This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Personal Finance and Investing All-in-One For Dummies

Book details

Book preview

Table of contents

Citations

About This Book

Providing a one-stop shop for every aspect of your money management, Personal Finance and Investing All-in-One For Dummies is the perfect guide to getting the most from your money. This friendly guide gives you expert advice on everything from getting the best current account and coping with credit cards to being savvy with savings and creating wealth with investments. It also lets you know how to save money on tax and build up a healthy pension.

Personal Finance and Investing All-In-One For Dummies will cover:

- Organising Your Finances and Dealing with Debt

- Paying Less Tax

- Building up Savings and Investments

- Retiring Wealthy

- Your Wealth and the Next Generation

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Personal Finance and Investing All-in-One For Dummies by Faith Glasgow, Faith Glasgow in PDF and/or ePUB format, as well as other popular books in Business & Accounting. We have over one million books available in our catalogue for you to explore.

Information

Book III

Building Up Savings and Investments

In this Book . . .

If you’re thinking investing is only for the super-rich, think again! This Book shows you how to make sound, sensible investment choices whatever your budget. Detailing shares, bonds, property, and the best savings accounts, we also cover alternative investments for the more experienced and adventurous investors.

Here are the contents of Book III at a glance:

Chapter 1: Squaring Risk and Return

Chapter 2: Saving for a Rainy Day

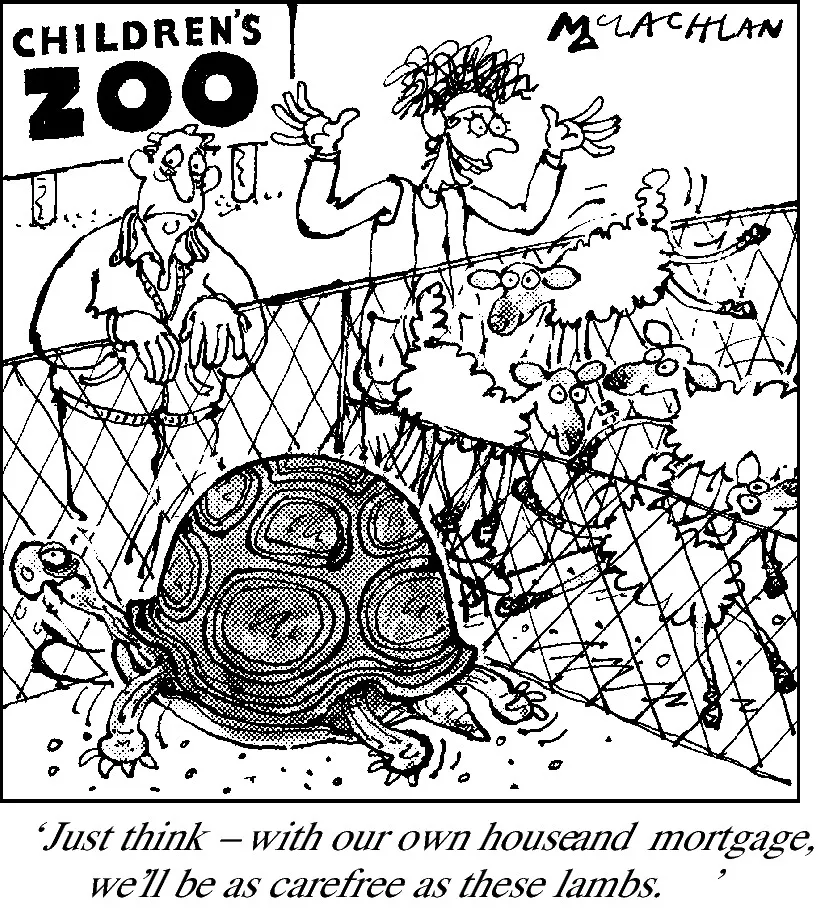

Chapter 3: Choosing a Mortgage

Chapter 4: Making the Most of Tax-Free Savings and Investments

Chapter 5: Delving Into Collective Investments

Chapter 6: Scrutinising Shares and Bonds

Chapter 7: Investing in Bricks and Mortar

Chapter 8: Making Exotic Investments

Chapter 1

Squaring Risk and Return

In This Chapter

When we walk down the street or drive a car, we’re aware of risks. We know, for example, that we might risk life and limb crossing a road when the Red Man symbol is displayed. And we know that our safety (not to mention driver’s licence) is threatened if we drive 60mph in a 30mph zone.

