![]()

Chapter 1

Prologue: Setting the Scene

Shake-ups and shakeouts

The decade spanning the second and third millennia proved a tumultuous time for world airline business. The globalisation of the industry, accompanied by market deregulation in Europe and parts of Asia, encouraged a newfound vigour in a relatively staid industry.1 These dynamics prompted the emergence of a multitude of price-based competitors, together with a fundamental restructuring of most existing airline companies and a consolidation of the airline industry. Consolidation was symbolised by first, a wave of mergers and acquisitions, particularly in the United States (US); and second, the emergence of a number of competing global alliance groups. These two phenomena are interrelated, with the largest survivors of US industry consolidation spearheading the formation of global alliance clusters. As Friedel Rödig, former Star Alliance chief executive, commented:

the number of alliances will be as many as there are large US partners… it is vital for each alliance to have a footing in the US.2

Most of the world airline industry therefore consolidated around a number of strategic ‘families’ of airlines, each one led by a large US – and European – airline. By early 2001, five such strategic families existed in global aviation. The Star Alliance had 15 member airlines and included large carriers like United Airlines, Air Canada, Singapore Airlines and Lufthansa. Oneworld had eight members and was headed by large carriers such as American Airlines, British Airways (BA), Cathay Pacific and Quantas. The Qualiflyer Group had 11 participants, including Swissair, Air Portugal and LOT Polish Airlines, but did not include any of the largest airlines and lacked a US member. Skyteam was smaller, having five associates, but did count major carriers such as Delta Airlines and Air France amongst its numbers. The final grouping had the fewest number of member airlines and was a more integrated coalition between Northwest Airlines, KLM and Alitalia. In terms of share of the world air passenger market, figures for 2000 ranked the Star Alliance first (19 per cent), followed by Oneworld (13 per cent), Skyteam (10 per cent), Northwest/KLM/Alitalia (nine per cent) and Qualiflyer trailed with three per cent.3 Overall, alliance groups constitute well in excess of 50 per cent of the total world air passenger market. These alliances offer numerous benefits to participating airlines such as cost savings, improved interlining service for customers and transcontinental hub-and-spoke networks. The downside is the impact on competition and therefore on the consumer, with at least the symbolic, if not actual, entrenchment of an oligopolistic structure in world aviation. It also indicates a return to pre-deregulation norms in the US and in the EU. However, there is one fundamental difference between the airline market of today and that of Europe in the 1980s or the US in the 1970s: alongside the large traditional airlines and their strategic partners are well-established, low price alternatives. Companies such as Southwest Airlines and JetBlue in the US and Ryanair and easyJet in Europe offer a clear and proven alternative model of air transport. Their profit margins and return on assets are among the highest in the industry and their cost structures and fare prices are forcing larger airlines to restructure and rethink their value proposition. It is these low cost/low price carriers that represent the emphasis of our study.

Purpose and parameters

This book is a general introduction to and overview of the low fare airline (LFA) sector, its market and competitor context and the structures and strategies of its main protagonists. It is not intended as a comprehensive economic or managerial study. We examine the industry structure and market conditions of the European airline sector, identify the main low fare carriers and comment on the impact that low fare operators have had on stimulating competition within the European air transport market. Significant attention is also given to the low fare experience elsewhere in the world, particularly in the US but also in Canada and Australia and to a lesser extent, Japan and Latin America. The competitive strategies of the main LFAs are compared and their limitations are highlighted. The US deregulation experience indicates that the large number of low fare carriers which emerge in the wake of market deregulation will dwindle over time and that only a handful will ultimately survive. Many are driven out of business by insufficient access to landing slots or by predatory activity on the part of larger airlines. Others simply cut prices further than they can afford, effectively pricing themselves out of the market. We determine the conditions and strategies that shape sustainable advantage for LFAs in highly competitive deregulated markets where established airlines seek to force out new entrants and considerable political interference remains. Despite the inevitability of a shakeout reminiscent of early 1980s America, Europe’s LFA sector is here to stay. Ever increasing industry liberalisation, together with customer demand, will guarantee a place in the market for cost efficient and reliable low fare carriers.

