eBook - ePub

Securitization and Structured Finance Post Credit Crunch

A Best Practice Deal Lifecycle Guide

This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Securitization and Structured Finance Post Credit Crunch

A Best Practice Deal Lifecycle Guide

Book details

Book preview

Table of contents

Citations

About This Book

In this book, you will be introduced to generic best practice principles for a post credit crunch market. First, the book takes a closer look at the reasons why the market froze during the 2007 to 2009 credit crisis. Then you will learn how to use the principles explained here in your generic deal's typical life cycle stages. Throughout, each stage is discussed in detail, from strategy and feasibility, pre-close, at close, and post close. The final section of the book contains a toolbox of references, tables, dictionaries, and resources.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Securitization and Structured Finance Post Credit Crunch by Markus Krebsz in PDF and/or ePUB format, as well as other popular books in Business & Managerial Accounting. We have over one million books available in our catalogue for you to explore.

1

Introduction

1.1 SETTING THE SCENE: ABOUT THIS BOOK

First of all—and before I forget: Thank you for buying this book.—I much appreciate your interest and curiosity.

As the subtitle of this book implies, we will be taking a close look at a securitization and structured finance “deal”. But, hang on a minute, there are so many different deals out there, spanning across many different asset classes as well as jurisdictions, so why are we looking at one “deal”?

The answer is simple: Our starting point for this journey is a generic deal, with no particular focus on asset class, deal structure, or jurisdiction. Based on the generics, I will guide you through along the way and would hope to develop your understanding so that you are equipped with the right tools, are able to ask the right questions, and consequently receive the appropriate answers.

Thinking about this introduction, I realized that there is really no such structured finance or securitization “college” or “university” course out there that would equip practitioners with the necessary tools and skills to just go away and structure or manage a deal throughout the transaction’s lifecycle for their firms. Clearly, there are many independent providers of courses (including more recently the rating agencies themselves), but with those courses being more theoretical in nature and typically only lasting a short duration (i.e., 2 to 5 days), don’t expect to walk away as a qualified structurer, underwriter, rating agency analyst, or securitization lawyer from such seminars.

Furthermore, a lot—if not most—of the practical knowledge and skills that are needed for these kinds of fairly complex activities are typically acquired over a long period of time on the job and by working with more experienced colleagues. However, as a direct consequence of the credit crisis, many banks and other financial institutions were forced to wind down some—if not the majority—of their structured finance-related business areas leading directly to a huge drain on experienced resource.

The knowledge in this book has been accumulated over at least 10 years including the “good” years, when this was a highly buoyant market as well as the four solid years of the 2007–2010 credit crisis—which many commentators referred to as the worst one of the last century. I am very grateful and indeed feel privileged to have been able to see both sides of the coin and to have been able to learn from both of them.

Whilst I can understand that some people may wish they could turn the clocks back pre crisis, when many institutions as well as individuals were doing very well, I can also understand an adjustment was probably overdue and with the crisis the pendulum had overswung. What we have seen since are many serious attempts to restore some kind of equilibrium. The danger here is of course that the securitization and structured finance market will be hit too hard with new regulatory requirements and essentially become prohibitively regulated.

Structuring a transaction can take anything from 2 to 6 months whereas the resulting structured finance deal is likely to be around for much longer—anything from 5 to 25 years, in extreme cases even considerably longer (usually due to specific legal or other requirements in certain jurisdictions).

The book’s key aims are twofold:

• To provide a solidly grounded back-to-basics approach that allows you to gain a quick understanding of the underlying key principles and sound practices for conducting these types of transactions.

• To give you a tried and tested set of tools to get you started in the structured finance market.

Please note, however, that the market itself has always been—and continues to be—in constant flux and, more recently, it has become increasingly difficult—if not at times impossible—to keep up with global developments. This leads to a higher level of uncertainty in terms of the form and shape the future market will actually evolve into. Taking a more generic deal view helps here in ensuring that most of this will be applicable to you in one way or another, no matter whether you are based in Europe, the U.S., or Asia—as I take a global view here.

