This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Book details

Book preview

Table of contents

Citations

About This Book

- 70-chapter authoritative reference that covers therapeutic monoclonal antibody discovery, development, and clinical applications while incorporating principles, experimental data, and methodologies.

- First book to address the discovery and development of antibody therapeutics in their entirety.

- Most chapters contain experimental data to illustrate the principles described in them.

- Authors provide detailed methodologies that readers can take away with them and use in their own laboratories.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Therapeutic Monoclonal Antibodies by Zhiqiang An in PDF and/or ePUB format, as well as other popular books in Biowissenschaften & Biotechnologie. We have over one million books available in our catalogue for you to explore.

Information

PART I

ANTIBODY BASICS

CHAPTER 1

Therapeutic Monoclonal Antibodies: Past, Present, and Future

1.1 Introduction

1.2 Historical Aspects

1.2.1 Historical Aspects: Origins of Serum Therapy, Forerunner to the Monoclonal Antibody Business

1.2.2 IVIG Therapeutics and Prophylactics

1.3 Technologies Leading to the Current Monoclonal Antibody Engineering

1.3.1 Fundamental Breakthroughs Allowing for Recombinant Monoclonal Antibodies

1.3.2 Hybridoma Technology

1.3.3 Transfectomas and Chimeric Antibodies

1.3.4 Humanization Technology

1.3.5 Humanized Mice

1.3.6 Phage Display Technology

1.3.7 Human Antibody Libraries

1.3.8 Summary of Core Therapeutic Mab Technologies Leading to Therapeutics

1.4 From Biotechnology to BioPharma

1.4.1 From OKT3®d to Remicade: Early Successes and Disappointments

1.4.2 Examples of Other Early Mabs

1.4.3 Evolution of the Biotechnology Industry to the New BioPharma Industry

1.5 Challenges and Opportunities for Monoclonal Antibodies

1.5.1 SWOT Analysis

1.5.2 Competition on “Hot” Targets

1.5.3 Targets

1.5.4 Differentiation and Fit-for-Purpose Biologies

1.6 Summary, and “Where Do We Go From Here”

References

ABSTRACT

In this chapter, an overview of the therapeutic antibody industry today, including the many commercial antibodies and Fc fusions and the rich clinical pipeline, is presented and analyzed. The long history of antibodies is given to bring context to the therapeutic antibody industry. This history includes serum therapy, the use of IVIG, and the evolution of those therapies into the development of the monoclonal antibody business as we know it today. The history of technologies that fostered the revolution of therapeutic antibody development in the 1990s is also described. Finally, the future of the therapeutic monoclonal antibody and Fc fusion business is presented along with opportunities and challenges facing the business and those who work in it.

