![]()

CHAPTER 1

Opportunities Away from the Land of Opportunity

We have long been fans of investing one’s money, in part, outside of the United States. There are many reasons into which we delve that help to further justify forays into foreign markets, but it has always struck us as being just plain common sense to at least consider other economies as places from which to make money. Complicating the issue of looking elsewhere has long been the 800-pound gorilla sitting squarely in the middle of the room: we are Americans who live in the United States. That simple fact has, in the last several decades, afforded us the best reason to simply disregard the consideration of other markets. The reality is that we have everything we need right here. The truth is that we still do. Certainly, recent events have made even the most U.S.-centered investor wonder what better opportunities might await him or her in the other corners of Planet Earth, but in the end, most people like keeping everything here, thank you very much. It is just simpler, cleaner, easier.

Historically, when it comes to our money, we just feel better when our money is here in the United States (or so we perceive it to be). After all, are there not thousands upon thousands of publicly traded U.S. companies from which to choose, to say nothing of the thousands of stock mutual funds, bond mutual funds, and real estate opportunities that exist here in the United States? Indeed. We do not have to learn a new language to invest here, we know (at least anecdotally) that the best technology . . . the best platforms are here, and the financial center of the United States is still, for the most part, the financial center of the world. As a people, we love to visit other countries and exotic places, but most of us are very happy when we arrive home. It feels safe.

That intangible is largely what motivates us in everything we do—we do things because they feel right—even if they are wrong. We do it in interpersonal relationships, and we act accordingly in business and money relationships. To many Americans, investing our money outside of the United States just feels wrong. Historically, we have had discussions with multitudes of clients for whom foreign investment vehicles would have been an excellent fit, and yet many would exhibit a discomfort with the prospect on a level that we could not ignore. You can attack these objections with all of the left-brain logic you wish—but if it does not feel right—that is it.

Psychologically, many of us tend to see only the risks of such a move, rather than focus on the multitude of prospective rewards. At a root level, many people who eschew global investing do so because they feel physically more removed from their money.

It is largely the very historical success of the United States and its role, perhaps now more symbolic than real, as a world leader, that seems to have caused many to shrug off the wonderful opportunities available elsewhere. Principally, we believe that we have everything we need here, and we really do. It is historically rare that we find ourselves chasing the technology or opportunities found in other countries; instead, it has been the United States that has set the standards for trends and innovation for so long. In truth, that is changing, and has been changing for some time, but as we know, perception is reality, and the perception of so many is that the United States is still number one. We are as nationalistic as the next person when it comes to pride in one’s country, but one must be careful not to permit that nationalism to blind oneself to the many glorious opportunities that exist elsewhere.

When you travel overseas, you see that the fascination with all things American remains very strong. Even many of the terrific products that are manufactured overseas, or made by companies that are otherwise based in foreign countries, and which are consumed by Americans, feel (there we go with feeling once again) very American.

It is our historical and cultural pride that remains perhaps our worst enemy from an investment perspective, but our relative geographical isolation plays a big part in all of that. Our role as a player on the world stage is ironic, considering how far removed we are from the rest of it. The “us versus them” mentality that permeates the thinking of so many Americans appears due, in no small way, to the fact that we have little occasion to consider other countries at all in our daily lives. Certainly we are bordered by Canada and Mexico, themselves geographically monstrous (Canada is the world’s second largest country by area, while Mexico, no slouch itself, is the 14th largest by area) but more negligible in terms of corporate influences: of the 100 largest corporations in the world (as of 2008), Canada and Mexico together have a total of one between them. Compare and contrast that with Belgium, France, Germany, Italy, Netherlands, Spain, and Switzerland, which are all countries continuously surface-connected by the same land mass with adjacent, accessible borders, and which among them have 36 of the world’s 100 largest corporations—five more than the mighty United States. If you want to throw in Great Britain by virtue of its channel tunnel, then forget about it; Britain’s contribution of 9 of the 100 world’s largest corporations brings the aforementioned total to 45.

The point in citing this is that many folks overseas, particularly those who live in or around the highly developed European continent, have a knowledge of, and relevance to, one another that we in the United States have not been able to have with anyone else. Accordingly, their acceptance of considering transborder investing is not as markedly nativistic as our own.

In our opinion, we have been done a disservice by this segregation, at a number of levels. Culturally, Americans tend to miss out on some amazing things. We often “ooh” and “aah” at the grand sights brought to us courtesy of the Travel Channel, but leave our interest behind once the credits roll. For most of us, it is just all too inaccessible. You do not have to be a wealthy person to travel from, say, France, as a resident of France, directly to Germany and then back to France, because you can do it all by train in much less than a day. If you are an American living in the United States, you may not have to be wealthy, per se, to travel to France or Germany, but you will likely have to spend thousands of dollars in order to enjoy any sort of meaningful trip to Europe and its neighbors. The point is that the relevance of other countries and people to our own, when noting it in terms of real-world experience, is largely diminished in comparison to the relevance of other countries and populations to one another.

