This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Real Estate Investing For Canadians For Dummies

Book details

Book preview

Table of contents

Citations

About This Book

Get involved in real estate investing

Real estate is a vital component of a well-balanced investment portfolio. Real Estate Investing For Canadians For Dummies offers a clear, comprehensive look at investing in real estate in Canada—even if you feel priced out.

From investigating properties—and other investment options, such as REITs—to securing financing, managing properties, and knowing when to sell, real-life anecdotes and a balanced perspective make this the ideal book for people looking to explore this lucrative field.

- Explains to millennial investors how success is within their grasp

- Includes information on new mobile tools

- Shows you how to research, analyze and manage potential properties

- Covers how the real estate market goes through changes and cycles

This new edition of Real Estate Investing for Canadians For Dummies helps you confidently identify opportunities in a challenging market.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Real Estate Investing For Canadians For Dummies by Douglas Gray, Peter Mitham in PDF and/or ePUB format, as well as other popular books in Personal Development & Personal Finance. We have over one million books available in our catalogue for you to explore.

Information

Part 1

Getting Started with Investing in Real Estate

IN THIS PART …

Understand how real estate fits into your life and financial plan.

Discover your options for real estate investment from raw land to REITs so you can find the right type of property investment for your plans.

Know the challenges that come with real estate investment, from the market, government, and your partners and how you can face them head-on.

Establish an investment strategy that matches your appetite for risk and reward, and discover how to make decisions to minimize your risks.

Find the right advisers who can guide you to investment success when purchasing real estate properties.

Chapter 1

Identifying Opportunities

IN THIS CHAPTER

Owning land has been a status symbol for generations. It once gave people a right to vote and a degree of independence from the demands of the world. Today, it promises financial independence, which amounts to the same thing for most people. Land is tangible; you can stand on it and live on it, things you can’t do with investments bought and sold online, and represented by numbers on a page. Whether you have a handful of homes you rent to university students, renovate a run-down character house to be sold at a profit, or buy the local strip mall and make it a gathering point for the neighbourhood, you’ve got opportunities for making money as well as making a contribution to your community.

Real estate is everywhere: the apartment or house you call home, the mall where you go shopping for groceries and clothes, and the office where you work. Even the park where you take your kids and walk your dog is property with potential investment value. But like any other investment, real estate has its risks, too. Remember the old saying “land rich, cash poor”? There’s real wealth in land but some equally real financial dangers, too, if you don’t have a strategy for making the most of it. What kind of real estate interests you most? Have you considered the skills — and weaknesses — you bring to your role as an investor? Successful investment in real estate means becoming land rich in order to become cash rich, too. You want to do it right!

In this chapter, we discuss the various opportunities awaiting you as an investor and some of the risks associated with real estate. We look at the considerations worth bearing in mind as you’re sizing up the different investment tools available. Finally, we investigate how real estate can fit into a long-term financial plan and the implications that it can have for your retirement and your estate.

Investigating Real Estate Investing

So what’s the real deal about real estate? What makes it such a hot topic and critical investment for everyone from the government honchos who manage the Canada Pension Plan down to the tech nerd from school who’s making oodles of money as a programmer? In this section, we check out the advantages of real estate and compare property relative to other kinds of investments you may consider as part of your portfolio.

Discovering the opportunities

Statistics from the Canadian Real Estate Association indicate that residential real estate has increased in value by an average of more than 5 percent a year over the past 30 years. Even though there have been some significant dips during that period, and not every property will make the same gains in every year or from city to city, the trend is unmistakable: The long-term potential for your real estate investment to appreciate is significant. Several reasons support our argument that an investment in real estate makes sense. We outline them here.

Leverage opportunities

Leverage is all about using a small amount of your own money and letting someone else’s cash do the rest of the work. Because real estate provides the loan’s security, a guarantee of repayment if you’re unable to pay off the loan, the risk is low. If you run into financial trouble and your creditors, the people who’ve loaned you cash, demand immediate repayment and call your loan, your property could be subject to proceedings that lead to its sale. Providing the property sells for more than the amount owing, you stand to emerge relatively unscathed. The nature of a forced sale of your property depends on the province and the mortgage documents you have signed. For example, in Ontario, the power-of-sale process doesn’t require court approval, whereas in some other provinces, the foreclosure and sale process requires the court to be involved throughout.

We discuss some of the basics of setting your limits as an investor so you can avoid the sale of your properties due to default of payment, in the section “Figuring Out if You’re Right for Real Estate Investing,” later in this chapter, and discuss financing at greater length in Chapter 6.

