![]()

PART I

HOUSES Home of Savings

If you want to SAVE BIG, you have to figure out the areas where you spend the most money, because that’s where you can save the most money. You might be sitting inside your number one expense right now: your home. According to the Bureau of Labor Statistics, we spend an average of $19,199 on our homes every year and those costs eat up 39 percent of our incomes.

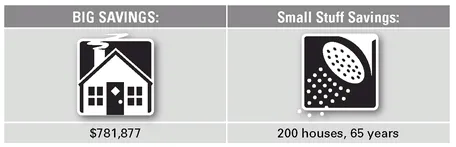

I’ll tell you right now that the way to cut those costs is not to install low-flow shower heads, yet that’s one of the most common tips for saving money around the house. If you do it to save the environment, fine. But to save money? Please. That’s Small Stuff Savings: five dollars a month at most. Peanuts. Pennies. Pathetic.

Instead, you can turn your number one expense into your number one savings. I will prove it in the coming pages. I’m going to show you how to attack the dumb, dull expenses that come with every home. The House section of this book contains $781,877 worth of BIG SAVINGS! You would have to install low-flow showerheads in 200 houses and bathe for 65 years to save that much money!

Homes can be pigs that gobble up massive, messy chunks of our paychecks. But they can also be piggy banks where we stash a little cash for later in life.

Amazed that you can save that much on your house? It makes sense because what other undertaking has so many side costs associated with it that are in the thousands of dollars? Homes can be pigs that gobble up massive, messy chunks of our paychecks. But they can also be piggy banks where we stash a little cash for later in life. I can help you keep your home from being a hog.

Chapters in Part I are arranged chronologically, in the order you are most likely to encounter these adventures on the journey of home ownership, from buying a home to maintaining it and then selling it again and starting over.

• Chapter 1: In the opening chapters we tackle buying a home. I lay out why you should buy a house ASAP because spending money on this giant purchase is actually your number one way to save money.

• Chapter 2: Here I argue that your mortgage payment should equal your rent as part of my painless plan for affording a house and paying it off early to SAVE BIG. We talk about why you should stoop—not stretch—for a house.

• Chapter 3: In this chapter, it’s time to make an offer. By negotiating with your realtor before she negotiates for your house, you can SAVE BIG. When it is time to negotiate, I tell you how to do the deal in a way that saves you thousands.

• Chapter 4: These next chapters are about mortgages. Choosing the right loan might be even more important than choosing the right house because it can save you $100,000 or more! We go over the pros and cons of the different types.

• Chapter 5: Next up, choosing a mortgage professional. I’ll teach you the tricks bankers and brokers use to make money off of you and how to beat them at their own game and get a fair deal.

• Chapter 6: Then we conquer closing costs, the fees you pay in order to complete your loan. Fight junk fees and you can save another couple thousand dollars.

• Chapter 7: Once you are in the home, there are more ways to save. Have you ever thought of fighting your property tax assessment? Only 2 percent of people do and it’s a way to SAVE BIG.

• Chapter 8: Refinancing is one of the truly unique opportunities to cut costs, but how do you know if the time is right? My simple Rule of 5s will help you decide.

• Chapter 9: Pay your mortgage off early and you can cut thousands of dollars and several years off of your loan. I’ll show you where to find free money to do this.

• Chapter 10: Finally, when it’s time to move on, consider selling your house yourself without an agent. Do this with even one of the homes you will own in your lifetime and you will SAVE BIG.

Ready to learn how to save $781,877? If you do that, it really will be a home sweet home. Let’s get started.

![]()

CHAPTER 1

Buy a House ASAP

You should buy a house as soon as possible, because it’s the one investment you can make with money you have to spend anyone investment you can make with money you have to spend anyway. After all, you have to pay money to live somewhere. If you currently rent, it’s your biggest expense, but you can make that money serve two purposes by buying a place instead. You get a nest and a nest egg. By contrast, you can’t sleep in a stock, and bonds don’t keep you warm in the winter. Besides, many people can’t afford to pay their rent and buy stocks and bonds, and others aren’t disciplined enough to be reliable investors.

According to the Federal Reserve, the median net worth of homeowners is $234,000, while for renters it’s $5,100. Buying a house is a forced savings plan where you can shelter your money and shelter your family. Go for it and you will SAVE BIG.

In this chapter, learn to SAVE BIG by:

• Making your housing payment serve two purposes: shelter and savings.

• Buying a house using somebody else’s money—but keeping any gains.

• Locking in a monthly payment instead of paying increased rent every year.

• Making money tax- free in the form of real estate appreciation.

Why You Should Buy

In the post-housing bubble years, it’s fashionable for naysayers to contend that houses are not good investments and that you should rent instead. They say that real estate doesn’t appreciate as fast as the stock market. They babble that it’s not a good idea to put all your eggs in one investment basket. They moan that houses are not liquid investments, so your money is stuck.

Guess what? It’s all true.

But they’re still wrong!

Let’s explore why, by looking at the fabulous financial fringe benefits that home ownership brings—from the opportunity to profit, to fat tax deductions, to locking in a steady housing payment you can count on.

Probable Profits

The best part of buying a house is this: What other investment enables you to use somebody else’s money to make money? That’s exactly what happens when your house appreciates in value and you sell it for a profit. Even though you still owe money on your mortgage, the people at the mortgage company don’t make you share the proceeds with them, now do they? What a deal! And to make this profit, you don’t have to overhear a brilliant stock tip or try to comprehend bond rates. All you have to do is pay your mortgage.

According to the U.S. Census Bureau, the average purchase price of a home in the United States right now is about $250,000. (I’ve rounded for easy math.) According to the National Association of Realtors, property values have gone up an average of 6 percent a year since 1968. I believe in making a full 20 percent down payment, which is $50,000 on that average $250,000 house. So let’s put those three factors together and see how we can profit:

Making Money Using Somebody Else’s Money | Cost of house | $ 250,000 |

| Down payment | $ 50,000 |

| Appreciation | $ 15,000 |

| BIG RETURN = | 30% |

In this scenario, our home’s value has gone up 6 percent, which is $15,000, but your return on investment is much greater. Why? Because you only put down $50,000 of your own money. A $15,000 profit on your $50,000 down payment is a whopping 30 percent return! If you made that kind of gain as a stock broker, you’d put out a press release!

Tax Benefits

But wait, there’s more! Home ownership comes with lucrative tax benefits. The first benefit starts the moment you move in. The IRS allows you to deduct the interest you pay on your mortgage from your federal income taxes. It’s the government’s way of supporting home ownership and it will help you SAVE BIG.

Let’s say you have a $200,000 mortgage with a 6.25 percent interest rate and you’re in the 25 percent federal income tax bracket. Here’s the average amount you will save in taxes every year:

Mortgage Interest Tax Deduction | Annual mortgage cost before tax deduction | $ 14,777 |

| Annual mortgage cost after tax deduction | 12,242 |

| BIG SAVINGS = | $ 2,535 |

That’s $2,535 in tax relief that renters don’t receive! I have a plan to use that “free money” to save even more money. You’ll see how in Chapter 9.

Here’s another tax treat courtesy of Uncle Sam. If you make money on a business or a bond, you have to pay capital gains taxes on the profit. But if you sell your house at a profit, the gain is tax-free up to $250,000 for individuals and $500,000 for couples.

Rent Goes Up, Mortgages Stay Steady

And finally, by buying a house you are locking in your monthly housing payment. By contrast, rent is almost guaranteed to go up. Since 1990, rents have risen more than 3 percent a year, according to Reis, Inc., a real estate for...