![]()

CHAPTER 1

Foreign Exchange Reports

Foreign exchange (FX) reports are market-intelligence documents that comprise many facets. Bank reports for example address direct and sometimes short-term market variables such as a short- or long-term trade, a possible central bank interest rate change, or economic variable that directly relates to the market.

Institutional reports address bigger-picture issues that comprise market intelligence in terms of overall trading volume, types of instruments traded, and a fundamental or technical aspect that must be addressed in order for the market to function. Yet these reports address overall market fundamentals and functions so traders and market professionals can understand the big picture as it relates to their overall trade plan. Institutional reports are always forward looking and written by market professionals with the ability to understand and analyze big-picture issues. Much information can be derived from professional reports in terms of strategies, risks, and highlighting of possible scenarios with future implications to profit. The key is to understand the various reports and their implications because some reports are nation specific while others address the overall market as it relates from nation to nation.

This section addresses a variety of market-intelligence reports that relate both to a specific nation and overall market picture. This section incorporates not only reports from a market-intelligence perspective but institutional histories, frequencies of reports, and types of information released and addressed.

Bank of International Settlements

Before we discuss the much-publicized implications of the Bank of International Settlements’ Triennial Survey and the not-so-publicized quarterly report, here’s a quick and basic overview of the role, functions, and historical aspects of the Bank of International Settlements (BIS) due to its profound importance to not only world banking and economic stability, but the markets in particular, both yesterday and today.

Established in 1930 as the world’s banker, the BIS today is much more than the facilitator of gold and FX transactions for the 54 central banks that contributed to its 2007 report. It was originally established to repatriate German monies to the Allies after the war at the behest of the Bank of England, which called for its establishment. How to implement further Treaty of Versailles’ arrangements between nations after World War I further heightened its need as intermediator to facilitate multilateral payments and currency conversions. Its location in Basel, Switzerland, attests to not only its neutrality but its commitment to carry out its mandate (BIS 2010).

The real existential challenge to the BIS came during the 1930s at the height of the currency wars, when the Bank of England suspended its gold standard in 1931 and the United States did the same in 1933. Gold-backed nations sought stability due to currency price fluctuations by the United States and the United Kingdom as trade imbalances seriously deviated from the norm of gold-backed nations and threatened their economic existence (BIS 2010).

The resolution was the Tripartite Agreement signed by the United States, France, and England in 1936 to ensure price stability and to abstain from competitive economic devaluations of currency prices as long as currency prices didn’t destabilize the economic balance of trade. While the world prevented a crisis, the BIS maintained its existence until the bank was rescued by President Truman in 1948 when the United Nations voted for its dissolution in 1944. Ironically, Franklin Roosevelt died shortly after in April 1945, so Truman assumed the presidency and, with the help of the United Kingdom, ensured the bank would remain today as one of the oldest world institutions (BIS 2010).

Moreover, the BIS provides short-term collateral loans to nations through their respective central banks and settles trades every trading day at 5:00 p.m. eastern standard time through its Committee on Payment and Settlements (BIS 2010). Closing spot currency, outright forwards, currency options, and swap prices are established at the 5:00 p.m. settlement to end a full-cycle trading day. Trading institutions must then reflect these changes to all accounts the world over through their respective central banks.

The Committee on Payment and Settlements ensures that world markets not only function properly but further ensures this functionality replicates itself every trading day. Rollover debits and credits are marked to market at the 5:00 p.m. close. Market bid/ask spreads tend to change dramatically at times as traders begin the new trading day during the Asian session. This however depends on the liquidity provided to markets based on trading activity. Robust trading means decreased spreads as liquidity is provided to the markets.

Triennial Survey

Since 1989 and every three years thereafter, the BIS publishes its quite detailed Triennial Survey through its Markets Committee and the Committee on the Global Financial System—established in 1971—that focuses on daily turnover in U.S. dollar amounts and outstanding contracts in FX for the last three years.

Information is reported to the BIS by central banks—54 at the 2007 count up from 52 in 2004, 48 in 2001, 43 in 1998, and 26 in 1995 (BIS 2007 Triennial Survey). Surveys covered data on amounts outstanding of over-the-counter (OTC) FX interest rate, equity and commodity, and credit derivatives. FX, spot, outright forwards, foreign exchange swaps, and currency and interest-rate derivatives are surveyed. Interestingly, the 2007 report included for the first time credit default swaps (CDS).

