Integrated reporting (IR) sought to address deficiencies with existing reporting frameworks, which were either dedicated to dealing with financial issues or failed to make the interconnections between economic, environmental and social capitals sufficiently clear. As explained by Mervyn King, in his foreword to the discussion paper by the Integrated Reporting Committee of South Africa (IRCSA):

[A] string of corporate collapses over the past decade has led many stakeholders to question the relevance and reliability of annual financial reports as a basis for making decisions about an organisation. Reports based largely on financial information do not provide sufficient insight to enable stakeholders to form a comprehensive picture of the organisation’s performance and of its ability to create and sustain value, especially in the context of growing environmental, social and economic challenges. Sustainability reports have similarly suffered weaknesses, usually appearing disconnected from the organisation’s financial reports, generally providing a backward-looking review of performance, and almost always failing to make the link between sustainability issues and the organisation’s core strategy. For the most part, these reports have failed to address the lingering distrust among civil society of the intentions and practices of business. Stakeholders today want forward-looking information that will enable them to more effectively assess the total economic value of an organisation.

(IRCSA, 2011, p. 1)

An integrated report is meant to follow a process of integrated thinking within the organization, suggesting that leadership and governance should be aware of the interrelated nature of the financial and non-financial capitals the organization uses to create value (De Villiers and Hsiao, 2018).

Some of the world’s leading organizations have been implementing IR practices and disclosure in anticipation of IR becoming a global norm. For example, KPMG (2017) finds that IR has been gaining momentum following the release of the International Integrated Reporting Council’s (IIRC) Framework, the International Integrated Reporting Framework (IIRC Framework), in several jurisdictions, including South Africa, Japan, Spain, the Netherlands, Brazil, the United Kingdom, Sweden and Poland. More broadly, the release of at least some form of corporate social responsibility report to complement conventional financial reporting has become generally accepted internationally for both large and mid-cap companies (KPMG, 2012, 2013, 2015, 2017). Emerging economies, in particular, have been devoting considerable attention to expanding their reporting models to address issues such as climate change, human rights and sustainable development (KPMG, 2017). Corporate responsibility reporting and, more recently, IR, is seen as offering an opportunity to attract foreign investment, signal the quality of underlying corporate governance systems, and demonstrate the credibility of these jurisdictions to the international capital market (KPMG, 2017; De Villiers and Maroun, 2018). At the same time, it is hoped that IR will promote a more responsible approach to doing business, which considers stakeholder interests and the importance of protecting the environment (King, 2018). Used in conjunction with existing reporting guidelines, governance systems and management practices, IR has the potential to drive positive organizational change and help with the realization of the United Nations’ Sustainable Development Goals (Guthrie et al., 2017; Al-Htaybat and von Alberti-alhtaybat, 2018; McNally and Maroun, 2018).

There are, however, a number of limitations and detractors. As discussed in more detail in Parts II to V of this book, the IIRC may be over-emphasizing financial capital providers to the detriment of stakeholder-centrism and long-term sustainability (see also Flower, 2015; Thomson, 2015). Despite efforts to develop a multi-capital reporting model, conceptualizations of value and value-creation continue to be constrained by economic imperatives (Brown and Dillard, 2014). The possibility of IR forming part of an impression management strategy, which simply obscures unsustainable business practices, cannot be precluded (Haji and Anifowose, 2016; du Toit et al., 2017) while the practical challenges of internalizing and applying the IIRC Framework should not be overlooked (Dumay et al., 2017; McNally et al., 2017).

Consequently, IR is best described as being in a developmental stage (De Villiers et al., 2014; Rinaldi et al., 2018). There is significant variability in how the IIRC Framework is being interpreted and applied, leading to differences in the content, format and structure of even the most recent examples from industry leaders (PwC, 2015; EY, 2018). Rather than ‘crystallizing’ into a standard reporting typology, IR remains an ambiguous concept, which requires cross-disciplinary advances to support full implementation and realise its potential for promoting long-term value-creation and sustainability.

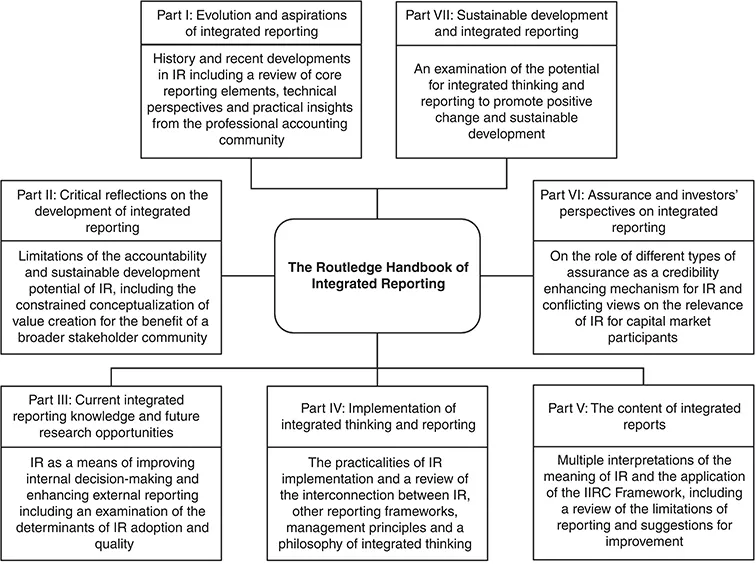

Given these differences in perspective on, and practice of, IR, The Routledge Handbook of Integrated Reporting provides the most current and comprehensive examination of IR at a time when the disparate views on IR could be a sign of a maturing field. The book includes insights from more than 60 authors, provided in 30 chapters. It includes authors who represent the IIRC, IRCSA, professional bodies and audit firms, as well as leading academics in the fields of IR, environmental, corporate social responsibility and sustainability reporting. The councils and professionals mostly promote IR, while the academics fall into different camps, some providing (seemingly) balanced empirical insights, while others provide insights on specialized areas, and yet others critique various aspects of the promotion and implementation of IR. Giving voice to these differing perspectives is a unique feature of this book, because of its openness to the inclusion of these differing perspectives.

The collected work provides an in-depth review of the development of IR, with a focus on the interpretation and guidance provided by the IIRC. The chapters include a detailed discussion on the potential of IR to promote financial stability and holistic value creation. They offer multiple perspectives on this emerging form of reporting and provide insights on current implementation and assurance strategies, the impacts of IR on management and disclosure practices and the relationship between IR and sustainable development. The chapters include reviews of the most recent research, practitioner viewpoints, conceptual pieces, case studies and disclosure analyses. The chapters in the book are written in accessible language; therefore, this handbook is suitable for all readers, regardless of their perspective or level of background knowledge on IR.