![]()

CHAPTER 1

Capital Markets

This book explores private capital markets, the last major uncharted financial markets. Private markets contain millions of companies, which generate more than half of the gross domestic product (GDP) of the United States and the world. Yet these markets are largely ignored, partly because of the difficulty obtaining information and partly because of the lack of a unified structure to approach them. This work offers such an approach. It provides a theoretical and practical framework that enables readers to make sound investment and financing decisions in the private capital markets.

A capital market is one in which businesses can raise debt and equity funds. Since the 1970s, public capital markets have received almost all of the attention from academics in the literature.1 In 2004, the first edition of this book challenged the assumption that public and private capital markets are substitutes, showing instead that the two markets were different in most meaningful ways. Specifically, 12 factors differentiate public and private markets:2

1. Risk and return are unique to each market.

2. Liquidity within each market is different.

3. Motives of private owners are different from those of professional managers.

4. Underlying capital market theories that explain the behavior of players in each market are different.

5. Private companies are priced at a point in time, while public companies are continuously priced.

6. Public markets allow ready access to capital, while private capital is difficult to arrange.

7. Public shareholders can diversify their holdings, whereas private shareholders cannot diversify.

8. Private markets are inefficient, whereas public markets are fairly efficient.

9. Market mechanisms have differing effects on each market.

10. Capital market lines (costs of capital) are substantially different for each market.

11. The expected holding period for investors is different.

12. The transaction cost of either buying or selling the interest is different.

Several of the major differences between public and private markets require further discussion. Specifically, public and private markets differ in structure and behavior, which necessitates unique capital market theories to better organize and predict behavior.

MARKET STRUCTURE

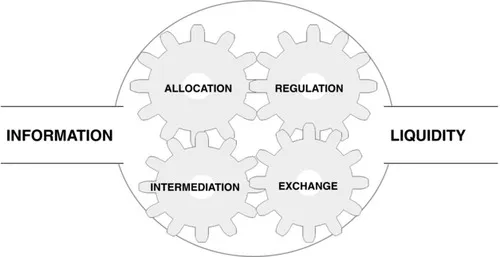

All markets are comprised of commercial activity where parties undertake an exchange because each expects to gain. In a free market, participants are able to meet and exchange for a mutually agreed price. Markets mechanisms are organized sets of activities enabling people to exchange or invest. Exhibit 1.1 depicts several market mechanisms as gears in a market that is greased by information and liquidity.

INFORMATION

The role of information is central in both public and private capital markets. Availability, accuracy, and access to information lubricate all market mechanisms. Information availability in public markets renders them more efficient. Theoretically, they are less likely to produce deals where one party takes advantage of another because of asymmetrical information. It takes government regulation and enforcement to ensure that public information is accurate and available to all.

Availability, accuracy, and access to information are significantly different in the private markets. Financial statements are the basic building blocks of information. Most private companies lack audited financial statements and are less likely to prepare their financial statements in compliance with generally accepted accounting principles. Even this lesser-quality information is not made publicly available. The absence of real-time, readily available information is a major difference between the markets.

Liquidity

Liquidity is the central value proposition of any market. Consider it as capital in motion, a necessary lubricant for movement between asset classes. The term refers to the amount of capital in a market and the flow of that capital internally as well as into and out of the market.

Markets are described as more or less liquid. For example, real estate and privately held businesses are typically illiquid investments, while investments in publicly held businesses are considered liquid. Public companies largely transfer fractional interests. Conversely, since there is no market to sell private minority interests, most private transfers involve enterprise sales. While an enterprise transfer of a private company can easily take a year or more, public enterprise sales normally require only six months. Investors in private companies factor a liquidity premium in their return expectations because they recognize that these investments are not easily exited.

Market Mechanisms

Market structure is comprised of several mechanisms; among them are:

- Allocation mechanism

- Regulatory mechanisms

- Intermediation mechanisms

- Exchange mechanisms

Market mechanisms provide a structured way to understand complex markets. These mechanisms are the activities or gears that enable a market to operate. Synchronization is possible because each mechanism contains elements of other mechanisms, all operate in a similar information environment, and all mechanisms tend toward equilibrium.

