- English

- ePUB (mobile friendly)

- Available on iOS & Android

About This Book

America's number one bestselling tax guide offers the best balance of thoroughness, organization, and usability

For over half a century, more than 39 million Americans have turned to J.K. Lasser for easy-to-follow, expert advice and guidance on planning and filing their taxes. Written by a team of tax specialists, J.K. Lasser's Your Income Tax 2012 includes all the outstanding features that have made this book the nation's all-time top-selling tax guide. It covers some of the most important topics associated with your taxes, from what must you report as income and strategies that will save you on taxes to how much tax you actually owe and what deductions can you claim.

As an added value, you can gain direct access to bonus materials through jklasser.com, including links to the latest tax forms from the IRS, up-to-the-minute tax law changes, small business help, and much more. Filled with in-depth insights and timely advice, this is the guide of choice for today's serious taxpayer.

- Contains over 2, 500 easy-to-use tax planning tips and strategies and easy-to-understand coverage of the year's tax law changes

- Includes filing tips and instructions to help you prepare your 2011 return

- Comprised of a quick reference section that highlights what's new for 2011 as well as a topic index to help pinpoint the biggest money-saving deductions

- Offers instruction for customers who use software or CPAs to file their taxes

Filled with practical tax guidance you can't find anywhere else, J.K. Lasser's Your Income Tax 2012 will help you plan and file your 2011 tax return in the most efficient way possible.

Frequently asked questions

Information

- Do You Have To File a 2011 Tax Return?

- Filing Tests for Dependents: 2011 Returns

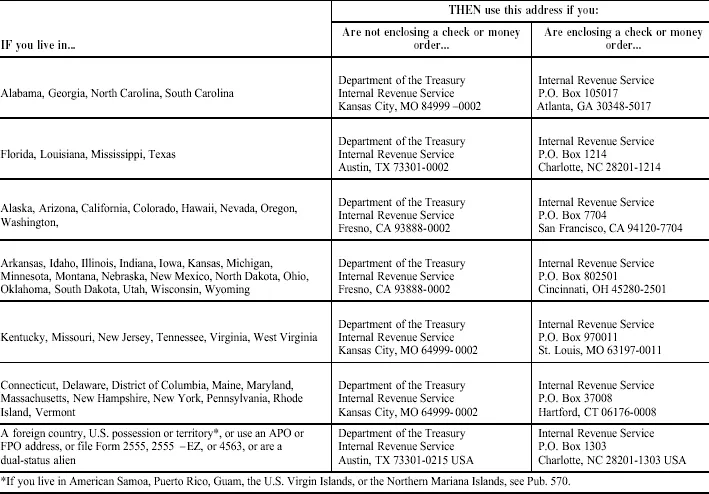

- Where To File

- Filing Deadlines

- Choosing Which Tax Form To File

- Chapter 1 Filing Status

- 1.1 – 1.20

- Whether you must file a return

- When and where to file your return

- Which tax form to file

- What filing status you qualify for

- When filing separately is an advantage for married persons

- How to qualify as head of household

- How filing rules for resident aliens and nonresident aliens differ

- How to claim personal exemption deductions for yourself, your spouse, and your dependents.

| If you are— | You must file if gross income is at least |

| Single | |

| Under age 65 | $ 9,500 |

| Age 65 or older on or before January 1, 2012 | 10,950 |

| Married and living together at the end of 2011 | |

| Filing a joint return—both spouses under age 65 | 19,000 |

| Filing a joint return—one spouse age 65 or older | 20,150 |

| Filing a joint return—both spouses age 65 or older | 21,300 |

| Filing a separate return (any age) | 3,700 |

| Married and living apart at the end of 2011 | |

| Filing a joint or separate return | 3,700 |

| Head of a household maintained for a child or other relative (1.12) | |

| Under age 65 | 12,200 |

| Age 65 or older on or before January 1, 2012 | 13,650 |

| Widowed in 2010 or 2009 and have a dependent child (1.11) | |

| Under age 65 | 15,300 |

| Age 65 or older on or before January 1, 2012 | 16,450 |

- You are self-employed and you owe self-employment tax because your net self-employment earnings for 2011 are $400 or more (Chapter 45), or

- You are entitled to a refund of taxes withheld from your wages (Chapter 26) or a refund based on any of these credits: the earned income credit for working families; the adoption credit (Chapter 25), the additional child tax credit (Chapter 25), or the American Opportunity credit (Chapter 38), or

- You owe any special tax such as alternative minimum tax (Chapter 23), IRA penalty (Chapter 8), household employment taxes (Chapter 38), and FICA on tips (Chapter 26), or

- You are a nonresident alien with a U.S. business or have tax liability not covered by withholding; see Form 1040NR.

- No. You must file a return if any of the following apply.

- Your unearned income was over $950.

- Your earned income was over $5,800.

- Your gross income was more than the larger of—

- $950, or

- Your earned income (up to $5,500) plus $300.

- Yes. You must file a return if any of the following apply.

- Your unearned income was over $2,400 ($3,850 if 65 or older and blind).

- Your earned income was over $7,250 ($8,700 if 65 or older and blind).

- Your gross income was more than the larger of—

- $2,400 ($3,850 if 65 or older and blind), or

- Your earned income (up to $5,500) plus $1,750 ($3,200 if 65 or older and blind).

- No. You must file a return if any of the following apply.

- Your unearned income was over $950.

- Your earned income was over $5,800.

- Your gross income was at least $5 and your spouse files a separate return and itemizes deductions.

- Your gross income was more than the larger of—

- $950, or

- Your earned income (up to $5,500) plus $300.

- Yes. You must file a return if any of the following apply.

- Your unearned income was over $2,100 ($3,250 if 65 or older and blind).

- Your earned income was over $6,950 ($8,100 if 65 or older and blind).

- Your gross income was at least $5 and your spouse files a separate return and itemizes deductions.

- Your gross income was more than the larger of—

- $2,100 ($3,250 if 65 or older and blind), or

- Your earned income (up to $5,500) plus $1,450 ($2,600 if 65 or older and blind).

Table of contents

- Cover

- Contents

- What’s New for 2011

- Key Tax Numbers for 2011

- Title

- Copyright

- Part 1: Filing Basics

- Part 2: Filing Basics

- Part 3: Claiming Deductions

- Part 4: Personal Tax Computations

- Part 5: Tax Planning

- Part 6: Business Tax Planning

- Part 7: Filing Your Return and What Happens After You File

- Part 8: 2011 Tax Table and EIC Table

- Glossary

- Index