![]()

Part I

The household debt explosion

Between 1992 and 2008, Australians experienced a 17-year-long economic boom that handed us a golden opportunity to get into financial shape — but we blew it. With an unprecedented run of uninterrupted economic growth following the 1990–91 recession until the 2008 credit crisis, we had the best-performing economy in the Western world. During this time we enjoyed rising incomes, stable government, no major wars and low unemployment, interest rates, inflation and oil prices. Despite this lengthy period of superb economic conditions, we didn’t get our houses in order. Instead, we went on a debt-fuelled spending binge:

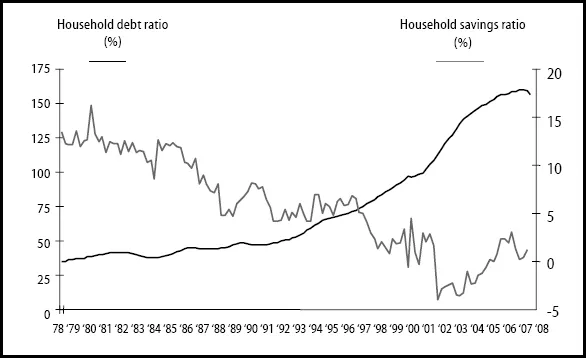

We borrowed more and more, saved less and less, and continued down the same path of increased spending and borrowing that we have been following since the 1970s (see figure 1.1).

All this occurred at a time when, according to the Australian Bureau of Statistics, total salaries and wages grew by less than 6 per cent per year, inflation ran at less than 3 per cent per year and the population grew by just 1 per cent per year. The corporate sector cleaned up its act and reduced debt levels, and the federal government got out of debt and into surplus. But the household sector, which makes up two-thirds of the overall economy, loaded up on debt and spent as if there was no tomorrow! In fact, for most of the 2000s Australia had a negative household savings rate, meaning we spent more than we earned. We kept on spending even though our wallets, purses and bank accounts were empty — and we borrowed even more to make up the difference.

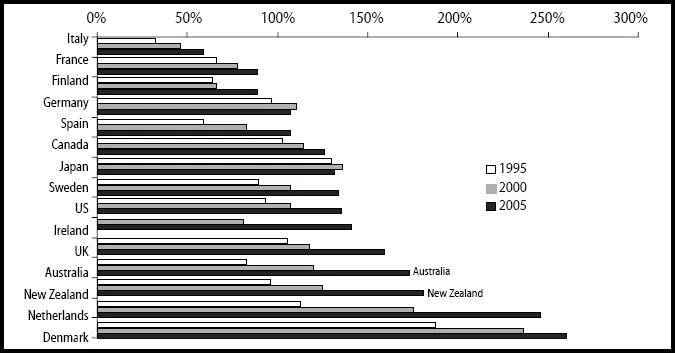

Australia’s and New Zealand’s performance on the household finances front are just about the worst in the world. Our levels of household debt are even higher than the US and UK where the 2008–09 credit crisis hit hardest, and our debts have been growing at a faster rate than almost any other country (see figure 1.2).

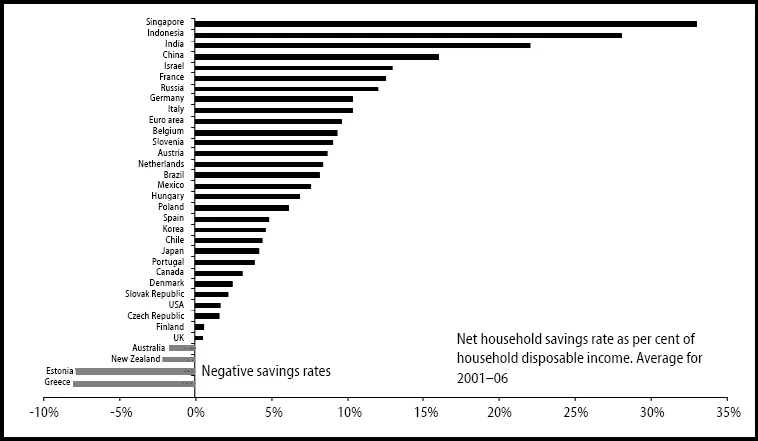

We are among the worst savers in the world. Over the 30 years leading up to the 2008–09 economy crisis, we had been saving less and less of our income, and now the only countries with worse household savings rates are Greece and Estonia (see figure 1.3).

Our nil or negative savings rate, together with our persistent current account deficits, means we haven’t even been able to generate the investment required to provide jobs for future generations. We need to rely on the savings of foreigners for our economic welfare. A country with a current account deficit is like a household that spends more than it earns. In order to make up the difference it must either borrow more from foreigners or sell more assets to foreigners. In doing so, we burden future generations with interest on the debt and we lose the future income from the assets we sell. Take a look at the top countries in figure 1.3. They have been powering ahead and building wealth rapidly over the past couple of decades, while those at the bottom have had to rely on the crumbs from their banquet.

Over the past decade the world went on a debt-fuelled consumer spending spree and Australians were the worst offenders. We were hypnotised by a string of unrealistic assumptions that turned out to be false:

- house prices would never fall (they do)

- share prices would keep rising forever (they don’t)

- China and India would somehow be ‘uncoupled’ from the rest of the world and keep commodity prices high (they didn’t)

- inflation and interest rates would never rise (they do).

