eBook - ePub

Greater China

Political Economy, Inward Investment and Business Culture

This is a test

- 140 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Book details

Book preview

Table of contents

Citations

About This Book

This book, first published in 1996, focuses on the possible (but problematic) emergence of a so-called 'Greater China' encompassing mainland China, Taiwan and Hong Kong, and the economic reforms, inward investment, spatial disparities, and changes to business culture that would ensue. The similarities, differences, underpinnings, results and prospects for the future of Greater China are analysed in close detail in the chapters collected here.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Greater China by Chris Rowley, Mark Lewis in PDF and/or ePUB format, as well as other popular books in Economics & Economic Conditions. We have over one million books available in our catalogue for you to explore.

Foreign Direct Investment in China: An Examination of the Literature

STEFAN KAISER, DAVID A. KIRBY and YING FAN

INTRODUCTION AND BACKGROUND

In 1978, after an era of political and economic isolation under Mao Zedong, China announced its ‘open-door’ policy, permitting foreign direct investment (FDI) into the country. Having experienced investment activities of foreign companies before the Communist Party came to power in 1949, China ended FDI in the early 1950s. State-owned joint companies with the Soviet Union were the only form of foreign investment which remained, those enterprises being also terminated in the late 1950s and turned over to the Chinese.1 Thus, up to 1978, China’s economy was largely closed off from the world economy. FDI was prohibited for historical, ideological and practical reasons.2

Since 1974, the Communist Party leaders have been directing China towards its long-term national goal, the modernization up to world standards of agriculture, industry, science, and national defence by the year 2000. At the Third Plenary Session of the Eleventh Central Committee of the Communist Party in December 1978, the new leadership, headed by Deng Xiaoping, restated that the primary national objective of China was to achieve these ‘Four Modernizations’.3 Chinese authorities also recognized that the only way to pursue this ambitious goal was to attract FDI which would provide the capital, the management skills and the technology that was lacking. Woodward and Liu4 have estimated the technological gap between China and the developed countries to be between ten and 30 years. Thus, the absorption of FDI was seen as a vehicle to more sophisticated technology, and in the 1980s, China had been one of the largest importers of technology in the world.5 Further, Chinese officials believed that partnerships with foreign companies could facilitate access to international markets which would absorb the country’s exports and generate the foreign exchange needed to finance China’s imports.6 Finally, China has viewed foreign investment as a means of conserving funds for building and accelerating the pace of construction, learning about management and using the markets of foreign capital.7 Child8 suggests that the new policy was both an immediate reaction to the shortcomings of the Cultural Revolution and a desire to exceed the limitations of the Soviet-style, centralized system developed in the first half of the 1950s. The new policy was based on a consensus that the economic failings of the Mao period had to be corrected.

With the establishment of an institutional and legislative infrastructure, investment conditions were improved and became more attractive and secure. The promulgation in 1979 of the ‘Law on Joint Ventures Using Chinese and Foreign Investment’ was the first step. The ‘Regulations for the Implementation of the Law of the People’s Republic of China on Joint Ventures Using Chinese and Foreign Investment’ followed in September 1983.9 In October 1986, the State Council issued 22 ‘Regulations Concerning Encouragement of Foreign Investment’ which offered foreign funded enterprises preferential treatment and operational freedom. A further step of improvement for investment conditions was an ‘Amendment to the Law of the People’s Republic of China on Joint Ventures Using Chinese and Foreign Investment’ in April 1990.

This ‘open-door’ policy has proved to be very successful. From 1979 to the end of 1994, more than 220,000 foreign funded ventures were approved, with contracted investment of US$300 billion and US$95 billion of utilized investment,10 making the country the most important recipient of FDI in the developing world.11 The 1994 figures show that the ‘Middle Kingdom’ absorbed roughly half the total for all developing countries.12

The aim of this paper is to analyse the phenomenon of FDI in China. It examines the different forms and composition of FDI, reviewing its development since the early days of the ‘open-door’ policy and analysing its importance to the Chinese domestic and export industries, as well as Western investor companies. Furthermore, the paper focuses on the worldwide sources of FDI in China and its distribution by both region and industry. Additionally, it reviews the existing research on FDI in China, emphasizing the investment mode of the equity joint venture (EJV). The article’s objective is to provide both a ‘hard’, economic framework for FDI in China, and a ‘soft’ research framework, based on an examination of the literature. The article is divided into two main sections, the analysis of FDI in China (the ‘hard’ framework) and the analysis of the literature on joint ventures (JV) in China (the ‘soft’ framework).

