- English

- ePUB (mobile friendly)

- Available on iOS & Android

Financial Risk Manager Handbook

About this book

The essential reference for financial risk management Filled with in-depth insights and practical advice, theFinancial Risk Manager Handbook is the core text for riskmanagement training programs worldwide. Presented in a clear andconsistent fashion, this completely updated FifthEdition-which comes with an interactive CD-ROM containinghundreds of multiple-choice questions from previous FRM exams-isone of the best ways to prepare for the Financial Risk Manager(FRM) exam. Financial Risk Manager Handbook, Fifth Edition supportscandidates studying for the Global Association of RiskProfessional's (GARP) annual FRM exam and prepares you to assessand control risk in today's rapidly changing financial world.Authored by renowned risk management expert Philippe Jorion-withthe full support of GARP-this definitive guide summarizes the corebody of knowledge for financial risk managers.

* Offers valuable insights on managing market, credit, operational, and liquidity risk

* Examines the importance of structured products, futures, options, and other derivative instruments

* Identifies regulatory and legal issues

* Addresses investment management and hedge fund risk Financial Risk Manager Handbook is the most comprehensiveguide on this subject, and will help you stay current on bestpractices in this evolving field. The FRM Handbook is the officialreference book for GARP's FRM® certification program. Note: CD-ROM/DVD and other supplementary materials arenot included as part of eBook file.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

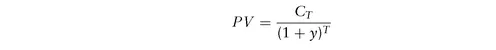

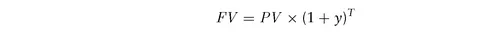

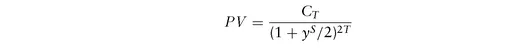

1.1 DISCOUNTING, PRESENT, AND FUTURE VALUE

Table of contents

- Title Page

- Copyright Page

- Preface

- About the Author

- About GARP

- Introduction

- PART One - Quantitative Analysis

- PART Two - Capital Markets

- PART Three - Market Risk Management

- PART Four - Investment Risk Management

- PART Five - Credit Risk Management

- PART Six - Legal, Operational, and Integrated Risk Management

- PART Seven - Regulation and Compliance

- About the CD-ROM

- Index

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app