eBook - ePub

Accounting for Real Estate Transactions

A Guide For Public Accountants and Corporate Financial Professionals

This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Accounting for Real Estate Transactions

A Guide For Public Accountants and Corporate Financial Professionals

Book details

Book preview

Table of contents

Citations

About This Book

Accounting for Real Estate Transactions, Second Edition is an up-to-date, comprehensive reference guide, specifically written to help professionals understand and apply the accounting rules relating to real estate transactions. This book provides financial professionals with a powerful tool to evaluate the accounting consequences of specific deals, enabling them to structure transactions with the accounting consequences in mind, and to account for them in accordance with US GAAP. Accountants and auditors are provided with major concepts, clear and concise explanations of real estate accounting rules, detailed applications of US GAAP, flowcharts, and exhaustive cross-references of the authoritative literature.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Accounting for Real Estate Transactions by Maria K. Davis in PDF and/or ePUB format, as well as other popular books in Business & Accounting. We have over one million books available in our catalogue for you to explore.

Part 1

Accounting for Real Estate Transactions—General

Chapter 1

Acquisition, Development, and Construction of Real Estate

1.1 Overview

Investments in real estate projects require significant amounts of capital. For real estate properties that are developed and constructed, rather than purchased, project costs include the costs of tangible assets, such as land and other hard costs (sometimes referred to as “bricks and mortar”); intangible assets and other soft costs, such as architectural planning and design; and interest and taxes. Costs are often incurred before the actual acquisition of the project, which raises certain questions—for example, from what point in time should costs be capitalized? What types of costs are capitalizable?

Determining what types of costs to capitalize in the preacquisition, acquisition, development, and construction stages of a real estate project has been an issue for many years. Several decades ago, in reaction to significant diversity in practice, the American Institute of Certified Public Accountants (AICPA) issued this accounting guidance related to cost capitalization:

In 1982, the Financial Accounting Standards Board (FASB) issued FASB Statement No. 67, Accounting for Costs and Initial Operations of Real Estate Projects, codified in Topic 970, Real Estate—General, extracting the accounting principles provided by these AICPA pronouncements. Nevertheless, diversity in practice has continued to exist in some areas, including the capitalization of indirect costs during the development and construction period and the treatment of repair and major maintenance costs incurred subsequent to the completion of real estate projects.

The AICPA undertook another project to develop a comprehensive framework for cost capitalization and, in 2003, issued for public comment the proposed SOP, Accounting for Certain Costs and Activities Related to Property, Plant, and Equipment. That proposed SOP was approved by the AICPA Accounting Standards Executive Committee (AcSEC) in September 2003; however, a final SOP was never issued. In April 2004, the FASB decided not to clear that proposed SOP, mainly for these stated reasons:

1.2 Acquisition, Development, and Construction Costs

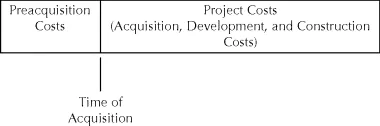

The Real Estate Project Costs guidance of Topic 970 (FASB Statement No. 67) provides the primary authoritative guidance for the cost capitalization of real estate project costs. That Statement divides the costs incurred to acquire, develop, and construct a real estate project into preacquisition and project costs. Preacquisition costs encompass costs incurred in connection with, but prior to the acquisition of, real estate. Project costs include costs incurred at the time of the real estate acquisition as well as costs incurred during the subsequent development and construction phase (see Exhibit 1.1).

Exhibit 1.1 Illustration of Cost Classification

Real estate developed by a company for use in its own operations other than for sale or rental is not within the scope of the Real Estate Project Costs Subsections of Topic 970 (Statement No. 67).1 Because—aside from the proposed SOP, Accounting for Certain Costs and Activities Related to Property, Plant, and Equipment—there is no authoritative literature related to the capitalization of costs for properties used by an enterprise in its own operations, the guidelines in the Real Estate Project Costs Subsections of Topic 970 (Statement No. 67) are generally also applied to properties used by an entity in its own operations.

1.2.1 Preacquisition Costs

Preacquisition costs are costs related to a real estate property that are incurred for the express purpose of, but prior to, obtaining that property.2 They may include a variety of costs, such as:

1.2.1.1 Principles for the Capitalization of Preacquisition Costs

Options to Acquire Real Property.

Payments for options to acquire real property are capitalized.3

Preacquisition Costs Other than Options to Acquire Real Property.

Preacquisition costs other than the cost of options can only be capitalized if the acquisition of the property (or an option to acquire the property) is probable,4 and if the costs meet these two criteria:

1. The costs must be directly identifiable with the property.

2. The costs would be capitalized if the property were already acquired.5

The guidance in Accounting Standards Codification (ASC) 970-340-25-1 through 25-3 (FASB Statement No. 67) has established a high threshold for the capitalization of preacquisition costs with the requirement that the acquisition of real property be probable. If the purchaser is not actively seeking to acquire the real estate property or does not have the ability to finance or obtain financing for the property, or if there is an indication that the real estate property the purchaser seeks to acquire will not be available for sale, the project is not considered probable.6 Any costs (other than costs related to an option to acquire real estate) incurred before a project is considered probable have to be expensed as incurred. If the project becomes probable at a later point in time, costs incurred prior to the project becoming probable cannot subsequently be capitalized.

Example—Preacquisition Costs

BetterStore Inc. (B) plans to build five storage centers in various cities throughout the United States. Ten suitable land parcels have been identified. The land parcels upon which B is considering building the storage centers are for sale, and B has the ability to obtain financing. The final decision as to which locations to use for the storage centers will be made after certai...

Table of contents

- Cover

- Wiley Corporate F&A Series

- Title Page

- Copyright

- Dedication

- Preface

- About the Author

- List of Abbreviations

- Part 1: Accounting for Real Estate Transactions—General

- Part 2: Accounting for Real Estate Industry-Specific Transactions

- Glossary

- Index