1.1 INTRODUCTION

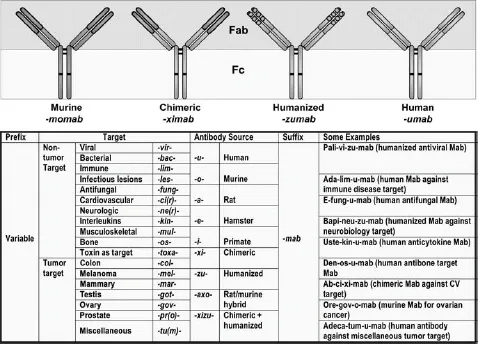

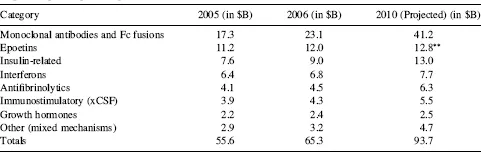

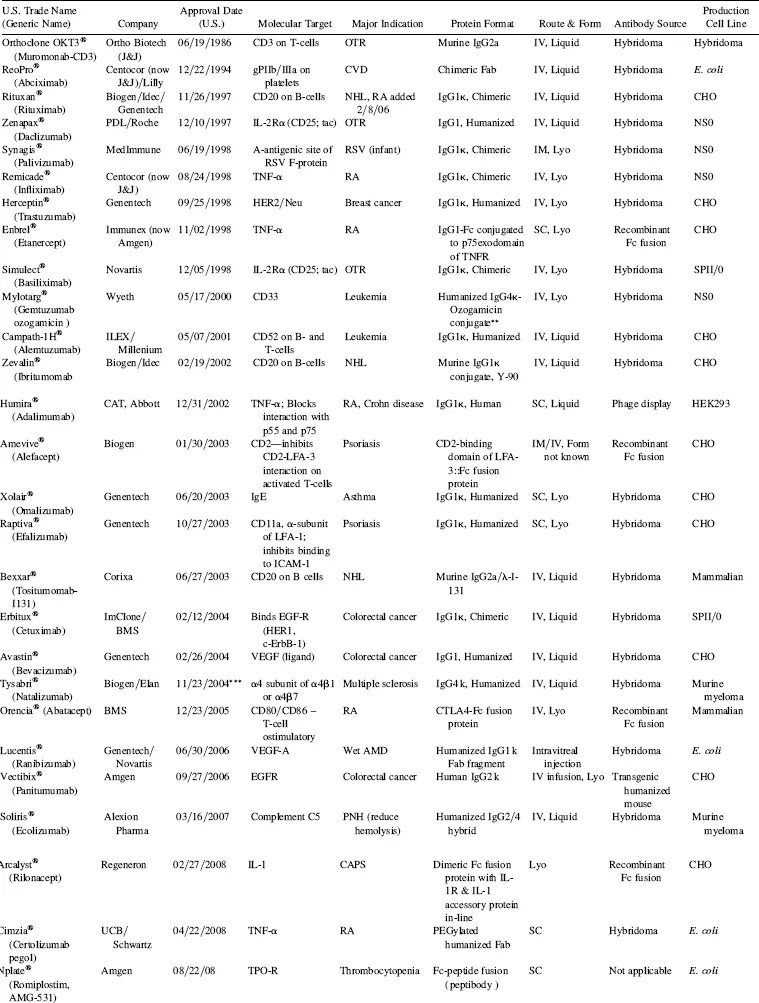

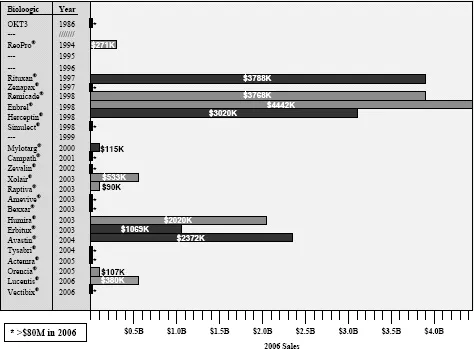

Protein therapeutics in general, and more specifically, therapeutic monoclonal antibodies (Mabs; Fig. 1.1) and Fc fusion proteins, have become a significant addition to the pharmaceutical repertoire over the past 20 years, and promise to play an even more significant role in the future of pharmaceutical intervention in diseases (Carter 2006; Riley 2006; Dimitrov and Marks 2008; Leader, Baca, and Golan 2008). In total, protein therapeutics produced by the BioPharm industry had over $55 billion in sales in 2005 (Table 1.1), approximately 20 percent of the roughly $280 billion 2005 pharmaceutical market. Based on the increase in value of protein therapeutics already on the market, therapeutic proteins are projected to reach about $94 billion by 2010 (Table 1.1), which calculates to an approximately 12 percent compound annual growth rate over that period. The 27 currently marketed monoclonal antibodies and Fc fusion proteins (see Table 1.2 for a complete listing) combine to make up 35 percent of the market value of all therapeutic proteins (based on 2006 data; Table 1.1), but are projected to increase in proportion by 2010, especially now that the market for epoetins has weakened based on safety concerns raised in mid-2007. Sales in 2006 for therapeutic Mabs and Fc fusion proteins topped $23 billion (Table 1.1), led by Enbrel®, Rituxan®, Remicade®, and Herceptin®, all of which were approved in the 1997–1998 time frame (Fig. 1.2). Of the six Mabs and Fc fusions brought to marketin 1997–1998, four (Rituxan®, Remicade®, Enbrel®, and Herceptin®) are significant blockbusters, each with markets great than $3 billion (Fig. 1.2). Of the more recently approved Mabs, Humira®, Erbitux®, and Avastin®, all approved in the 2003–2004 time frame (Table 1.2, Fig. 1.2), had not yet hit their peak sales by 2006, the time at which these numbers were generated. Thus, it is expected that these successful new entries also will hit blockbuster status like some of their predecessors. The key inflection points for success in bringing these Mab-based biologics to market appear to be the late 1990s, 2003–2004, and the period 2007–2012 (Fig. 1.3), the latter being the period in which we are currently working. This near-term future inflection point is likely to be a direct result of the success of monoclonal antibodies marketed in the late 1990s, as well as a maturation of antibody engineering technologies and strategies to make more commercially successful biologics molecules.

