![]()

Chapter 1

Frequently Asked Questions

1. What is Corporate Finance?

Short Answer

Corporate finance describes the financial decisions of corporations. Its main objective is to maximize corporate value while reducing financial risk. The financial manager has responsibility for corporate finance decisions.

Long Answer

In order to understand what corporate finance is, we need to understand who the financial manager is and what his or her responsibilities are.

The financial manager is responsible for financing the firm and acts as an intermediary between the financial system's institutions and markets, on the one hand, and the enterprise, on the other. He or she has two main roles:

1. To ensure the company has enough funds to finance its expansion and meet its obligations. In order to do this, the company issues securities (equity and debt) which the financial manager sells to financial investors at the highest possible price. In today's capital market economy, the role of the financial manager is less a buyer of funds, with an objective to minimize cost, but more a seller of financial securities. By emphasizing the financial security, we focus on its value, which combines the notions of return and risk. We thereby reduce the importance of minimizing the cost of financial resources, because this approach ignores the risk factor. Casting the financial manager in the role of salesman also underlines the marketing aspect of the job. Financial managers have customers (investors) whom they must persuade to buy the securities of their company. The better financial managers understand their needs, the more successful they will be.

2. To ensure that, over the long term, the company uses the resources provided by investors to generate a rate of return at least equal to the rate of return the investors require. If it does, the company creates value. If it does not, it destroys value. If it continues to destroy value, investors will turn their backs on the company and the value of its securities will decline.

The company's real assets are transformed into financial assets in the financial manager's first role. The financial manager must maximize the value of these financial assets, while selling them to the various categories of investors. The second role is a thankless one. The financial manager must be a ‘party-pooper’, a ‘Mr. No’ who examines every proposed investment project under the microscope of expected returns and advises on whether to reject those that fall below the cost of funds available to the company.

References and Further Reading

Quiry, P., Dallocchio, M., Le Fur, Y. and Salvi, A., Corporate Finance, 3rd ed. John Wiley & Sons, 2011.

2. What are Cash Flows?

Short Answer

Cash flows refer to the excess of cash revenues over cash outlays. They are usually measured during a specified period of time.

Example

Let's take the example of a greengrocer, who is ‘cashing up’ one evening. What does she find? First, she sees how much she spent in cash at the wholesale market in the morning and then the cash proceeds from fruit and vegetable sales during the day. If we assume that the greengrocer sold all the products she bought in the morning at a mark-up, the balance of receipts and payments for the day will be a cash surplus. If the greengrocer decides to add frozen food to her business, the operating cycle will no longer be the same. The greengrocer may, for instance, begin receiving deliveries only once a week and will therefore have to run much larger inventories. The impact of the longer operating cycle due to much larger inventories may be offset by larger credit from her suppliers. However, most importantly, before she can start up this new activity, our greengrocer needs to invest in a freezer chest. All these activities produce cash flows.

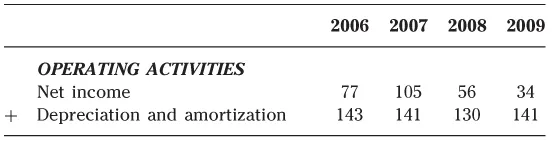

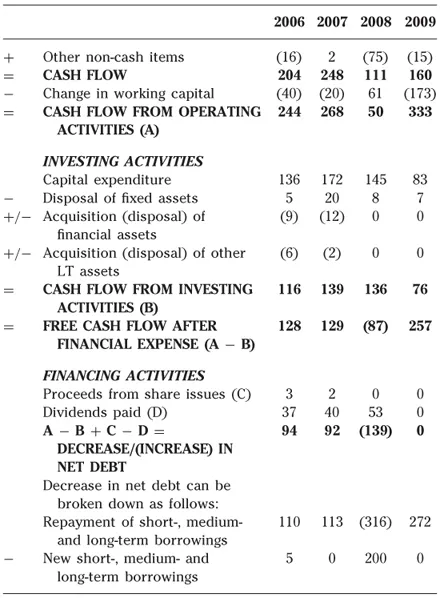

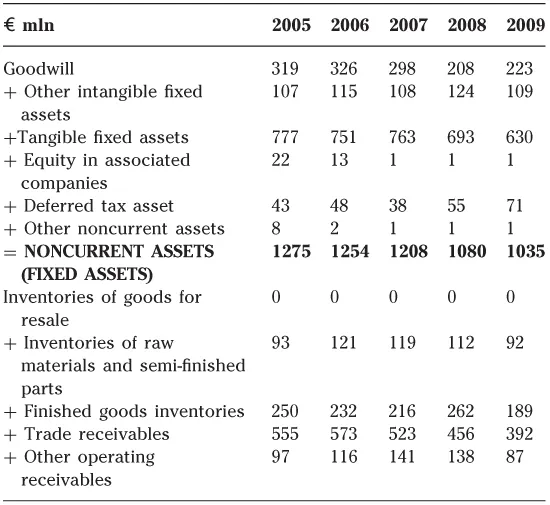

Example—Let's also take an example of a real company (Table 1.1), Indesit

Table 1.1: Cash flow statement for Indesit (€m)

Long Answer

The cash flows of a company can be divided into four categories: operating and investment flows, which are generated as part of its business activities, and debt and equity flows, which finance these activities.

