eBook - ePub

An Econometric Model of the U.S. Copper and Aluminum Industries

How Cost Changes Affect Substitution and Recycling

This is a test

- 406 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

An Econometric Model of the U.S. Copper and Aluminum Industries

How Cost Changes Affect Substitution and Recycling

Book details

Book preview

Table of contents

Citations

About This Book

Originally published in 1984. This book addresses the economics of the changing mineral industry, which is highly affected by energy economics. The study estimates, in quantitative terms, the short- to mid-term consequences of rising energy prices alongside falling ore quality for the copper and aluminum industries. The effects of changing cost factors on substitution between metals is assessed as is the potential for relying on increased recycling. Copper and aluminum industry problems should be representative of those faced by the mineral processing sector as a whole. Two complex econometric models presented here produce forecasts for the industries and the book discusses and reviews other econometric commodity models.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access An Econometric Model of the U.S. Copper and Aluminum Industries by Margaret E. Slade in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Chapter I: Background and Introduction

I:1 Changing Mineral Industry Costs

Much attention has been focused on changing energy economics in the last decade. The Arab oil embargo and Organization of Petroleum Exporting Countries (OPEC) price increases of 1973-74 forced the realization that we cannot count on secure supplies and cheap prices of petroleum in the future. Subsequent price increases for all energy sources have caused inflationary pressures worldwide and have directed attention to the long-term nature of the problem. The need to assess the short-, mid-, and long-range consequences of rising energy prices is obvious. Because energy is an essential input to virtually all industrial production, almost all industries have experienced higher energy-related costs. Particularly hard hit have been the mineral industries. These industries are highly energy intensive and process intensive. The energy intensiveness of mining, refining, and smelting means that mineral-industry energy-related costs have been rising faster than costs in other sectors. The use of energy in these industries primarily for basic physical processes means that energy savings are difficult to achieve.1 The burden of higher energy prices is not borne equally by all of the mineral industries. For example, primary-aluminum production is several times more energy intensive than is primary-copper production, and secondary production of these metals (production from scrap or recycling) requires one tenth to one twenty fifth of the energy needed to process the equivalent metal from ores. The unequal effects that increased energy prices have on mineral-industry costs will therefore cause changes in their competitive positions and substitutions in the use of their products.

Higher energy prices are possible because total resources of fossil fuels are finite and unequally distributed geographically and because many low-cost sources have already been exploited. Resources of non-fuel minerals are finite, unequally distributed, and of differing quality as well. In fact, whereas there are energy sources such as solar power that are virtually unlimited, all mineral resources are limited and nonrenewable.2 As high-quality mineral deposits are depleted, higher costs are incurred by those industries that must process lower quality ores. Not all metals are equally abundant. For example, aluminum constitutes 8% of the earth’s crust whereas copper accounts for only .006%. Mineral industries involved in the production of scarce metals might therefore experience rising costs,3 while those that process abundant metals are temporarily unaffected by the depletion of low-cost deposits. Therefore, changing ore quality will also cause changes in metal-use patterns.

This study is an attempt to estimate, in quantitative terms, the short- to mid-term consequences of rising energy prices and falling ore quality for two domestic mineral industries — copper and aluminum. The effects of changing cost factors on substitution between metals will be assessed, the potential for increased recycling (because of higher energy and other natural-resource costs) will be examined, and the reserve positions of the two metals will be studied to see whether lower grade ores will have to be rained (requiring more energy-intensive techniques and thus higher costs).

II:2 Estimating the Effects of Cost Changes

Changes in energy economics affect the mineral industries in three important ways. First, increased energy prices cause increased mineral-processing costs, directly (through the purchase of fuels) and indirectly (through the purchase of factors that require fuels in their production). Metal prices must rise, but, because the energy-intensiveness of metal production varies, they rise by unequal amounts. Second, because the processing of ores is more energy-intensive than is the processing of scrap, higher energy prices may increase the potential for recycling. But, as a higher proportion of available scrap is recovered, the energy-intensiveness of secondary production increases, dampening the original incentive to recycle. And third, increased production of a scarce metal means that ores of lower quality, which require more energy inputs per ton of refined metal, must be processed. Therefore, for scarce metals, higher production means higher energy costs.

The three effects just described can be expected to change relative metal prices. Changed relative prices cause purchasers to substitute one metal for another and to substitute nonmetalic materials for metals. This process is dynamic, because time is required for the effects of changed costs to filter down to the ultimate consumer. Therefore, the mid- and long-terra consequences of higher costs can be expected to be considerably greater than those experienced at first, and cost changes that occur today will affect metal-use patterns for years to come.

