Introduction

Over the last two decades, researchers and practioners have paid great attention to understanding and examining innovative mobile financial technologies and mobile financial services (MFS). The underline reason for this devotion from the research and the industry is attributed to the momentous shift seen in the technological culture and the rise of smartphones. Because of the availability and affordability of smartphones and tiny but smart wearables, customers are now more empowered and have endless virtual and physical options for accessing information, researching, choosing, buying, as well as using new financial and payment products and value-added services at the convenience of anytime anywhere.

This rapidly converging financial landscape was earlier dominated by branch-oriented banking, which provided services to customers who maintained a formal relationship (bank account) with the banks. Paper-based instruments, such as checks, payment drafts, dominated the transactions mode and a transactions cycle was completed in days. The rise of the digital natives during late 1980s, birth of the Internet and Internet-based business models during early 1990s, mobile technology, and the retail agent network (in case of branchless banking) have transformed delivery of financial services. Internet banking, point-of-sale banking, and telephone banking were introduced and added to the repertoire of banking channels. These innovative banking channels, commonly known as ‘alternative delivery channels’ or ‘digital banking channels,’ became the lingua franca of banking business globally.

Historically, these developments in the domain of digital banking were originally started in the 1960s and received a tremendous momentum during the late 1980s. The climax was in the 1990s, and slowly eroded the need for branch-oriented banking. In the 2000s, portable and wearable devices brought a major revolution in the consumer mindset and lifestyle in general because of their massive social and economic impact (Liébana-Cabanillas, Sánchez-Fernández, & Muñoz-Leiva, 2014). Similarly, digital banking channels including mobile were developed and deployed in most of the developed world. Later on, their deployment and usage has been noticed in emerging and developing countries as well. Perhaps, this diffusion of financial digital services including MFS in the developing markets is essentially due to the increasing usage of smartphones as well as the presence of the digital native segment.

According to Helsper and Eynon (2010), the digital natives (also known as net generation, the Google generation, or the millennials) are those consumers or users who were born during the late 1980s and have always been surrounded by, and interacted with, new technologies such as mobile. On the other hand, the people who were born before this new digital era, which began around 1980, are called ‘digital immigrants’ (Helsper & Eynon, 2010). According to Prensky (2001), digital immigrants may learn to use new and innovative technologies but will still be in some way located within the past, unable to fully understand the digital natives.

In tandem with these global advancements seen in the mobile technology, the financial institutions located in emerging and developing countries started developing mobile-based innovative solutions and offering retail mobile financial banking services to a more heterogeneous, demographically disbursed, and relatively less-privileged population. A significant impediment to reaching the remote customer segment was the non-availability of infrastructure, high security risks, and low deposit rate. The adoption of mobile telephony to provide financial services in Africa and other developing regions of the world has become instrumental in integrating the hitherto less-inclusive or unbanked and underbanked segments of the population to the mainstream financial systems (Ouma, Odongo, & Were, 2017).

Earlier, the strategy to reach the underbanked and unbanked was the part of financial inclusion programs, which were introduced and motivated by the government agencies and regulators. These financial programs were undertaken by banks, other financial institutions, mobile network operators (MNO), and retail agent networks with an underlying purpose to increase the financial and social inclusion, increase the financial well-being of the underbanked (and even unbanked consumers), and entice the customers to access and use the mainstream banking and payment services. These developments have gradually designated ‘mobile’ as absolutely necessary for many banks, MNOs, and other nonbanking institutions.

Despite these developments and the availability of extensive literature on MFS, there has been no effort to date to comprehensively define and conceptualize the term ‘MFS.’ This chapter extends the depth of previous studies and demonstrates the need for defining and conceptualizing the term ‘MFS’ and investigating what constitutes the field of MFS. In doing so, this chapter provides an analysis and synthesis of the past literature in the field of MFS. Because the prior research has not defined the term ‘MFS’ – at least until recently, researchers often overlook the potential of MFS, especially the branchless banking. This chapter seeks to answer the following research questions:

- What is the mobile financial services landscape?

- What are MFS and how are they conceptualized in the marketing and IT literature?

- How has prior literature segregated MFS into different types?

