![]()

Chapter 1

Product Fundamentals

1.1 Chapter Overview

In this chapter we consider the features of a number of instruments that will be the focus of subsequent sections. The coverage is not intended to be comprehensive; the aim is to make sure that the reader is armed with sufficient terminology to be able to understand the more detailed concepts that will follow. Pricing and risk management will be the subject of Chapters 2 and 3, respectively.

This chapter starts with a discussion of the main “cash” (i.e., non-derivative) markets of fixed income, inflation and credit. The coverage then widens to incorporate the derivative building blocks, namely futures, forwards, swaps and options. Within this section the material occasionally leans towards the detail of specific products in certain asset classes that are considered key. However, the discussion relating to options is asset class neutral to keep the chapter size manageable.

Readers with a good knowledge of these subjects can skip this chapter but we would suggest a quick skim of the pages just in case a review is needed!

1.2 Bond Fundamentals

A key building block for the first part of the text will be bonds. A bond is an IOU that evidences the indebtedness of a borrower. Borrowers comprise mainly sovereign and corporate entities, although there have been issues made by individuals such as the pop star David Bowie.

1.2.1 Fixed income structures

Although bonds have many different forms we will initially focus on standard (“vanilla”) structures. In return for borrowing a given sum of money, the issuer of the bond will pay a series of contractual interest payments to the owner of the instrument. When bonds were issued in physical form, the owner would detach a small coupon and present this to a bank appointed on behalf of the borrower as their eligibility to receive interest. As a result of this practice, interest payments on bonds have become termed coupons. At the maturity of the instrument the investor will be repaid the value stated on the face of the bond, but this may not be the sum that was originally paid to acquire the asset. This is because bonds are traded on a price basis, which is quoted as a percentage of the face value. Bonds are priced by present valuing all of the future cash flows, but this concept will be considered in Chapter 2. Suffice to say that with a limited amount of any bond in issue, the relative attractiveness of the fixed coupon will be the key determinant of how much an investor will pay to acquire the bond. If a bond has a fixed coupon of 5% but investors could earn a greater return on an equivalent investment (equivalent in terms of maturity and the risk of default), the bond will have to be priced at less than its face value in order to make the investment attractive. If it were priced at say 95.00 and the investor held the instrument to maturity, they would be repaid 100% of the face value and would enjoy a capital gain of just over 5% over the period. The opposite would be true for a bond that has a relatively attractive coupon. Through the interaction of demand and supply, investors will seek to possess the bond, which will drive up its price. If held to maturity the investor will incur a capital loss but will have earned an above-market interest rate. The market uses the concept of a yield, which captures any capital gain or loss in addition to the receipt of a particular coupon.

1.2.2 Floating-rate notes

Floating-rate notes (FRNs) are interest-bearing securities that pay a variable coupon on a regular basis (usually quarterly). The coupon is usually a spread to a given margin relative to an interest rate index such as LIBOR (London Interbank Offered Rate) or Euribor. For example, the instrument may pay 3-month USD LIBOR + 0.15% (15 basis points). The instrument is economically equivalent to a series of consecutive fixed-term bank deposits, where the interest rate is reset on a periodic basis. The fixed percentage margin over the specified interest rate index is referred to as the quoted margin. The quoted margin is a function of the issuer's default risk relative to the interbank rate to which the interest payments are referenced. The better the credit rating the lower the quoted margin and vice versa.

FRN issuance is driven by the desire of the issuer to match their assets and liabilities. For example, banks will tend to be big issuers of FRNs (which will represent a liability) as the assets that the bond proceeds are used to purchase will tend to pay a variable rate of interest (e.g., mortgages). This ensures that if interest rates change, interest costs and income will move in tandem. The concept of banks being able to borrow on a LIBOR basis will become key to much of the analysis that follows. This is because investment opportunities are often analysed based on the return they generate relative to LIBOR. FRN investors will include many different entities:

- Bank treasuries with excess cash who are looking to match floating-rate liabilities.

- Central Banks, retail investors and credit-conscious fund managers will buy sovereign-issued FRNs.

