- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Essentials of Banking

About this book

The essential guide for finance professionals in all industries for quick answers to banking questions, Essentials of Banking provides a nuts and bolts presentation explaining the regulatory, business, and people facts of the business of banking in a handy, concise format. It is the only guide you will need containing all the relevant facts of banking, all in one place.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Chapter 1

Banking 101: Understanding the Basics

After reading this chapter, you will be able to:

- Understand the origin of banking and how it has evolved.

- Explain the role of banks in the creation of money.

- Discuss the essential elements of electronic banking and funds transfers.

- Recognize the role of banks in financial intermediation.

- Describe the range of products and services offered by banks.

- Understand how financial products and services satisfy the needs of customers.

What Is a Bank?

A bank is defined by Merriam-Webster’s online dictionary (www.merriamwebster.com) as “an establishment for the custody, loan, exchange, or issue of money, for the extension of credit, and for facilitating the transmission of funds.”

While they are simple to describe, the roles of banks, bankers, and banking are—for some—not as simple to understand.

“Banking” can be defined as “the business of banking,” a vibrant business that continually evolves to meet the latest financial needs and economic conditions. In order to understand how banking evolves, it is important to gain a broad understanding of financial concepts, fundamental banking functions, and the banking business in a technology-driven world.

From Barter to Payment Systems

Money is the basis of banking. And the basis of money is the need for a substitute for directly bartering for everything we need. “Barter” is defined as trading without the use of money—and it can be traced back to the very origin of civilization. Can you imagine how our economy would operate if we didn’t use money? You would either have to be completely self-sufficient or have to produce a good or service that you could trade for whatever you could not produce yourself. Most of us would spend our time making almost everything we needed (including growing food, building shelter, and making clothes) or working at a specialty that others needed so we could trade for many of the necessities of life. The specialties would be few. Our technological advances would be restricted by an incredibly inefficient system of exchanging goods and services.

The development of money was a significant advance over barter as a payment system. But today we have extended the concept of payment systems way beyond the original concept of money. One of the first steps into more sophisticated payment systems was the development of checks and checking accounts.

Money is a symbol of value, and checks are a symbol of money. We give another person a check when we want to give him or her money. The other person then takes that check and sends it through the check clearing system so that the money it represents is transferred from us to him or her.

Believe it or not, prior to the age of computers, banking employees posted transactions on individual account cards. Banks had to close for business early in the afternoon so that several hours could be devoted to recording and reconciling the day’s transactions.

The early computer systems used in banking seemed like a tremendous advance over manual systems. But today they seem like pocket calculators compared to the computing power that the banking industry and customers depend on and, frankly, take for granted.

Computers have changed the face and complexion of the banking business. Computers have changed how customers use banking services, how banks operate internally, and how banks interact with the rest of the financial system.

Technology has revolutionized banking and continues to do so at a fiercely accelerating speed. Computers, the Internet, mobile technology, wireless access, and other improved communication systems give banking great flexibility and efficiency. All of this growth continues to create new opportunities to reinvent banks and, in particular, banking careers.

Banking also fulfills a valuable role in society by:

- Playing a key role in financial intermediation

- Creating financial products and services that benefit businesses and consumers

- Driving a thriving financial system regulated by state and federal governments

- Facilitating the creation of money

- Being involved in the transfer of funds

- Reinventing the financial future—the future of banking

In order to understand the business of banking, it is useful to understand one of its key elements—financial intermediation.

Bank’s Role in Financial Intermediation

Financial intermediation is an important role in banking. The term “financial intermediation” means accepting funds from one source (such as savings customers) and using the money to make loans or other investments. Essentially, financial intermediation means acting as a go-between for individuals or businesses that have extra money and individuals or businesses that want to borrow money.

Each person or business with extra funds could try to find a borrower on its own, but the process would be time-consuming and difficult. Can you imagine how difficult it would be to find another person who would want to borrow the exact amount of your savings for the length of time you want to lend it?

Financial intermediation is a business activity that supplies a service by pooling funds from many different sources and advancing loans and making investments. The people and businesses that supply the funds receive interest or services for allowing their funds to be pooled and loaned out or invested. The borrowers pay interest for the privilege of borrowing money they use to generate income or meet other goals.

Another way to understand financial intermediation is to compare it to another type of intermediation. Consider how a blood bank operates. A blood bank finds healthy individuals and arranges for them to donate blood. The blood bank then processes the blood and makes it available to hospitals. The blood bank does not actually use the blood; it simply acts as a channel (or intermediary) between the donors and the hospitals.

Just as the blood bank functions between the donor and recipient of blood, a bank acts as an intermediary between those with extra money and those who want to borrow money. It is a financial intermediary. This is one of the unique characteristics of financial institutions, and of banks in particular—their role as financial intermediaries.

