![]()

PART I

Understanding Terms and Theory

As with any field of study, an understanding of the vocabulary and special terms used is essential. Options use a special language. Specific terms that you should master are noted in italics. Learning the language of options is the first step in learning how to use them.

Continuing the development of our foundation toward option understanding, we devote time to the study of the two types of options, the call and the put, and their unique risk/rewards for the investor.

From there, we move on to option theory with special emphasis on the pricing model, the Greeks, and synthetic positions.

The pricing model gives you an overview of those components that contribute to the price of options; the Greeks provide the tools necessary to manage risk; and the synthetic positions set the groundwork for the versatility of option use.

![]()

CHAPTER 1

Options Basics and Terms

An option is a traded security that is a derivative product, a product whose value is based on or derived from the price of something else. A stock option is based on, among other things, the price of the underlying stock. Options also exist on other traded securities, such as currencies, commodities, bonds, indexes, and interest rates.

A distinguishing factor of an option is that it is a depreciating asset; that is, it has a limited life. It has to be used before the date on which it expires. As time goes by, the option loses value as it moves closer to its expiration date.

When we speak of options in terms of volume, we refer to contracts. Each stock option contract is equivalent to 100 shares of stock. When we talk about two contracts, we are talking about 200 shares; 10 contracts, 1,000 shares; 75 contracts, 7,500 shares; and so on.

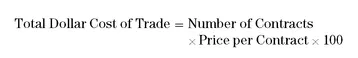

It is important to understand the dollar cost of options before actually trading them. When an option is quoted at $1.00 per contract, the investor must realize that the $1.00 represents a price of $1.00 per share, not per contract. Remember that each contract represents 100 shares. This means that if you buy one option contract at a quoted price of $1.00, your total cost would be $100.00 (1 contract × $1.00 per share × 100 shares per contract). If you buy 10 contracts for $1.00 per contract, your total cost will be $1,000.00. Use the following formula when calculating total dollar cost of the option, and review Table 1.1.

TABLE 1.1 Option Dollar Costs ($1.00 Quoted Price of Option)

Option contracts are literally a sales agreement between two parties. The two parties are the buyer (or holder) and the seller (or writer). When you buy an option contract, you are considered long the option. When you sell an option contract, you are considered short the option. This, of course, is assuming you have no previous position in that option.

In an option contract, although it seems as if the buyer and seller must be tied together, they are not. You see, the buyer doesn’t really buy from the seller and the seller doesn’t really sell to the buyer. In reality, an organization called the Options Clearing Corporation (OCC) steps in between the two sides. The OCC buys from the seller and sells to the buyer. This makes the OCC neutral, and it allows both the buyer and the seller to trade out of a position without involving the other party.

CALLS AND PUTS

There are two types of options, a call option and a put option.

1. A call option gives the buyer the right, but not the obligation, to buy a specific security at a specific price by a specific date. It is a way of locking in the purchase price of the stock for a period of time.

2. A put option gives the buyer the right, but not the obligation, to sell a specific security at a specific price by a specific date. It is a way of locking in the sales price of a stock for a period of time.

The specific date is known as the contract’s expiration date. On or prior to the expiration date, the holder of the option contract has the right to exercise the option; that is, the option holder can trade out of the position at any time up to expiration in the open market.

The term exercise stands for the process by which the buyer of an option converts the option to a long stock position in the case of a call or a short stock position in the case of a put. Buyers of options exercise.

The term assign or assignment refers to the process by which the seller of an option is notified of the buyer’s intention to exercise.

The strike price or exercise price is the price at which the holder has the right, but not the obligation, to buy (for a call) or sell (for a put), the underlying security. Strike prices are quoted in dollars; for example, May 50 calls means May $50.00 strike calls.

A long position is defined as any position that theoretically will increase in value, should the price of the underlying security increase. Likewise, the position theoretically will decrease in value, should the underlying security decrease. The buying of stock, the buying of a call, or the sale of a put all constitute establishment of long positions since they all represent ways that will benefit the position owner from an increasing stock price

A short position is defined as any position that theoretically will increase in value, should the price of the underlying security decrease. Similarly, the position theoretically will decrease in value, should the underlying security increase. The selling of stock, the selling of a call, or the buying of a put establishes a short position where all will benefit from a decrease in the underlying stock price.

CLASSES AND SERIES

The option class identifies the specific underlying security the option is written on. The option series describes the expiration month and strike price. As an example, let’s use the Microsoft (MSFT) May 65 calls. MSFT is the option class (identifies the security). May 65 call is the option series. May is the expiration month, and 65 is the strike price. All segments of this option are represented by symbols. The underlying stock, month, and price have a special code.

