CHAPTER 1

The End of Economic Civilization As We Know It

On 10th April 1975, the following obituary appeared in the columns of the Times newspaper. “The age of full employment is over ... the price ... quite simply ... accelerating and ultimately explosive inflation ... is too high.”

What looked at the time like a brilliant triumph for Marxist propaganda was secured, not by the authors of some sinister conspiracy to discredit the free enterprise system, but by the most passionate of the self-proclaimed disciples of Adam Smith.

So successful were their efforts, that the average percentage of the total labour force out of work throughout the OECD countries in the 1980s was more than double its level of the 1960s. The damage to British industry caused by high unemployment during the 1980s was almost double the cost of the destruction caused by enemy bombing during the whole of the Second World War*

The achievement is all the more remarkable in view of the difficulty in finding any political party which is actually in favour of high unemployment. On the contrary, one of the few issues over which there is wide agreement across the whole political spectrum is the desirability of full employment without inflation. If an effective policy for price stability and full employment were available, there would be no shortage of politicians eager to pursue it. However strenuously economists seek to evade responsibility, the failure of economic policy is directly attributable, not to lack of will on the part of politicians, but to errors of logic in the textbooks of economic theory.

Economic theory is often criticised on the ground that it applies to an ideal world of perfectly competitive markets — a world which is far removed from the experience of real life. Yet there is no harm in assuming ideal conditions — however completely they are divorced from reality. In the natural sciences, successful theories have been developed on the assumption of perfect vacuums, zero gravity, and frictionless bearings — even though no such phenomena are experienced in the real world. The problems of economics remain unsolved, not because economists are preoccupied with an ideal world, but because their explanation of the ideal world is hopelessly mistaken.

In the face of a critical shortage of labour, which is becoming progressively more acute for the demographic reason of an ageing population, any waste of labour in unemployment is criminally irresponsible. It is like pouring away precious water in a desert.

The obituary needs to be rephrased more honestly. “The age of full employment is over ... the vested intellectual interest in false economic theory is too powerful.”

Errors of logic in the textbooks of economic theory are more than a matter of academic regret; they are directly responsible for two of the most serious violations of economic law and order — unemployment and inflation.

CHAPTER 2

The Breakdown of Law And Order

It all seemed to be going so well.

The nineteen-thirties had not been without their economic difficulties; but there were two economic essentials upon which Britain could always depend: Bank rate at 2% and Scotch Whisky at 12/6d a bottle.

In the period following the Second World War,* unemployment seemed to have found a natural level of just over 1% of the labour force. After a hiccup in the early 1950s caused by the Korean War, inflation (expressed as an annual change in the consumer price index) settled down below 2%.

Then came 1956 and the Suez Crisis. The effect on the British economy was cataclysmic. Inflation soared to 4%. Wages went through the roof — to a weekly average in manufacturing industry of no less than £9.18.6. With Scotch Whisky approaching £2 a bottle, the natives began to fear that the End of the World was Nigh. Their worst fears were confirmed in the panic of September 1958 when Bank rate was raised to the crisis level of 7%. Unemployment got completely out of hand; at almost 2% of the labour force, there were over 450,000 people on the dole. Marxists gleefully proclaimed the beginning of the Collapse of Capitalism.

But there was one abiding comfort. No civilised government would let unemployment rise above half-a-million. The Marxists had no answer to that; for, deep down in their hearts, they knew it was true.

Unemployment was no longer a political issue. Economic science had the problem under control. The bad old days of the 1920s and 1930s were gone for ever.

The Bad Old Days

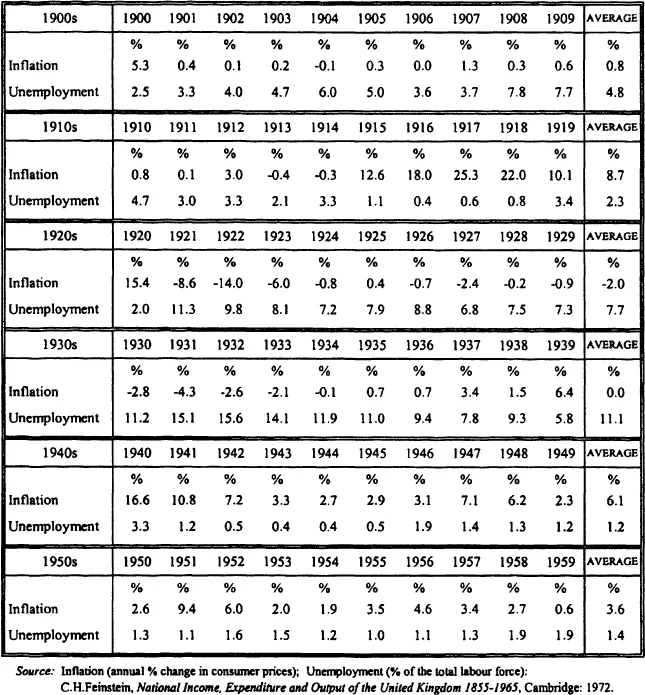

In the decade following the First World War, unemployment at 7%, 8%, or 9% of the total labour force became common.† But that was before the discovery of macroeconomics.