I personally hope that you get value out of the book. If you have any comments—good or critical—please feel free to send them to me via the book’s companion website www.structuredfinanceguide.com or contact me at www.markuskrebsz.info

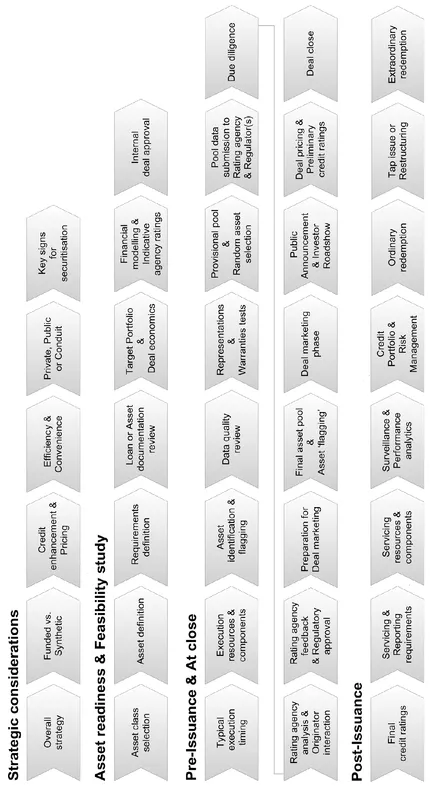

1.2 DIAGRAMMATICAL OVERVIEW OF DEAL LIFECYCLE STAGES

The following section provides a diagrammatical overview of deal lifecycle stages for a generic structured finance transaction. I emphasize the focus on generic as there may be slightly different steps depending on the asset class and jurisdiction that are involved. Figure 1.1 gives you a general overview of these deal lifecycle stages and also provide a roadmap to the book.

Following this overview you will find a more detailed roadmap (Chapter 2) dependent on the particular role you may currently be playing in the market (i.e., originator, issuer, deal structurer, arranger, lawyer, rating agency analyst, investor, portfolio manager, researcher, regulator, financial journalist, or other interested parties).

1.3 ROLE-BASED ROADMAP TO THE BOOK

Assuming that you are currently playing a particular role in the structured finance market, you would typically be more interested in certain areas and chapters more than others. Hence, I hope that you will find the following guidance with a focus on your particular area useful.

1.3.1 Originator, issuer, deal structurer, arranger

If you look at these roles logically, you may see that most of the chapters covering pre-close and at-close lifecycle stages are likely to be of most interest to these types of market players.

1.3.2 Investor, portfolio manager, asset manager

Equally, from an investor’s, portfolio manager’s, and asset manager’s perspective anything post close of a transaction’s lifecycle is likely to be most interesting for the analysis of transactions. However, in light of recent regulatory changes (e.g., requiring investors to undertake their own due diligence), some chapters on asset readiness are likely to be of interest to these roles too.

Figure 1.1. Generic deal life cycle stages

1.3.3 Lawyers, rating agency analysts, researchers, regulators, financial journalists and others that do not fit any of these categories

For the remaining readers, I’m afraid it pretty much depends what in particular you are after, so you are best advised to take a look in the table of contents as well as the comprehensive index at the back of the book to see if this helps.

Part I

The credit crisis and beyond

2

Looking back: What went wrong?

2.1 OVERVIEW

To answer the question, “Looking back: What went wrong?”, the answer can be succinctly given as “Quite a few things actually.”

But in all fairness, each of the following sore points on their own would probably not have led to the spectacular collapse of the structured finance market, in particular, and the global financial markets, in general. The combination of them, however, within the framework of globally operating and highly interconnected capital markets led to the chain of events that unfolded into the financial crisis 2007 to 2010.

This was then further exacerbated by a panicked reaction of the global financial regulators as well as market participants. For instance, the decision to withdraw formal support for Lehman Brothers in September 2008: I remember working for one of my clients who was at that time holding one of the largest portfolios of structured finance bonds—approximately 1,100 bonds worth around £45bn at the time—and many of these bonds were in one way or another exposed to Lehman credit risk as counterparties. The impact of Lehman’s bankruptcy on those bonds as well as countless transactions where it acted as credit default swap (CDS) or interest rate swap (IRS) counterparty was almost impossible to assess—you can imagine the tension in the air; something I will never forget.

