![]()

PART I

WELCOME TO THE WAR ON WEALTH

![]()

CHAPTER 1

The Weapons of Mass Destruction in the War on Wealth

Government’s view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.

—Ronald Reagan

Taxes are the weapons of choice used by the government in its War on Wealth. Income tax, dividend tax, capital gains tax, estate tax, and income tax again on retirement plans are the new WMD. They may not be Weapons of Mass Destruction, but they are Weapons of Mass re-Distribution. Further, it impacts a hell of a lot more than 5 percent of U.S. taxpayers. You are the target.

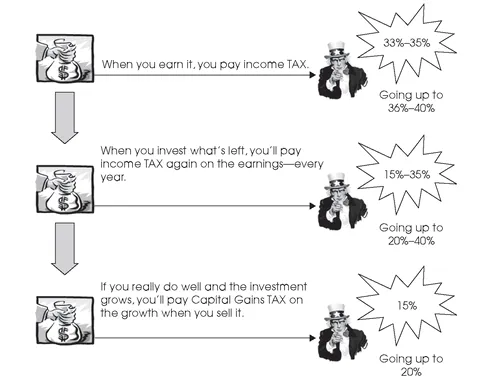

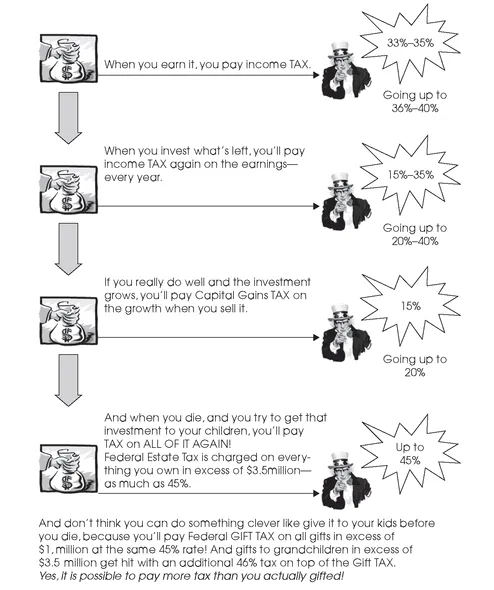

This chapter poses a simple question, “Just how many times can you tax the same damn dollar?” I tell you in advance that you’re not going to like the answer, but you need to know what you’re up against. We work under the brunt of a tax system that can impose different types of tax on the same dollar up to three or four separate times. With every tax dollar you pay you move farther along the road to accidental philanthropy. Let’s take a look at each tax, when it is applied, and just who pays it. If you have any antidepressants or antacids lying around the house, you may want to take them all now. Put the laxatives away—you’re not going to need ‘em.

Tax #1: The Federal Income Tax—Negative Impact 28 Percent to 35 Percent. Going to 36 Percent to 40 Percent

Before I get into what the income tax rate is now and what it will be when the Bush tax cuts expire in 2011 (as proposed under President Obama’s budget), let’s take a look at who actually pays this tax and how much we pay.

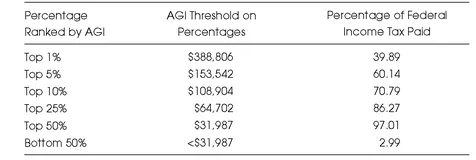

Table 1.1 shows that, according to the latest IRS statistics (based on 2006 Adjusted Gross Income, AGI), the top 5 percent of the highest earning Americans, pay more than 60 percent of all the income taxes paid. But here is the stunning part of that statistic—to be in that category you only need income over $153,000! To be in the top 10 percent, who pay 71 percent of all the taxes, your earnings only need to exceed, $108,000. If you want to be in the rare air of the 1 percent who pays 40 percent of all the income taxes, you only need adjusted gross income greater than $389,000. The bottom 50 percent pays less than 3 percent of the tax burden.

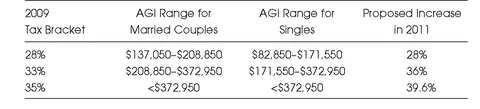

The takeaway from Table 1.1 is that while everyone seems focused on the evil top wage earner making more than $250,000 per year, the reality is that if you’re earning more than $150,000 you’re bearing the brunt of taxes as well. How much are we talking about? Take a look at Table 1.2.

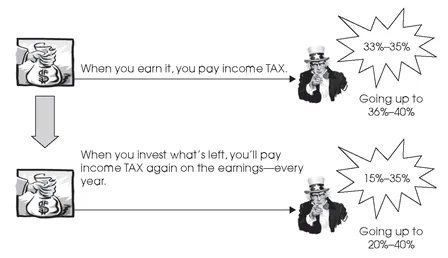

We may not like it, but it is the simplest to understand. For every new dollar we earn, we give away currently 33 cents to 35 cents. When the Bush tax cuts expire at the end of 2010, that number increases to 36 cents to 40 cents. Not great, but if that was the only time that dollar was taxed I don’t think many of us would complain. I’m not saying we’d be throwing a party, but we wouldn’t be miserable either. The problem is that if you play by the rules and save some of your money instead of spending it all, the government repays you by continually taxing that same dollar. How? Read on.

Table 1.1 Income Taxes Paid by Catagory

Source: IRS Statistics via Kiplinger.com, July 25, 2008, “What’s Your Share of the Nation’s Tax Bill?” by Kevin McCormally.

Table 1.2 Current and Proposed Income Tax Rates.

