eBook - ePub

Strategic Finance for Criminal Justice Organizations

This is a test

- 292 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Strategic Finance for Criminal Justice Organizations

Book details

Book preview

Table of contents

Citations

About This Book

Traditionally, the study of financial decision making in law enforcement and criminal justice entities has been approached from the perspective of tax revenues and budgeting that focus only on the past and present. Capital investments of cash flow provide future benefits to all organizations, and among courses in business administration, these noti

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Strategic Finance for Criminal Justice Organizations by Daniel Adrian Doss, William H. Sumrall III, Don W. Jones in PDF and/or ePUB format, as well as other popular books in Law & Criminal Law. We have over one million books available in our catalogue for you to explore.

1

Introductory Concepts

The problem is not that people are taxed too little, the problem is that government spends too much.*

President Ronald Reagan

1.1 Objectives

The objectives of this chapter are to:

• Understand the use of money as a tool to facilitate the exchange of goods and services

• Understand the basic question of economics

• Understand examples of historical American finance

• Understand examples of historical American economics

1.2 Introduction

During the independent courses of their careers, the authors have experienced a variety of different work environments among an array of employers, independent contractor situations, and service duties. Combined, these professional employment settings represent over 70 years of experience among a variety of different organizations. These environments ranged from grocery stores to global software development settings; from venture capital start-up firms to the settings of nonprofit organizations; from defense-related firms to community service organizations; from small, four-year colleges to universities of Carnegie research standings; from realty shops to sales positions; and from State Guard military units to law enforcement settings. These settings also manifested different organizational purposes involving military police and security forces, systems integration and testing, national defense, overnight package delivery, electronic and wireless software and hardware systems, customer service, and various facets of academia.

Regardless of the type of environmental setting or purpose that was experienced, or of the type of work that was performed, or of the product or service that was developed, one characteristic was shared among each of these environments: the rendering of a human decision regarding money. Within each of these contexts and cases, issues of money were the financial factors that either precluded organizational demise or that invigorated the monetary heartbeat of organizational life. Cash flow is the lifeblood of any organization. Any financial decisions regarding the use of organizational funds must be seriously considered and soundly evaluated.

1.3 The Concept of Money

Before considering decisions regarding money, or any other form of personal or organizational financial decision, one must understand the basic concept of money with respect to a market environment. The market itself is nothing more than the environment in which a variety of transactions occur through time. Within markets, people provide services and partake of services. They also provide goods and obtain goods. However, among such markets, a central concept that underlies these transactions is that of the existence of a commonly accepted medium for servicing and facilitating such exchanges and transactions. This commonly accepted medium must have some attribution of value associated with its existence and use among societies. Using contemporary terms, this concept is expressed and identified quite simply: money. (See Figure 1.1.)

Although the mentioning of the word money may invoke mental models of shiny coins or colorful, oblong papers demarked with enumerated values and national symbols, money is a concept that pervades practically all societies globally. Historically, with respect to its use among transactions, the concept of money was described by a variety of phrases, terms, words, and names: wampum, pesos, beads, jewels, dollars, pounds, gold, silver, legal tender, skins and furs, bimetallism, script.* Many of these descriptors continue to be expressed during modern times, and are readily recognizable among many contemporary languages. However, they are all commensurate with the notion of a medium of exchange, toward the facilitation and completion of market exchanges, with respect to servicing and satisfying the needs and wants of humans.

Regardless of the society or language, all humans have needs and wants, and these needs and wants are presumed to be unlimited through time. Attempts to satisfy such human needs and wants occurs with respect to the scarcity of available, viable resources that are commensurate regarding the fulfillment of these human requirements. For the biological purposes of survival, humans both need and want to be warm in winter and cool in the summer. Humans both need and want food and water for survival. Such considerations demonstrate the congruency of needs and wants concerning the biological survival of humans. However, it should be noted that there is a distinct difference between needing something and wanting something. Regardless of this distinction, an exchange medium must exist to facilitate market transactions for the purpose of servicing both human needs and human wants.