Figure 1.1 The different forms of therapeutic monoclonal antibodies that have been approved for marketing, including murine, chimeric, humanized, and fully human antibodies, as well as how the generic names are applied to each of them based on structure, source, and target. (See color insert.)

TABLE 1.1 Breakdown of Estimated Market for Protein Therapeutics Based on the Sales of the Top-Selling Biologies Drugs*

*Based on published 2005 and 2006 sales, and 2010 projected sales of the top 70 biologics currently on the market, excluding vaccines (multiple sources).

*Projections were made prior to published safety concerns in mid-2007, which have depressed overall sales of epoetins.

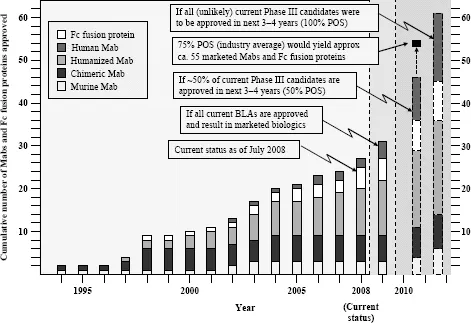

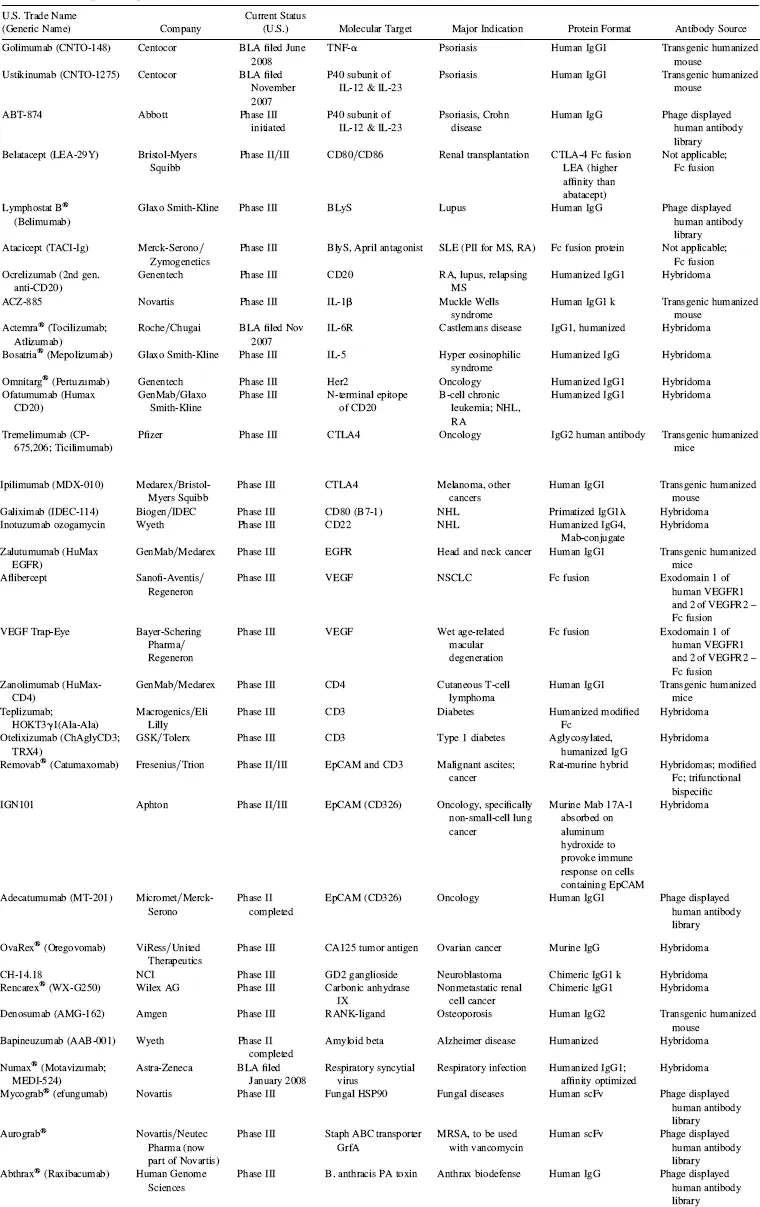

At the time of this writing, Biologic License Application (BLAs) for four additional antibodies had been submitted for regulatory approval in the United States (Table 1.3), and an additional 30 Mabs and Fc fusion proteins are in advanced clinical trials (defined here as Phase III or entering into Phase III based on successful completion of Phase II clinical trials; Table 1.3). Between 2007 and 2012, the growth of marketed monoclonal antibodies promises to be extraordinary (Fig. 1.3). Although not probable, if all current Phase III candidates listed in Table 1.3 were to achieve registration, this would translate to over 60 monoclonal antibodies and Fc fusion proteins on the market by the 2012–2013 time frame (Fig. 1.3). Even if only 50 percent are successful in being marketed, that number still reaches 46, a 50 percent increase in numbers over the currently marketed antibodies and Fc fusion proteins (Fig. 1.3). With the current rate of success for monoclonal antibodies transitioning from Phase III to the market at 75 percent (KMR Group, Inc. 2007), this would translate into about 53 to 54 Mabs and Fc fusion proteins on the market by the 2012–2013 time frame. These additional marketed bio-logics should have a substantial impact on the pharmaceutical industry over the next five years. It has been projected that 60 percent of the total growth in the pharmaceutical industry between 2004 ($271 billion total) and 2010 ($317 billion) will be driven by biologics (Riley 2006), and the data presented herein (Table 1.1, Fig. 1.2) suggest that a significant fraction of that growth will be accounted for by Mab and Fc fusion proteins.