The cult of cost reduction

Constant and ever improving methods of operational cost reduction are de rigueur for any organisation. Ames and Hlavacek (1990) argue that managing costs is at the heart of every successful company and that four related cost truisms apply universally to every business situation. These are first, over the long term, it is essential to be a lower cost supplier; second, to maintain a competitive position, the inflation-adjusted costs of producing and supplying any product or service must continuously decrease; third, the true cost and profit of each product or service and every customer segment must always be transparent; and fourth, a company should focus on cash flow as much as on profit generation. Market deregulation and industry globalisation have increased the competitive pressures on companies, reducing the margin for error and rendering the ‘cult of cost reduction’ indispensable. Nowhere is this more apparent than in the commercial air transport business. For airline companies, successful and constant cost control is essential and cannot be neglected, even temporarily. SAS learned this lesson during the 1980s when their market driven philosophy caused their costs to escalate unchecked (Robertson 1995, p. 29). The margin of profit for most airline companies is minimal. There is little difference between the average total cost of any given flight and the number of passengers and yield per passenger needed on that flight to turn a profit. For traditional foil fare airlines, the difference is normally only a few percentage points. This means that airlines are highly susceptible to market fluctuations and any related fall in traffic. The obvious way to safeguard a company against this acute market vulnerability is to decrease operational expenses and increase employee and aircraft productivity. By suppressing the breakeven load factor figure, an airline can ensure that any drop in the average passenger load factor figure will still reap a profit – albeit reduced – for the company. The key factors affecting indirect costs for an, airline are fleet structure, route network and company policies on remuneration and work rules (Seristö and Vepsäläinen 1997, p. 11). Together, these determine the total cost differences between airlines and the primary ways in which an airline can reduce its costs relative to competitors. Uniform fleet structures, flexible work rules, performance-related pay schemes and point-to-point services operating between lower cost and less congested secondary airports, are all examples of ways in which a carrier can reduce its costs and improve its relative competitiveness. As we will illustrate throughout this book, all of these cost reduction techniques are fundamental elements of the LFA business model.

The 1990s witnessed substantial improvements in productivity and costs in the airline industry but the gains were not uniform (Morrell and Lu 2000, p. 80). Studies4 show that during the 1993-8 period, average European available tonne-kilometre (ATK) per employee increased by 31 per cent to 380,000 and unit costs decreased by 15 per cent to 58 US cents per ATK. Improvements also occurred in other areas of productivity and cost reduction. The North American and Asia Pacific regions experienced similar improvements. These were usually not as considerable as in Europe because most European carriers lagged behind their North American and Asian counterparts and were going through a process of ‘catch-up’. These gains were not uniform within Europe either, as measures of productivity and cost differ according to the nature and strategic objectives of an airline. For instance, costs are lower for a carrier heavily involved in the charter and cargo markets. Similarly, long haul carriers have a per unit cost advantage over short haul carriers (Morrell and Lu 2000, p. 81). Likewise, short haul carriers experience higher aircraft utilisation and greater yields than their long haul counterparts.

In the airline business, the contest to lower costs, increase productivity and gain market advantage is often accompanied by price-based competition. Demand for air travel is highly elastic: reduce the price and sales rise sharply. However, reducing prices to gain market share is not usually a sound business strategy. Unless a company has a significant cost advantage of at least 30 per cent, reducing prices can trigger a suicidal price war (Garda and Marn 1993, p. 87). Price wars are common in the airline industry, where the commodity is largely undifferentiated, customers are highly concentrated and many are very price sensitive, and switching costs for consumers are very low (Garda and Marn 1993, p. 94). This scenario is accentuated in markets where many competitors co-exist. In essence, a company that competes on price must ensure that it has the cost base and cash resources to be the low price leader and not just a low price competitor. In operational terms, cash resources are vital to ensure a new entrant’s survival in the face of predatory pricing by established carriers – a customary reaction by many existing large airlines. Cash also enables the airline to defer any downsizing measures during periods of market stagnation or decline. Low price market leaders such as Southwest Airlines in the US and Ryanair in Europe have developed

business models that place constant cost reduction and cash accumulation at their core. These companies have emerged as the most effective cost and price competitors in the business. They are also the most consistently profitable airlines in the world. In addition, companies such as Southwest and Ryanair are extremely robust during times of economic crisis and market decline. For these reasons, we have chosen to study the structures, strategies and contexts (market and industry) of LFAs. Many invaluable lessons emerge both for other airline companies and for all companies struggling to compete in highly competitive international markets.