The operating cycle is characterized by a time lag between the positive and negative cash flows deriving from the length of the production process (which varies from business to business) and the commercial policy (customer and supplier credit). Operating cash flow (the balance of funds generated by the various operating cycles in progress) comprises the cash flows generated by a company's operations during a given period. It represents the (usually positive) difference between operating receipts and payments. Operating cash flow is independent of any accounting policies, which makes sense since it relates only to cash flows. More specifically:

- the company's depreciation and provisioning policy

- its inventory valuation method

- the techniques used to defer costs over several periods

have no impact on the figure.

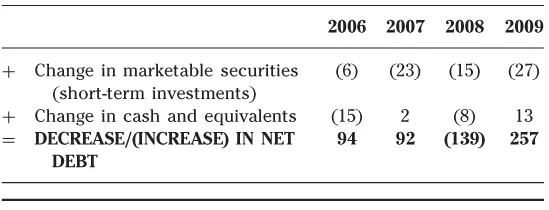

From a cash flow standpoint, capital expenditures must alter the operating cycle in such a way as to generate higher operating inflows going forward than would otherwise have been the case. Capital expenditures are intended to enhance the operating cycle by enabling it to achieve a higher level of profitability in the long term. This profitability can be measured only over several operating cycles, unlike operating payments which belong to a single cycle. As a result, investors forgo immediate use of their funds in return for higher cash flows over several operating cycles (see Table 1.2 for a cash flow statement).

Table 1.2: A simplified cash flow statement

Free cash flow can be defined as operating cash flow less capital expenditure (investment outlays).

When a company's free cash flow is negative, it must cover its funding shortfall by raising equity and debt capital.

Where a business rounds out its financing with debt capital, it undertakes to make capital repayments and interest payments (financial expense) to its lenders regardless of the success of the venture. Accordingly, debt represents an advance on the operating receipts generated by the investment that is guaranteed by the company's shareholders' equity.

Short-term financial investment, the rationale for which differs from investment, and cash should be considered in conjunction with debt. We prefer reasoning in terms of net debt (i.e. net of cash and of marketable securities, which are short-term financial investments) and net financial expense (i.e. net of financial income).

3. What Alternative Formats of the Balance Sheet May Companies Use?

Short Answer

A balance sheet can be analyzed either from a capital-employed perspective or from a solvency-and-liquidity perspective.

Example

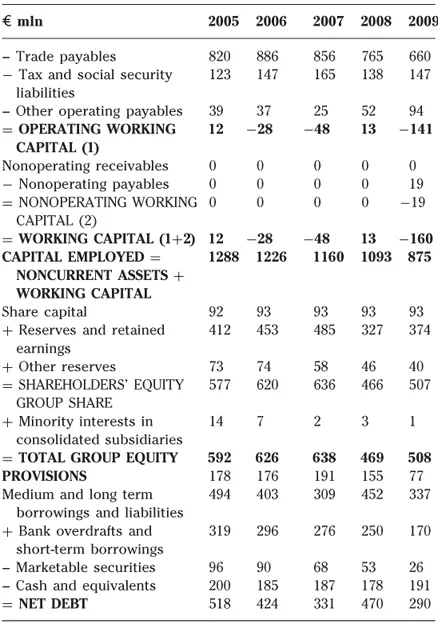

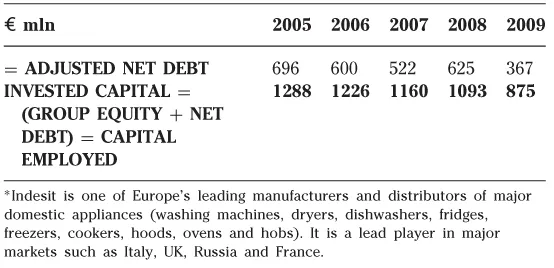

Table 1.3: Capital-employed balance sheet for Indesit*

Long Answer

A capital-employed analysis of the balance sheet shows all the uses o...