- 206 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Energy, Foresight and Strategy

About this book

The essays in Energy, Foresight and Strategy apply rational expectation theory to various energy markets with the intention of discussing issues relevant to analysis and decision making in the whole of the energy field. Originally published in 1985, issues explored include oil exportation, energy prices and embargoes, both focussing on how past regulation has created issues in the market at the time of publication as well as creating models to ascertain the futures of various energy resources. This title will be of interest to students of Environmental Studies and Economics.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

1

Energy, Foresight, and Strategy

Thomas J. Sargent

This book contains five essays that use dynamic economic theory to study the processes by which energy sources are discovered, developed, priced, supplied, and stored. Dynamic economic theory is required for analyzing these processes because of the intertemporal nature of the economic problems that confront both the owners of energy sources and the customers they serve. Owners of energy sources face decisions about how rapidly to extract and sell their resources. Because energy sources are typically both durable and exhaustible, owners have strong incentives to care about the likely future time paths of the prices of their sources of energy and competing sources, as well as about the paths of cost factors such as tax rates.

Users of energy face decisions about designing plants that potentially can use different amounts and sources of energy. Because these plants are durable, users of energy care about the future prices both of energy and of complementary and substitute inputs and about the availabilities of alternative energy sources. Thus, participants on all sides of energy markets have strong incentives to exercise foresight about relevant aspects of the physical environment and about the future actions of other participants on all sides of such markets.

Rational Expectations Theory

Successful analysis of the interaction of a collection of agents in such environments requires two things. First, it requires tools that permit analyzing individual agent's choices of intertemporal strategies, which are constrained both by the physical technologies and by the intertemporal strategies chosen by other market participants, both private and governmental. Second, it requires an equilibrium concept suitable for studying the dynamic interaction of a collection of agents. Such a concept must insure that agents' choices of intertemporal strategies are mutually consistent with the physical constraints and with their perceptions of each other's strategies. The essays in this book are united in using models that posit agents who solve stochastic optimal-control problems and that use an equilibrium concept in which agents accurately perceive those constraints that the physical environment and the strategies of other agents impose. Such dynamic theories are usually referred to as "rational expectations" theories.

The ostensible subject matter of the five essays in this book mostly concerns aspects of energy economics, but the essays use and develop methods of analysis that are applicable in many other fields. Many of the phenomena and problems that occur in energy markets closely resemble those that arise in other contexts. Any system of purposeful agents acting in a dynamic environment has essential features in common with energy markets.

A few general concepts help clarify the structure of these dynamic multiagent systems. The state of a system at date t consists of a list of variables that completely characterize the position of the system at date t. We let x(t) denote the state at t and regard x(t)asa vector. We imagine that the model describes n agents, each of whom faces choices that potentially influence the future position or state of the system. In particular, we imagine that the ith agent has the power to choose a control, or vector of controls, u(t, i) at date t. The evolution of the state is supposed to be governed by the transition equations or "laws of motion"

x(t + 1) = f[x(t), u(t, 1), u(t, 2),..., u(t, n), e(t + 1)] (1.1)

where e(t + 1) is a random vector that is distributed independently and identically through time according to the cumulative distribution function Prob[e(t + 1) < E] = F(E). The random vector e(t + 1) is included as an argument of (1.1) to capture the idea that the process by which future states evolve out of past states and controls is partly shrouded in uncertainty.

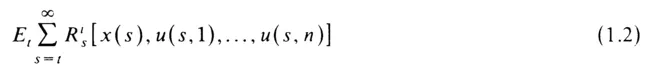

Next we require a statement of the purposes that guide the n agents in their choices of controls u(t, i). We shall suppose that agent i generally cares about the future paths of the state of, and all of the controls in, the system in a way that can be summarized by the function

where Et is the expectation operator conditional on the i th agent's information at time t. We call (1.2) the objective function of agent i.

In order to complete the specification of the structure of this system, we must describe the form of strategy or "strategy space" over which the i th agent is imagined to search for a maximizer of (1.2). Also necessary is a description of each agent's views about all other agents' strategy spaces and objective functions (1.2) in order that any of their maximization problems be well posed. Because strategy spaces can be specified in a variety of ways, we shall adopt a notation intended to accommodate a variety of possible alternative specifications. We suppose that agent i uses a strategy of the form

u(t, i) = hi, [Ii,(t)] (1.3)

where Ii (t) is the information at t that agent i possesses and upon which the agent's decisions are contingent. We also assume that all other agents know agent i 's objective function (1.2) and strategy space (1.3). We make this assumption for i extending across all n agents.

