![]()

Chapter 1

Corporate Cost-Control Strategies

CONTROLLERS’ CORPORATE COST-CUTTING PLANS

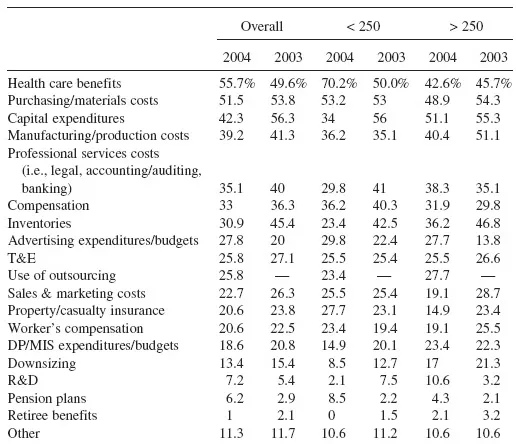

Despite the strongest economic environment and profit rebound in the past 20 years for most businesses, companies are still targeting areas in which to further streamline costs. Because of the strength of the expansion, though, controllers at smaller companies have dramatically altered their focus—away from capital spending, where increases are now the norm, and toward areas such as health care costs and purchasing/materials costs, where prices still can be hammered away at (see Exhibit 1.1). An IOMA survey revealed that although hundreds of controllers at larger companies are still focusing mainly on capital spending, other areas are increasingly coming under the spotlight.

Small Firms Identify Health Care Benefits Costs as Main Focus

A whopping 70% of controllers at small firms (less than 250 employees) now target health care costs as their key focus for the next 12 months. To do this, they are increasing cost sharing with employees; increasing co-pays, deductibles, and lifetime limits; changing to prescription programs with two or more tiers; and adding or enhancing voluntary benefits programs.

For the past few years, employers have emphasized cost sharing as the most effective means of controlling benefits costs, along with increased co-pays, deductibles, and lifetime limits. The shift shows that more companies are asking their employees to pay for more of the coverage. Employers large and small are using this approach. In many companies, all employees are now expected to contribute to the costs of their insurance, even for single coverage. Many also now offer a three-tiered system of contribution to insurance coverage across the board: the more money you make, the more you contribute toward the insurance. Most companies also offer a buyout of the insurance plan if an employee can show that he or she is covered elsewhere.

Changing to a tiered prescription drug program is the next most effective cost-control technique. Under these programs, cost sharing by employees increases if they choose brand-name drugs and decreases if they choose formulary or generic drugs. (See Chapter 3 for a fuller discussion of each of these approaches.)

Supply Management Best Practices: “Get Tough” Attitude

Controllers at both large and small companies place supply management nearly at the top of the list of areas on which they need to focus. This reflects their response to the economy and the upturn in business conditions. Specifically, it means taking a tougher stand on price increases and renegotiating existing supplier contracts when possible. It also means continuing to consolidate the supplier base, issuing blanket purchase orders for some goods, and shifting inventory to suppliers. At the same time, most controllers increasingly recognize their dependence on their suppliers’ control of their own costs; hence, they are looking across the entire supply chain and their logistics operations for savings.

Another best practice that purchasing managers now increasingly favor is global sourcing. Foreign-based suppliers are able to cut most companies’ materials costs by 30% or more, although the supply chain is longer and better planning is necessary. E-sourcing and e-purchasing processes are also gaining favor with purchasing managers, with about one in five now doing either or both. (These approaches are all described in more detail in Chapter 10.)

Controlling Compensation Costs: Reducing the Size of Merit Pay Increases

Controlling compensation costs ranks fifth on controllers’ list of where they are focusing their efforts. In this area, it is often best to take a cue from compensation managers who face this issue every day. Nearly half of these experienced professionals indicated that reducing merit pay increases was their top method for controlling compensation costs. In many cases, however, companies are combining reduction in merit increases with a new emphasis on performance and rewards to top employees, partially as a way to offset any resulting ill will, as well as to emphasize the “merit” portion of the merit increase concept.

Following well behind reduced merit increases are hiring freezes and head-count reductions. More than one-third of compensation professionals indicated that these were their most effective means of controlling costs. Far more creative and less draconian is to create a pay structure that distinguishes much more sharply between high and low performers. This approach ranks third in effectiveness, but has a much better impact on morale and productivity. (See Chapter 4 for more detailed descriptions of these approaches.)