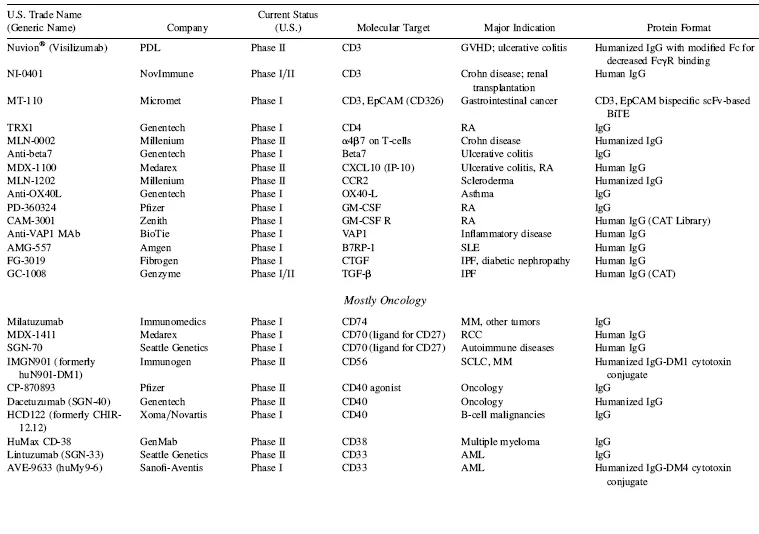

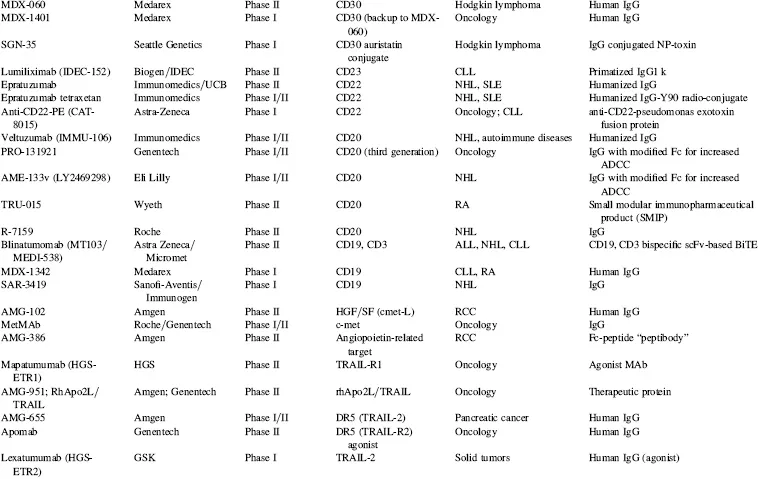

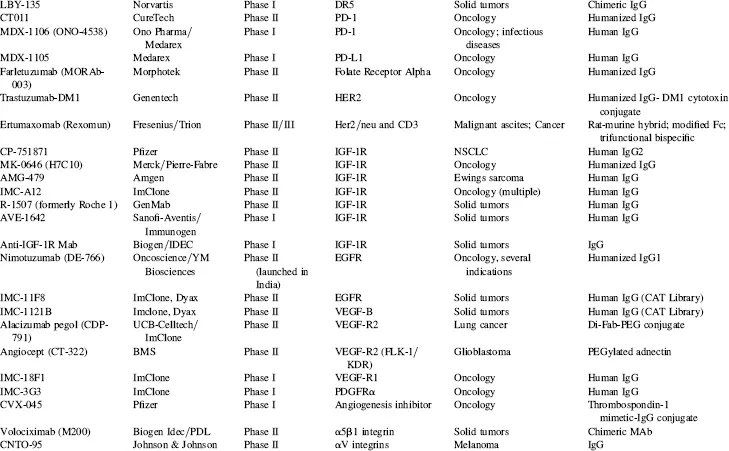

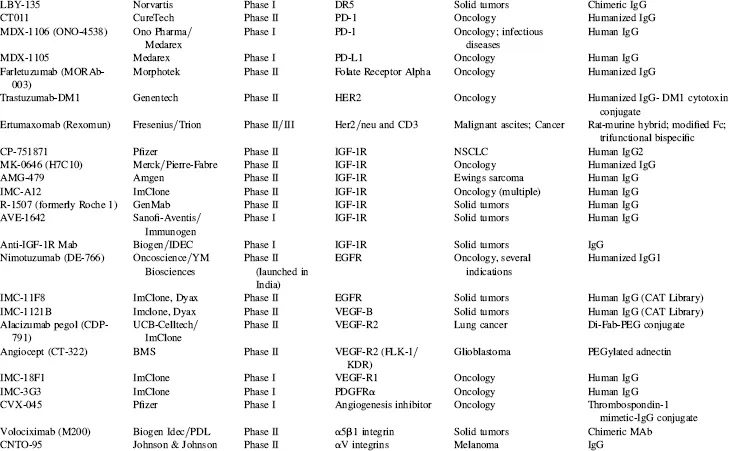

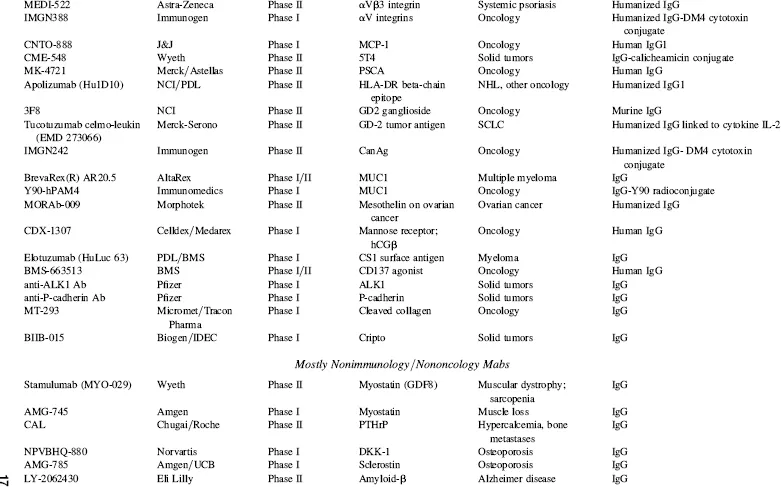

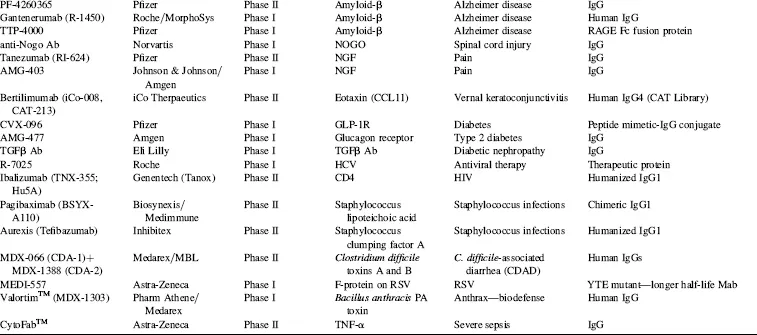

There are currently over 140 additional publicly stated, commercially funded monoclonal antibodies in early clinical trials (defined here as Phase I and Phase II candidates combined), many of which are listed in Table 1.4. With the probability of success (POS) for antibodies transitioning between Phase II and Phase III currently at about 62 percent (KMR Group, Inc. 2007), approximately 50 of the 84 Phase II candidates shown in Table 1.4 should result in Phase III candidates. Of the 58 known Phase I candidates listed in Table 1.4, 35 should transition to Phase II (based on 61 percent POS; KMR Group, Inc. 2007), and of those, 22 would be predicted to make it to Phase III based on the 62 percent POS for that transition. Thus, of the 142 early phase candidates listed in Table 1.4 (these represent the majority, but likely not all, early phase commercially funded clinical candidates), 72 (50 from current Phase II candidates and another 22 from the current Phase I candidates) should eventually reach Phase III. Based on the 75 percent POS for transition from Phase III to marketing approval (KMR Group, Inc. 2007), this could result approximately in an additional 54 Mabs and Fc fusion proteins on the market between 2013 and 2018 (Fig. 1.3).

