eBook - ePub

Morningstar's 30-Minute Money Solutions

A Step-by-Step Guide to Managing Your Finances

This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Morningstar's 30-Minute Money Solutions

A Step-by-Step Guide to Managing Your Finances

Book details

Book preview

Table of contents

Citations

About This Book

The quick and easy way to manage money and achieve financial goals

The recent economic meltdown has left people in terrible financial shape with little idea of how to turn things around. Using Morningstar's time-tested strategies and sensible approach to money management, Morningstar's 30-Minute Money Solutions: A Step-by-Step Guide to Managing Your Finances breaks down important financial tasks into do-able chunks, each of which can be accomplished in 30 minutes or less. The practical, no-nonsense book

- Lays out the tools to get organized, including how to create a filing and bill paying system

- Details how to find the best uses for one's money, as well as how to properly invest for savings, college, and retirement

- Other titles by Benz: Morningstar® Guide to Mutual Funds: Five Star Strategies for Success

These are uncertain times. Morningstar's 30-Minute Money Solutions provides expert guidance on all aspects of personal money management, and it does so in quick, easily digestible steps.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Morningstar's 30-Minute Money Solutions by Christine Benz in PDF and/or ePUB format, as well as other popular books in Personal Development & Personal Finance. We have over one million books available in our catalogue for you to explore.

Information

PART ONE

Find Your Baseline

JIM, ONE OF MY GOOD FRIENDS, had a deathly fear of going to the doctor, as many men do. Having enjoyed his share of beer and rare steaks, he was sure that a diagnosis of sky-high cholesterol would consign him to a life of broccoli and flaxseed. Jim also feared that bad genetics were another strike against him, as his father had encountered several serious health problems before the age of 70. Jim figured that enduring the periodic anxious thought about his health was preferable to visiting the doctor and opening a Pandora’s box of health concerns.

Eventually, Jim’s chronic heartburn led him to break down and schedule a doctor’s appointment. Much to his surprise, Jim was in better shape than he had imagined. Yes, his doctor did recommend that he watch his fat intake, get more exercise, and cut out black coffee. But Jim’s cholesterol level was within normal range, his weight was good for someone his age, and his ticker was fine. After hearing this good news, Jim was a little like Mr. Scrooge on Christmas morning. He began running 5 and 10Ks, learned to love oatmeal, and now prides himself on looking a lot younger than his 45 years.

Much like Jim, many people are so terrified about the state of their finances that they don’t even want to schedule a checkup. They’d rather not know anything about their financial picture than find out that they’re just a few paychecks away from financial ruin.

Yet once they get over the fear of the unknown and see the facts of their money situation laid out in black and white, many individuals find that their finances aren’t nearly as bad as they had feared. And even if they do have work to do, they still feel a huge sense of relief—much like Jim did. Rather than worrying constantly that things could get worse, they can rest assured that they know what their problem areas are and are taking action to improve matters.

Finding your financial baseline, which is the focus of the chapters that follow, is a lot like giving yourself a financial checkup. Seeing where you are now—in terms of your assets and liabilities as well as your spending and savings patterns—may seem a little daunting. But it’s an essential first step if you want to banish worries and get on the road to improving your finances, something this book is designed to do. I discuss how to calculate your net worth and create a cash-flow statement in Chapters 1 and 2. Chapter 3 helps you set your financial goals and prioritize them, while Chapter 4 demonstrates how to develop a budget that will help you achieve your goals.

1

Calculate Your Net Worth

FOR MANY PEOPLE, stepping on the scale at the doctor’s office can inspire a touch of anxiety.

If you’ve been eating well and finding time to exercise, the weigh-in can be proof that you’re on the right track. But if you’ve just returned from a vacation where fried shrimp and umbrella drinks were the norm, the scale lets you know you’ve got some work to do.