- Money market funds and corporates can earn an enhanced yield compared to alternatives such as cash and commercial paper.

1.2.3 Inflation

Definitions

Although most people would argue that they understand the concept of inflation, both authors have found that in reality a number of market participants often struggle when trying to verbalize a definition. Inflation represents rising prices, deflation falling prices and disinflation is where price increases slow down.

Within the inflation world a nominal frame of reference looks at investments in terms of cash paid without taking into account the loss of purchasing power. So if an item costs €1 today, with 2% inflation it will cost €1.02 by the end of the year. Alternatively we could say that at the end of the year, €1 will only buy 0.98 of the item. How would this relate to bonds? Consider a 1-year bond that pays a principal of €100 plus one interest payment of €5 at its maturity. The real value of this final cash flow will depend on what happens to prices over the period. If an investor expected inflation to be 3% then it will cost €103 in 1 year to buy something that costs €100 presently. However, the bond will pay a cash flow of €105 and so you expect to have €2 of extra purchasing power—a 1.94% increase in purchasing power.

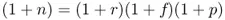

The Fisher equation is used extensively by the market to express the relationship between the yields on nominal bonds and expected inflation. The equation expresses the relationships as:

where:

n = yield on nominal bond

r = real yield on inflation-linked bond

f = inflationary expectations

p = premium

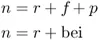

However, the market has shortened the expression:

where:

bei = breakeven inflation

In essence, the formula states that the yield on a nominal bond is made up of three components:

- A required real yield that investors demand over and above expectations of inflation.

- Inflationary expectations over a particular period of time (“breakeven inflation”).

- A factor that captures the combination of a risk premium and a liquidity discount.

- The risk premium is the compensation an investor earns for accepting undesirable inflation risk when holding nominal bonds. One interpretation is that it represents the risk premium demanded by nominal bond investors for unexpected inflation.

- The liquidity discount represents the yield premium that investors demand to hold a less liquid inflation-linked bond.

However, the third component is generally considered to be difficult to disaggregate and so is generally ignored by the market.

The breakeven rate can be thought of as the average rate of inflation that will equate the returns on an inflation-linked bond and a comparator nominal bond issue of the same return. To illustrate how it should be interpreted, consider the following example. Suppose there are a nominal 5-year sovereign bond that is yielding 4.5% and an inflation-linked sovereign bond of the same maturity whose yield on a real basis is 1.5%. Using the principles of the Fisher equation this implies a breakeven inflation rate of 3.0%. An investor could use the value of breakeven inflation to assess which bond should be purchased:

- If the investor expects inflation to average less than 3.0% over the period, they should hold the nominal bond.

- If the investor expects inflation to average more than 3.0% over the period, they should hold the inflation-linked bond.

- If the investor expects inflation to average 3.0% over the period, they will be indifferent between the two assets.

Arguably the difficulty experienced by practitioners in trying to grasp the concept of inflation lies in defining the concept of a real yield. If one looked at the Fisher equation, a simple but somewhat unsatisfactory definition of real yields is simply the difference between nominal yields and inflation expectations. We present three other definitions:

- A real rate of interest reflects the amount earned or paid after taking into account the impact of inflation.

- It is the market clearing rate of return in excess of expected future inflation that ensures supply meets demand for a particular investment opportunity.

- The return for forgoing consumption today to consume more goods and services tomorrow.

Real yields should also:

- Reflect the growth in an economy's productivity.

- Represent the rate at which investments are rewarded. Investments compete for capital on the basis of the real yield they offer given their associated risk.

What can be even more confusing is when real rates of interest become negative, an example of which occurred in the US Treasury market in 2008. This happened when inflation expectations were higher than nominal interest rates. These negative real yields were attributable to:

- Slower economic growth prospects, which lowered rates of expected returns across investments.

- The US Federal Reserve was expected to cut interest rates such that inflation would be greater than nominal rates.

- A “flight to quality” by investors, which drove up the price of government securities, reducing their nominal returns.

So in general terms, negative real yields could occur if:

- An asset is not considered a productive use o...