This is a test

- 360 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Emergence of the Trust Company in New York City 1870-1900

Book details

Book preview

Table of contents

Citations

About This Book

Between 1875 and 1900, the assets of trust companies in New York City grew at a compound annual rate of 9.6%, compared with 4.1% for national banks. The purpose of this book, first published in 1986, is to bring to light the entrepreneurial, economic and political forces which prompted the growth of the trust companies and resolved the movement into a well-defined financial intermediary and eventually led to the merging of the trust movement with commercial banks.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access The Emergence of the Trust Company in New York City 1870-1900 by H. Peers Brewer in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

CHAPTER I

AN OVERVIEW OF THE TRUST COMPANY MOVEMENT: 1870–1900

Object of the Dissertation

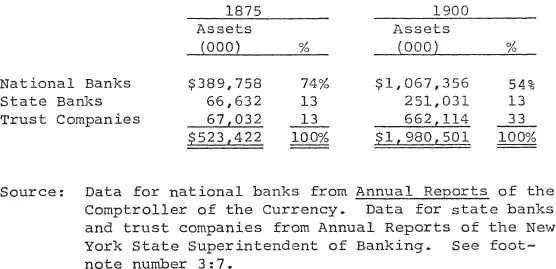

Between 1875 and 1900, the assets of trust companies in New York City grew at a compound annual rate of 9.6%, compared with 4.1% for national banks and 5.4% for state banks located in the City.1 At the least, the superior growth rate of trust companies would quicken one’s curiosity, but more important, from the aspect of financial history, the trust company movement was the primary channel through which the state banking system reestablished a competitive position with the national banking system. As Table 1:1 indicates, the trust companies moved from 13% of the City’s banking assets in 1875 to 33% by 1900. Combined, the state banks and trust companies held 26% of the assets in 1875 and 46% by 1900.

The purpose of this dissertation is to bring to light the entrepreneurial, economic and political forces which prompted the growth of the trust companies and, step-by-step, resolved the movement into a well-defined financial intermediary and eventually led to the merging of the trust movement with commercial banks.

TABLE 1:1

Distribution of Assets in the New York City Banking Sector

Distribution of Assets in the New York City Banking Sector

Some years, of course, are more important than others. An historical analysis is the process of imputing meaning to time—of recognizing which years and events are important for an understanding of the present. One day (December 7, 1941) is more important than another day (December 7, 1931) because events occurred on that date which moulded lives and institutions, changing thereby the alternatives people would have in the future.

Although the first New York trust company (Farmers Fire and Loan Company) was chartered in 1822, and a half- dozen or so were chartered in the next forty years, it was not until the years following the Civil War that the formation of trust companies reached the proportion of a movement, drawing the attention of a broad range of entrepreneurs, challenging the equilibrium of the established financial community, and demanding the protracted attention of legislative and regulatory bodies.

The period between 1870 and 1900, therefore, is especially significant because events occurred in these years which moulded a scattered group of moneyed institutions into a financial intermediary with well-defined economic and behavioral properties. Accordingly this study focuses on the 1870–1900 period.

The study also focuses on New York City. This is particularly appropriate first because of the primacy of New York City in the nation’s financial and commercial structure—its central position in the payments mechanism, the size and quality of the stock and bond exchanges, and the sheer size of all financial intermediary groups. If the trust companies penetrated the New York financial structure, then the movement was of consequence in the over-all financial history of the nation. A second reason for concentration on New York is the richness of the surviving data on New York financial institutions of this period which facilitates the pursuit of a broad spectrum of issues.

Defining a Trust Company

By the mid–1870’s the phrase “trust company” was widely employed in the titles of specific companies and, to a lesser extent, as a generic term referring to a class of companies.

Of the eight operating New York City trust companies formed prior to 1870, all had the phrase “trust company” in their corporate name. Of the forty-seven companies which sought charters between 1870 and 1873, twenty-two had the phrase in their corporate name. Unlike national banks, that had to have the word “National” in their title, a company could be a trust company whether or not the phrase appeared in the corporate name.

By the mid-1870’s, national banks, state banks, savings banks and insurance companies all had specific enabling legislation. As financial intermediaries, these companies were well defined by legislation and function. All other financial intermediaries were classified under the residual term “moneyed corporations.” Trust companies were a subset of “moneyed corporations.” The first general legislation in New York State, (Laws of 1874, Chapter 324) dealing with trust companies was entitled “An Act relative to Moneyed Corporations, other than Banks, Institutions for Savings, and Insurance Companies.” The title of this Act, as passed, varied slightly from the title of the bill (Number 88) as introduced into the State Senate: “An Act for the regulation of trust companies, and certain other moneyed corporations.”

Trust companies in the 1870’s were by far the largest segment of the “moneyed corporation” classification. As the century drew to a close, other companies emerged from this classification to become identified as distinct financial intermediaries; specifically, building and loan societies, safe deposit companies and investment corporations. As the century moved on, companies initially called by the residual phrase “moneyed corporations” gradually acquired specific legislative, judicial and economic identification points, which taken together served to define separate financial intermediaries.

From approximately the end of the nineteenth century, the term “trust company” connoted to most observers a bank with authority to engage in personal and corporate trust business. For the 1870–1900 period, however, this definition was entirely too specific.

