Routledge Handbook of Banking and Finance in Asia

- 534 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Routledge Handbook of Banking and Finance in Asia

About This Book

The Routledge Handbook of Banking and Finance in Asia brings together leading scholars, policymakers, and practitioners to provide a comprehensive and cutting-edge guide to Asia's financial institutions, markets, and systems.

Part I provides a country-by-country overview of banking and finance in East, Southeast, and South Asia, including examples from China, Japan, Hong Kong, India, and Singapore.

Part II contains thematic chapters, covering topics such as commercial banking, development banking, infrastructure finance, stock markets, insurance, and sovereign wealth funds. It also includes examinations of banking regulation and supervision, and analyses of macroprudential regulation, capital flow management measures, and monetary policy. Finally, it provides new insights into topical issues such as SME, green, and Islamic finance.

This handbook is an essential resource for scholars and students of Asian economics and finance and for professionals working in financial markets in Asia.

Frequently asked questions

1

Introduction

Characteristics of Asian financial systems in comparative perspective

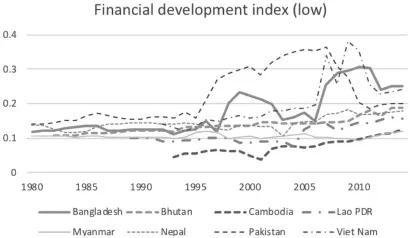

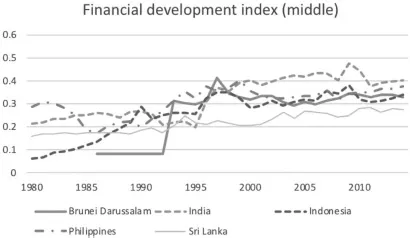

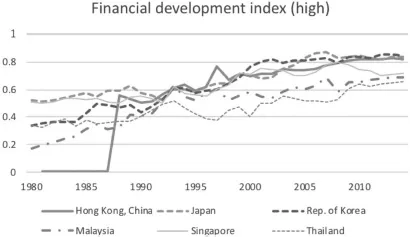

Current situation of financial development, capital market openness, and financial inclusion

Overall financial size

| Economy | Bank Credit | Bonds | Stocks | Total |

|---|---|---|---|---|

| Bangladesh | 41.0 | NA | 24.9 | 65.9 |

| Brunei Darussalam | 40.1 | NA | 0.0 | 40.1 |

| Cambodia | 56.5 | NA | NA | 56.5 |

| People’s Republic of China | 140.4 | 62.6 | 64.1 | 267.2 |

| Hong Kong, China | 212.2 | NA | 1,029.1 | 1,241.3 |

| India | 50.2 | 32.4 | 42.0 | 124.7 |

| Indonesia | 31.5 | 24.6 | 71.5 | 127.6 |

| Japan | 102.6 | 208.1 | 85.9 | 396.6 |

| Republic of Korea | 136.6 | 140.3 | 99.8 | 376.7 |

| Lao PDR | 18.9 | NA | NA | 18.9 |

| Malaysia | 119.6 | 108.7 | 26.3 | 254.6 |

| Mongolia | 55.2 | NA | 24.9 | 80.0 |

| Myanmar | 16.0 | NA | 4.0 | 20.0 |

| Nepal | 56.7 | NA | 26.5 | 83.1 |

| Pakistan | 14.9 | 35.8 | 27.1 | 77.8 |

| Philippines | 39.5 | 50.5 | 25.2 | 115.2 |

| Singapore | 127.9 | 97.5 | 88.4 | 313.9 |

| Sri Lanka | 27.5 | 11.5 | 29.3 | 68.3 |

| Thailand | 114.6 | 77.7 | 97.7 | 290.1 |

| Viet Nam | 102.8 | 24.2 | 53.6 | 180.5 |

Banking sector development

Table of contents

- Cover

- Half Title

- Title

- Copyright

- Contents

- List of figures

- List of tables

- Box

- List of contributors

- Acknowledgments

- List of abbreviations

- 1 Introduction: characteristics of Asian financial systems in comparative perspective

- Part I Country chapters

- Part II Thematic chapters

- Index