The system will not yet have been completely specified until we describe the structure of "dominance" across agents. Equations (1.1), (1.2), and (1.3) imply that the evolution of the state, and hence the value of agent i 's objective, depend on the strategy (1.3) chosen by agent j, where j extends over the remaining n — 1 agents. This means that, in general, agent i 's optimal choice of strategy will depend on what the remaining n — 1 agents choose as their strategies, and vice versa. Thus all the strategy choices are interdependent. This interdependence can be imagined to be structured in a variety of ways, each of them internally consistent, depending precisely on how the various agents are supposed to believe that agent i 's choice of strategy influences their strategy choices.

Several distinct ways of modeling the structure of dominance are common. In a "Nash equilibrium," each agent / is assumed to know the strategies of the remaining n — 1 agents but to regard them as fixed with respect to its own choice of strategy. In a "rational expectations competitive equilibrium," each agent i is imagined to take as given and beyond its influence the aggregate state variables that determine the evolution of market prices. (Usually the rational expectations competitive equilibrium is a limiting version of a Nash equilibrium when the number of agents n becomes large.) In a "dominant player" or "Stackelberg" equilibrium, one of the agents is imagined to take into account the influence that its choice of strategy has on the strategies some or all of the other agents choose, while the remaining agents are imagined to behave in a Nash or competitive way.

Given a structure of dominance and a specification of strategy spaces, an equilibrium is a collection of all n agents' strategies (1.3) that maximize their objective functions (1.2) subject to the laws of motion of the system (1.1) and also subject to their perceptions of other agents' strategies and the structure of dominance. In general, for each specification of a structure of strategy spaces (1.3) for the n agents, a distinct structure of dominance gives rise to a distinct equilibrium. Simply describing an equilibrium as a Nash equilibrium is incomplete unless supplemented with a description of strategy spaces. An example of this fact can be found in the chapter by Epple, Hansen, and Roberds. The Nash equilibrium they calculate using Euler equation methods assumes a different strategy space and results in a different dynamic equilibrium for the industry than does a Nash equilibrium defined in the space of feedback decision rules computed by "stacking" a system of matrix Ricatti difference equations. (For a discussion of this latter kind of Nash equilibrium, see Hansen and Sargent, 1984.)

Evidently, with a given description of the physical environment, the structure of strategy spaces and the structure of dominance across agents can be set up in a variety of alternative ways to produce distinct concepts of equilibrium. Descriptions of the physical environment (1.1), the objectives of the n agents (1.2), the strategy spaces (1.3), and the structure of dominance define what is known as a dynamic game, or differential game.

This brief excursion into the realm of differential games has been abstract, with no names attached to any of the variables in x(t) or u(t, i) and no identities assigned to the n agents playing the game. When x and u are defined appropriately, energy problems fit nicely into this framework. Imagine a system in which the state vector x(t) includes (possibly noisy) measures of the stocks of energy sources possessed by their owners at t, together with measures of stocks of physical capital, energy sources, and employment of labor by users of energy at t. The u(t, i)s might include exploration and extraction rates chosen by owners of energy sources, together with users' rates of consumption and of addition to stockpiles of energy sources, as well as rates of accumulation of physical capital and employment, and also domestic tax rates and tariffs chosen by one or more governments. In such a setting, the n agents might be identified with the owners of energy, their customers, and possibly one or more governments. These categories of agents could be further subdivided in various ways, as is done, for example, in setups with a dominant supplier supplemented by a competitive fringe of suppliers (see the chapter by Aiyagari and Riezman). The analyses in this book all adopt definitions of states, controls, and agents that are chosen to illuminate some aspect of the economics of energy.

The preceding description has been vague about the forms of the functions f, R, and h in (1.1). (1.2), and (1.3), as well as about such matters as the existence, uniqueness, and computation of equilibria of differential games. Without restricting these functions, little or nothing can be said about these matters. Most of the models in this collection can be represented in a form in which Rs is quadratic, while f and hi are linear. These assumptions are adopted for purposes of tractability because for this set of assumptions (or under a closely related set of log-linear, Cobb-Douglas assumptions), the most is known about existence, uniqueness, and computation of equilibria of differential games. Even for such linear-quadratic dynamic games, much remains to be learned. The chapter by Epple, Hansen, and Roberds develops new methods for studying the existence, character, and computation of equilibria of such games. Eckstein and Eichenbaum (chapters 3 and 4) require new results about the existence and uniqueness for vector stochastic expectational difference equations in order to characterize the equilibrium of their optimal-tariff model. (The results they need are closely related to the Epple, Hansen, and Roberds work on factoring nonsymmetric matrix characteristic polynomials.) These new theoretical results and applications, although initially inspired by the energy examples treated in this book, will also be useful in other contexts.