Banking and the “Creation” of Money

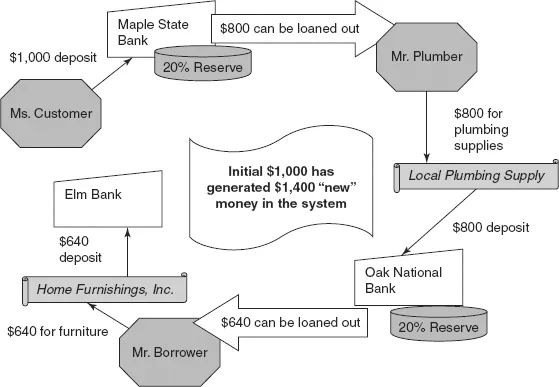

Banking plays the most critical role in the “creation” of money—no, not by cranking up the presses and printing money. Banks do not print currency What we mean by the “creation of money” is this: The financial system “creates money” by expanding the supply of money through deposit and loan transactions. Exhibit 1.1 is an example of how it works.

EXHIBIT 1.1 Creating Money

Assume that Carol Customer puts $1,000 in a checking account at Maple State Bank. The bank must set aside part of this money as reserves and can then loan out the remainder.

The Federal Reserve System establishes reserve requirements. Reserve requirements are usually fairly low, but, for this example, assume they are 20 percent of the deposit. This would mean that $800 of the deposit could be loaned out.

Paul Plumber, a Maple Bank customer, needs to borrow money and draws on a line of credit in the amount of $800. He writes out a check for the $800 and gives it to Local Plumbing Supply to purchase materials for a bathroom-remodeling project he has been hired to complete.

Local Plumbing Supply deposits the check to its checking account at Oak National Bank. Oak National Bank can also lend out these funds (after setting aside a portion for reserves).

Bill Borrower, a customer of Oak National Bank, draws on his home equity line of credit in the amount of $640. He uses the funds to purchase furniture from Home Furnishings, Inc.

Home Furnishings, Inc. then deposits this money in its checking account at Elm Bank.

This cycle of deposits and loans continues to “create” additional money with each set of transactions. The initial deposit of $1,000 has generated “new” money in the amount of $1,440 in the financial system.

In addition to the creation of money, banking plays an important part in the economy by providing for payment mechanisms or methods to transfer funds. Cash is the historical basis for trading goods and services in our country, but today most consumers or businesses use other methods to transfer funds from one person or business to another.

The traditional system historically is the use of checks and checking accounts. Our payment systems, however, have evolved to include other systems such as credit cards, debit cards, paperless checks, and electronic transactions (such as payments that are automatically deducted from checking accounts) to give consumers and businesses many other alternatives to cash. With the advent of Internet banking systems, the range of choices continues to expand.

Satisfying Customers’ Needs—Banking Is a Service Business

While banks play a critical role in financial intermediation and in the creation of money, banking’s primary focus is the satisfaction of customers’ financial needs. Banking services satisfy financial needs such as:

- Earning a return on idle funds

- Borrowing money to achieve goals

- Preventing losses

- Managing money conveniently and efficiently

To be successful, banking must meet the financial needs of customers. But most customers need assistance to wade through the bewildering array of banking products and services. Many customers are not aware of all the different services available and may not have a good understanding of whether a particular service would be useful to them. Often customers are overwhelmed at the vast array of products and services. Banking professionals are the link between these products, services, and customers.

Bankers act as interpreters between the banking products and services and help custom...

Table of contents

- Cover

- Contents

- Title

- Copyright

- Dedication

- Acknowledgments

- About the Author

- Preface

- Chapter 1: Banking 101: Understanding the Basics

- Chapter 2: Deposit Insurance and the Regulatory Environment: How Does It All Work?

- Chapter 3: Understanding Banking Deposit Accounts, Interest Rates, and Limitations

- Chapter 4: Regulatory Compliance: The Essentials

- Chapter 5: The Business of Banking and the Bank Secrecy Act

- Chapter 6: The Banker: Knowledge, Skills, and Attitude

- Chapter 7: The Ethical Banker: An Introduction to Ethics

- Chapter 8: Managing Others: What Every Banker Needs to Know

- Chapter 9: The Market: It’s Bigger than You Think

- Chapter 10: Customer Service: The Key Ingredient

- Chapter 11: Context and Content: Putting It All Together

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Essentials of Banking by Deborah K. Dilley,Deborah K. Dilley in PDF and/or ePUB format, as well as other popular books in Economics & Banks & Banking. We have over one million books available in our catalogue for you to explore.