An introduction to Europe’s low price players

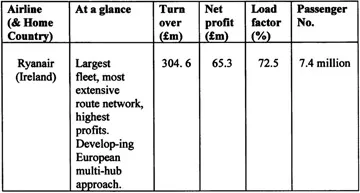

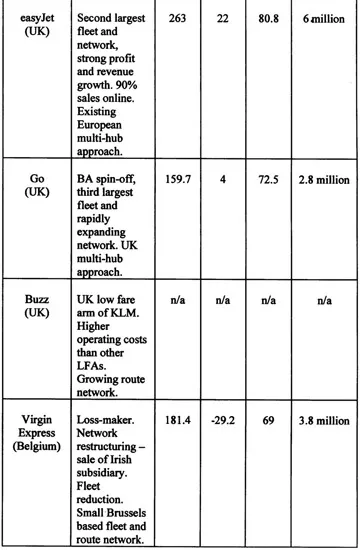

As of 2001, five scheduled European airlines had established proven track records as LFAs5 (Table 1.1). This group represented the most visible and clearly identifiable low fare players in Europe. Basiq Air is not included, as it had not established a clear market profile by the time of writing.6 Other airlines, such as Air One in Italy or Deutsche BA in Germany, are occasionally referred to in trade publications and the media as low cost/low fare players. Although they have slightly lower costs than larger rivals, their fares are not low in the Ryanair or easyJet sense, nor do they adhere to many of the basic elements of the low fare model outlined in subsequent chapters. Such airlines are more accurately classed as regional carriers and do not meet the requirements set out in this book to be classified as LFAs.

Table 1.1 Europe's low fare airlines in 2000

The airlines are ranked according to aircraft fleet size (see Figure 7.1) and net profit margins (1999-2001). A point worth noting from the above table is the degree of market penetration and saturation in the UK and Ireland. It is unlikely that these markets will experience any further growth or new entrants. This fact is acknowledged by Ryanair in its efforts to grow mainland European markets through establishing a hub in Belgium (due to be followed by hubs elsewhere – probably in Italy, Germany and Sweden). The market potential across Europe is enormous, with an EU population base alone that is close to 100 million more people than in the US. Statistics already indicate that this potential is being exploited, as the low fares market is the fastest growing segment of the European air industry. The number of LFA passengers increased from 10.5 million in 1998 to 14 million in 1999 and is predicted to grow to 19 million in 2001.7

Overview and arguments

The book is divided into ten chapters, with a number of common issues and ideas permeating each and creating a follow-on from one to the next.

Chapter 1 establishes the book’s context, objectives and structure and introduces us to the low fare players in European aviation.

Chapter 2 details the global and European policy shift towards a more liberalised airline industry and devotes particular attention to the EU’s three phases of market deregulation. The conflict between national governments and the European Commission over state aid transfers to national carriers is also discussed, as are more recent developments in the EU-nation state-firm policy interplay.

In Chapter 3 we examine the impact that LFAs have had on the European air transport industry and market. We also define and discuss LFAs and place them in the wider context of the European airline industry. This leads us into a consideration of the similarities and differences between low fare, charter and regional airlines in Europe. This is followed by a brief comparison of the point-to-point and ‘hub-and-spoke’ systems and a review of route networks in the European LFA sector.

Chapter 4 begins by charting the evolution and dynamics of the European airline industry during and immediately after the deregulation process. This leads into an assessment of the widely cited barriers to airline competition in Europe. We examine a number of these in detail, consider their impact on LFA expansion strategies and comment on the extent to which there are limits to the liberalisation of Europe’s airline market.

Chapter 5 considers how to best define and measure customer service for airlines and considers whether customer satisfaction and service quality are interchangeable or distinct concepts. We argue in this chapter that the price to service equation does not need to be a zero-sum game. You can have a win-win situation, with low prices and high quality service.

In Chapter 6, we examine the business model and cost reduction techniques of the European low fare leader, Ryanair. Ryanair’s operational structure and corporate strategy are placed in the context of Porter’s strategic positioning framework and strengths and wea...