Figure 1.1 Money example of U.S. $1.00 coinage. (Courtesy of the U.S. Mint, http://www.usmint.gov/about_the_mint/coinLibrary/#Pres.)

A consideration of unlimited human needs and wants versus attempts to satisfy them with scare resources may be contemplated historically. The concept of an exchange mechanism to facilitate the transactions through which human needs and wants were satisfied also may be viewed historically. This concept of a medium for exchange permeates the historical literature of the United States.

1.4 Formative U.S. Transactions

Some of the earliest writings and historical accounts of the United States, from a national perspective, are those of its Congress. Within these writings are found allusions to the economic and financial aspects of various human needs and wants. Further, such historical documentation contains a myriad of discussions regarding the concept of market transactions, and it also alludes to the concept of an exchange medium: money. A historical review of the Journal of the Senate yields some interesting commentaries regarding market transactions during the formative period of the nation.

During these formative years, a variety of issues were considered among the members of the Congress. During the year 1791, the Journal of the Senate indicated that

the price of all land sold or granted by the United States, shall be twenty-five routs per acre, except such as may be sold by special contract, and such as may be granted as bounties for military services; the warrants for which last mentioned lands shall be located, surveyed, and patented, in the same manner as warrants issuing from the land-office, in consideration of the payment of money, and the exclusive right of locating such warrants in districts set apart for the army, shall cease from anal after the first day of May, one thousand seven hundred and ninety-four: Provided, always, that any purchaser of lands, when the payment thereof shall be due, may proffer in payment any of the certificates of the funded debt of the United States, at the same rates as the treasurer shall have allowed for such certificates, respectively, in the last purchase which he shall have made thereof prior to such payment.*

Such early records of the nation demonstrate the existence of a market for real estate. Within this passage, allusions to the characteristics of human needs and wants are manifested through the description of the realty transaction. The method of satisfaction, with respect to the expressed scope and limitations of the transaction, is delineated regarding the issue of compensation. The last portion of the statement alludes to the existence of a medium through which the real estate transaction may be facilitated. Obviously, this medium involves the concept of money.

1.5 Nineteenth-Century U.S. Transactions

Perusing historical literature also provides notions that were prominent considerations, nearly a century later, during the latter period of the nineteenth century. Considerations of regional, national, and international markets; exchange mediums; and valuation discussions are found among a variety of historical journal articles. An examination of American historical writings, from the latter half of the nineteenth century yields similar considerations of market characteristics. (See Figure 1.2.)

Again, the Journal of the Senate (April 15, 1874) may be examined regarding this historical perspective. Such an examination shows historical Congressional considerations of compensating the “State of West Virginia for moneys expended for the United States in enrolling, subsisting, clothing, supplying, arming, equipping, paying, and transporting militia forces to aid in suppressing the rebellion; which was read the first and second times, by unanimous consent, referred to the Committee on Military Affairs, and ordered to be printed.”*

Figure 1.2 Cancelled check in the amount of $7.2 million for the purchase of Alaska, issued August 1, 1868; Records of the Accounting Officers of the Department of the Treasury; Record Group 217; National Archives. With this check, the United States purchased Alaska from Russia. For less than 2 cents an acre, the United States acquired nearly 600,000 square miles. (Courtesy of the National Archives, http://www.archives.gov/global-pages/larger-image.html?i=/historical-docs/doc-content/images/check-for-alaska-l.webp&c=/historical-docs/doc-content/images/check-for-alaska.caption.html.)

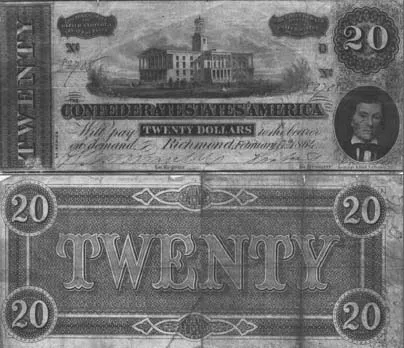

Again, such a historical consideration alludes to the presence of market environments, alludes to the presence of market transactions, alludes to the consideration of financial reimbursement, and alludes to the economic allocation of resources. These considerations are indicative of human needs and wants, regarding compensation, with respect to a variety of activities that occurred during the U.S. Civil War. The concept of money, as a tool through which the servicing of human wants and needs is facilitated, is expressed through the referencing of “moneys expended” regarding these market activities.† Both the United States and the Confederate States of America used some form of printed and coined money (see Figure 1.3).