Compounding this problem is that some of the best opportunities to make money overseas, via direct investment on the appropriate platform (s), in countries that present some of the best opportunities, will require a concerted effort to become familiar with languages, cultures, flows of information, traditions, and so forth, that remain literally foreign to most of us. Granted, that is not really true in the case of what we call the middle ground instruments of foreign investing, like mutual funds and American Depositary Receipts (ADRs), but for those who want to go all the way and take advantage of the best, most organic opportunities presented by the foreign marketplace, all of that is quite true. Staying stateside requires no such special effort or knowledge. U.S.-based companies are born, live, and breathe in a world we know and understand. Besides, there are lots of them. The number of stocks listed on the NYSE, NASDAQ, and AMEX totals about 6,000, and there are roughly 12,000 U.S. equity mutual funds at present. Our brokerages and trading platforms are highly evolved, and besides, the United States is, by history and reputation, the epicenter of the financial universe. Where else do you need to go?

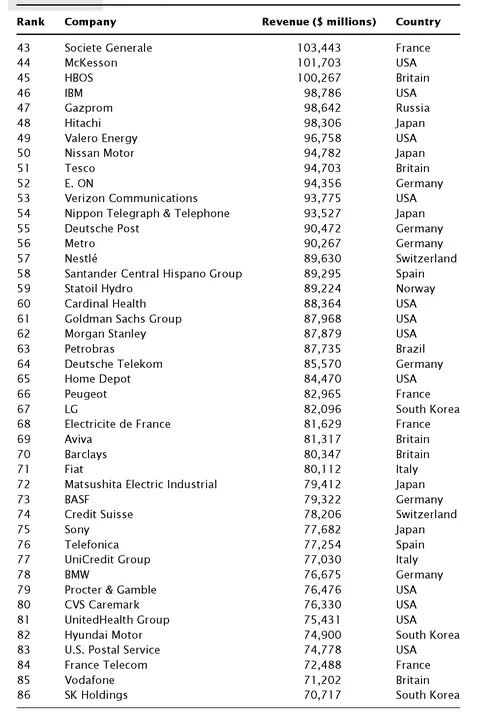

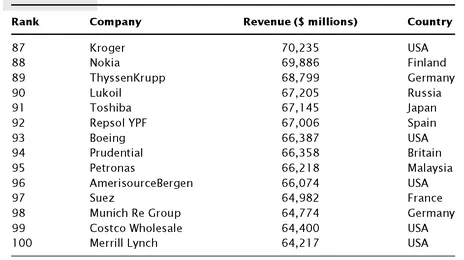

Lots of places, actually. We are going to show you facts and figures a little later that illustrate how the United States is not the only game in town any longer, but you might also notice that the United States is still the biggest game in town. For example, (see Exhibits 1.1 and 1.2), of the world’s 100 largest companies, those based in the United States comprise only about 30 percent percent of that list—but looked at another way, that 30 percent is far and away the largest representative, per country, of the listed companies; the next-largest percentage is attributed to Germany, at 13 percent. So it depends on how you choose to look at things: either you look at such a list and say, “70 percent of the word’s largest companies are located outside of the United States,” or you say, “the United States, by itself, has 30 percent of the world’s largest companies contained herein; why do I need to look anywhere else to invest?” Obviously, there is a lot more to investment decision making beyond such a basic criterion, but the fact is that such a perspective is shared by even some, more sophisticated investors.

The answer to the question just asked is another question: Do you want your investing to be easy, or do you want it to be profitable? This is a big part of deciding to officially and formidably step out of the relative comfort of the United States and move into more exciting, but more challenging, realms. The truth is that from the standpoint of investment return, the United States has long been a disappointment. We discuss that more specifically throughout this chapter, but the time has come, for those who have not already accepted what the authors believe is obvious, to devote a good portion of your investment efforts to foreign-based targets.

So what are the compelling reasons for going global with one’s investments? There are several, and it is likely that you are well acquainted with something between “some” and “all” of them if you have made the decision to buy this book. That said, let us take a few minutes to examine what they are—closely, for the benefit of those who are reading because they heard it was generally a good idea to go global, as well as for the benefit of those who are not certain they want to go global at all—but are nonetheless intrigued.

EXHIBIT 1.1 Fortune Magazine’s List of the 100 Largest Corporations in the World (as of 2008)

Source: Fortune magazine.

EXHIBIT 1.2 Countries Represented in the Top 100 List (In Order of Representation)

Source: Based on data from Fortune magazine.

| Country | # of Top 100 Companies |

|---|

| United States | 31 |

| Germany | 13 |

| France | 10 |

| Britain | 9 |

| Japan | 8 |

| Italy | 4 |

| South Korea | 4 |

| China | 3 |

| Spain | 3 |

| Switzerland | 3 |

| Netherlands | 2 |

| Russia | 2 |

| Belgium | 1 |

| Belgium/Netherlands | 1 |

| Brazil | 1 |

| Finland | 1 |

| Luxembourg | 1 |

| Malaysia | 1 |

| Mexico | 1 |

| Norway | 1 |

GOING GLOBAL WITH YOUR INVESTMENTS

Reason #1. It Is the Best Opportunity Remaining to Realize Substantial Portfolio Growth Over the Long Term

In order to grow, you have to have room to grow, and in the United States, there just is not the amount of room there used to be. This is something that does not really require a detailed analysis to prove. Even if you chose to rely on little more than your intuition, that should be good enough. Do you know anyone who does not own a car? Do you k...