![]()

chapter 1

the options market today

trading options today

The Internet has gone from an abstract concept to a global information network with endless applications in everyday life. By 2007, more than 160 million adults (age 18 or older) in the United States were surfing the Net. Almost 75 percent of U.S. households now have Internet access. Odds are you are connected. In fact, there is a good chance that you bought this book online.

People use the Internet in different ways. The rise of online media is giving television a run for its money. People are no longer satisfied digesting spoon-fed TV news or programs. They want to download their own podcasts, you-tubes, music videos, and movies. People want greater control of the content they digest into their systems. In many cases, they have even become broadcasters of their own media.

In addition, e-commerce is altering the way people spend their hard-earned dollars. As this immense shift in control takes place, the nature of the human adventure evolves and entire new industries are booming. Bookstores are trying harder to lure in customers to compete with Amazon.com, car salesmen often look over empty lots because sales are taking place on autotrader.com, and there are very few lines waiting for bank tellers as online banking has transformed the way people handle their finances.

The success of the Internet has also created a maelstrom in the investment world. Conventional brokers, the traditional intermediaries of an investor’s game plan, are losing ground as more than seven million investors move to online brokers instead. Reduced commissions and lightning-fast information access have enabled online trading enterprises to redefine the role of a broker.

With a keystroke, traders can access real-time quotes, annual reports, breaking financial news, technical and fundamental analytical data, and investing tips from a multitude of insightful (and not so insightful) market analysts. In seconds you can find out which stocks are hitting new highs or new lows or review an option’s volatility. It has become possible to look over charts and graphs, and then, with the click of a mouse, enter an order to buy or sell that stock or option.

Meanwhile, news sites compete for readers by offering daily market analyses, economic reports, and shrewd investment commentary. Market research firms maximize the investment community’s ability to track ever-changing fundamentals and technical indicators. Even exchanges offer a variety of free services geared to educate and inform the Net-surfing masses.

In fact, there is so much information available on the Internet that it can be overwhelming. There’s just too much to be able to digest it all. The key is to develop a comprehensive game plan that enables you to systematically trade to win. This involves more than just marking your favorites in your Web browser; you have to learn to filter out all the noise and useless information that won’t help you make a dime. This book, especially this chapter and the two that follow, is designed to help you cut through the information clutter by highlighting the most important and useful online sources of options-related information.

the exchanges Options trading volume continues to set records year after year. In 2007, six different U.S. exchanges listed put and call options. According to the Options Clearing Corporation (OCC), a total of 2.9 billion contracts traded hands that year, which represents a 45 percent increase over the roughly 2.0 billion contracts that traded in 2006.

How do traders use options? In a variety of ways. A call option can be used to participate in a move higher in a stock. An investor can buy a put option to bet on a decline in a stock price. For example, an investor who bought put options (which give the right to sell a stock) on Intel on December 31, 2007, would have seen the value of the put option more than triple when the stock fell 18 percent over the next few weeks. During that same time, Citigroup fell 3 percent, and put options on its stock rose 32 percent.

So options can be used to profit from price changes in a stock, whether higher or lower. Puts and calls can also be used to profit from price changes in a variety of other assets, known as underlying securities, including gold, oil, bonds, the stock market, and specific sectors. Furthermore, there are a variety of more advanced strategies (covered later in this book) that can generate profits if the underlying asset moves higher, lower, or sideways.

underlying asset or underlying security

the security (stock, index, or futures) from which an option (put or call) derives its value.

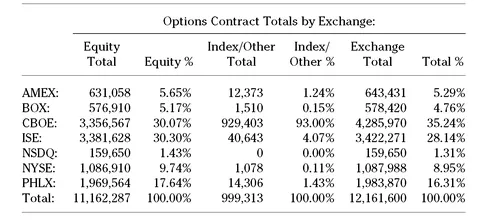

The versatility of options explains why the options market has become one of the fastest-growing areas of finance today. The seven exchanges that offer options trading—the American Stock Exchange (AMEX), the Chicago Board Options Exchange (CBOE), the International Securities Exchange (ISE), the Boston Options Exchange (BOX), the New York Stock Exchange Arca (NYSE), the NASDAQ, and the Philadelphia Stock Exchange (PHLX)—continue to see steady order flows and strong business. Table 1.1 breaks down the total volume by exchange on a typical trading day in 2008.