We can expect changes in the competitive positions of all the mineral industries as cost factors vary. However, this study concentrates on two domestic mineral industries — copper and aluminum. These two metals are substitutes in many end uses. They also differ in the energy-intensiveness of production and in their domestic and world reserves. Copper-and aluminum-industry problems should be representative of those faced by the mineral processing sector as a whole, and, because the two industries are unequally affected by higher energy prices and falling ore quality, they should exhibit diverse responses to the changed situation.

To make quantitative estimates of metal usage, substitution, and market shares as cost factors vary, two econometric models were constructed and estimated, one of the domestic copper industry and one of the domestic aluminum industry. The models are linked by copper and aluminum prices, derived demand from the copper- and aluminum-using sectors of the economy, and the copper-aluminum elasticities of substitution in each sector. To forecast the short- to mid-term (ten year) consequences of higher energy prices and falling ore quality for copper and aluminum prices, market shares, and the fraction of consumption of each that is supplied by recycled metal, model simulations are performed. The copper- and aluminum- industry forecasts resulting from these simulations depend on the exogenous-variable forecasts used. Alternative assumptions about future energy prices are made, and the sensitivity of future metal price, consumption, production, and substitution to the choice of energy-price forecast is analysed. The consequences of alternative assumptions about the quality of ore deposits to be mined in the future are also examined.

I:3 Model Overview and Study Outline

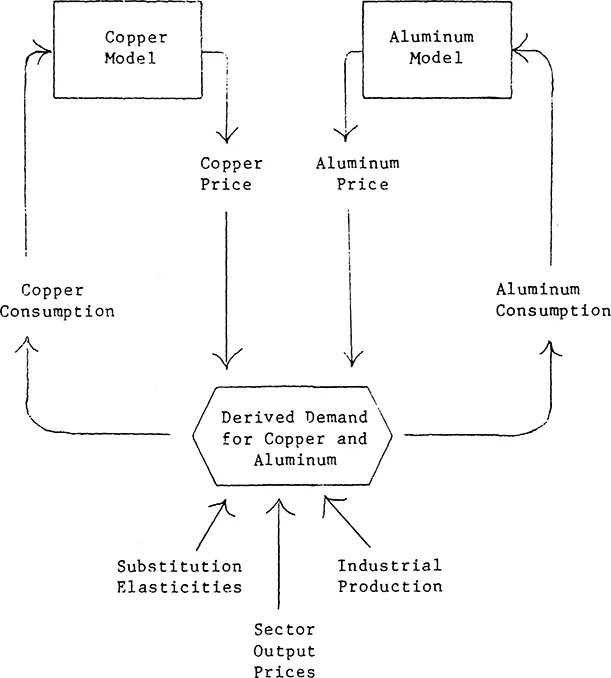

Two econometric models have been constructed and estimated, one for each industry — copper and aluminum. Figure I:3:1 illustrates the inter-metal market relationships that link the industry models through the demanding sectors. Because most metal is used as an input to industrial production, the demand for it is derived; that is, metal demand is prompted by the demand for metal products. In the copper-aluminum substitution (CAS) model, there are five copper-aluminum-using sectors as well as two sectors that use only aluminum. In each sector, the demand for the metals combined is derived from the sector’s production function. The demand equations are neoclassical marginal productivity equations, and sector demand depends on copper and aluminum prices, aggregate economic activity, and the price of the sector’s output. The way in which the sector demand for copper and aluminum combined is divided between the two metals depends on the estimated long-run elasticity of substitution in that sector. Just as price is an output from the industry models, consumption (as determined by the derived demand and elasticity of substitution equations) is an input to the models. However, the process of price and consumption determination is not sequential; it is simultaneous, and the variables — price and consumption — are jointly determined.

