- English

- ePUB (mobile friendly)

- Available on iOS & Android

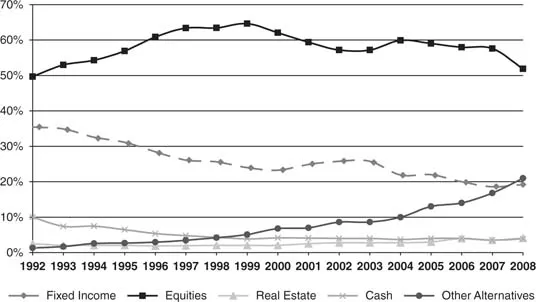

The Modern Endowment Allocation Model

About this book

The authors of The Endowment Model of Investing provide an overview in this chapter of the traditional versus modern methods of endowment investing as a basis for understanding diversification and managing equities for endowments today. It is meant as a brief introduction to the topic and book. Discussed is how the tradition of the long term policy portfolio with relatively fixed asset categories was at one point ubiquitous in the endowment and foundation World but how now with increased market volatility and the appearance of attractive new asset classes, this tradition of overly rigid allocations and fixed asset buckets is questioned and put into old news. The late Peter L. Bernstein was one of the earliest and most articulate authors arguing for a rethinking of the policy portfolio concept.

This chapter includes topics on:

- Institutions working in a more flexible fashion with allocations

- wider allocation bands

- using assets that do not necessarily fit into the traditional categories

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Table of contents

- Cover

- Title Page

- Copyright

- Part One: Alpha/Beta Building Blocks of Portfolio Management

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app