All stocks and options are identified by symbols. Each stock has a specific symbol. For example, stock symbol HD = Home Depot, while MSFT = Microsoft. Options have symbols too. These symbols are standardized for all exchange-traded (listed) options. Most stock symbols match their ticker symbol. For options of the New York Stock Exchange (NYSE) and American Stock Exchange (AMEX), the option’s symbol is always the same as the ticker symbol. The exceptions are the stocks of the NASDAQ. The stock symbol for NASDAQ stocks consists of four letters. Option-class symbols are limited to three letters. Symbols for NASDAQ-traded options are close to the ticket symbol but include the letter Q (to signal NASDAQ). For example, consider the computer maker Dell; its ticker symbol is DELL and its option symbol is DLQ. The ticker symbol for Intel is INTC and its option symbol is INQ.

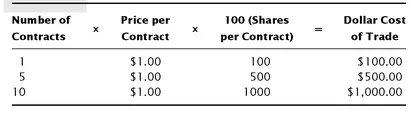

TABLE 1.2 Month Symbols

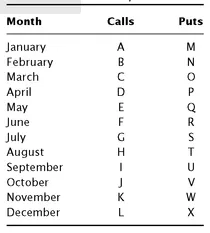

TABLE 1.3 Strike Prices (Basics)

Another exception for the ticker symbol use is with LEAPS. Options in different years receive different class symbols to overcome the limitation of the expiration month symbol, which does not take into account the same month existing in different years. The month symbol remains the same but the class symbol changes to signify the different year.

After the option-class symbol, a different letter identifies each specific month’s call or put. Table 1.2 shows which letters coincide with which month’s calls and puts.

The strike price symbol (shown in Table 1.3) follows the month symbol. A letter represents each different strike price. These strike prices are also standardized for all listed options.

We are using the basics to introduce the decoding of option symbols. However, since there is a wide range of potential strike prices and a limited number of letters, each letter represents more than one strike price. This fact creates the need for a bit of guesswork, but nothing too complicated when you are familiar with the basics. For instance, the letter A represents a $5 strike price but can also represent $105. The value of the stock should guide you to the meaning of the letter used. If a stock is listed for $95, the A is $105 rather than $5. When in doubt, you can go to the Option Clearing Corporation web site (www.optionsclearing.com) for a detailed explanation of the symbols.

Using Tables 1.2 and 1.3, let’s decode the symbol HD GF: “HD” is the stock symbol that represents Home Depot. “G” signifies a call option with a July expiration date. “F” indicates a strike price of $30. This means that the buyer of this option has the right to purchase 100 shares of HD between now and July expiration at a price of $30 per share.

In the case of the symbol PG US, “PG” stands for the stock Procter & Gamble. The “U” signifies a put with an expiration date in September. Finally, the “S” stands for a strike price of $95. This means that the buyer of this option has the right, but not the obligation, to sell 100 shares of Procter & Gamble between now and September expiration for a price of $95 per share.

Though exceptions do exist in option symbols, when decoding, it generally helps to remember that the last letter in the group refers to strike price and the letter right before it refers to the expiration months (puts and calls).

IN THE MONEY, OUT OF THE MONEY, AND AT THE MONEY

An option can be described by the proximity of its strike price to the stock’s price. An option can either be in the money (ITM), out of the money (OTM), or at the money (ATM). It is necessary to understand how calls and puts can be ITM, OTM, and ATM and the characteristics each carries.

At the Money

An at-the-money (ATM) option is described as an option whose exercise price or strike price is approximately equal to the current price of the underlying stock. For instance, if Microsoft (MSFT) is trading at $65.00, then the January $65.00 call would be an example of an at-the-money call option. Similarly, the January $65.00 put would be an example of an at-the-money put option.

In the Money

An in-the-money call (ITM) option is described as a call whose strike (exercise) price is lower than the current price of the underlying. An in-the-money put is a put whose strike (exercise) price is higher than the current price of the underlying (i.e., an option that could be exercised immediately for a cash credit if the option buyer wanted to exercise the option).

Using our Microsoft example, an in-the-money call option would be any listed call option with a strike price below $65.00 (the price of the stock). So, the MSFT January 60 call option would be an example of an in-the-money call. That is because at any time prior to the expiration date, you could exercise the option and profit from the difference in value: in this case $5.00 ($65.00 stock price - $60.00 call option strike price = $5.00). You could exercise your right to buy the stock at $60 and then sell it at the market price of $65, realizing a $5 gain. In other words, the option is $5.00 in the money.

Again, using our Microsoft example, an in-the-money put option would be any listed put option with a strike price above $65.00 (the price of the stock). The MSFT January 70 put option would be an example of an in-the-money put. It is in the money because at any time prior to the expiration date, you could exercise the option and profit from the difference in value: in this case $5.00 ($70.00 put option strike price - $65.00 stock price = $5.00). You can sell for a guaranteed $70 stock that you can purchase for $65. In other words, the option is $5.00 in the money.

Out of the Money

An out-of-the-money (OTM) call is described as a call whose strike price (exercise price) is higher than the current price of the underlying. Thus, the entire premium of an out-of-the-money call option consists only of extrinsic value. There is no intrinsic value in an out-of-the-money call because the option’s strike price is higher than the current stock price. For example, if you chose to exercise the MSFT January 70 ...