Figure I:3:1 Linkage of the Copper and Aluminum Models

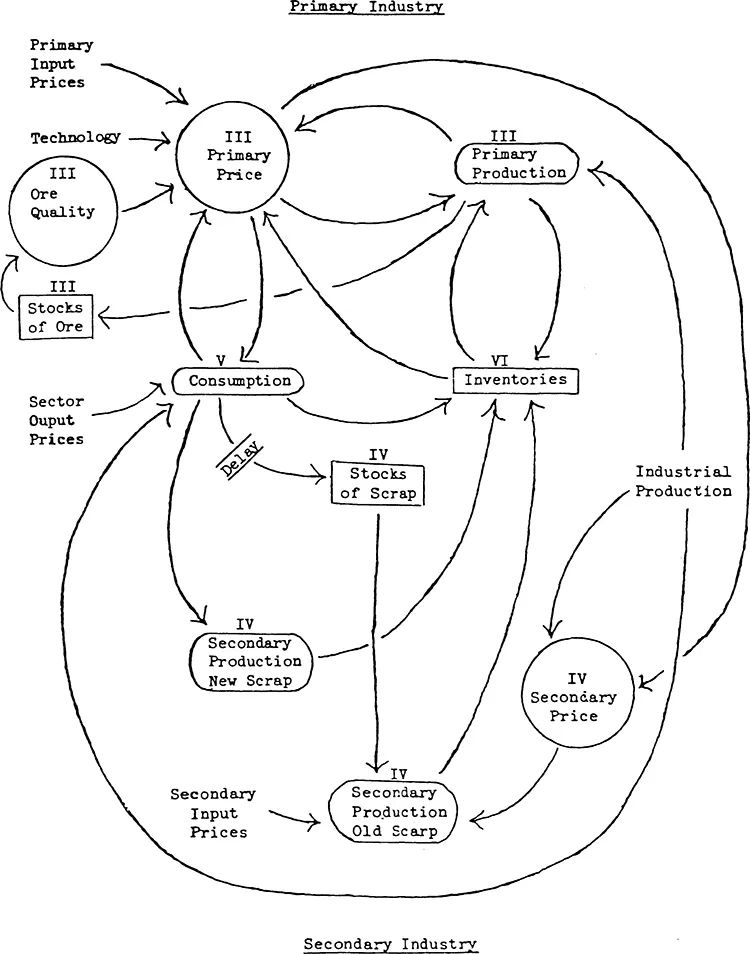

Each industry model (a box in figure I:3:1) involves a complex set of relationships as shown in figure I:3:2.4 An industry is subdivided into a primary sector (where production is from metal ores) and a secondary sector (where production is from scrap metal). In figure I:3:2, the primary industry is shown at the top of the page; the principal primary-sector relationships are price and output. The secondary industry is shown at the bottom of the page, with two types of production — production from new (industrial) and old (post-consumer) scrap — as well as secondary metal price. The primary and secondary industries are linked through consumption and inventories (see the center of the page) with the three types of production — primary, and secondary from new and old scrap — adding to, and consumption subtracting from, inventories. The flow chart in figure I:3:2 is referred to, expanded, and clarified in later chapters.

Figure I:3:2 Flow Chart of an Industry Model

In the next chapter, econometric commodity models are reviewed, compared» and classified, and the differences between this study and previous commodity modeling efforts are discussed. The following four chapters (chapters III through VI) are devoted to detailed descriptions of different aspects of the copper and aluminum industries and the related model equations. Chapter III discusses the primary industries, chapter IV describes the secondary industries, and chapter V is devoted to metal consumption and substitution; inventories and imports are covered in chapter VI. The performance of the complete model over the historic (1962-1976) and forecast (1977-1986) periods is discussed in chapter VII, where different simulations are presented. Conclusions are drawn and policy implications analysed in the final chapter.

Because this is an economic study, it is organized according to economic relationships (price, production, consumption, etc.) rather than according to metal (copper and aluminum). The similarities between the domestic copper and aluminum industries with respect to structure and conduct make this economic organization both reasonable and tractable.

I:4 Limitations of the Analysis

The most important limitation of this analysis is its partial-equilibrium nature. For example, copper and aluminum are not just substitutes for one another, each is a substitute for other materials such as steel and plastic. The energy and other natural—resource costs of producing the principal substitutes for copper and aluminum are not explicitly considered here. Instead, the simplifying assumption is made that, if energy prices are high, there will be a shift away from using very energy-intensive materials such as copper and aluminum. It is not specified whether this shift will be accomplished through an increase in the use of substitutes for copper and aluminum that are less energy-intensive, or through a general decline in the demand for the products that are made with copper and aluminum as the prices of these products rise, if such substitutes are not available.

Another important limitation is that, although copper and aluminum are internationally traded, international factors are only cursorily treated in this study. Many events outside the United States (such as slow economic growth in the rest of the industrial world or political disruptions in the copper- or aluminum-producing developing nations) could influence domestic copper and aluminum markets. However, prediction of these events is difficult and well beyond the scope of this study. Changes in world metal markets are, however, treated exogenously in chapter VII.

A further limitation is the neglect of certain domestic cost factors, such as the higher capital requirements necessary to conform with U.S. government environmental regulations. The economic impact of federal air- and water-pollution-control legislation is too recent and uncertain to be analysed in the statistical framework developed here. Engineering estimates of future cost increases resulting from compliance with proposed environmental regula...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Table of Contents

- List of Figures

- List of Tables

- Acknowledgments

- Chapter I: Background and Introduction

- Chapter II: Econometric Commodity Models — Review and Comparison

- Chapter III: Primary Copper and Aluminum

- Chapter IV: Secondary Copper and Aluminum

- Chapter V: The Using Sectors

- Chapter VI: The Balance Between Domestic Production and Consumption

- Chapter VII: Simulation, Forecasting, and Policy Analysis

- Chapter VIII: Conclusions and Policy Implications

- References Cited

- Appendices