- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

The must – read guidebook for entrepreneurs looking to get into accelerator programs and to build and scale their startups with speed

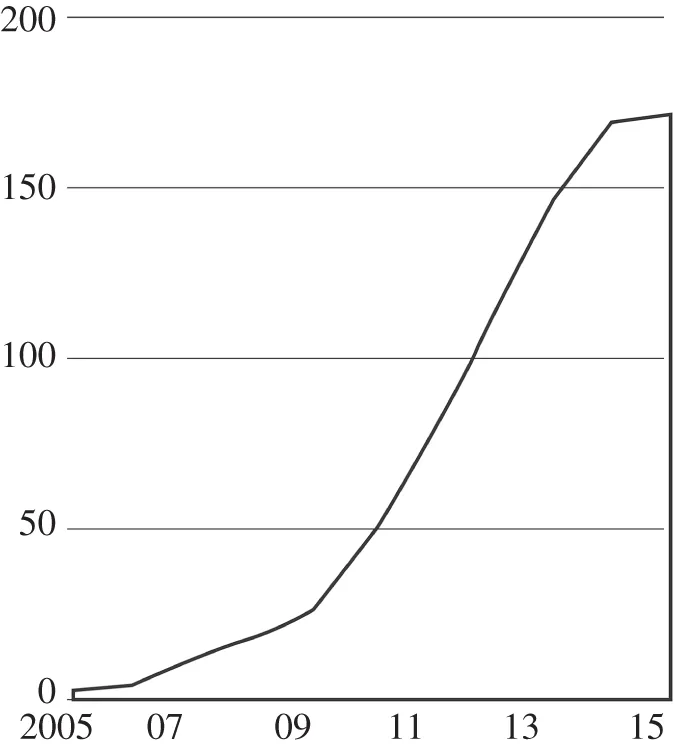

Accelerator programs have become one of the most powerful and valuable resources for entrepreneurs seeking to learn rapidly, build powerful networks, raise capital, build their startups and do this at speed and scale. In recent years, the number of accelerator programs around the world has grown at an incredible rate, propelling startups such as AirBnB, Uber, DropBox, Reddit, and others — many to billion-dollar valuations. The number of accelerators, the differences in accelerator program offerings and the unique benefits and costs of different accelerator locations makes choosing the right accelerator a challenge. Selecting the wrong accelerator, failing to be accepted in the right one, or not fully taking advantage of all the accelerator has to offer can be costly, sometimes fatal. With the stakes so high, entrepreneurs need to understand all their options, choose carefully and do the right things to maximize their chances of success.

Startup Accelerators is the go to guide for any entrepreneur, providing a firsthand look into the acceptance criteria and inner workings of different accelerator programs. Written by entrepreneurs for entrepreneurs, this indispensable resource explains what different accelerator programs offer, how to get accepted, what to do during the program, how to raise money during accelerators, what to do after the program ends, and much more. Packed with real-world case studies and advice from leading experts on startup accelerator programs, this one-stop resource provides step-by-step guidance on the entire accelerator process.

- Reveals how accelerators help founders navigate different challenges in the startup journey

- Describes the differences in the benefits and costs of different accelerator programs

- Explains how to prepare accelerator applications

- Discloses what actions to take during an accelerator to make the most of it

- Depicts case studies of entrepreneurs' accelerator applications, experiences and outcomes across different accelerators

- Features interviews with accelerator program managers, founders who went through accelerators, and investors in companies going through or having gone through accelerators

- Includes insightful data and reflections from entrepreneurship education researchers and academics

Startup Accelerators: A Field Guide will prove to be invaluable for startup founders considering or going through accelerators, as well as aspiring entrepreneurs, educators, and other startup accelerator stakeholders.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

CHAPTER 1

The Emergence of Startup Accelerators

The accelerator model has become a “graduate school” for startups.Alex Friedman, co-founder and president, Ruckus; Member, Forbes Councils

Emergence

Ascendance

Table of contents

- Cover

- About the Authors

- Acknowledgments

- Preface

- Introduction

- CHAPTER 1: The Emergence of Startup Accelerators

- CHAPTER 2: What Happens in an Accelerator

- CHAPTER 3: Is Your Startup Ready for an Accelerator?

- CHAPTER 4: How to Prepare the Accelerator Application

- CHAPTER 5: How to Handle the Accelerator Interview

- CHAPTER 6: Should You Give Up Equity to Get into an Accelerator?

- CHAPTER 7: Choosing an Accelerator Program

- CHAPTER 8: How to Get the Most out of an Accelerator

- CHAPTER 9: What to Expect after the Accelerator Ends

- Appendix: Founder Resource Directory

- Index

- End User License Agreement

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app