![]()

PART I

Fundamentals

![]()

CHAPTER 1

An Introduction to Sustainable Investments

1.1 Environmental and Social Challenges

As economic markets have become increasingly interconnected, the effects of globalization on investors are unavoidable. Moreover, the immense social and environmental challenges of the twenty-first century will have a long-term impact on investors’ success. We next describe some of the most significant challenges we must meet to ensure sustainable development of life on planet Earth.

Climate Change

Depending on the level of greenhouse gas emissions, it is highly likely that the temperature of the Earth’s atmosphere will rise by between 1.1 and 6.4 degrees Celsius during the course of this century, having already risen twice as much in the past 50 years as compared to the previous 100 years. Greenhouse gas emissions would have to fall by 50 percent by the year 2050 to limit global warming to two degrees Celsius (Intergovernmental Panel on Climate Change, 2007).

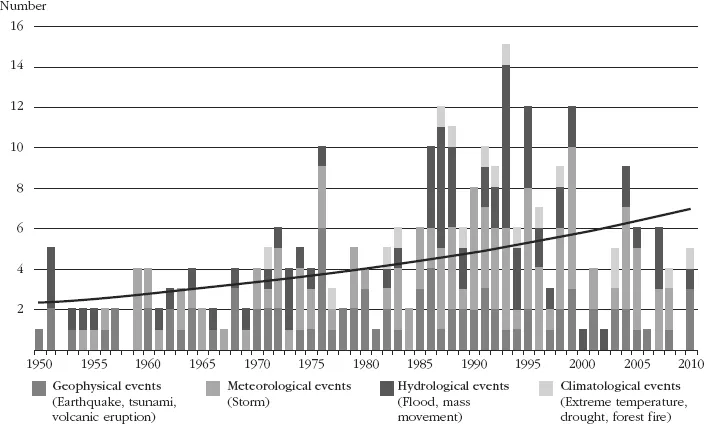

The number of meteorological and hydrological catastrophes has tripled in the past 30 years, and geophysical events such as earthquakes, volcanic eruptions, and tsunamis—which pose an immediate mortal danger as well as an environmental threat—have nearly doubled, as shown in Figure 1.1. We can expect such dramatic climate phenomena to increase.

Since 1993, as a result of global warming, sea levels have risen by an average of around three millimeters annually, as compared to 1.7 millimeters annually during the course of the entire twentieth century. Slightly more than half of this rise is due to thermal expansion of warming oceans; around 25 percent is due to the melting of Alpine glaciers; and about 15 percent to the melting of ice sheets. From the start of industrialization to 2005, the carbon dioxide (CO2) content of the earth’s atmosphere rose by 35 percent, of which 78 percent is attributable to the use of fossil fuels (IPCC, 2007).

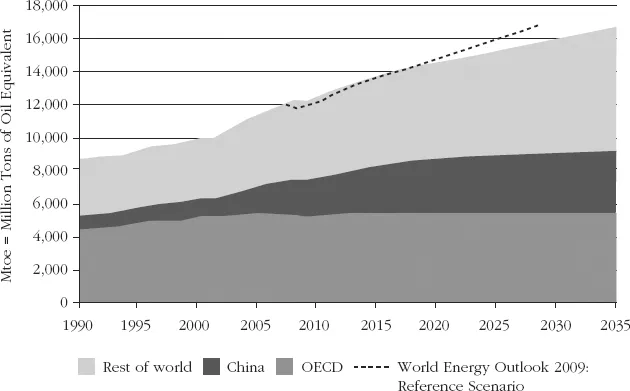

The International Energy Agency (IEA) predicts that the world primary demand for energy increases from approximately 12,300 in 2008 by one-third, in 2035 and energy-related CO2 emissions increase by 20 percent (see Figure 1.2). The dynamics of energy markets are determined more and more by the emerging economies. Over the next 25 years, 90 percent of the projected growth in global energy demand comes from non-OECD economies; China alone accounts for more than 30 percent.

Scarcity and Pollution of Freshwater Reserves

Both the global extraction of water and water consumption rose sixfold in the twentieth century, relative to a threefold increase in the global population. According to current estimates, by 2025, 1.8 billion people will be living in countries or regions with absolute water scarcity and two-thirds of the world population could be subject to water stress (UNEP, 2007).

Deforestation and Desertification

Twenty percent of all greenhouse gas emissions are caused by the clearance of tropical forests that sequester CO2 emissions. The Amazon rainforest alone stores 4.6 billion tons of carbon dioxide over four million square kilometers; every year, an area half the size of Germany is lost to deforestation (IPCC, 2007).

Decreasing Biodiversity

Climate change is presumed to accelerate the loss of biodiversity: A 2 to 3 percent increase in global temperature threatens the extinction of 30 percent of the planet’s flora and fauna (Sustainable Development Management, 2006).

Poverty

According to the World Bank, around 1.4 billion people currently live on less than $1.25 a day, and the disparity between the rich and poor in the globalized world is steadily increasing. According to the Food and Agriculture Organization (FAO), in 2010 over 900 million people worldwide suffer from hunger. And 10 million children aged five and under die annually, of whom an estimated 5.6 million suffered the effects of malnutrition, UNICEF states.