An examination of the charters acquired or sought by trust companies between 1870 and 1873 indicates that most were not even interested in personal or corporate trust business.

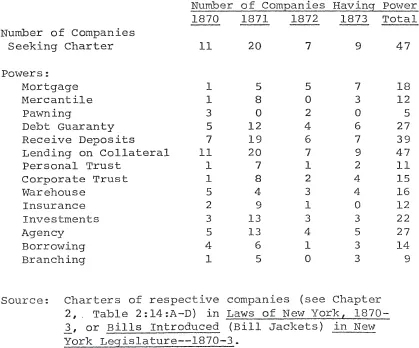

TABLE 1:2

Summary of Corporate Powers of Trust Companies Based on Charter Provisions

Summary of Corporate Powers of Trust Companies Based on Charter Provisions

As Table 1:2 illustrates, out of the 47 companies seeking charters in the 1870-3 period, only 11 requested personal trust powers and only 15 requested corporate trust powers. Clearly, the personal-corporate trust theme is too narrow a definition for the trust companies of this period.

What, then, did the term “trust company” mean?

The term “trust” referred to a debtor-creditor relationship. More exactly, to the function of lending on collateral. Bouviers Law Dictionary (1874), the definitive law dictionary of the time, wrote under the topic “Trusts”:

Express trusts are those which are created in express terms in the deed, writing, or will.... Express trusts are usually found in preliminary sealed arguments, such as marriage articles, or articles for the purchase of land; in formal conveyances, such as marriage settlements, terms for years, Mortgages, assignments for the payment of debts, raising portions, or other purposes.2

Chaplin in Express Trusts stated that express trusts might be created for four purposes, one of which was “to sell real property for the benefit of creditors.”

Chaplin’s language in discussing this type of express trust is revealing:

If, under a trust of the first class, the beneficiaries (i.e., the creditors of the creator o_f the trustj_ release their claims against him /the creator/ in consideration of his releasing to the trustee all his revisionary interests in the subject of the trust, the trust itself thereupon ceases. For there are no longer any debts to be paid, to furnish the basis of a trust.3

Chaplin also makes it clear that the above purpose of express trusts relating to the sale of real property also applies to personal property.

It was important for the trust companies to have explicit power in their charters authorizing them to enter into a trust relationship with borrowers. Chaplin stated:

There is a class of artificial persons—that is corporations—which cannot be trustees unless specifically empowered in their charters, or by way of necessary incident to the powers and rights given,...

Overwhelmingly, the term “trust company” referred to a debtor-creditor relationship and this in the function of lending on collateral.5 Whether or not the words “trust company” appeared in the title was immaterial.

Seen in this light, it is apparent that trust companies were basically lending institutions. It is a curious fact of financial history that this definition has been so widely misunderstood.

If trust companies were interested in commercial banking business, how was it that they were each chartered by special, individual legislation and were not chartered under the New York State General Banking Law of 1838? The Constitution of the State of New York (Article 8, Section 4) did prohibit the special chartering of financial companies that could be chartered under the Law of 1838.

The legal loop-hole which allowed trust companies to come into existence without being under the Act of 1838 was an almost incidental by-product of a case at law in 1855. In this case (U.S. Trust Company vs. Brady), Brady (the defendant) had taken a loan from Knickerbocker Savings Institution and secured the loan with hypothecated stock. Knickerbocker became insolvent. The receiver, U.S. Trust Company (the plaintiff), sought to recover the loan from Brady. Brady argued, among other things, that U.S. Trust could not bring action because its charter was illegal under Article 8, Section 4 of the State Constitution; that the Trust Company should be chartered under the Act of 1838. The New York State Supreme Court held that the charter was constitutional, that the Legislature could at its discretion grant special charters, just as long as it did not grant special banking powers.6

In point of fact, the U.S. Trust charter (April 12, 1853) did permit several functions which could be regarded as banking—making loans and investments, receiving deposits—but it did not allow the issuance of circulating notes. The judges hearing the case apparently felt the ability to issue circulating notes was a critical feature in bringing a company under the Act of 1838 and under Article 8, Section 4 of the State Constitution.

None of the trust companies ever had the authority to issue circulating notes, although their charters permitted virtually every other type of banking function.

Statutory and Regulatory Background

In the 1870–1900 period, trust companies were created and regulated by state law. In New York two pieces of legislation during this period were especially important for the trust company movement: (1) The Act of 1874, and (2) the Act of 1887.

The Act of 1874. In 1874, the New York Legislature passed the first general legislation relating to trust companies.

The Act provided in substance that all trust companies would in the future report to and be examined by the State Superintendent of Banking. Most of the sections of the Act concerned the mechanical aspects of the examinations and reports and the recourses available to the Superintendent if companies failed to cooperate. The Act also required all trust companies that received deposits to place with the Superintendent government bonds in the amount of 10% of paid-in capital. And ...

Table of contents

- PREFACE

- LIST OF TABLES

- LIST OF CHARTS

- CHAPTER I: AN OVERVIEW OF THE TRUST COMPANY MOVEMENT: 1870–1900

- CHAPTER II: The Trust Company Movement Quickens: 1870-3

- CHAPTER III: The Asset Structure

- CHAPTER IV: The Liability Structure

- CHAPTER V: The End of The Century: Signs of Maturity

- CHAPTER VI: Summary

- BIBILIOGRPHY