Table 2.1

Inflation and Unemployment in the United Kingdom from 1900 to 1959

Source: Inflation (annual % change in consumer prices); Unemployment (% of the total labour force): C.H.Feinstem, National Income, Expenditure and Output of the United Kingdom 1855-1965, Cambridge: 1972.

So great was the progress made by economic science during the 1930s, however, that after the Second World War it was possible to avoid the mistakes made in the aftermath of the First.

Then in the 1960s came a major theoretical breakthrough.

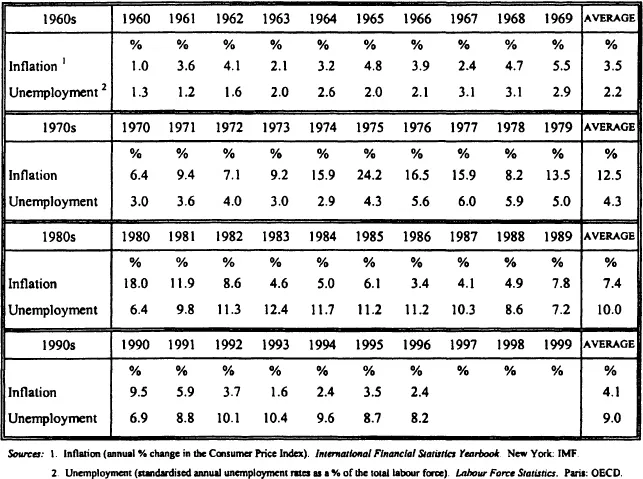

Historically, unemployment had normally been accompanied by falling prices, and inflation had normally been accompanied by falling unemployment. It was either one thing or the other — inflation or unemployment. But the new economics made possible, throughout the 1980s, the consistent achievement of both together — a feat which has been hailed in some quarters as the “economic miracle”.

The Economic Miracle

During the past thirty years, the British economy has experienced an unremitting cycle of inflation and unemployment.

Table 2.2

Inflation and Unemployment in the United Kingdom from 1960

Sources: 1. Inflation (annual % change in the Consumer Price Index) International Financial Statistics Yearbook New York: IMF

2 Unemployment (standardised annual unemployment rates as a Ye of the total labour force). Labour Force Statistics. Paris: OECD.

The labels “unemployment” and “inflation” are perhaps misleading; they suggest diseases which societies “catch” by chance or by “infection” from abroad. There are other labels which might be more appropriate.

Just as assault and theft are crimes by individuals against society, so inflation and unemployment are crimes by society against individuals. Unemployment robs them of their income; inflation robs them of their savings.

Inflation: The Sting

Individuals who wish to get themselves mugged, do not have to venture out into the streets. It can be arranged in the comfort of their own home. All they have to do is invest their savings in any bank, building society, life insurance company, or financial institution of their choice.

According to A Survey of Britain ’s Savings Institutions made by The Economist [November 29,1975, p.4], “in the 18 months to mid-1975 Britons with any savings lost a quarter of the real value of their personally-held financial wealth. Over 35 billion was taken from them by inflation.”

£35,000 million sounds rather a lot. As a matter of fact, it is rather a lot. It is the equivalent of 17,500 Great Train Robberies — or one every three-quarters of an hour, throughout the whole of the 18 month period.* Keynes refers to inflation as “taxation by currency depreciation” [1923, p.9]. By comparison, the whole of the revenue from both personal and corporate taxation levied openly during the same period amounted to less than £20,000 million.

Now, that £35,000 million — and all the other millions which preceded and followed — did not simply disappear from the face of the earth. Inflation is not like unemployment. Wealth is not lost; it is merely redistributed. To the community as a whole, the cost is zero. One person’s loss of purchasing power is another person’s gain. It is “merely” redistribution — just like mugging. The main operators are burglars and the financial institutions. But, on the whole, the financial institutions are more skilful.†

According to Section 16 of the Theft Act 1968:-

“(1) A person who by any deception dishonestly obtains for himself or another any pecuniary advantage shall on conviction on indictment be liable to imprisonment for a term not exceeding five years.

(2) The cases in which a pecuniary advantage within the meaning of this section is to be regarded as obtained for a person are cases where —

(a) any debt or charge for which he makes himself liable or is or may become liable (including one not legally enforceable) is reduced or in whole or in part evaded or deferred;...”

One of the less publicised success stories of the past twenty-five years is the extent to which the savings institutions and other organisations have managed, in the words of the Theft Act, to “reduce or evade” the debt for which they are liable. The “Pecuniary Advantage” secured for property investors at the expense of...