- 296 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

European Competition

About this book

Europe is increasingly becoming an everyday reality for many companies, not only for large corporations but small and medium-sized enterprises as well. European Competition offers students an introduction to the field of competition, cooperation and competition policy in the EU. To increase students' understanding of the workings of the Internal Market, most chapters start with case-studies.

The book focuses on the subject areas economics and law and is written from both a business and a social/legal perspective.

European Competition is an essential introductory textbook for students at both undergraduate and graduate levels in a wide range of degree and professional programmes. Including Economics, MBA and Law. It is of particular relevance to students interested in the European context of these disciplines and can be used as a core textbook for courses in European Integration or Business and International Environment in Europe and other parts of the world. This text is complementary to the book European Business Environment.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

1

Competition and competition policy

- 1.1 Pricing strategy and competition

- 1.2 Analysing the market arena

- 1.3 Corporate strategy and market power

- 1.4 Competition

- 1.5 EU competition policy

Case study: KLM and the airline industry

- There is a continuing process of liberalisation. The airline industry in the EU has been highly deregulated as a result of the creation of the internal market. In the past, governments had a significant influence over decisions on tariffs, granting, landing rights, etc., which resulted in only limited competition. Since the 1990s, however, the market has opened up. The so-called ‘open skies agreements’ between the EU and the USA also contributed to this openness. At first agreements were made between the USA and individual EU countries, later on also between the USA and the EU as a whole.

- The lower entry barriers that were the result of this liberalisation have contributed to the rise of low-cost carriers such as Ryanair and easyJet.

- There is a strong move towards concentration. Many smaller companies (Belgian Sabena, for instance) have not been able to survive and other companies have merged and/or have concluded cooperation agreements. The merger of Air France and KLM is a case in point.

- Fuel prices have an important influence: the price increases of crude oil to a level of more than $150 a barrel (mid 2008) led to rocketing costs. In the third quarter of 2008, for example, Air France KLM reported an increase in fuel costs of €498 million to €1.6 billion (with a turnover of €5.9 billion in the same quarter). Its reported loss over the fiscal year 2009–2010 was largely attributed to increased fuel costs.

1.1 Pricing strategy and competition

Amsterdam-London, a competitive market

- Competition on short-haul routes is fierce. At the moment, KLM still attracts passengers who do not opt for one of the cost-cutters on the basis of the service offered by KLM and because of its reputation.

- Competition is not restricted to the Amsterdam-London route. Passengers will have fewer problems than in the past diverting to smaller airports, also because checking in and out at such airports takes less time.

- Competition is not restricted to other airline companies. Especially in the tourist market, the Channel Tunnel route (Calais-Folkestone) is a serious alternative for train travellers and motorists. To a somewhat lesser extent this also holds good for the crossing by ferry.

- The recession (from 2009) puts pressure on passenger numbers.

- Fuel prices are constantly going up and down. The question is to what extent the competition will include these changes in its pricing policy.

- Besides a decision about the prices to be charged, KLM should also reach a decision about the capacity (number of aircraft) to be employed on routes like these.

Amsterdam-Paramaribo, a 'monopolistic' market

- It was laid down in an agreement between the Dutch and Surinam governments in 1990 (valid until 2006) that KLM and Surinam Airways were to be the only airlines allowed to offer flights on this direct route. In practice KLM operated the flights in a joint venture with Surinam Airways (SLM). In 2006 this cooperation ended and it was agreed that other airlines would also be allowed to offer flights. Until now, though, KLM and SLM are still the only airlines to offer direct flights.

- Besides the direct routes there are indirect alternatives. However, possibilities are limited and considerably more expensive. A round trip with Delta Airlines, for instance (via Toronto and Port of Spain in Trinidad and Tobago), costs nearly €3,000 (May 2010).

- For years now KLM has been under pressure from groups such as the Surinamese-Dutch association SHIVA and the Travellers’ Association (Vereniging van Reizigers (VVR)), who accuse KLM of applying excessively high tariffs. In the past these groups pointed out that a round trip Amsterdam-Jakarta (Indonesia) was much cheaper while the distance is almost twice as great. (In 2010, however, this was much less the case: a round trip Amsterdam-Jakarta cost approximately €1,150). The Travellers’ Association also complained of the poor availability of flights, especially during the holiday season. As early as 1998 SHIVA lodged complaints about this with the Netherlands Competition Authority (NMa), but these complaints were rejected in 2001. In its ruling in 2001 the Authority concluded that KLM and SLM occupied a monopoly position on the non-stop route Amsterdam-Paramaribo by dint of their cooperation, but it did not find that this was a violation of the legal prohibition on an economic position of power by KLM/SLM. In 2003 the Travellers’ Association lodged another complaint, which was in the first instance rejected by the Competition Authority in 2004 and again in 2006. However, an appeal by the Travellers’ Association in August 2010 resulted in this case being considered once more by the Competition Authority.

- The majority of the flights on the Amsterdam-Paramaribo route are taken for family visits. Although the alternatives are limited, there certainly is a degree of price sensitivity: if tariffs are too high, people will decide to cancel their planned visit.

- Also for flights like these, there is the consideration that a recession will lead to less air traffic.

- Finally, KLM will have to decide if they are going to adjust the number of flights on this route, in other words deploy more or fewer aircraft.

Conclusion

1.2 Analysing the market arena

1.2.1 Market power

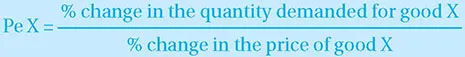

Price elasticity of demand

Table of contents

- Cover

- Title

- Copyright

- Table of contents

- Introduction and study guide

- 1 Competition and competition policy

- 2 Dominance and market power

- 3 Competition and cooperation in oligopoly markets

- 4 EU cartel legislation

- 5 Mergers and acquisitions

- 6 EU Competition and state aid

- 7 EU Competition Law in an International Perspective

- Glossary

- List of Abbreviations

- List of contributors

- Index

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app