Population Growth

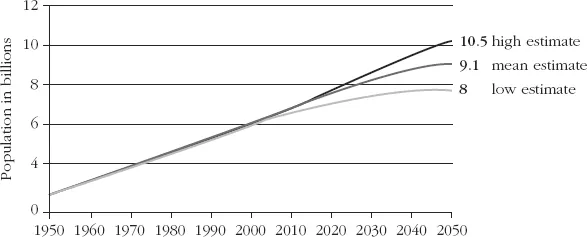

As of 2011, global population stood at about 7 billion people, a figure that increases by three people every second. According to the United Nations (UN) forecasts, the earth’s population will reach about 9 billion by 2050, corresponding to an annual growth of almost 90 million people. There seems to be no end in sight for the exponential growth of the world’s population, as shown in Figure 1.3. At the same time, millions of people will increase their incomes, as well as their consumption. If consumption habits and production methods remain unchanged, a massive drain on the world’s resources will result. In particular, demand for energy will skyrocket.

Aging of Western Populations

The populations of industrialized nations (as well as China, due to its one-child policy) are getting older. In Western Europe, 16 percent of the population was over 65 as of 2009, a percentage that will rise to 27 percent by 2050. Globally, the population over 60 is growing at a rate of 2.6 percent per year. Since 1950, the proportion of elderly citizens has been rising steadily, from 8 percent in 1950 to 11 percent in 2009, and is expected to reach 22 percent in 2050. The number of elderly people on the planet is expected to exceed the number of children for the first time in 2045 (United Nations, 2009).

Developed-world aging coupled with a shrinking workforce is leading to substantial increases in the dependency ratio (Urwin 2010a). Pension and healthcare institutions face the difficult question of how to generate returns in order to sustainably fund their obligations.

1.2 Sustainable Investments as Part of the Solution

Philosophical Underpinnings

As a rule of thumb, it takes one generation to implement new ways of thinking. Some 200 years ago, the German philosopher Arthur Schopenhauer described the path of a new idea: First it is ridiculed, then it is violently opposed, and finally it is accepted as self-evident. Schopenhauer’s observation applies to the professional sphere of institutional asset management. Already in the 1950s, Harry M. Markowitz developed the “modern portfolio theory,” which postulates the concept of diversification to maximize expected portfolio return for a given amount of portfolio risk. Only 30 years later, in 1990, Markowitz was awarded the Nobel Prize for Economics for this groundbreaking idea. Today, his theory of diversification is widely accepted and shapes regulations on the investment of pension and insurance assets and virtually every investment policy.

More recently, sustainability issues have begun to influence asset management. Though we have passed through the stage of laughter and ridicule, the idea of taking environmental and social criteria into consideration along with financial concerns when making investments continues to be controversial. Currently, the discourse on sustainability has also passed the stage of violent opposition, as evidenced, in part, by the awarding of the 2006 Nobel Peace Prize to Bangladeshi professor Muhammad Yunus and his Grameen Bank, a bank for the poor that brought the concept of microcredit to the world’s attention. The following year, former U.S. Vice President Al Gore and the Intergovernmental Panel on Climate Change (IPCC) jointly received the Nobel Peace Prize. Given that the Nobel Peace Prize promotes new ways of thinking, these awards suggest that the time for recognizing environmental and social concerns has arrived. To ignore these concerns would jeopardize social cohesion in our increasingly global village.

This insight—which requires not sacrifice, but initiative—must be reflected in our economic activity. A ruthless society is not only a burden to its members, but also to the environment, and contributions are required of all of us. The allocation of capital to sustainable companies, governments, and real assets is a significant factor. By incorporating the criteria of sustainability in our investment strategy, we take a necessary step toward serving the greater good.

Practical Considerations

The recognition that pollution, climate change, overexploitation of resources, increasing food shortages, and soaring energy needs threaten human well-being has triggered a massive search for sustainable solutions. Some of the remedies being pursued include technological innovations, a switch from fossil fuels to renewable energies, price mechanisms that compensate for environmental damage, and entrepreneurial solutions to social problems—and all of them offer enormous economic opportunities.

These challenges also pose huge risks to the global economy. In 2008, environmental damage caused by human activities amounted to around $6.6 billion globally, according to Trucost. By 2050, environmental costs could rise from 11 percent to 18 percent of projected global GDP (UN PRI/UNEP FI, 2010). Rising external costs affect the profitability of companies globally as well as diversified investment portfolios. These cost increases are inevitably reflected in long-term increases in insurance premiums, taxes, and prices, which in turn, have a negative effect on future cash flows and dividends of the securities in an investment portfolio.

Pension funds, insurance companies, asset managers, foundations, and family businesses, all of which have a long-term investment horizon, should take these major challenges and threats into account when making investment decisions. On the one hand, enterprises and corporations that do not reflect global changes and challenges in their strategic outlook may make gains in the short or medium term, but are bound to lose out in the long term. On the other hand, investors can seize new challenges as opportunities. Investing in companies that address these challenges in their business strategy should create profits as a result of changing framework conditions. Sustainability is a global megatrend—a development that, regardless of temporary setbacks and resistance, is unstoppable in the long run.

1.3 Conclusions for Practitioners

Climate change, environmental disasters, and increasing scarcity of resources compounded by the rising economic activity of newly industrializing countries contribute to the challenge of sustainable...