Calculating your net worth—summarizing your assets and liabilities, which is the first step in any financial plan—is a lot like stepping on the scale in your doctor’s office. (I promise, this is the last time I’ll bring up the doctor. But the analogy is particularly apt here.) Your net worth statement (sometimes called a personal balance sheet or statement of financial position), like the scale, provides a clear-eyed look at how well you’re doing. Sometimes your net worth isn’t pretty—particularly when the stock market isn’t cooperating or you’ve been hit with unexpected expenses. But if you have been watching your expenses, saving regularly, and taken care in your investment selections, it can be pretty gratifying to see your net worth trend up from one year to the next.

Your net worth statement is only a snapshot of where your household’s finances stand at a given point in time; your real net worth fluctuates every day, depending on the value of your assets. But that snapshot can go a long way toward helping you identify red flags, plot what your financial priorities should be, and make sure you’re on track to reach your goals.

Your net worth statement will also serve as the foundation for other financial-planning-related activities that I discuss in this book. In Chapter 7, I walk you through how to create a master directory so that you will always be able to find important information about your assets: account numbers, passwords, contacts, and so on. Creating a net worth statement will help expedite the process of creating that directory.

Creating and maintaining a net worth statement will also help expedite the estate planning process, because taking a full inventory of your assets and liabilities is usually the first step. (In Chapter 34 you find what you need to know to get started on your estate plan.)

To create a net worth statement, you’ll need:

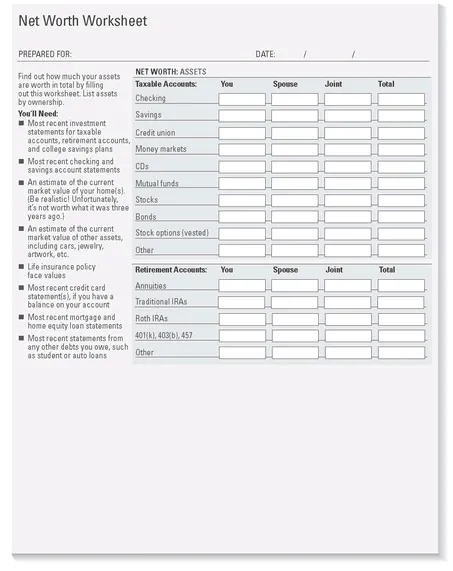

• Net Worth Worksheet (Worksheet 1.1, available at www.morningstar.com/goto/30MinuteSolutions)

• Most recent investment statements for taxable investment accounts, retirement accounts, and college savings plans

• Most recent checking and savings account statements

• An estimate of the current market value of your home(s). (Be realistic! Unfortunately, homes aren’t worth what they were three years ago.)

• An estimate of the current market value of other assets, including cars, jewelry, artwork, and so on

• Life insurance policy face values

• Most recent credit card statement(s), if you have a balance on your account (s)

• Most recent mortgage and home equity loan statements

• Most recent statements from any other debts you owe, such as student or auto loans

Start the Clock

Step 1

To create your net worth statement, fill out the information on the Net Worth Worksheet (Worksheet 1.1), available at www.morningstar.com/goto/30MinuteSolutions . Remember, you’re filling in the current market value of your assets, not your purchase price (and not as nice as those memories may be, what the assets were worth at their peak). If you’re part of a couple and you and your spouse hold some assets jointly and some separately, note who owns what—and the current value—on the form.

Worksheet 1.1

Print your worksheet at: www.morningstar.com/goto/30MinuteSolutions

In some cases, like publicly traded securities such as stocks and mutual funds, you’ll be able to get a very current, very specific read on what they’re worth—for example, if you own 1,000 shares of Microsoft MSFT and the stock closed at $23.45 today, your shares are worth $23,450. For other, less-liquid assets (that is, those that don’t trade all the time, such as real estate and automobiles), arriving at their value is more art than science. Web sites like zillow.com can help you make an educated guess about the value of your real estate, while Kelley Blue Book’s web site (www.kbb.com) helps you estimate the value of your automobile.

You’ll notice that I’ve included a line for personal assets. Don’t get carried away totaling up the value of every pillowcase and pair of shoes that you own. But if you do have other assets of worth, such as artwork or expensive furniture, you can estimate their fair market values and record them here.

