![]()

Section Two

Stocks and Equity Markets

STOCKS AND EQUITY MARKETS

This section is about stocks and the people and organizations who use them. We begin, in Chapter Four, by discussing the various forms of stocks that exist and how issuers (who use stock to finance their business activities) and investment bankers (who help them) work together to create new shares of stock. In Chapter Five, we discuss the various settings in which stock is bought and sold, from the traditional “open outcry” markets, with their floor brokers representing customers and specialists making markets, to the latest digital exchanges that exist only in cyberspace, matching bids and offers of buyers and sellers who may never see each other or learn the other’s identity.

Discussion of the settings in which trading takes place leads naturally into Chapter Six, a discussion of the different styles of investing used by stock market participants. Investment styles, of course, are dependent on access to many sources of information, the focus of Chapter Seven.

Finally, having looked at what stock is, who trades it, where and when it is traded, and by which methods of analysis it is deemed a buy, a sell, or a hold, we come to Chapter Eight, which offers a framework for deciding how to put all this information to good use.

![]()

Chapter 4

VARIETIES OF STOCKS

Just What is a Security, Anyway?

What is a security (or financial instrument)? What makes stock different from other securities? As we mentioned in the previous chapter, a security (such as a stock, bond, or option) can be defined in three different ways:

1. A paper document providing proof of a financial stake of some kind.

2. An electronic/computer system equivalent to such a document.

3. An abstract but verifiable financial stake that may be represented through a paper document or a computer system, but does not disappear just because something happens to the piece of paper (or the computer) on which it was recorded.

The third definition has the advantage of recognizing that 100 shares of IBM do not become a different security when the certificate is turned over to a broker who records the shares in book entry form.

The financial stakes represented by securities are stakes in some business, government, or other legal entity.

• If the security is a

stock, then the investor’s role is ownership (together with other investing

shareholders, if any). Ownership in a corporation that is divided among a group of shareholders is sometimes referred to as an

ownership interest. stock

Securities representing an ownership interest in a corporation’s undivided assets.

• If the security is a

bond, then the investor is a

creditor, and the other entity can be corporate or governmental.

bond

Long-term debt securities issued by governments and corporations; also used generically to refer to debt of any maturity.

• If the security is an option, then the investor has certain well-defined rights and the other entity has corresponding obligations. (Some options are not considered securities, because the underlying asset is not a security. Even so, such options are still considered financial instruments.)

• Futures contracts, though they share many of the characteristics of securities, are separately regulated and therefore are generally said not to be securities at all, although they are financial instruments. This may change, especially if the “on-again, off-again” merger between the Securities Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) ever becomes reality.

Bonds, options, and futures will all be discussed in much greater detail in later sections of this book.

Stock is denominated in units called shares. The share-issuing entity is always a corporation (investors cannot buy partial ownership of a government!). Shares in a mutual fund, whether of the open-end or closed-end variety, are a specialized form of stock. Mutual funds have become so important to investors that they are given a section of their own in this book.

Normally, as a shareholder, you have certain basic rights, including the following:

1. A claim, proportional to the number of shares held, to a portion of the corporation’s assets. This does not mean, however, that you can go into corporate headquarters and walk off with a desk! Your claim is on the undivided assets of the corporation, not on any specific piece of property.

2.

The power to vote on company business at shareholder meetings, again in proportion to shares held. Specifically, you are entitled to vote for

directors, either in person or by

proxy. Not all stock, however, comes with voting rights. In any event, relatively few individual investors who are shareholders attend the annual meeting of the corporation. Many do not

proxy

Someone to whom you give the right to vote your shares at a shareholder meeting.

even bother to mail in the proxy that accompanies the announcement of a meeting.

3.

The right to dividends that may be voted by the board of directors. However, not all stocks pay dividends.

dividend

Portion of corporate earnings distributed to shareholders by vote of board of directors.

4. Sometimes, a preemptive right to purchase new shares before they are offered to the general public. This right, however, may be abridged under certain circumstances (e.g., corporate mergers) or by the articles of incorporation.

So what does it really mean to own shares of stock in a corporation? It seems that if there is an essential component to stock ownership, it is a sharing of the underlying assets jointly with other shareholders.

Issuers and Underwriters: Why Does a Corporation Sell Stock to the Public?

Historically, public companies—that is, companies that issue stock to the public—came about in response to the need to finance large commercial enterprises on a scale that was either too grand or too risky for even the wealthiest individuals or families to undertake alone. By reaching out to the public at large, a small group of entrepreneurs can collect the enormous sums of money needed to finance new corporate undertakings, or even entirely new enterprises.

