![]() PART B

PART B![]()

4. Negotiation Issues in the M&A Process

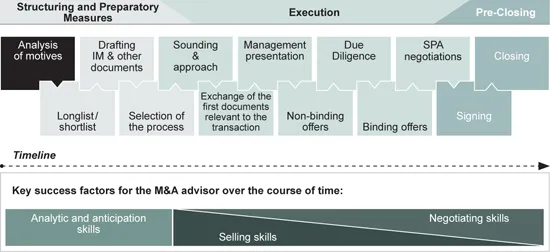

Generally, the M&A process can be divided into three phases:

- a) Structuring and preparatory measures (Structuring)

- b) Execution

- c) Pre-closing phase

Structuring is sub-divided into the following aspects:

- Analysis of motives

- Longlist/shortlist

- Preparation of the information memorandum and other documents relevant to the transaction

- Selection of the process

In the execution phase of the sale of an enterprise we make the following distinctions:

- 5. Sounding and approach

- 6. Exchange of the first transaction documents

- 7. Management presentation

- 8. Obtaining non-binding offers

- 9. Due diligence

- 10. Obtaining binding offers

- 11. Negotiation of the purchase agreement

The third phase c) Pre-closing is the period between

- 12. the signing of the transaction agreement – Signing, and

- 13. the legal consummation of the transaction – Closing

This period is characterized by a number of special aspects.

4.1 Structuring and Preparatory Measures

4.1.1 Analysis of Motives

The first step in the process in the course of the structuring and the preparatory measures is the analysis of the motives. For this purpose, let us recall once more the process overview from Part A of the book.

Figure 52

Analysis of the motives in the course of the M&A process

4.1.1.1 Analysis of Sell-Side Motives

On the side of the seller, the reasons for a disposal of a company can generally be classified into four categories:

- - Solution of the entrepreneurial succession, e.g. for reasons of age or health

- - Sale of the company for strategic reasons in order to secure its existence

- - Partial or complete sale as monetary reward for years of entrepreneurial achievement

- - Sale of the company in the course of a portfolio streamlining

It is not unusual for the real motive for the sale of the company to be withheld from the advisors prior to their commissioning. In addition, there are situations in which the seller himself is not consciously aware of the true reasons.

More often than not, upon closer inspection the reason which is often cited for the sale of a company, namely that it is necessitated by the unsolved issue of succession in the enterprise, is not the only motive – or is even only a pretext. Only in rare cases are there no successors whatsoever in the enterprise at shareholder level. If, for example, the entrepreneur had already established a second management level years ago and started to groom a suitable successor with a long-term perspective, the passing on of the shares in the company within the family would be possible. An advisory board could substitute or supplement any lacking business administration competence on the part of the new generation of shareholders/heirs and the succession problem would be solved.

In many cases, profits have been withdrawn from the enterprise for years – a practice certainly also favored by former tax policy – and invested in the private area. If now, at the same time, there is an industry cycle of consolidation or, respectively, if the relocation of production to other locations becomes necessary and creates a massive need for capital, it would often be required for the strengthening of the equity basis that the equity invested in private assets is again contributed into the enterprise. Since these funds are, in most cases, not liquidly available, this point in time is used in order to look for the exit from this entrepreneurial activity. Obviously, in this case the entrepreneur will not disclose that he has to sell for strategic reasons, in order to secure the existence of the company in the long term, but he will emphasize the solution of the succession problem.

In many cases, entrepreneurs who for years have convincingly and successfully sold their products are also very convincing when arguing the reasons prior to the commissioning. Often the advisor also realizes the real motive for the sale only in a later phase of the process. In that case, it has to be reviewed whether the intended transaction is actually suitable or, as the case may, whether is has to be corrected.

However, if the arguments have already been communicated between the prospective buyer and the advisor of the seller and the real reasons only transpire subsequently, this can lead to a massive loss of trust.

In addition to the analysis of the motives of the seller, it is advisable to also analyze at an early stage the motives of the other parties involved in the transaction – both at one's own side of the table and those of the negotiation partner – (see checklist).

Case study 1:

Rainer Bremer is the managing shareholder of BREMER publishing group, a small publisher for periodicals in the medical and health area. Mr Bremer is 55 years old and tired of the day-to-day fight as a small publisher against the large publishing houses and media companies in the industry, which are penetrating ever smaller and formerly protected segments.

Mr Bremer commissions M&A advisor Goodman to sell his company. Mr Goodman conducts a textbook preparation of the sale and finds a buyer in VPMT Group who is financially strong and very interested.

