![]()

◄ CHAPTER ONE ►

Why No Financial Services Institution Is Immune to Fraud

The introduction to this book painted a less-than-rosy picture of the ethical fabric of the American financial services industry. It is true that the industry has been wracked by colossal incidents of fraud and abuse and sometimes multiyear scandals that threatened its very survival.

In reality, despite what you read in the newspapers, which thrive on bad news, there are still plenty of financial institutions that run a tight ship, take care of their customers, invest depositors’ cash prudently, and show a profit almost every quarter.

It is to the managers of these institutions, as well as those in institutions that have experienced fraud and who wish to prevent further incidents, that this book will be most useful. For, as stated earlier, even those institutions with the best of intentions and the highest of ethical standards cannot fully protect themselves from the large and growing population of financial fraudsters and the continuously evolving methods to their criminal modus operandi.

► Statistical Perspective

It cannot be denied that fraud is becoming an increasingly serious and costly problem in American business—especially in the financial services industry. The statistics that follow will demonstrate that. Despite this threat, the important thing to remember is that it is still possible to manage a bank or other financial institution in a relatively fraud-free manner. The upcoming chapters of this workbook will provide you with practical, actionable techniques for doing exactly that.

The next statistics will provide you with perspectives on the big picture of organizational fraud in America and on the seriousness of the fraud problem in the financial services industry in particular.

Starting with the big picture, did you know that:

• Organizations of all kinds collectively lose an average of 7 percent of gross revenue to fraud every year? In 2008, that represented approximately $994 billion.1

• The most common method by which fraud is detected is tips? Over 46 percent of cases that are detected are reported via a tip from an employee, vendor, or other whistleblower.2

• Billing schemes—the most common form of employee-level fraud—are twice as common in organizations as fraudulent financial reporting, which is the main form of management fraud?3

• Organizations that implement entity-wide fraud awareness training cut fraud losses by 52 percent?4

• Seventy-four percent of employees report that they have observed or have firsthand knowledge of wrongdoing in their organization in the past 12 months?5

• The average fraudulent financial reporting fraud costs the victim organization $2 million, while the average loss per incident of billing fraud is only $100,000?6

• The majority of public companies investigated by the Securities and Exchange Commission (SEC) for fraud subsequently suffer a substantial (50 percent or more) decline in stock price?7

• It takes an average of 24 months for a fraud to be detected?8

• One-third of large-organization executives say they have no documented investigative policies or procedures for fraud and one-half have no incident response plan?9

• The most common type of fraud affecting organizations—by far—is theft of assets, which can include money, services, or physical assets?10

Financial Institution Fraud in Statistics • All financial institutions insured by the Federal Deposit Insurance Corporation (FDIC) together held $80.3 billion in asset-backed securities on December 31, 2005. By the same date in 2008, that number had ballooned to $129.2 billion.11

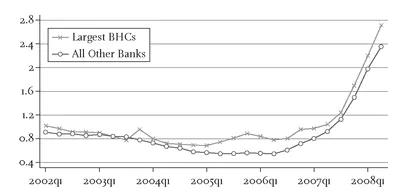

• Between 2005 and early 2009, the percentage of nonperforming real estate loans on the books of FDIC-insured institutions exploded from approximately 0.6 percent to 2.8 percent. See Exhibit 1.1.

• Seventy-one percent of financial institutions experienced attempted or actual payments fraud in 2007 (check fraud, Automated Clearing House [ACH] fraud, or credit card fraud).12

• Ninety-three percent of all financial institutions that were targets of payments fraud reported attempted check fraud in 2007.13

• Although electronic payments are steadily gaining on checks as the preferred payment method by many organizations, the incidence of check fraud remains far greater than that of ACH fraud.14

• Twenty-six percent of organizations that were targets of payments fraud in 2007 were hit by at least one incident of ACH debit fraud—down from 35 percent in the previous year.15

• Of 21 industries surveyed by the Association of Certified Fraud Examiners for its 2008 Report to the Nation on Occupational Fraud,“Banking/Financial Services” topped the list in the percentage of total fraud cases, with 14.6 percent.16

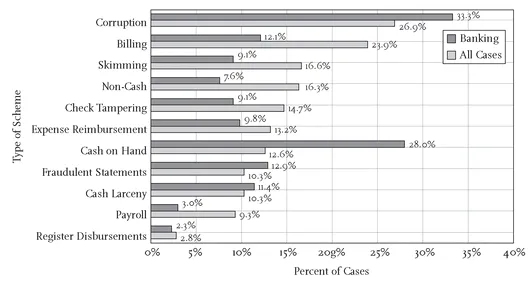

• The most common types of internal fraud affecting the financial services industries (see Exhibit 1.2) are corruption (primarily bribery and kickbacks), theft of cash, fraudulent financial statements, and expense reimbursement schemes.17

• In 2008, financial services companies were defendants in 103 class action filings, representing 49 percent of all securities-related class actions across nine industries represented in the Standard & Poor’s (S&P) 500. Of the 103 filings in which financial services firms were defendants, 91 were related to the subprime credit crisis.18

• In 2008, 32 percent of the financial services companies in the S&P 500 were defendants in securities class actions, up from 9.4 percent the year before.19

• Reported incidents of mortgage fraud were up by a startling 45 percent in the second quarter of 2008 compared with the same period in 2007.20

• The number of reported mortgage fraud incidents represented by fraudulent appraisals jumped by 21 percent between the second quarter of 2008 and the same quarter of the previous year.21

Exhibit 1.1: Nonperforming Real Estate Loans (Percent of Real Estate Loans)

Source: Federal Reserve Bank of New York, Quarterly Report on Banking Statistics (November 2008), p. 4.

Exhibit 1.2: Occupational Fraud Schemes in Banking and Financial Services Industry

Note: Based on 132 cases. The sum of percentages in this chart exceeds 100 percent because several cases involved multiple schemes from more than one category.

Source: Association of Certified Fraud Examiners, 2008 Report to the Nation on Occupational Fraud and Abuse, p. 29.

Remember

If you hear from a colleague or boss that your organization does not experience much fraud, the statistics prove the opposite. If anything, fraud is getting worse. For that reason, everyone in the organization must be more alert to it than ever.

► What Is Fraud?

Most people in the fraud-fighting business have their own concept of what fraud is . . . and what it is not. The result is that we have a grab bag of definitions to choose from in guiding our day-to-day work. Some are legal definitions. Others are academic, while still others are based on personal experience. Out of the lot, the most useful definitions boil down to two.

According to the Association of Certified Fraud Examiners, fraud is:

Any illegal acts characterized by deceit, concealment, or violation of trust. These acts are not dependent upon the application of threat of violence or of physical force. Frauds are perpetrated by individuals and organizations to obtain money, property, or services; to avoid payment or loss of services; or to secure personal or business advantage.22

According to the American Institute of Certified Public Accountants, fraud is:

A broad legal concept that is distinguished from error depending on whether the action is intentional or unintentional.23

Regardless of whose definition of fraud you accept, you will find that nearly all incidents of fraudulent activity—also called white-collar crime—fall into one or both of two categories: theft and deception. Exhibit 1.3 is a graphic illustration formulated by White-Collar Crime 101 of this dual-category definition of fraud.

In attempting to narrow down the definition of fraud to criminal conduct specific to the financial services industry, it is fair to say that the...