TABLE 1.2 Marketed Monoclonal Antibodies and Fusion Proteins*

Abbreviations: OTR, organ transplantation rejection; CV, cardiovascular disease; RA, rheumatoid arthritis; RSV, respiratory syncytial virus; NHL, non-Hodgkin’ s lymphoma; TNF, tissue necrosis factor; PNH, paroxysmal nocturnal hemoglobinuria; AMD, age-related macular degeneration; CAPS, cropyrin-associated periodic syndrome; LYO, lyophilized; IV, intravenous; SC, subcutaneous; ND, not disclosed.

*Data obtained from prescribing information released by the manufacturers, company websites, Prous Science Integrity.

**Conjugate is ozogamicin, a calecheamycin (natural product cytotoxin).

***Suspended 2/28/05; reinstated under specified conditions.

Figure 1.2 Sales of marketed antibodies in 2006 as a function of the year in which they reached the market. Two important features can be observed: (1) only 9 of 23 of the marketed antibodies and Fc fusion proteins have achieved substantial sales; (2) several of the Mabs and Fc fusion proteins on the market from the 1997–1998 period have been major blockbusters, which has driven broad interest by the pharmaceutical interest in biologics.

Figure 1.3 Accumulated Mabs and Fc fusion proteins on the market in the United States up to 2008, with projections for near-term (2012–2013 timeframe) future numbers based on current Phase El clinical candidates.

TABLE 1.3 Examples of Important Monoclonal Antibodies and Fc Fusion Proteins in Advanced Clinical Trials*

Abbreviations: MS, multiple sclerosis; NHL, non-Hodgkin’s lymphoma; MRSA, methicillin-resistant Staphylococcus aureus; NSCLC, non-small cell lung cancer; RA, rheumatoid arthritis; SLE, systemic

lupus erythematosus.

*Data as of August 2008; data obtained from company websites, Prous Science Integrity, and www.clinicaltrials.gov.

TABLE 1.4 Key Phase I and Phase II Clinical Candidates by Indication and Target*

Abbreviations: ADCC, antibody-dependent cellular cytotoxicity; ALL, acute lymphoblastic leukemia; AML, acute myelogenous leukemia; CLL, chronic lymphocytic leukemia; GVHD, graft-versus-host disease; IBD, irritable bowel disease; IPF, idiopathic pulmonary fibrosis; MM, multiple myeloma; NHL, non-Hodgkin’s lymphoma; NSCLC, non-small cell lung cancer; RA, rheumatoid arthritis; RCC, renal cell carcinoma; RSV, respiratory syncytial virus; SCLC, small cell lung cancer; SLE, systemic lupus erythematosus.

*Data as of August 2008; data obtained from company websites, Prous Science Integrity, and www.clinicaltrials.gov.

