- English

- ePUB (mobile friendly)

- Available on iOS & Android

About This Book

Have you ever wondered why some people are naturally good with money?

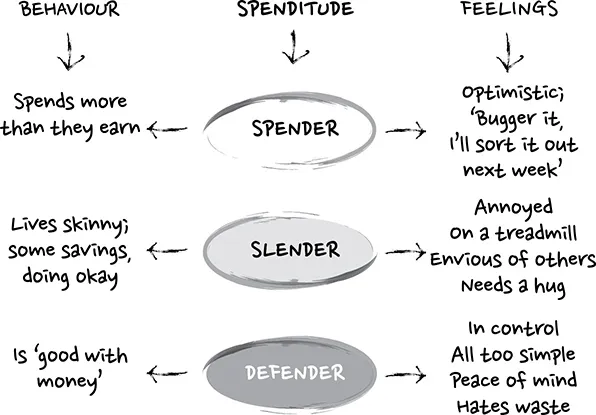

No matter your age or your income it is your spenditude – your attitude to money – that influences your financial success. Spenditude shows you how to tackle your habits and behaviours to uncover what drives your spending and allows you to gain financial security and live the life you want.

This book is not about tedious budgets, get-rich-quick schemes, or giving up your daily coffee. Instead you will learn how to improve your relationship with money so you can release your financial anxiety and walk through life feeling in control. Financial wellbeing experts Paul Gordon and Janine Robertson reveal how with small and incremental steps you can empower yourself to change your spenditude for the better. Backed by extensive research, relatable case studies and in-depth interviews, this life-changing guide will help you get on the right path to financial security.

It may seem an overwhelming task to change your thinking about money, but developing sound financial habits is within reach. Behaviour is the key that unlocks better financial outcomes. This motivating and practical guide will enable you to identify the habits you need to change, establish your financial goals and learn how to develop and follow a plan best-suited for your situation. Clear, straightforward chapters relate days of the week to the decades of your life – Monday to Friday is your working life and the weekend is your retirement – to drive home the fact that life is short so don't waste time.

In a world where change is constant, FOMO is prevalent, and social media's influence is unmistakable, there has never been a better time to take stock of your spenditude and put your financial future squarely in your own hands. Spenditude will change your attitudes to money so you can benefit from the coming changes and enjoy the rest of your life.

Frequently asked questions

Information

Chapter 1

What's my spenditude?

Why should I care about my spenditude?

Just one thing …

Identifying your spenditude

The sibling test

The three categories of spenditude

A bit about behaviour

Table of contents

- Cover

- Title Page

- Copyright

- Acknowledgements

- Foreword

- Introduction

- Chapter 1 What's my spenditude?

- Chapter 2 Dozy, sleepy, drowsy and weary

- Chapter 3 Where did the time go?

- Chapter 4 The voice inside my head

- Chapter 5 The why factor

- Chapter 6 Where's the tiger?

- Chapter 7 This intelligence isn't artificial

- Chapter 8 What could possibly go wrong?

- Chapter 9 Under the spreadsheets

- Chapter 10 A bit on the side (and the future of work)

- Chapter 11 Rewirement

- The beginning

- About the authors

- Index

- End User License Agreement