In fact, the ISE, which was the first all-electronic options exchange, was acquired by Eurex, a European exchange, in 2007. The year before, the New York Stock Exchange (NYSE) bought out Archipelago and, in the process, acquired the options trading business of the Pacific Stock Exchange, which is now known as NYSE Arca. More recently, the NASDAQ Stock Market launched its own options market and became the seventh exchange to list puts and calls. The all electronic exchange received SEC approval on March 12, 2008, and started trading options shortly thereafter. Like the six others, the NASDAQ options market offers trading in equity, ETF, and index options. In addition, the exchanges are becoming more efficient with the help of technology. Options trading has never been easier or more popular among individual investors. It is a strong trend that is showing no signs of slowing.

table 1.1 percentage of market share by exchange

source: the options clearing corp. (9-29-08)

At the same time, while the exchanges have been growing, they are also competing for investor attention and order flow. Consequently, the exchanges have become important sources of information regarding industry trends. For example, a visit to the CBOE web site provides a plethora of useful options-trading information, much of it free. This includes not only product specifications but also quotes, research, and historical data. The AMEX, NASDAQ, ISE, and PHLX also provide useful information on their respective web sites, listed below and in Table 1.1 for your convenience:

American Stock Exchange, Inc.

86 Trinity Place

New York, New York 10006

(212) 306-1452

www.amex.com

Boston Options Exchange

(866) 768-8845

www.bostonoptions.com

Chicago Board Options Exchange, Inc.

400 LaSalle Street

Chicago, IL 60605

(312) 786-7705

www.cboe.com

International Securities Exchange

60 Broad Street

New York, NY 10004

(212) 943-2400

www.iseoptions.com

NASDAQ Stock Market

One Liberty Plaza

165 Broadway

New York, NY 10006

(212) 401-8700

www.nasdaq.com

NYSE Arca

(Formerly Pacific Stock Exchange)

301 Pine Street

San Francisco, CA 94104

(415) 393-4000

www.nyse.com

Philadelphia Stock Exchange, Inc.

1900 Market Street

Philadelphia, PA 19103

(215) 496-5000

www.phlx.com

reality check for online traders

These days, most option orders are sent electronically to the exchanges. When I first started trading, this kind of technology didn’t exist. Customer orders were sent to the brokerage firm by phone and then the order was usually sent from the firm to the exchange through a direct line. Sometimes the order went through several individual brokers before finding its way to the pits of the exchange floor. Electronic trading has changed all that; now customers can often send orders directly to the exchanges where the best prices exist.

Since options are multiple listed, the same contract can be listed simultaneously on several different exchanges. For example, the January 30 calls on Intel might be quoted at $3.00 on the ISE and $3.05 on the CBOE. In that case, the customer would want a buy order to go to the ISE. However, that doesn’t always happen due to poor execution on the part of the brokerage firm handling the order. For that reason, many active traders prefer to deal with a direct access broker, or one that allows customers to direct their orders to specific exchanges.

direct access broker

a brokerage firm that allows customers to direct orders to specific options exchanges.

Obviously, with the help of technology, online trading is changing the nature of investing more than we can even begin to understand. It remains to be seen whether the proliferation of online trading—especially in options—is a dramatic shift in the way investors trade or just a hyped-up way for investors and traders to lose money faster in the markets. I hope it is not the latter, but I must be realistic. After all, the faster someone can trade, the more likely that person is to trade more often.

Moreover, the ease with which investors and traders are able to move in and out of the market may very well be inversely correlated to the amount of research they actually do to find and manage investment opportunities. It is paramount to your success as a trader to fight against this kind of gambler mentality when it comes to online trading disciplines. Don’t try to make up for losses by trading more and more aggressively. Instead, if you have a series of losses, stop trading.

It’s important to let the power of the Internet work for you. Online trading services increased the speed of the transaction, lowered the cost, and gave traders unimaginable access to information from which knowledgeable investment decisions can be made. Brokerage firms have never offered more objective information to their customers. It’s online and often free to customers. At the same time, the costs of trading are still falling. According to the annual ranking of online brokers by Barron’s (“Making It Click: Annual Ranking of Best Online Brokers,” by Theresa Carey, March 17, 2008), “Overall, our analysis puts the average commission at $6.52 this year, up a bit from $6.35 last year, for a 500-share block. A number of firms, meanwhile, cut their options commissions last year.” The days of paying $25 or $50 for an options order execution are over.

However, although the trend of falling commissions is clearly working in our favor as options traders, the psychology of trading hasn’t changed much. Just like with most jobs, there are fast days and there are slow days in the financial markets. You never know what might happen next. Perhaps it’s the uncertainty that’s so exhilarating.

For most professional traders, financial markets are exciting. It’s the most exhilarating game. Every morning you wake up early and have no idea what might happen next. The key to long-term success is the ability to make good decisions quickly; this is also the backbone to making consistent profits. Time waits for no one, especially the trader. However, the one attribute all traders must learn is patience. Many of the best trades take time to mature. So be patient, especially if you have placed a delta neutral options trade. Sometimes it is better to wait than to keep reacting to the market’s every whim. In fact, since many other traders are also reacting to the same news, it is almost impossible to get an edge by trading on news alone.

So while, on the outside, trading consists of buying and selling stocks and stock options, on the inside, market sentiment and trader psychology can rip the novice trader apart. Even experienced traders can get caught up in periods of market euphoria or panic. Instead, try to keep your wits and withstand everything the marketplace has to throw at you—from bidding wars to international market collapses. The first rule: Don’t panic. By remainin...