Taking into account the currently marketed Mabs and Fc fusion proteins (Table 1.2, Fig. 1.3), as well as the POS-adjusted clinical candidates listed in Table 1.3 (late clinical phase) and Table 1.4 (early clinical phase), there could potentially be a total of 135 Mabs and Fc fusion proteins on the U.S. market by the 2018 time frame, a decade from now. This number is approximately five times the current 27 Mabs and Fc fusion products on the market today, most of which have been marketed in the 10 year period of 1997–2007. These calculations, while necessarily forward projecting, suggest that there will be significant expansion of Mab and Fc fusion products reaching the market over the next decade, which could have a profound and lasting impact on the pharmaceutical industry in general. This could be especially noticeable if the overall POS for Mabs remains in the 18 to 20 percent range, as compared with the historical POS for small molecules, at about 7 to 8 percent. Thus, by 2018, a decade from now, therapeutic proteins in general and, more specifically, Mabs and Fc fusion proteins, should comprise a significant fraction of worldwide pharmaceutical revenues, considerably higher than the 20 percent fraction that biologics make up today.

In a sampling of the more than 1500 clinical trials testing Mabs today (www.clinicaltrials.gov), approximately 45 percent of these represent oncology studies using “naked” antibodies (i.e., no toxin- or radioconjugate attached). Another 31 percent, many funded by the National Cancer Institue (NCI) and/or academic groups, are being conducted using radioconjugated Mabs to kill tumors, and 2 percent represent toxin-conjugates for oncology. Thus, 78 percent of all current clinical trials on Mabs are focused on the therapeutic area of oncology. Fourteen percent are focused on immunology-related indications, and the final eight percent on non-oncology, non-immunology-related indications. These clinical trials data are somewhat skewed, however, by the large number of academic- and government-funded Phase I clinical trials focused on testing radioconjugated monoclonal antibodies for oncology indications. In another view of the therapeutic area breakdown, of the more than 200 combined clinical candidate Mabs and Fc fusion proteins listed in Tables 1.3 and 1.4, approximately 50 percent are either used for, or are being tested primarily for, oncology indications, 32 percent for immunology-related indications, and about 18 percent for non-oncology, non-immunology indications. This final category includes a wide range of indications, including, for examples, atherosclerosis, diabetes, infectious diseases, bone loss, muscle wasting and dystrophy, and other assorted indications.

1.2 HISTORICAL ASPECTS

It now has been approximately a third of a century since Köhier and Milstein described methods for producing murine hybridomas, in what is accepted by most as the dawn of the era of therapeutic monoclonal antibodies (Köhier and Milstein 1975). After Mab hybridoma technology was first described in 1975, it took 11 years, until 1986, before the first commercial therapeutic antibody, Orthoclone OKT3® (muronomab-CD3), was licensed by Ortho Biotech, a subsidiary of Johnson … Johnson, for inhibition of transplanted organ rejection. It was yet another eight years before the second antibody, the chimeric Fab antibody, ReoPro® (abciximab), was developed by Centocor (now a subsidiary of Johnson … Johnson), and marketed by Eli Lilly to inhibit platelet aggregation post-cardiovascular surgery. Thus, even two decades after the seminal paper was published on monoclonal antibodies, only two monoclonal antibody products had been brought to the market. This changed dramatically in 1997–1998, when a total of five monoclonal antibody drugs were introduced to the market (Table 1.2, Fig. 1.3), generating considerable interest in the field of therapeutic monoclonal antibodies. How did we get from discovery to market, and why did it take so long? In the next section, the history leading up to the current status of the monoclonal antibody field will be addressed.

1.2.1 Historical Aspects: Origins of Serum Therapy, Forerunner to the Monoclonal Antibody Business

The first concept of using antibodies as therapeutics came long before the generation of hybridomas, as shown in Figure 1.4. It started when Robert Koch,...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- FOREWORD

- PREFACE

- CONTRIBUTORS

- PART I ANTIBODY BASICS

- PART II ANTIBODY SOURCES

- PART III IN VITRO DISPLAY TECHNOLOGY

- PART IV ANTIBODY ENGINEERING

- PART V PHYSIOLOGY and IN VIVO BIOLOGY

- PART VI ANTIBODY CHARACTERIZATION

- PART VII ANTIBODY EXPRESSION

- PART VIII THERAPEUTIC ANTIBODIES

- ABBREVIATIONS

- INDEX