- English

- ePUB (mobile friendly)

- Available on iOS & Android

Time Series Analysis and Forecasting by Example

About this book

An intuition-based approach enables you to master time series analysis with ease

Time Series Analysis and Forecasting by Example provides the fundamental techniques in time series analysis using various examples. By introducing necessary theory through examples that showcase the discussed topics, the authors successfully help readers develop an intuitive understanding of seemingly complicated time series models and their implications.

The book presents methodologies for time series analysis in a simplified, example-based approach. Using graphics, the authors discuss each presented example in detail and explain the relevant theory while also focusing on the interpretation of results in data analysis. Following a discussion of why autocorrelation is often observed when data is collected in time, subsequent chapters explore related topics, including:

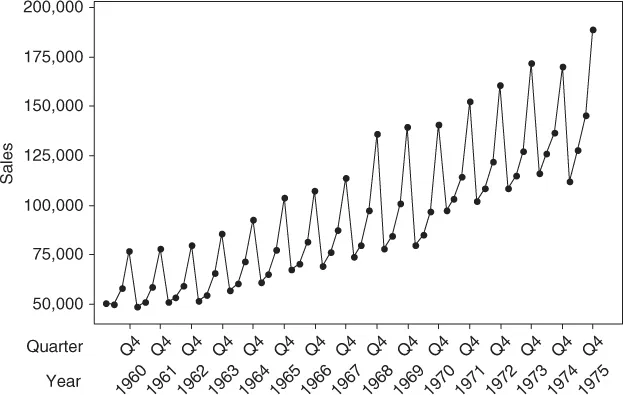

- Graphical tools in time series analysis

- Procedures for developing stationary, non-stationary, and seasonal models

- How to choose the best time series model

- Constant term and cancellation of terms in ARIMA models

- Forecasting using transfer function-noise models

The final chapter is dedicated to key topics such as spurious relationships, autocorrelation in regression, and multiple time series. Throughout the book, real-world examples illustrate step-by-step procedures and instructions using statistical software packages such as SAS, JMP, Minitab, SCA, and R. A related Web site features PowerPoint slides to accompany each chapter as well as the book's data sets.

With its extensive use of graphics and examples to explain key concepts, Time Series Analysis and Forecasting by Example is an excellent book for courses on time series analysis at the upper-undergraduate and graduate levels. it also serves as a valuable resource for practitioners and researchers who carry out data and time series analysis in the fields of engineering, business, and economics.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Table of contents

- Cover

- Series Page

- Title Page

- Copyright

- Dedication Page

- Preface

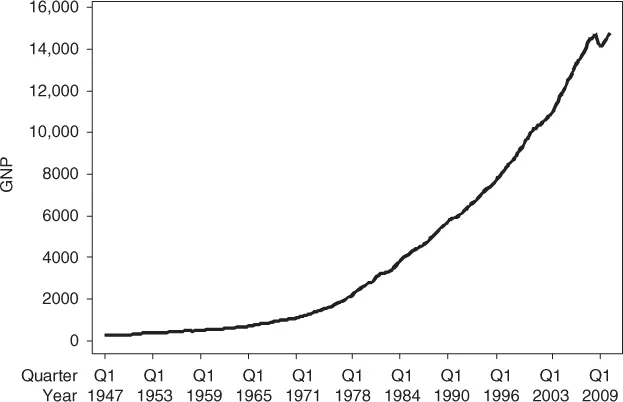

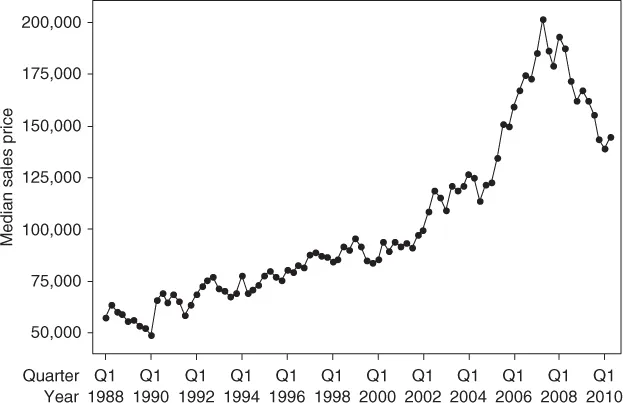

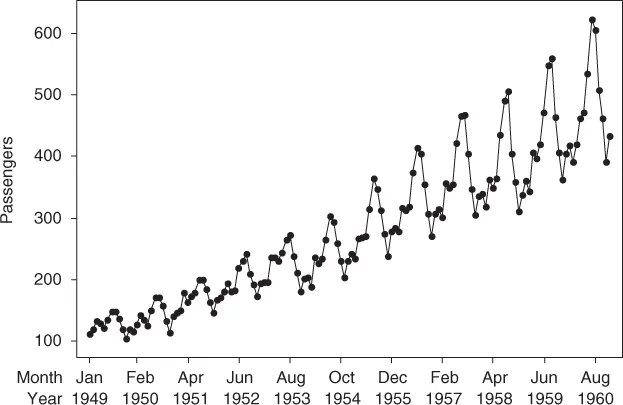

- Chapter 1: Time Series Data: Examples and Basic Concepts

- Chapter 2: Visualizing Time Series Data Structures: Graphical Tools

- Chapter 3: Stationary Models

- Chapter 4: Nonstationary Models

- Chapter 5: Seasonal Models

- Chapter 6: Time Series Model Selection

- Chapter 7: Additional Issues in Arima Models

- Chapter 8: Transfer Function Models

- Chapter 9: Additional Topics

- Appendix A: Datasets used in the Examples

- Appendix B: Datasets used in the Exercises

- Bibliography

- Wiley Series

- Index

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app