Given that nearly a century had elapsed between the respective times of these historical accounts of Congress, the size, scope, and magnitude of U.S. economic growth had increased, and new considerations of finance abounded during the latter portion of the nineteenth century. Such issues involved considerations of financial valuation, the types of coinage of money that impacted regions of the United States, and international market issues that spurred debates. Within these contexts, allusions are made to the existences of markets, economic activities, and financial activities. Such characteristics are indicative of the attributes of economic and financial mechanisms that are necessary to service human needs and wants through time.

Figure 1.3 Example of monetary note issued by the Confederate States of America during the Civil War. (Courtesy of the U.S. National Park Service, http://www.nps.gov/history/museum/exhibits/vick/siege/scans/VICK738ConfederateTwentyDollar.html.)

Andrews considers bimetallism within the regions of Boston and New England, and alludes to robust debates that existed regarding the coinage of silver during this period.* Walker considers attributes of the historical period that affected the valuation of money.† Edgeworth, from a monetary valuation perspective of appreciation, considers the potential and capacity of money to purchase the “luxuries, conveniences, and necessaries of life.”‡ From the perspective of international trading endeavors, Bastable considers notions concerning a lack of consensus regarding monetary standards internationally and contemplates difficulties associated with various instantiations of money that existed during the period.§

Such discussions are well over a century old, and allude to the existence of human wants and needs, allude to the presence of some environment in which exchanges and transactions occurred, and allude to the conceptual methods through which such historical market exchanges and transactions were facilitated. Within these historical writings, the presence of a salient notion is manifested: the concept of money.

1.6 Contemporary U.S. Transactions

This concept of money remained unchanged during the initial portion of the twentieth century. The concept of money provided the mechanism through which the servicing of human needs and wants occurred through time. Again, a review of historical accounts provides discussions of economic and financial issues that were considered among members of Congress. Such an additional, historical review may be considered from the perspective of the latter years of the twentieth century.

A review of the Congressional Record provides a perspective of historical issues that were of Congressional debate during the 1990s. Within this instance, discussions concerned the Indian Development Investment Zone Act of 1990. The purpose of this proposed legislation was to generate “economic opportunities” among Native American community settings. These opportunities were hoped to improve conditions among “Indian reservations,” because a number of these reservations had been “decimated by a combination of high unemployment rates reaching well over 50 percent and equally troubling poverty rates.” Despite the willingness and desire of Native American peoples to work to support themselves, they were unable to do so because of the unavailability of employment opportunities. As a result, a migration of Native Americans occurred, from reservations to “metropolitan areas,” for the purpose of seeking employment, which intensified the complexities of the “problems of urban America.”*

Again, this portion of the Congressional Record alludes to the presence o...

Table of contents

- Cover

- Title Page

- Copyright

- Contents

- Preface

- Acknowledgments

- Authors

- Acronyms and Abbreviations

- 1 Introductory Concepts

- 2 Concepts of Decisions

- 3 Financial Management Decisions

- 4 Tools of the Trade: Making a Decision

- 5 It Is Time for Payback: The Payback Time Method

- 6 A Present for the Present: The Net Present Value Method

- 7 How Do We Rate? With the Internal Rate of Return

- 8 Red or Black? The Profitability Index Method

- 9 Putting It All Together! Let’s Make a Decision

- 10 Day and Night Shifts: Integrating the Concepts

- 11 The Slammer: Concuding Remarks

- Afterword

- Appendix A: Financial Variables and Symbols

- Appendix B: Financial Formulas

- Index