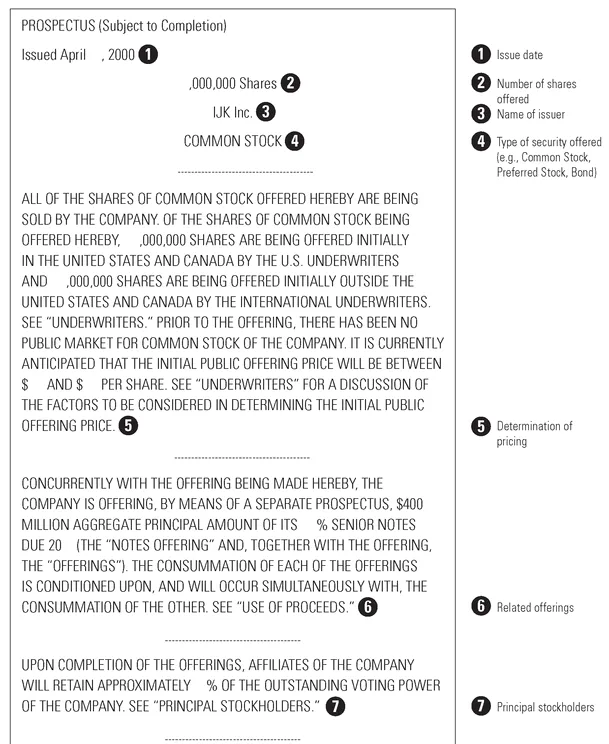

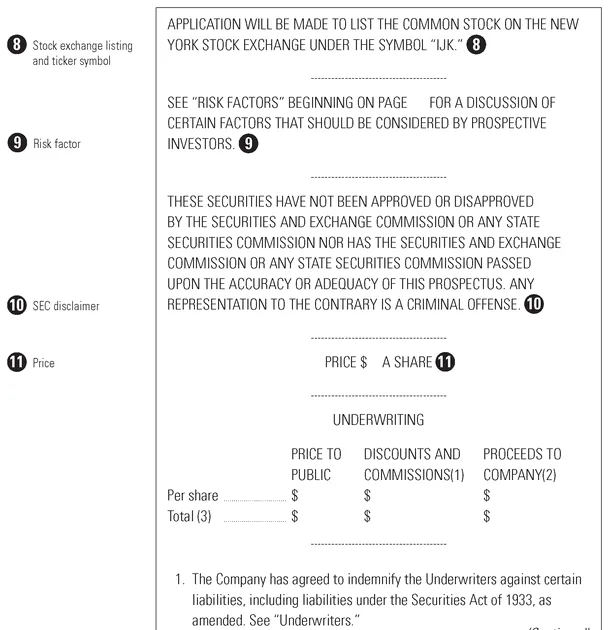

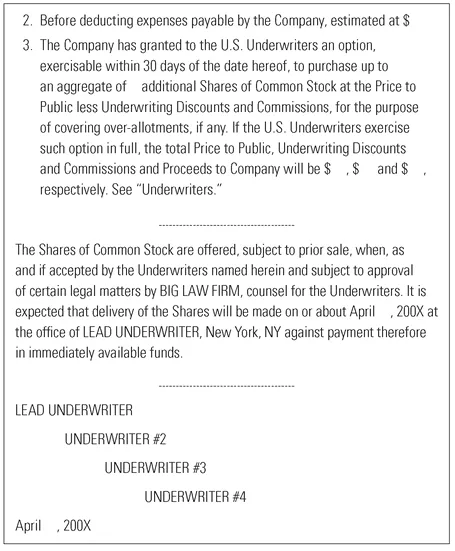

When corporations issue stock (or other securities), they are referred to as issuers. Stock can be issued for sale to the public or for private placement. When issuers prepare to sell securities to the public, they usually call upon investment bankers to act as underwriters. The underwriters’ names are literally “written under” the copy at the bottom of the cover page of the prospectus, a legal document that, together with a registration statement, must be filed with the SEC, the government agency charged with regulating the securities industry. An initial or preliminary prospectus is often referred to as a red herring because of the red ink that connotes its preliminary status (see “Prospectus of IJK Inc.”).

Beginning in the “dot.com” era, some issuers, particularly of initial public offerings (IPOs) have taken advantage of the low marketing costs of the Internet to offer direct IPOs, bypassing underwriters entirely. And some have become a new kind of underwriter, offering direct IPOs over the Internet. Over the last decade, direct public offerings (DPOs), as well as special purpose acquisition companies (SPACs), private investments in public equity (PIPEs), and alternative public offerings (APOs) have transformed the issuing landscape.

initial public offering (IPO)

First offering of a company’s stock to the public.

• DPOs are means by which companies may raise capital by marketing directly to their own employees, customers, and friends, without the need for an underwriter. SPACs are publicly traded shell companies created with the goal of acquiring a private company with the capital raised through an IPO.

• PIPEs are deals that involve publicly traded stock, which may or may not be registered with the SEC.

• APOs combine a PIPE deal with a so-called “reverse merger” to create yet another alternative to a traditional IPO.

The idea behind the Internet investment banking business is simple yet potentially powerful. Instead of seeing IPOs as the permanent preserve of institutional insiders, the Internet is used as an enabling technology to bring issuers into contact with a broad group of potential individual investors. This could be a good thing for individuals. Until now, studies have shown that most individuals investing in IPOs get in too late to share in the early price run-ups. And who stands to lose? Traditional underwriters, who stay away from this technology, and institutions, who will lose their monopoly on IPOs and, perhaps more important, may lose some of their ability to “juice” portfolios with issues that almost always go up—initially.

Prospectus of “IJK Inc.”

Why Investors Buy Stock

All well and good for the entrepreneur and the corporation. But why should anyone buy stock? It all goes back to the investor’s current mix of assets and liabilities, along with his or her financial goals and expectation of future needs. An investor with available cash or credit will buy stock if such a purchase fits his or her financial framework. In broad terms, most investors are motivated by both long-term and short-term needs.

• Long-term capital appreciation. As a long-term investor, you want the total value of your stocks to increase. The value of your stock position can increase in a number of ways, including a rise in the price per share, a share split which gives you additional shares at the same price, or the reinvestment of dividends. Reinvestment can be done automatically through a dividend reinvestment program (DRIP).

•

Short-term income. Aside from your needs as a long-term investor, you may have an immediate need for income from your investments. For short-term income, many investors choose bonds (or bond mutual funds) rather than dividend-paying stocks, because dividend payments are not as reliable as interest payments.

Other, more specific motivating factors may include the following:

• Attraction to a company or one of its...