Equity opportunities

By paying down a mortgage, you’re paying the purchase value of the property and making its value your own over several years. Real estate is therefore unlike many other investments because it gives you a chance to build equity — your share of the property’s net worth at the time of sale — over the course of the investment rather than invest everything up front and hope for the best. Because the value of a property will change while you’re paying down the original value, you have two ways to build wealth, not just one.

To some investors, negative cash flow is a bigger concern than negative equity because negative cash flow leaves them short of cash to cover immediate expenses. However, negative equity is an unrealized loss that could turn into positive equity when the market improves. The key to successful investing in both cases is avoiding overleveraging, which means having more debt than you can handle. It implies excessive risk-taking, which most investors consider an imprudent investment strategy.

Return opportunities

When investors talk about returns, they’re talking about the money they’ll see – not the option to return their property for a refund! You’re quite right to ask for your money back when you invest in real estate, but the smart investor will get to keep the property, too. In fact, our calculations estimate that it’s not impossible to enjoy a net return of more than 75 percent annually on your investment. How do we figure that? Here’s the math.

If you buy a $300,000 property with a $30,000 down payment and the property increases in value by half over five years, the increase in equity is $150,000. That amounts to approximately $112,500 after the government taxes the appreciation in the property’s value, or capital gain (we discuss capital gains at greater length in Chapter 15). This would represent a return of 375 percent over five years, or at least 75 percent annually on your original investment of $30,000. Assuming the debt you incurred to buy the property decreased over the course of the five years, and the property generated rental income, you would enjoy an even greater return on your investment.

Tax opportunities

Real estate offers several tax advantages for you as an investor, especially if you’ve developed an investment strategy that accounts for taxes. Taxes erode the return you’ll see on investments yielding a fixed return, such as bank accounts, bonds, and guaranteed investment certificates (GICs), but not Tax-Free Savings Accounts (TFSAs). Stocks and other equities put your principal at risk. Real estate investments, however, frequently enjoy a reduced tax rate. Between tax-free capital gains on your principal residence to savings of up to 50 percent on taxes levied on capital gains from investment properties, there are many tax advantages to investing in real estate. You’re also able to deduct investment expenses and write off any depreciation in property values on your real estate purchases. We discuss taxes in greater detail in Chapter 15.

Hedge opportunities

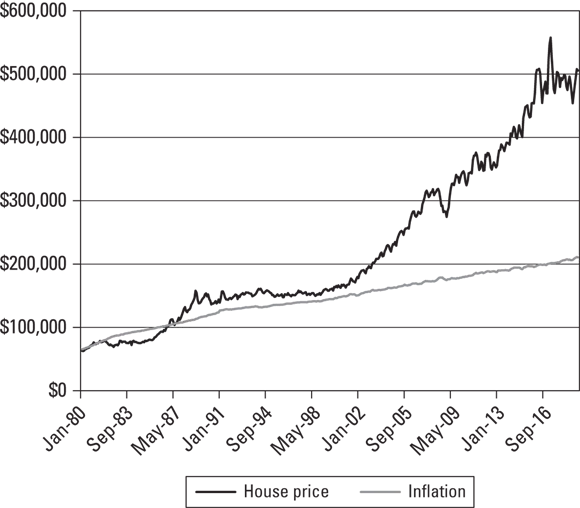

No, we’re not suggesting you hide from your creditors in a bush! The kind of hedging we’re talking about means taking shelter from the effects of inflation, which works to erode your buying power. The rate of inflation varies from month to month, year to year, and even country to country. But real estate typically appreciates at a rate 3 to 5 percentage points above the inflation rate. So if inflation is running at 3 percent, look for your investment in real estate to appreciate at 6 to 8 percent. If you choose wisely, your investment stands a good chance of increasing at a rate greater than that of inflation, as Figure 1-1 shows.

Source: Canadian Real Estate Association.

FIGURE 1-1: Average home prices haven’t always increased at the same rate as inflation, but long-term gains have steadily outpaced the inflation rate.

Flexibility opportunities

Real estate offers a variety of investment...

Table of contents

- Cover

- Table of Contents

- Introduction

- Part 1: Getting Started with Investing in Real Estate

- Part 2: Preparing to Buy: Financing Real Estate Investments

- Part 3: Selecting Properties

- Part 4: Building Value: Managing Your Investment and Seeing a Return

- Part 5: The Part of Tens

- Index

- About the Authors

- Connect with Dummies

- End User License Agreement