- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

Praise for The Volatility Surface

"I'm thrilled by the appearance of Jim Gatheral's new book The Volatility Surface. The literature on stochastic volatility is vast, but difficult to penetrate and use. Gatheral's book, by contrast, is accessible and practical. It successfully charts a middle ground between specific examples and general models--achieving remarkable clarity without giving up sophistication, depth, or breadth."

--Robert V. Kohn, Professor of Mathematics and Chair, Mathematical Finance Committee, Courant Institute of Mathematical Sciences, New York University "Concise yet comprehensive, equally attentive to both theory and phenomena, this book provides an unsurpassed account of the peculiarities of the implied volatility surface, its consequences for pricing and hedging, and the theories that struggle to explain it."

--Emanuel Derman, author of My Life as a Quant "Jim Gatheral is the wiliest practitioner in the business. This very fine book is an outgrowth of the lecture notes prepared for one of the most popular classes at NYU's esteemed Courant Institute. The topics covered are at the forefront of research in mathematical finance and the author's treatment of them is simply the best available in this form."

--Peter Carr, PhD, head of Quantitative Financial Research, Bloomberg LP Director of the Masters Program in Mathematical Finance, New York University "Jim Gatheral is an acknowledged master of advanced modeling for derivatives. In The Volatility Surface he reveals the secrets of dealing with the most important but most elusive of financial quantities, volatility."

--Paul Wilmott, author and mathematician "As a teacher in the field of mathematical finance, I welcome Jim Gatheral's book as a significant development. Written by a Wall Street practitioner with extensive market and teaching experience, The Volatility Surface gives students access to a level of knowledge on derivatives which was not previously available. I strongly recommend it."

--Marco Avellaneda, Director, Division of Mathematical Finance Courant Institute, New York University "Jim Gatheral could not have written a better book."

--Bruno Dupire, winner of the 2006 Wilmott Cutting Edge Research Award Quantitative Research, Bloomberg LP

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

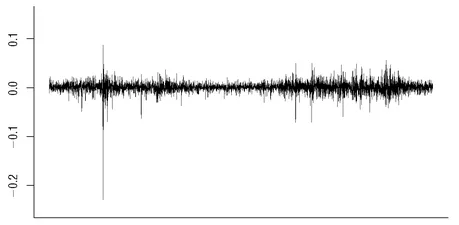

STOCHASTIC VOLATILITY

Table of contents

- Title Page

- Table of Figures

- List of Tables

- Praise

- Copyright Page

- Dedication

- Foreword

- Preface

- Acknowledgments

- CHAPTER 1 - Stochastic Volatility and Local Volatility

- CHAPTER 2 - The Heston Model

- CHAPTER 3 - The Implied Volatility Surface

- CHAPTER 4 - The Heston-Nandi Model

- CHAPTER 5 - Adding Jumps

- CHAPTER 6 - Modeling Default Risk

- CHAPTER 7 - Volatility Surface Asymptotics

- CHAPTER 8 - Dynamics of the Volatility Surface

- CHAPTER 9 - Barrier Options

- CHAPTER 10 - Exotic Cliquets

- CHAPTER 11 - Volatility Derivatives

- Postscript

- Bibliography

- Index

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app