These surveys feature quite detailed reports that serve as important guides for market professionals and traders because they determine where money flowed to seek its best yield and the types of instruments utilized to facilitate those returns. All have important implications for the spot trade.

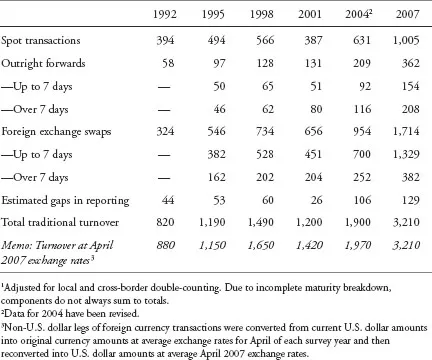

Triennial Survey 2007 versus 2004

From the 2007 report provided in Exhibit 1.1, Global Foreign Exchange Market Turnover, we learned that daily turnover of all spot, outright forwards and swap transactions increased to $3.2 trillion, up from $1.9 trillion in 2004, a 69 percent increase. Based on types of instruments from Exhibit 1.1, swaps rose 80 percent in 2007, an increase of 45 percent from 2004. But notice the number of up-to-seven-day swap transactions in Exhibit 1.1 that increased since its full reporting period began in 1995.

EXHIBIT 1.1 Global Foreign Exchange Market Turnover1: Daily Averages in April, in Billions of U.S. dollars

Source: Bank of International Settlements.

From 1995 to 2001, the number of up-to-seven-day swap transactions doubled to the over–seven-day counterpart, while those same transactions doubled from 2004 to 2007 with the number of swap transactions on a continual rise. Why? A swap is primarily an agreement to exchange cash flows. One can look at swaps as a bank simultaneously buying or selling a currency for one maturity and selling or buying the equivalent amount at a later date. They trade OTC and were once employed primarily when normal markets couldn’t offer financing, but their popularity has increased year over year as a regular form of finance. A swap can be an interest rate swap, a commodity swap, an equity swap, or a currency swap.

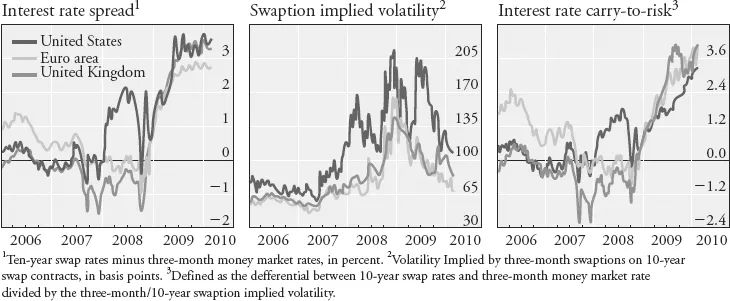

Yet swaps can be employed as a hedge against an interest rate swap, a currency swap, a commodity swap, or an equity swap. As noted in Exhibit 1.2, a trend developed from 2006 to 2010. As interest rate spreads tightened, implied volatilities decreased and carry to risk rose.

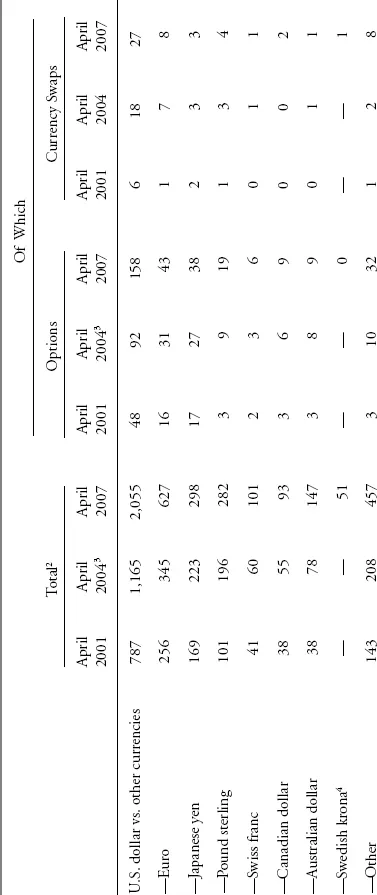

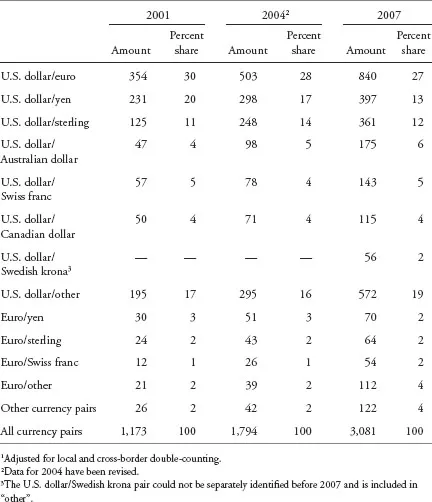

As noted in Exhibit 1.3, clearly the U.S. dollar and other currencies are the most widely traded swaps from 2001 to 2007, followed by the euro, Japanese yen, pound sterling, Swiss franc, Canadian dollar, and Australian dollar.