In equilibrium, the supply of companies for sale equals the demand for those companies. More sellers in a market lead to greater competition enabling buyers to get better value in the exchange. Fewer sellers mean less value for buyers. In short, a market is in equilibrium when supply equals demand.

Market mechanisms operate in an environment lubricated with information and liquidity, and one that tends toward equilibrium. This occurs, for example, in allocating scarce resources.

Allocation

Allocation is the market mechanism of rationing resources. Because resources are finite, markets allocate money, resources, effort, authority, and cooperation as well as tangible and intangible assets. Allocation decisions may be arrived at using a variety of criteria. For example, a first-come, first-served process benefits the fleet of foot. A political process, however, allocates benefits based on the ability to manipulate that process.

Resource allocation in the public markets is relatively efficient as demonstrated by both pricing and access to capital by public companies and investors. This is a distinct contrast with the relative inefficiency found in the private capital markets, as demonstrated by the inefficiency surrounding the Pepperdine Private Capital Market Line introduced in Chapter 2.

Regulation

“Regulation” refers to attempts to bring the market under the control of an authority. Regulation is provided by a number of sources, including government and competition.

Government regulation is pervasive, typically expressed as restrictions on behavior. It provides adjudication of disputes as well as rules for eligibility and participation. Governments may attempt to control all elements of the market. Yet in a free market system, governmental control itself operates under restrictions, which introduces competing authorities. Public companies are exposed to more extensive governmental regulation than are private companies.

Markets are also regulated through a severe discipline imposed by competition. Firms are not free to raise prices or salaries without facing economic consequences. Nor can a company pay its employees whatever it wants. Competition forces efficiency and ultimately causes supply and demand to balance. Competition regulates the market.

Intermediation

Specialization creates a need for intermediaries to serve as agents of exchange. This leads to increased efficiency based on developing expertise in disparate areas; however, it also breeds inefficiency through isolation. Specialization creates the need for information and trading expertise. Intermediaries act as infomediaries where information opacity exists.

Intermediaries add efficiency to a market in three ways:

1. They provide a communication system between parties.

2. They work to establish prices that often serve as the starting point in exchange discussions.

3. They might act as market makers by actually participating in the market as sellers or buyers in order to create a liquid market.

The public transfer market functions with agents and market makers. Public investment bankers are agents who advise on public enterprise transfers. Market makers are firms that stand ready to buy and sell a particular stock on a regular and continuous basis at a publicly quoted price. Public agents and market makers provide liquidity and efficiency to the public market. The private transfer market has agents, such as business brokers, merger and acquisitions (M&A) intermediaries, and private investment bankers. Yet none of these groups performs all the functions of public market makers.

Exchange

Market participants in a supply and demand economy are free to exchange something for an agreed price. Supply and demand in a market is affected by a host of factors. Shifts in supply or demand cause price increases and decreases. Changes in customer preferences or the cost of money may alter demand. Equilibrium is reached at the point where the greatest number of consumers and producers is satisfied.

An exchange is an institutionalizing mechanism. Institutionalized exchanges take many forms, including business-to-business, business-to-consumer, intermediated, and direct exchanges. The nature of the exchange mechanism is the most obvious difference between public and private markets. There is no single place or entity where an owner or investor might exchange an interest in a private company.

Comparison of the Markets

Market mechanisms explain the structure of the private capital markets. Exhibit compares and contrasts transfer issues in the public and private capital markets. The private capital markets are a complex interacting network of discrete exchanges rather than a unified structure. They differ greatly from the unified structure of the public markets. For example, institutionalization in the public markets is developed more than in the private markets. In the public market, the players are licensed, highly regulated, and larger in size, and they tend to offer a wide range of financial services. In the private market, there is a host of smaller transfer players who provide discrete services. While these services are largely unregulated, the Securities and Exchange Commission and various state authorities provide some regulation.

EXHIBIT 1.2 Comparison of the Capital Markets