Growth Stage of Business Cycle Alters Strategies

Given the current growth stage of the business cycle, controllers are, for the most part, no longer focused on reducing research and development (R&D) expenditures or downsizing. Inventory strategy, however, requires constant attention. The best way to control inventory, regardless of the stage of the business cycle, remains the periodic review. Identified by more than 60% of inventory managers for the past five years running is the periodic—daily, weekly, monthly, quarterly, or other time frame—seeking-out of slow-moving, excess, and obsolete stocks. This involves virtually everyone in the company who has any impact on inventory. (For more on this and other approaches, see Chapter 11.)

BAIN STUDY OUTLINES STRATEGIC IMPORTANCE OF CONTINUOUS COST-REDUCTION PROGRAMS

More controllers are working with senior managers to develop a new framework for examining and continuously reducing costs. Under this approach, top managers have decided that cost discipline will be a program, not just an implicit element of operations. Further, they expect this program to become a core competency.

In many cases, controllers who participate in these continuous cost-reduction programs are helping to remake corporate culture. Reason: At most businesses, cost discipline is an incidental reaction to events—usually a sales slump—and a byproduct of budgeting. Though this cultural change is hard work, controllers usually say the eventual success justifies the effort. Indeed, the consulting firm Bain & Company claims that businesses with successful programs of continuous cost reduction typically achieve half their increase in annual profits directly from cost reduction.

Controllers who work on these programs often emphasize two additional benefits. First, they say a business with a free-standing program of cost discipline stabilizes more rapidly in a downturn. This means that such companies are ready to grow once the business cycle turns.

Second, these firms adjust more rapidly to so-called trigger events. Bain identifies these as a collapsing market, a new technology, or a sudden increase in competition. Key point: All of these have a profound effect on sales and profits. In this situation, companies with weak cost discipline go into a survival mode and respond with across-the-board cost cuts. In contrast, companies with continuous cost-cutting programs tend to be low-cost producers. As a result, trigger events weaken their margins but leave room for flexible responses and decision making.

Starting Continuous Cost Reduction

There are four basic and widely recognized categories of cost reduction:

1. Eliminate waste and duplication

2. Implement best practices

3. Introduce technology where it is effective

4. Create virtual operations through Web enablement

Often, companies that develop continuous cost-reduction programs focus first on eliminating waste and implementing best practices. These are frequently two sides of a single coin and are often achievable through low-tech change.

The monthly close—where costs rise with the duration of the close—is a case in point. Best practices for accelerating the monthly close usually include eliminating multiple approvals, eliminating the filing of multiple copies of a single document, and automating recurring journal entries.

Tying Cost Discipline to Strategy

Certainly, all controllers support the elimination of waste and the implementation of best practices. Key point: When these measures are in place, employees are better able to use their natural problem-solving abilities to cut costs and work more effectively.

Even so, top management has to clarify how these cost-reduction efforts fit with the company’s strategy. Cost cutting that occurs without reference to an overall strategy feels like torture to employees. Yes, they are happy to have jobs as their companies, say, downsize. If they do not know where the cost cutting is headed, though, they may consider cost reduction a mere tactic to pile more work on their desks, with top management lacking a real vision for converting spending and costs into business growth.

Writing for the Harvard Management Update, Bain consultant Vernon Altman described the importance of strategic cost cutting as follows:

It has been emphasized that the payback for helping employees work more efficiently is enormous. Altman observed: “The basic insight is that a company that manages to lift the efficiency of its employees from 65% to 70% gets a 5% improvement in productivity. In terms of cost-discipline, that is huge.”

Identifying and Empowering Advocates

When implementing a continuous cost-reduction program, top management identifies and empowers champions. These share one quality: they are employees who enjoy focusing on the cost side of the business. Here, top managers work from a premise that is obvious to controllers through their budget monitoring responsibilities: namely, that most managers like the revenue-generation game and are not wired for cost reduction.

Interestingly, Bain recommends giving these champions small centralized teams to plan cost-reduction initiatives. In the Bain scheme, members of these teams come from line organizations (i...