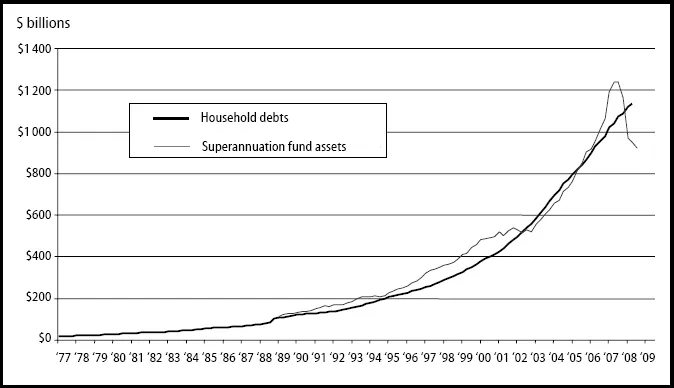

Lenders abandoned basic lending rules and consumers abandoned common sense. Now the party’s over and we’re left with a mountain of debt. Our retirement funds in the superannuation system have been growing over the same period, but we can’t rely on this to get us out of debt and fund our retirements as well. The ‘superannuation revolution’ has been more than wiped out by the household debt explosion. On a net basis we’re actually no better off than before the compulsory superannuation system started 20 years ago, because household debts have risen faster and further than superannuation fund balances (see figure 1.4). We need to get out of debt — fast.

Having high levels of household debt is dangerous at a national level and for each household. High debts make us vulnerable to economic shocks such as rising interest rates and unemployment, as well as falling incomes, house prices and asset values.

High debts also mean we are not financially independent; rather, we are at the mercy of lenders and reliant on others for our financial wellbeing. The sooner we get out of debt the sooner we can get on with building real wealth for the future — for our retirement and for our families. Having no debt means having more control over our lives and more flexibility — to not have to work just to pay the mortgage and other debts, and to be able to decide for ourselves when we want to work less, retire, travel, study or take a break. Having no debts also means less stress and less worry, and that means a healthier and more enjoyable life.

Getting out of debt is not just a good idea in recessions. Having no personal debt is one of the fundamental principles of building wealth. Personal debts comprise all debts that aren’t used to generate investment or business income. These include home mortgages, credit cards, personal loans, lines of credit, car loans, boat loans and all other types of consumer lending.

Getting into debt is easy. We are constantly bombarded with offers of easy credit almost everywhere we look — on the TV and radio, at the cash register and ATM, through the mailbox, via email, text messages on our phones and pop-up ads on the internet, and on billboards, bus sides and trains. Resisting all these temptations and actually paying off debt may seem hard but it need not be. Hundreds of thousands of people have done it and so can you.

The methods outlined in this book come from my many years in the lending game, both through my professional career and as an investor. I was initially a lender by trade. I started out in the early 1980s as a lender and spent many years in major Australian and international banking groups. I have seen the lending game from all angles — from lending to consumers and small businesses to major corporations and everything in between. My time in the banking system included several senior executive roles, from running branch networks, developing products and systems, and running marketing departments, to being chairman of the pricing committee and chief financial officer of one of the ‘big four’ retail banks in Australia. I have consulted to mortgage brokers and originators. Over the years I have also built, bought and sold a number of businesses, and advised business owners and companies on financial structure and raising capital.

Although my wife and I made good incomes while we were working, we have made most of our money from our investments, mainly in properties and shares. We discovered early on that working pays the bills but it doesn’t build wealth — only investing builds wealth.

In the case of our properties, we started out in 1986 with a mortgage on our first house, then we watched in horror as our mortgage interest rate shot up to 18 per cent by the end of 1989. This was all the motivation we needed to put everything into paying it off over the next few years. Since then we have bought many properties of all shapes and sizes, and we have used — and paid off — a number of different types of mortgages from a variety of lenders. Our properties have contributed about half of our total wealth (the other half has been from shares).

Having to pay off an 18 per cent mortgage while heading into the 1990–91 recession also taught us some critical lessons, such as spend less than we earn, always pay credit cards off in full each month, and always pay cash for items that depreciate in value (for example, furniture, cars, holidays, boats and renovations). These are lessons we have followed ever since. Fortunately we were able to retire from ‘work’ several years ago and live off our investments while our two kids were still young.

![]()

About this book

I have seen many people use debt wisely to make a lot of money, but I have also seen many people get into trouble with debt because they didn’t know how to use it properly. They let debt control them instead of the other way around. This book provides you with an insider’s knowledge of how to beat the lenders at their own game.

This is not a self-help book full of New-Age mumbo jumbo and nonsense such as ‘Just think positive thoughts and the universe will provide!’ or ‘Dream of a dollar figure and it will magically appear in your bank account!’ This book is very different. It outlines dozens of practical and proven methods that just about anybody can use to get out of debt and stay out of debt. It covers the major types of personal debt. It also covers small business debts and investment debts as nearly one-third of Australian adults either operate a small business or own investment properties or shares bought with debt.

Building wealth is not about earning more money, because higher incomes usually just disappear in higher expenses. Building wealth is about what you do with the money you have. To pay off debts and start building wealth you need to change what you do with your money. There are dozens of practical things virtually anybody can do to reduce spending to free up cash, but these are beyond the scope of this book. There are many books and websites full of great ideas on budgeting and spending less. This book is about how to put money to its best use to get out of debt as quickly and as effectively as possible.

Often people k...