![]()

CHAPTER ONE

Foundations

THIS BOOK IS ABOUT strategic management, the process by which the chief executive shapes a company’s strategies and drives its financial performance over time. Strategic management is not strategic planning, or strategy formulation, or setting the strategic direction of the company, though these activities may be part of it. It is a broader concept, encompassing all of the CEO’s major decisions and their ultimate impact on the quality of a company’s strategies and the height of its economic success.

Strategic management comprises five high-level choices every CEO must make:

1. Performance objective choices—deciding what the company will define as success

2. Participation choices—deciding where the company will compete to achieve its performance objectives

3. Positioning choices—deciding how the company will compete to achieve its performance objectives

4. Organizational choices—deciding how to build an institution that can sustain high performance over time

5. Risk management choices—deciding how the company will protect its performance from catastrophic setbacks

Companies vary enormously in how, and how well, they make these choices. Many factors can influence these choices, including a company’s history, industry practices, its understanding of customers, its competitive situation, its embedded resource allocation processes, the quality of information available to its executives, and the effects of its reward systems. These and others factors combine in unique ways that predispose one company to make certain strategic management choices one way, while other companies facing similar choices tend to make them in entirely different ways.

The fundamental question for the CEO, and for all executives, is: How do we make the right choices?

The ability to make the “right” strategic management choices is based on two governing principles, one relating to the purpose of strategy itself and the second relating to the role of the CEO. These governing principles and their impact on how companies should address each of the five choices are the foundations of superior strategic management.

THE PURPOSE OF STRATEGY

As a first principle, the purpose of business strategy is to maximize the growth of economic profit over time. It is not to do anything else. If a new strategy will increase economic profit over time, it is better than the old strategy. If a new strategy would reduce economic profit over time, it is inferior to the old strategy regardless of other benefits it might bring. Specifically, it is not the purpose of strategy to achieve competitive advantage as measured by indicators such as having the largest market share, having the most satisfied customers, or being the low-cost producer. For some businesses, achieving these goals will increase economic profit growth, but in other cases, achieving some or all of these goals will reduce economic profit growth. As the following chapters will show, pursuing these and other commonly accepted strategic objectives is simply not a reliable path to improving, let alone maximizing, the economic performance of a business.

There will be a chorus of objections to this principle. One curious objection is that the principle is “obvious,” as though that somehow diminishes its validity. As obvious as it may be, few companies or CEOs have actually embedded this principle at the core of their strategic management processes, nor is it even mentioned in most of the strategy literature. Another objection is that strategy is about much more than mere financial results and cannot be reduced to a simple financial metric. Well, certainly formulating and executing great strategies requires capabilities far beyond measuring financial outcomes, but the greatness of a strategy is not determined by the skill or cleverness with which it is constructed but by the concrete economic results that it produces. Yet another objection to the principle is that maximizing shareholder value, not economic profit growth per se, is the purpose of business strategy. This is a fair objection, but not a particularly useful one in the conduct of everyday strategic management. As will be shown, maximizing economic profit growth is an excellent proxy for maximizing value under most circumstances, not only theoretically but in the observed results of top performing companies, and it is much easier to employ in everyday decision making.

The idea behind this principle appears simple, but appearances can be misleading. The task of formulating and executing the strategies that maximize economic profit growth over time is extremely demanding, much more demanding than conventional goals like gaining market share or increasing operating income, earnings, or even return on investment (perhaps this is why the principle is admired more in the breach than in the observance). A first step toward understanding, and then accepting and utilizing the principle is to examine the explicit linkages between strategic decisions and financial outcomes. A framework describing these key linkages is the subject of Chapter 2.

