Part I

Accounting Basics

In this part . . .

Accounting is important in all walks of life, and it’s absolutely essential in the world of business. Accountants are the bookkeepers, scorekeepers, and occasionally the gatekeepers of business. Without accounting, a business couldn’t function, wouldn’t know whether it’s making a profit or loss, wouldn’t know its financial situation, or if it was in danger of running out of cash.

Bookkeeping – the record-keeping part of accounting – must be managed well to make sure that all the financial information needed to run the business is complete, accurate, and reliable, especially the numbers reported in financial statements and tax returns. Wrong numbers in financial reports and tax returns can cause all sorts of trouble.

Speaking of taxes, you can’t take more than three or four steps before bumping into dreaded taxes. No one likes to pay taxes, but managers must collect and pay taxes as part of running a business. In addition to income taxes, accounting plays a bigger role in your personal financial affairs than you might realise. This part of the book explains all this and more.

Chapter 1

Introducing Accounting to Non-Accountants

In This Chapter

Understanding the different needs for accounting

Making and enforcing accounting rules

Peering into the back office: The accounting department in action

Transactions: The heartbeat of a business

Taking a closer look at financial statements

Should you let your baby grow up to be an accountant?

Most medium to large businesses employ one or more accountants. Even a very small business could find value in having at least a part-time accountant. Have you ever wondered why? Probably what you think of first is that accountants keep the books and the records of the financial activities of the business. This is true, of course. But accountants perform other very critical, but less well-known, functions in a business:

Accountants carry out vital back-office operating functions that keep the business running smoothly and effectively including payroll, cash receipts and cash payments, purchases and stock, and property records.

Accountants prepare tax returns, including VAT (value-added tax) returns for the business, as well as payroll and investment tax returns.

Accountants determine how to measure and record the costs of products and how to allocate shared costs among different departments and other organisational units of the business.

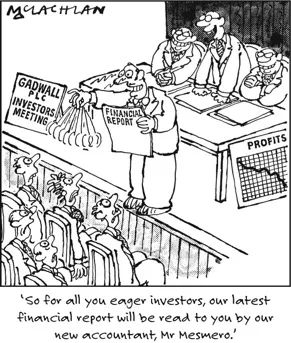

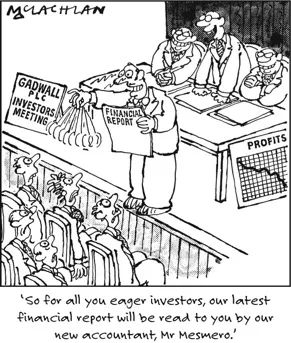

Accountants are the professional profit scorekeepers of the business world, meaning that they are the ones who determine exactly how much profit was earned, or just how much loss the business suffered, during the period. Accountants prepare reports for business managers, keeping them informed about costs and expenses, how sales are going, whether the cash balance is adequate, what the stock situation is and, the most important thing, accountants help managers understand the reasons for changes in the bottom-line performance of a business.

Accountants prepare financial statements that help the owners and shareholders of a business understand where the business stands financially. Shareholders wouldn’t invest in a business without a clear understanding of the financial health of the business, which regular financial reports (sometimes just called the financials) provide.

In short, accountants are much more than bookkeepers – they provide the numbers that are so critical in helping business managers make the informed decisions that keep a business on course toward its financial objectives.

Business managers, investors, and others who depend on financial statements should be willing to meet accountants halfway. People who use accounting information, like spectators at a football game, should know the basic rules of play and how the score is kept. The purpose of this book is to make you a knowledgeable spectator of the accounting game.

Accounting Everywhere You Look

Accounting extends into virtually every walk of life. You’re doing accounting when you make entries in your cheque book and fill out your income tax return. When you sign a mortgage on your home you should understand the accounting method the lender uses to calculate the interest amount charged on your loan each period. Individual investors need to understand some accounting in order to figure the return on capital invested. And every organisation, profit-motivated or not, needs to know how it stands financially. Accounting supplies all that information.

Many different kinds of accounting are done by many different kinds of persons or entities for many different purposes:

Accounting for organisations and accounting for individuals.

Accounting for profit-motivated businesses and accounting for non-profit organisations (such as hospitals, housing associations, churches, schools, and colleges).

Income tax accounting while you’re living and estate tax accounting after you die.

Accounting for farmers who grow their products, accounting for miners who extract their products from the earth, accounting for producers who manufacture products, and accounting for retailers who sell products that others make.

Accounting for businesses and professional firms that sell services rather than products, such as the entertainment, transportation, and health care industries.

Past-historical-based accounting and future-forecast-oriented accounting (that is, budgeting and financial planning).

Accounting where periodic financial statements are mandatory (businesses are the primary example) and accounting where such formal accounting reports are not required.

Accounting that adheres to cost (most businesses) and accounting that records changes in market value (investment funds, for example).

Accounting in the private sector of the economy and accounting in the public (government) sector.

Accounting for going-concern businesses that will be around for some time and accounting for businesses in bankruptcy that may not be around tomorrow.

Accounting is necessary in any free-market, capitalist economic system. It’s equally necessary in a centrally controlled, socialist economic system. All economic activity requires information. The more developed the economic system, the more the system depends on information. Much of the information comes from the accounting systems used by the businesses, individuals, and other institutions in the economic system.

The Basic Elements of Accounting

Accounting involves bookkeeping, which refers to the painstaking and detailed recording of economic activity and business transactions. But accounting is a much broader term than bookkeeping because accounting refers to the design of the bookkeeping system. It addresses the many problems in measuring the financial effects of economic activity. Furthermore, accounting includes the financial reporting of these values and performance measures to non-accountants in a clear and concise manner. Business managers and investors, as well as many other people, depend on financial reports for vital information they need to make good economic decisions. Accountants design the internal controls in an accounting system, which serve to minimise errors in recording the large number of activities that a business engages in over the period. The internal controls that accountants design can detect and deter theft, embezzlement, fraud, and dishonest behaviour of all kinds. In accounting, internal controls are the gram of prevention that is worth a kilo of cure. An accountant seldom prepares a complete listing of all the details of the activities that took place during a period. Instead, he or she prepa...