FDI IN CHINA - AN ANALYSIS

The purpose of this section is to analyse inward FDI in China emphasizing the forms of FDI, its composition, its development since 1979, its importance for China’s domestic and export industries and for foreign investors, the investment sources and its regional and industrial sector distribution.

The Forms of FDI in China

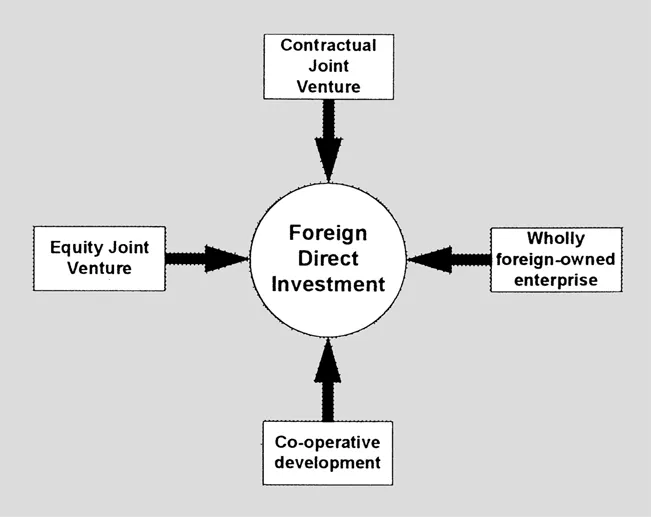

FDI, exporting and licensing are the three archetypal methods of servicing foreign markets. Ding13 discovered four distinctive types of FDI in the People’s Republic of China, namely the EJV, the contractual joint venture (CJV), the wholly foreign-owned enterprise (WOS) and the co-operative development. These four types of FDI were are also suggested by Wei14 who examined the economic impact of the ‘open-door’ policy on China’s growth. He argues that Chinese official statisticians also count compensation trade15 as FDI. However, Kueh16 suggests that this form has lessened in importance over time with its share in FDI declining from about 20 per cent in the early 1980s to less than five per cent in 1990. Analysis of the statistics for previous years suggests that the importance of compensation trade as a form of FDI has become negligible or is no longer counted as FDI, or both.

FIGURE 1

FOUR DISTINCTIVE TYPES OF FDI IN CHINA

FOUR DISTINCTIVE TYPES OF FDI IN CHINA

Equity joint venture: The EJV has a separate legal status and takes the form of the limited liability company formed in accordance with China’s law on Chinese-foreign EJVs, first adopted by the Second Session of the Fifth National People’s Congress in July 1979. Chinese and foreign partner(s)17 contribute to the registered capital and take profits, risks and losses in proportion to that contribution. The minimum 25 per cent joint venture foreign-equity can be contributed in the form of cash, intellectual property, machinery and equipment or other tangible assets. The contribution of the Chinese partner is similar. In addition, the Chinese partner provides the right to use the site on which the JV is located. The EJV is usually managed jointly - under the direction of a board of directors, generally selected by the investors in proportion to their respective share of equity investment. Only after a revision of the EJV law in April 1990 was the board of directors of the joint venture allowed to be chaired by the foreign partner.

Contractual joint venture: The CJV subsumes a variety of arrangements whereby the Chinese and the foreign partner(s)18 co-operate in joint projects and business activities according to the terms and conditions stipulated in a venture agreement. In contrast to the EJV, the CJV does not necessarily require the creation of a new legal entity. Authors19 even rule out the formation of a new entity. The CJV can take any form of agreement and provides, therefore, more flexibility in negotiation than the EJV. However, CJVs share many characteristics with EJVs since, with most contracts, the partners contribute capital in a variety of forms (for example, cash, buildings, ...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Author Biographies for the 2019 Edition

- Original Title Page

- Original Copyright Page

- Table of Contents

- Abstracts

- Greater China at the Crossroads? Convergence, Culture and Competitiveness

- The Political Economy of Greater China

- Foreign Direct Investment in China: An Examination of the Literature

- Inequality, Inflation, and their Impact on China’s Investment Environment in the 1990s and beyond

- Hermes Revisited: A Replication of Hofstede’s Study in Hong Kong and the UK

- Culture’s Consequences for Management in Hong Kong