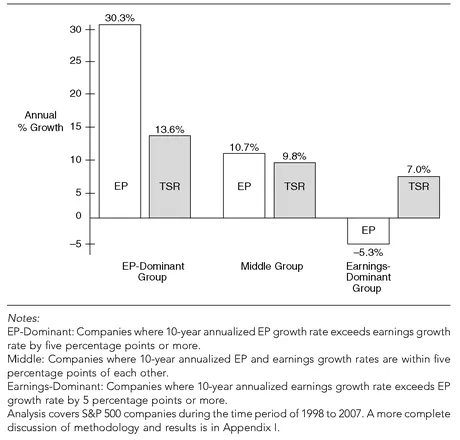

Principles are fine, but is there good evidence that maximizing economic profit growth over time has real consequences? Do companies that achieve higher economic profit growth also achieve higher valuations and returns for their shareholders over time? The answer, with appropriate qualifications, is yes, they do. Exhibit 1.1 shows the results of an analysis of S&P 500 companies comparing their 10-year economic profit growth and total shareholder return performance.

The results here show the EP-dominant group (companies that grew economic profits per share faster than they grew earnings per share) generated far higher total shareholder returns than the earnings-dominant group (companies that grew earnings per share faster than they grew economic profit per share). The nearly 7 percent annual compound difference in total shareholder returns between these two groups is enormous, and the nearly four percentage point difference between the EP-dominant and middle groups is also significant. These results, which are explained more fully in Appendix I, offer compelling evidence of a strong link between companies’ longer-term economic profit growth and their total shareholder returns, reinforcing the proposition that maximizing economic profit growth is both the purpose and the result of good strategic management.

EXHIBIT 1.1 Economic Profit (EP) Growth and Total Shareholder Returns (TSR)

THE ROLE OF THE CEO

The primary job of the CEO is to determine the proper level and disposition of a company’s resources. Whether adding a new product line, making an acquisition, entering a new market, increasing research and development, promoting a key executive, or divesting a business, the CEO is constantly reshaping the configuration of the company’s human and capital resources. For major resource commitments, the CEO may make the decisions directly, or with other executives, with support or authority from the board. For the many other decisions made by management at all levels, the CEO’s influence on the level and disposition of resources will be indirect, though powerful, through the people, performance standards, and approval processes he or she has put into place.

The majority of a company’s resources are committed through strategic decisions about how, and how fast, to grow (or shrink) lines of business or business units. Some investments may be evaluated on a stand-alone project basis, but a company’s chosen business strategies will ultimately determine the nature and magnitude of its total resource commitments. These strategies will also determine the rate of economic profit growth the company is able to sustain over time.

Therefore, the second principle of strategic management can be stated more precisely:

The paramount role of the CEO is to ensure that all resources of the company are committed to strategies that maximize the growth of economic profits over time.

The role defined here is “paramount” because although there certainly are other tasks a CEO must perform, none is more important to the long-term strategic and financial health of the company. Enforcing the company’s values, meeting with employees and key customers and suppliers, maintaining good community relations, or responding to a sudden crisis might all be legitimate demands on a CEO’s time, but consistently directing resources to achieve superior economic profit growth is the sine qua non of the CEO’s leadership role. The benefits from doing other tasks well would pale in comparison to the costs to all of the company’s stakeholders if the CEO performs this supreme task poorly.

Looking at the definition in more detail, “all resources” means all of the human, technological, and financial resources the company can bring to bear on the strategies that will increase economic profit. The company’s inventory of resources is not assumed to be fixed; if more resources can be invested to meet the objective, they should be added; if fewer resources are needed, they should be reduced. In addition, and of critical importance, is the implied corollary to this principle, which is that the CEO has a responsibility to ensure that none of the company’s resources are committed to strategies that diminish economic profit growth.

The term “strategies” refers to both business unit and corporate center strategies. The CEO of a multibusiness company obviously cannot formulate individual business unit strategies personally; that is the job of the business unit leaders. But at the end of the day, the CEO must approve each of the business unit strategies, together with the commitment of resources needed to support those strategies. This approval should be subject to a number of tests designed to determine whether the proposed strategies are likely to maximize economic profit growth. As will be elaborated in later chapters, rigorous strategy reviews are one of the most effective tools a CEO has available to execute his or her role successfully.