EXHIBIT 1.3 Reported Foreign Exchange Turnover in OTC Derivatives Markets by Currency Pair1: Daily Averages in April, in Billions of U.S. dollars

Source: Bank of International Settlements.

The number of outright forwards from its up-to-seven-day to its over–seven-day trade has held steady since the full reporting began in 1995. Yet swap transactions far outnumber outright forwards by four times in 2007 and five times in 2004. Overall outright forwards increased 73 percent in 2007 from 2004. An outright forward is a transaction where two parties agree to buy or sell a predetermined amount of currency at an agreed rate sometime in the agreed-upon future. Traders trade views based on future exchange rates.

Major world companies doing business across borders trade forwards to take advantage of a particular exchange rate to repatriate money, to lock in rates for future business, to hedge, and speculate.

Spot transactions increased 56 percent in 2007 from 2004, according to latest reports, but this increase was lower than previous years. Yet from 1998 to 2007, spot transactions almost doubled from $568 billion to $1.5 trillion and almost tripled from $394 billion in 1992 to $1.05 trillion in 2007. Notice how swaps slightly outnumber spot transactions from 1995 to 2007. Further notice how swap transactions almost doubled over spot transactions in 2001. Spot traded $387 billion to $656 billion for swaps. Interest rate volatility may be one explanation because interest rate swaps are the most widely traded of all swap instruments. Yet 2001 was the year 9/11 occurred, so much volatility was experienced (Triennial Survey 2004, 2007).

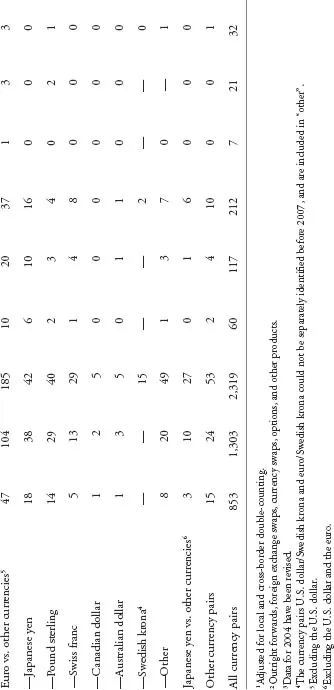

In Exhibit 1.4, the U.S. dollar is by far the most widely traded element of a pair. The number one traded pair is the euro, yen, sterling, Australia, Swiss franc, and Canadian dollar. And all traded against or with the U.S. dollar. An interesting phenomenon is the Hong Kong dollar that traded a daily turnover of $79 billion in 1998 to $175 billion in 2007. The Singapore dollar falls within the same parameters of daily turnover exhibits. Both trade in government controlled trading bands.

EXHIBIT 1.4 Reported Foreign Exchange Market Turnover by Currency Pair1: Daily Averages in April, in Billions of U.S. dollars and Percent

Source: Bank of International Settlements.

The interbank market in 2007 accounted for 43 percent of all foreign exchange transactions, down from 53 percent in 2004. The retail currency broker may be one explanation, as well as the number of swap and forward transactions that occur on the OTC market.

While the Triennial report may have a three-year look-back period, it has profound effects for currency markets. We learned that spot and swap transactions account for the majority of foreign-currency trades around the world, about $2.7 trillion in 2007. The U.S. dollar by far is the most widely traded instrument, followed by the euro, Japanese yen, British pound, Swiss franc, Canadian dollar, and Australian dollar. All other currencies of the world are thinly traded and can’t compare to the amounts traded of these major currencies. One reason is the convertibility factor.

Of the vast majority of the world’s currencies, 150 of 200 can’t be directly converted, so conversion is facilitated through the major currencies because they are more liquid. Another reason is larger economies where trade and investment not only flow freely but gross domestic product (GDP) levels...