Some Energy Applications

All the models in this book are based on differential games. Aiyagari and Riezman (chapter 2) study two kinds of dynamic games that owners of energy sources might play with their customers. The authors first undertake to analyze embargoes as a recurrent intermittent strategy that suppliers of energy consider using. Thinking about this problem in a differential game context directs the authors to study the effects that a strategy of occasionally imposing embargoes will have on the demand behavior of oil customers. Aiyagari and Riezman adopt a particular probabilistic structure for the form of the embargo, which amounts to choosing a strategy space that permits a randomized strategy. They analyze how energy customers, behaving as Nash players, use decision rules with parameters that are functions of the parameters characterizing the randomized embargo strategy of the supplier. The supplier is then imagined to behave as a dominant player with respect to customers. The authors characterize the conditions under which the economic interests of such a dominant supplier will be served by imposing a randomized embargo strategy within the particular strategy space they consider. Roughly speaking, only for high discount rate economies does their analysis predict that such behavior is in the interests of the supplier.

Two features of this analysis are noteworthy. First, adopting a differential game framework immediately directs Aiyagari and Riezman not to take demand curves as structural, or invariant, with respect to variations in the supplier's choice of embargo strategy. Second, Aiyagari and Riezman's analysis directs our attention to the question of how embargoes and other supply disruptions are to be conceived and modeled. Are they to be imagined as uncontrollable random shocks chosen by nature or as the result of a purposeful, albeit perhaps randomized, choice by suppliers?

Inspired by this second point, Aiyagari and Riezman go on to analyze another setup in which supply disruptions emanate from uncontrollable random shocks to the supplies of a competitive fringe of suppliers. The dominant seller takes the supply curve of the competitive fringe as given and chooses how to respond to these supply shocks to maximize its own expected present value. The dominant seller behaves as a dominant player with respect to the customers in the market and takes into account how its strategy influences the decision rule of energy users, who are imagined to behave in a Nash-like fashion.

Chapter 3, by Eckstein and Eichenbaum, is an analysis of dynamic strategic issues surrounding the demand for and holding of inventories of sources of energy by a country that imports all of its energy sources. Eckstein and Eichenbaum set up a closed stochastic dynamic competitive equilibrium model of a single country that draws down stockpiles of energy in order to produce consumption goods. As a whole, the country is a large demander of energy in the sense that its aggregate energy imports influence the world price via an upward-sloping world supply price of energy. The authors take this supply curve as given (compare and contrast this with the spirit of the Aiyagari-Riezman analysis) and proceed to study the optimality of the rational expectations competitive equilibrium for the home country.

Eckstein and Eichenbaum find that the rational expectations competitive equilibrium fails to maximize the expected present value of home country consumer surplus net of home country social costs of production. The reason is that competitive players neglect the market power that. taken as a whole, the country possesses in the energy market. The authors construct an intervention strategy by the home government that corrects this failure of the competitive equilibrium. This intervention amounts to a dynamic optimum-tariff strategy supplemented by a rebate program. In choosing this tariff strategy, the home government is imagined to behave as a dominant player with respect to home country private agents, while home co...

Table of contents

- Cover

- Title

- Copyright

- Original Title

- Original Copyright

- Contents

- Foreword

- Acknowledgments

- 1. Energy, Foresight, and Strategy

- 2. Embargoes and Supply Shocks in a Market With a Dominant Seller

- 3. Oil Supply Disruptions and the Optimal Tariff in a Dynamic Stochastic Equilibrium Model

- 4. Inventories and Quantity-Constrained Equilibria in Regulated Markets: The U.S. Petroleum Industry, 1947–1972

- 5. Linear-Quadratic Duopoly Models of Resource Depletion

- 6. The Econometrics of Exhaustible Resource Supply: A Theory and an Application

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Energy, Foresight and Strategy by Thomas J. Sargent in PDF and/or ePUB format, as well as other popular books in Economics & Environmental Economics. We have over one million books available in our catalogue for you to explore.