Tax #2: Investment Income Tax—Negative Impact: 15 Percent to 35 Percent. Going up to 20 Percent to 40 Percent

After you have paid income tax on your earnings, you have a choice as to what to do with what’s left. You can spend it, you can save it, or you can do a combination. Remember, we’re talking about your after-tax earnings, not your 401(k), or other pretax retirement plan (we cover those later). You probably spend some, save some in an effort to accumulate a nest egg for whatever the future holds. You would think that a country with one of lowest savings rates in world would provide an incentive to save, we don’t. In fact, we do the opposite; we tax the crap out it.

If you invest that after-tax dollar into corporate America (you know, the stuff capitalists do to make money and help the country grow) you’ll pay a tax on your earnings. If you buy corporate bonds the annual bond income is taxed at your ordinary income tax rate. If you buy a stock that pays a dividend, you’ll pay tax at the current dividend tax rate of 15 percent. Both rates are scheduled to increase under the proposed budget.

If you choose to invest some of your savings into other programs like real estate or more exotic funds, you will not escape an additional tax on your investment earnings. Municipal bonds are the only income-producing investment that is tax-free. Have you looked at those returns lately?

There’s no need to beat this to death, I have far more disturbing stuff to get to. I just want you to be aware of tax #2. A lot of people skip over it like it’s not a big deal. It is.

Tax #3: Capital Gains Tax—Negative Impact: 15 Percent Going to 20 Percent

In my view there is nothing quite as harmful as the tax on capital gains. It is a pure penalty imposed on the capitalist for investing in something that works. For the U.S. business owner, it is the ultimate slap in the face for his or her success. It is like the government saying, “Our way of thanking you for building this country is to tax you on the profits you made on the money we’ve already taxed, after taxing you on all the income that you produced.” Does that make any sense to you, or is it just me?

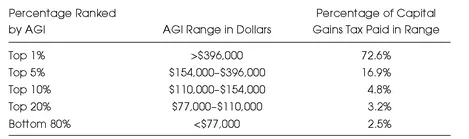

Like the federal income tax, the sweet spot for capital gains tax is the top 5 percent of income earners. People earning more than $154,000 per year account for 89 percent of all the capital gains tax paid! That is a stunning number. Even more stunning is the fact that the tax rate, currently 15 percent will increase under the proposed budget to 20 percent in 2011. That ought to stimulate the economy, right? Table 1.3 shows the stats on who pays the capital gains tax. For example, if you are a taxpayer in the top 10 percent of wage earners, your group accounts for more than 94 percent of all the capital gains taxes.

So, if you’re keeping score, first you pay 40 percent tax on the income you earn. Then, you take some of that remaining income and invest it for the future, and you pay 20 percent to 40 percent on the income that it generates each year. Then, if you’re lucky enough to invest in something that appreciates in value over time, you pay tax again when you sell it; to the tune of another 20 percent! And, that’s just the injury; we haven’t gotten to the insults yet.

Table 1.3 Who Pays Capital Gains Tax?

Source: IRS Statistics of Income, 2006; Institute on Taxation and Economic Policy, March 2006.

Tax #4: Federal Estate Tax—Negative Impact: 45 Percent on Transfers at Death Over $3,500,000

And then, you die. Imagine that after paying tax all along the way during your life, you get one more parting shot when you die and try to transfer what’s left to your kids. The message behind this tax is very clear; it is redistribution of the wealth in its purest form. It is the government standing between you and your children. It is that simple.

Federal estate tax impacts less than 2 percent of Americans each year, but accounts for more than $22 billion in tax revenue. We all receive a tax credit on the transfer up to $3,500,000 at death. Estate tax kicks in after that to the tune of 45 percent. Here’s the part you need to understand. Unlike the other three taxes you pay along the way, the federal estate tax is not a tax on new income or new growth. It is not a tax related to cash flow at all. It is a tax on all your stuff !

Everything, your house, your car, your rugs, your collectibles, your jewelry, your investments, your retirement plan (I get into more detail on that in a minute), your business, your investment real estate, your insurance, your furniture, everything you own is subject to estate tax. Even stuff you inherited from other family members—that you already paid tax on—is subject to tax.

And here’s the cruelest rub of all, though your assets are valued at current market prices, even if they are illiquid, the government wants cash—in nine months. Can you imagine forcing a sale of a home in the current real estate market? Do you think you’d get what the home is worth, especially if the buyers knew there was a government clock ticking?

Estate taxes can be devastating because it sucks out all of the cash first, and leaves the family with illiquid assets. The net result to the family can be far worse than the 45 percent price tag.

Don’t think that you can fool the IRS by gifting your assets to your children before you die. You can’t beat ‘em, in fact the tax could be worse. The gift tax rates are the same as the estate tax rates with one major difference, the free pass ($3,500,000 at death) is only $1,000,000 for gifts. Skip the kids and go directly to the grandkids and you face an additional generation-skipping transfer tax of 46 percent on transfers more than $3,500,000.

But Wait, There’s One More Tax

Do you have any idea what happens to your IRA when you die? You better grab a bucket; you’re going to need it.

The war on wealth takes place on many fronts; the bloodiest of these is the battle over control of the destiny of your retirement plan. Retirement plans come in many types: IRA, 401(k), SEP, SIMPLE, TSA, or 403(b). They are lumped together as “qualified retirement plans.” To keep things simple I refer to all qualified plans as IRAs. They are savings vehicles that the government allows you to fund on a before-tax basis. Of course, the amount you can deposit each year is capped because we wouldn’t want to encourage you to save too much. Your deposits are invested, and the whole thing gro...