“Maximizing” any economic benefit is a somewhat slippery concept. Two of the most difficult complications involve trade-offs and time frames. For example, what does the CEO do if maximizing economic profits means reducing revenues or earnings for a period of time? Or, over what time frame is “maximizing” economic profits supposed occur: one year, five years, the “long term,” infinity? These are eminently fair questions of any economic objective, and they will be addressed in subsequent sections of the book.

Finally, it should be emphasized that nothing about the role of the CEO defined here is meant to imply the acceptance of illegal or unethical behavior to achieve the objective. Maximizing economic profits is itself an entirely ethical pursuit, an honest attempt by the CEO and top management team to create the wealth that results in new products and services, new technologies, growing employment, growing taxes, and growing returns on savings and investment. It is never a good commercial decision, let alone a proper legal or ethical decision, to put that growing stream of wealth at risk by evading or ignoring the requirements of good citizenship and good conscience.

FIVE CHOICES THAT SHAPE STRATEGY

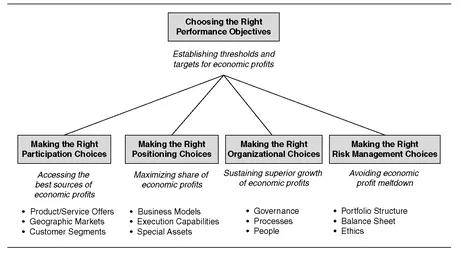

Transforming the two governing principles into the real work of a CEO requires understanding strategic management choices in terms of concrete economic goals. In Exhibit 1.2, each of the five big choices is characterized in terms of the role it plays in driving the company’s economic profit growth over time.

Each of these choices will be described briefly here and then developed more fully in the chapters that follow:

1. Choosing the right performance objectives. The choice of performance objectives has an enormous impact on the shaping of strategy. For instance, a company that gives precedence to increasing return on investment will pursue markedly different strategies than a competitor that gives precedence to earnings growth. An error in choosing the right performance objectives can be, and usually is, magnified many times over by the resultant errors in choosing the best strategies. To assure alignment of strategic choices with the governing principles, performance objectives should be based on maximizing the growth of economic profits over time. Pragmatically, these objectives must also be translated into something more concrete and measurable than the fairly abstract notion of “maximizing” economic profit growth. Specific recommendations for setting these objectives will be the subject of Chapter 3.

EXHIBIT 1.2 Five Choices that Shape Strategy

2. Making the right participation choices. Participation choices should be directed at committing the company’s resources to product markets that are likely to be good sources of economic profit growth and avoiding those product markets that are unlikely to be so. Specifically, participation choices consist of which products and services to offer, in which geographic markets, and to which customer segments. Most important, these are also choices of which products and services not to offer and which geographic markets and customer segments not to serve. Of all of the strategic choices a business unit head or the CEO makes, participation choices frequently have the biggest overall impact on the magnitude and potential growth rate of economic profit. A framework for assessing participation options is the subject of Chapter 4.

3. Making the right positioning choices. Within the product markets in which the company chooses to participate, its competitive objective should be to maximize its share of the total economic profit pie over time. The biggest single factor that will determine economic profit share is the choice of the business model, or set of core convictions, based on which the business unit head or CEO will commit the resources for growth. Among all aspects of strategy, creating the right business model is probably the most difficult, requiring tremendous creativity and often entailing a fair amount of risk. Once a business model is adopted, two additional positioning choices need to be made: the execution capabilities in which the business must excel and the best means of exploiting any special assets the business may have. Chapter 5 addresses business models and their companion positioning choices in detail.

4. Making the right organizational choices. Sustaining superior economic profit growth over long periods of time is the hallmark of a well-managed company. There are many examples of excellent CEOs who were able to lead their companies to achieve great economic profit growth during their tenures, but there are far fewer cases where that same high level of perf...