Step 2

Next, record your outstanding debts. As with your list of assets, married couples should indicate which spouse owes what (unless the debt is in both people’s names).

Step 3

Once you’re finished recording your assets and liabilities, total up each column and subtract the smaller sum from the larger one. That amount is your net worth, which you can then track in subsequent years.

Step 4

Now it’s time for some analysis. Start by focusing on your bottom line.

• Is your net worth negative or barely positive? If so, you’ve got work to do; I discuss how to set up a budget in Chapter 4.

• Even if your net worth is positive, spend some time scrutinizing the underlying numbers. Check to see whether a big share of your net worth is tied up in a single asset or two, such as your house or stock issued by your employer. Of course, homes are the largest asset for many households, and there’s nothing inherently wrong with that. But it does mean that your future savings should go toward building up your investment assets.

Step 5

Next, check out whether your cash cushion is sufficient. By cash cushion, I mean any money you have stashed in safe, liquid securities such as CDs, money market funds, and checking and savings accounts. The right amount to hold in these investments will vary depending on your circumstances.

• If you’re already retired and relying on your own assets to cover your living expenses, strive to keep two to five years’ worth of living expenses in safe, highly liquid vehicles. If you’re retired and relying on other sources of income, such as a pension, to fund your day-to-day expenses, your cash cushion can be at the low end of this range.

• If you’re still working, you, too, should maintain a cash cushion so that you can get by in case of a financial emergency like a big home repair or the loss of a job. The usual rule of thumb is that you should have three to six months’ worth of living expenses in your emergency fund, but I think that figure may be too low for many individuals. If you have any reason to be nervous about your job security (and these days, that’s just about everyone) or you’re a higher-income earner, plan to save closer to a year’s worth of living expenses. I show you how to create an emergency fund, and recommend what to put in it, in Chapter 10.

Next Steps

• Financial decision making isn’t always rational. (The whole field of what’s called behavioral finance, in fact, addresses how investors often make decisions that aren’t in their best interests when deciding what to buy and sell and when.) Combat that tendency by thinking about allocating your own financial capital just as a good businessperson would: You scout around for the best use of your assets at that particular point in time.

As with a businessperson assessing the company balance sheet, your net worth statement can provide you with important direction in allocating your capital and can help alert you to potential problem spots. In Chapters 8 and 9 I coach you on taking a logical approach to deploying your hard-earned money.

Don’t worry, you won’t be reduced to a robot—you’ll allocate some capital to fun and allow room for the inevitable so-called irrational purchase. The point is that by making the effort to understand your overall financial position, you’ll be able to do these more enjoyable things while still being confident that you’re in good financial shape.

• Assessing your net worth periodically—I recommend doing so once a year—can also provide a window into trends in your financial picture and whether you’re on track to meet your goals. Of course, it’s better to see your assets outweigh your liabilities no matter what your life stage or age, but that’s particularly true as you get older. You’ll want to see your financial assets trending up and eventually far outweighing your liabilities. The reason is pretty straightforward and intuitive. As humans, we come into this world with a lot of what my colleagues at Ibbotson Associates call human capital—essentially, our own earning power, or ability to earn and create financial capital, or assets. But as we age and near retirement, our human capital diminishes and we need to rely more on our financial capital to meet our daily living expenses.

2

See Where Your Money Goes

WHILE BALANCING THE FAMILY CHECKBOOK ONE DAY, one of my friends looked at her husband and said, “We’re broke.” Their ...

Table of contents

- Title Page

- Copyright Page

- Dedication

- Foreword

- Preface

- Acknowledgements

- PART ONE - Find Your Baseline

- PART TWO - Get Organized

- PART THREE - Find the Best Use of Your Money

- PART FOUR - Get Started in Investing

- PART FIVE - Invest in Your Company Retirement Plan

- PART SIX - Invest in an IRA

- PART SEVEN - Invest for College

- PART EIGHT - Invest in Your Taxable Account

- PART NINE - Invest during Retirement

- PART TEN - Monitor Your Investments

- PART ELEVEN - Cover Your Bases on Estate Planning

- About the Author

- Index