable, and therefore that you can take the energy of your thoughts and feelings and convert them to matter — that is, they can become ‘real’ in your life.

I could write pages of instructions explaining how you can perform an action so you will get a result, and there are many good instruction manuals out there. Instead I want you to highlight why you want to escape from debt. I want you to create some momentum and become excited about what you are going to gain by making some changes to the way you handle your finances. By being clear about what you desire in your life and by generating a feeling of true excitement about the results, about being debt free, you’ll actually create your own plans and follow them through.

For example, you might realise, like I did years ago, that your car is keeping you in debt. I had to go to work simply to make the repayments, and if I didn’t go to work my car would be repossessed. This was a stressful time in my life, but the answer came that I...