The due diligence examination is set to begin and Mr Goodman requests again from the tax advisor of BREMER the relevant documents for the tax due diligence. Mr Goodman considers the submitted documents incomplete and he inquires with both Mr Bremer and his tax advisor whether the compilation was correct. Mr Bremer declares the documents had to be complete, since the tax advisor, who had already worked for Mr Bremer since the founding of the company, was very conscientious. After all, BREMER was the largest client for the tax consultancy and, accordingly, this small firm was extremely dedicated in the handling of all inquiries. Mr Goodman should trust the documents to be complete. In the personal conversation with the tax advisor, he also receives the reply that everything had been compiled. Mr Goodman's request for the signing of a declaration of completeness regarding the content of the data room is granted promptly by Mr Bremer. Mr Bremer considers the obtaining of such a declaration from the tax advisor to be completely exaggerated and emphasizes that Mr Goodman should not ask too much of the man. He knew what he had in the tax advisor and wanted to avoid anything that would annoy him.

In the conversation with the auditors of the interested party, similar questions are now raised to the ones already anticipated by the M&A advisor in advance. Mr Goodman asks the tax advisor to attend the meeting, who only agrees to do so upon intervention by Mr Bremer. In the conversation, it becomes evident that the tax situation of BREMER publishing group is an entirely different one. The documents requested in addition are not currently available in the enterprise, because a special audit is in process. Unfortunately, it had been forgotten at the tax consultancy to make any copies. All documents were at the tax office. The prospective buyer is not only irritated, but also accuses Mr Goodman of unprofessional preparation. VPMT withdraws from the transaction. Mr Bremer asks Mr Goodman to postpone the transaction until this set of facts, which Mr Bremer does not recall any more, either, has been clarified.

Five years later, BREMER is still a valued client of the tax consultancy, but meanwhile has significant problems, since many readers have substituted the print media of the publishing house with online publications of a competitor. The tax consultancy is now also involved in the preparation of the documentation of the reorganization of BREMER for the banks.

This friendly fire, which finally led to the break-off of the transaction, could have been identified with a more accurate analysis of the initial situation. Even if it is likely that here there would have been no solution for this problem, Mr Goodman would have been in a position to address the problem already at the beginning. If Mr Bremer had dismissed the concerns as unfounded, Mr Goodman would at least have been able to include an appropriate provision for this case in his fee agreement, which would have reduced the economic risk for Mr Goodman of the break-off of the transaction for this reason.

Case study 2:

The sole shareholder and CEO of VULCAN AG has reached the age of 75 and now wishes to sell his enterprise, in the course of a succession solution, to BERGNER Group, which is twice as large and even a competitor in a few segments. The preliminary talks have been conducted, an agreement regarding the price has been reached. The due diligence examination is conducted.

When the necessary discussions regarding the so-called findings (items requiring clarification) from the due diligence are held, the two other members of the management board are first absent because of urgent customer calls.

Next time they both fail to attend, because they are held up in heavy traffic.

At the third meeting, they make an indifferent and uninformed impression.

Since the acquiror needs the management on board and considers this conduct unfriendly, he does not pursue the transaction further.

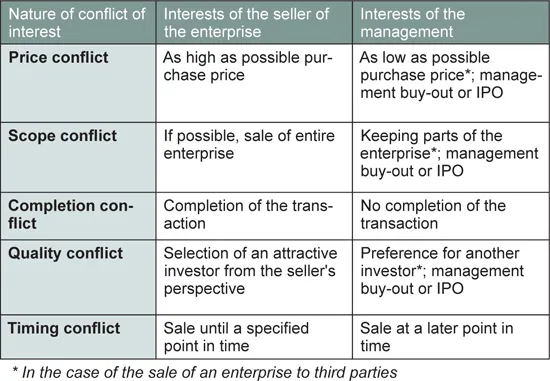

Generally, the motivation of the management always has to be taken into account in the analysis of the initial situation. Any conflicts that exist may not only lead to a delay in the sales process, but can also result in the complete failure of the negotiations. Here, too, variations of the aforementioned principal-agent problem can occur. Dr Ronald Weihe defines as follows: The management, “in a self-serving manner and possibly using deceptions, conducts one or more act(s) that are detrimental for the seller of the enterprise or it omits to conduct beneficial acts, which it would not have conducted or, respectively, omitted if there had not been a conflict of interests or if they had failed to perceive the latter.”58

The table below gives a good overview of the individual areas in which problems may arise.

Figure 53

Forms of conflicts of interest of seller and management59

Where individual purchasing interests in the form of a management buy-out also exist in addition to the interests of the management listed above, the conflict with the seller becomes obvious. In contrast to strategic interested parties, MBO managers are unable to include any synergies in the calculation for their own determination of the value or, respectively, the purchase price, with the consequence that their purchase price offers are usually significantly lower than those of a strategic investor, e.g. of a direct competitor. This friendly fire described above, i.e. conflicts on...