Some call this “the law of unintended consequences” and I guess they are right. These panicky decisions were taken in a matter of days—sometimes hours—and the only people involved were usually senior government officials, central bankers, and the CEOs of all the big banks affected—not necessarily best placed though to understand the potential impact of their decisions on the market, particularly the structured finance market.

I don’t blame them: it’s just the way things were in those days in many institutions: information would be filtered before it actually hit the top level and in many cases senior management would only get to see part of the picture—not always able to properly understand the implications of what they did get to see. Another example was a client who was sitting on a sizable structured finance portfolio for years with senior management blissfully unaware of what “assets” were sitting in its books.

In order to develop best practice principles for the market post credit crunch it is important to understand what went wrong and why? Once the shortcomings have been identified, we will be able to look ahead and understand the requisites so that a better and more robust market develops.

Before we delve deeper into this in Section 2.2, please note that we will be taking a closer view at areas that are of particular importance for securitization and structured finance only. If you are after additional sources and reports covering the whole financial market and not only this subsector, then please refer to this book’s bibliography. Alternatively, search for “Financial crisis of 2007–2010” on Google which will help you identify the comprehensive coverage and the underlying problems that led to the credit crunch.

2.2 DATA, DISCLOSURE, AND STANDARDIZATION

When you as an individual are borrowing a substantial sum (e.g., for a mortgage) from your bank, the lender would like to become fairly comfortable that you will be able to repay the mortgage over the agreed period as well as ensuring that you have a sufficient regular income to service the interest payments for the term of the mortgage. You may call this process of gathering data and answers to relevant questions “due diligence”.

In order to support such due diligence activities as well as subsequent risk analysis your lender will typically request a considerable amount of information (i.e., data) so that he can support his decision and justify whether or not you have the creditworthiness and financial standing to service your principal as well as interest payments.

Some of the data used by lenders would be information about your financial history and possibly the use of a “credit score” of some kind, which simply puts you into one of various categories which expresses your presumed current credibility based on your past financial performance. This credit score would then be used as a measure to forecast and predict whether or not you may be able to repay the mortgage over the term of the loan.

You would expect the same lender to be even more prudent when using substantially larger amounts of (not quite his own money) to purchase, say, AAA-rated prime U.S. RMBS tranches. Amazingly, this was not always the case with structured finance investments as many investors turned to the credit rating agencies for such assessment instead.

For starters, rating agencies would typically receive larger amounts of data which enables them to undertake detailed analysis. Some of these data would have been treated almost as proprietary by the originators of such instruments and hence they would not offer the same level of information to investors of their structured finance bonds. Furthermore, rating agencies would also request considerable amounts of historical data in order to model the future expected (rating) performance of these structured finance bonds. The difficulty here though is that it is fairly difficult—in fact, almost impossible—to model future performance based on historical information because

• A rating model will always be a “model” and never be able to reflect true reality. In fact, as my dear friend Nassim Taleb would put it: “Models are always wrong, but some are harmful.” So please keep this in mind.

• People in the investment funds business know and understand this truth—hence they include a disclaimer in their prospectuses which states that “Past performance is no indication of future returns” which is not just a legal clause but a fundamental investment principle that should never be ignored.

Once the deals have been structured and issued to the market, there would be—depending on the asset class—considerable amounts of performance-related data (e.g., trustee, servicer, cash manager reports, etc.) available to investors. However, from an investor’s perspective, it can be a l...

Table of contents

- Title Page

- The Chartered Institute for Securities & Investment

- Copyright Page

- Dedication

- Preface

- Acknowledgments

- Chapter 1 - Introduction

- Part I - The credit crisis and beyond

- Part II - Deal lifecycle

- Part III - Toolbox

- Part IV - Analytical tools

- Appendix A - Glossary

- Appendix B - Ratings

- Appendix C - List of abbreviations

- Appendix D - Bibliography

- Index