Granted, if we run helter-skelter down the street or drive recklessly down the road, ignoring everyone and every rule, we might arrive more quickly at our destination. But the faster we go and the more corners we cut, the greater the chance of losing everything. So we generally take simple precautions to avoid risks. That way, we make some progress through life.

But what if we never took risks at all and, instead, wrapped ourselves in cotton wool? If we only walked on perfectly kept, deserted fields and drove on empty roads at exactly 20mph? We’d simply not get anywhere, and our lives would be boringly empty. We’d make no progress through life. We’d be taking the risk of missing out on something interesting and perhaps profitable.

The same can be said about investing. Investment risk is no different from the risks of daily life. There are steady-as-you-go investments that give a moderate rate of return with perhaps the occasional loss (after all, even the most careful driver can have a bad experience). There are hell-for-leather investments that can offer massive returns or huge losses. And there’s the investment equivalent of surrounding yourself with layers of cotton wool – where nothing will happen at all.

In this chapter, we examine investment risks – specifically, the benefits and drawbacks of various investment possibilities and ways to increase your odds of successful returns.

Examining Two Investing Principles You Should Never Forget

Here are a couple of clichés that sound banal but should be carved in mirror writing on every investor’s forehead, so she or he can read them first thing each morning when facing the wash basin:

Financial markets – indeed, all of capitalism – work on these two principles.

Here’s an example to help you see the importance of these two philosophies. Suppose that you’re running a company and need £10m to expand your firm into a new product. You could borrow the money from the bank knowing that you’ll pay 10 per cent interest a year whether the new venture works or not. If the new venture fails, you still have to pay the bank its £10m plus interest even if it means selling the rest of the business. But if your business goes on to be a winner, the bank still only gets its £10m plus interest while your fortune soars.

Alternatively, you could raise the cash through an issue of new shares, where the advantages for you are no fixed-interest costs and, if the project is a flop, your investors suffer rather than you. They could lose all their money. That’s the risk they run. But if the venture is a success, the shareholders receive dividends from you and see the value of their stake rise due to everyone demanding a share of the action. You shared the risk with others, so now they get a slice of the reward.

Now suppose that no one had taken any risks. You decided not to expand into the new product. The bank manager vetoed all loans. And the share buyers sat on their hands and kept their money under their beds. There’d be no pain – no one would lose – but there’d also be no gain for you, the bank, the investors, or the wider economy.

Granted, all these potential participants could’ve argued that they’d taken a risk-free stance with their cash. But had they? No. They’d taken the very severe risk of missing out on something positive. They didn’t speculate. They didn’t accumulate.

Absolute safety means little or no reward

The most secure place to keep your money is in a low-interest guaranteed account from the government’s National Savings & Investments department. In certain circumstances, this is a good place for some of your money. But unless you have very good reasons, you risk losing out on potentially better investments.

Putting your money in such an account also presents a second danger. When you protect a piece of china in cotton wool and bubble wrap, you expect it still to be there years later, but money is different. Its buying value erodes each year due to rising prices. You’ll go backward in real terms if all you do is put all your money in the safest possible home. And the longer you look at investing your money, the truer that becomes.

Suppose that two people coming back from the Second World War in 1945 each had £100 to invest. One person invested the money in a basket of shares, each with an uncertain future, and the other person put the money in super-safe UK government stocks. Both investors told their family and friends that they’d re-invest all the dividends and interest they received.

By the end of 2002, the investor who went the safe route had a fund worth £3,668 according to figures from Barclays Capital. But when inflation is taken into the calculation, the £100 is only worth £150. And it took until 1996 before that original £100...

Table of contents

- Title

- Contents

- Introduction

- Book I : Organising Your Finances and Dealing with Debt

- Book II : Paying Less Tax

- Book III : Building Up Savings and Investments

- Book IV : Retiring Wealthy

- Book V : Protecting Your Wealth for the Next Generation

- : Further Reading