- How do the different types of MFS differ from each other?

Attention is given to the contemporary and relevant published sources including journal articles and conference proceedings published during the last decade, i.e., 2008 till 2017 (inclusive) defining and conceptualizing the term ‘MFS.’ Within the broader scope of this conceptualization, we have used the term ‘mobile financial services’ or ‘mobile banking services’ or ‘retail mobile financial services,’ or ‘mobile banking and payment services’ interchangeably.

The chapter is organized as follows: the next section offers the definition and conceptualizes the term ‘MFS’ and its different facets. This is followed by a discussion on how to differentiate the terms ‘mobile banking,’ ‘mobile payments,’ and ‘branchless banking services.’ The chapter ends with a conclusion.

Mobile financial services landscape

This section addresses the first research question: What is the mobile financial services landscape?

The retail banking sector is considered the backbone of the financial services industry, economy, and it permeates different realms of social, private, and economic life. Retail banking fulfills everyday banking and payment needs of the consumers and encompasses high-volume and low-value transactions. Retail banking sector facilitates both electronic and paper-based transactions, and it includes a horde of delivery channels with variant capabilities to promote, for example, financial inclusion as well as the financial well-being of the customers. Historically, the development and the deployment of these multiple digital banking delivery channels by the financial companies, including banks, is based on a very simple notion, i.e., the bank-customer relationship is built on interaction between the partners and should not (metaphorically and literally) end at the bank branch door (Feinberg, Hokama, Kadam, & Kim, 2002).

Mobile devices have added the element of pure mobility to digital services consumption and have provided motivation and several business opportunities to the retail financial sector to expand their business portfolio. Resultantly, the widespread penetration and use of portable devices as an information-rich tool created a new payment environment, a new revenue stream for banks, and became a central payment business strategy. Using the functions of the cell phones – payment – mobile financial systems became the next big thing and an ultimate choice for the consumers.

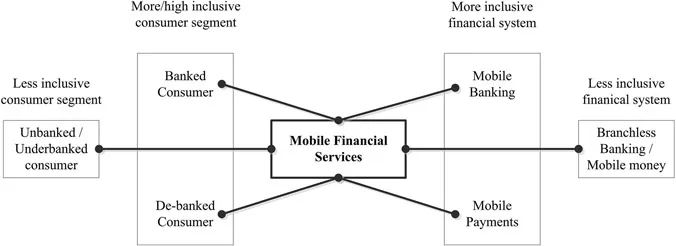

Figure 1.1 depicts the landscape of the retail MFS and how these services are segregated in different types by the research and the industry. Figure 1.1 segregates the consumers (such as banked, de-banked, and unbanked) who access and use the MFS. These segregations are largely based on the evidences collected from the prior research (e.g., Demirgüç-Kunt & Klapper, 2013) that have identified two functional domains in the financial system:

Figure 1.1 Retail mobile financial services landscape

(1) more inclusive mobile financial systems and (2) less inclusive mobile financial systems.

More inclusive mobile financial systems include mobile banking and mobile payments, including its advanced version called mobile wallets. Banked and de-banked consumers with an easy and always access to the infrastrusture, Internet, and mobile devices are generally considered as the inclusive consumer base. On the other hand, a less-inclusive mobile financial system consists of branchless banking or mobile money. Here unbanked and underbanked consumers using their cell phones perform basic banking and payment transactions. Since banks could not manage the mobile network by themselves, mobile money services allow greater collaboration between and among various banking and nonbanking players, such as mobile network operators (MNOs), software houses, and newly emerging Fintech start-ups.

There have been some assertions that the MFS, including more-inclusive and less-inclusive, provide several benefits to the consumers, such as MFS provide more personalize experiences, better customer service, reduced costs, the increased reactivity of the bank and other financial institutions, increased market share, reinforced brand image, and provide the unbanked with new opportunities to access financial services (Morawczynski, 2009). Furthermore, Kumar, Lall, and Mane (2017) discuss wider benefits from using MFS, such as increasing customer satisfaction, increasing profitability, sustaining competitive advantage, providing a higher level of convenience, and also as a tool to cater to unbanked customers.