This is a test

- 278 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Book details

Book preview

Table of contents

Citations

About This Book

Improved tax systems can help countries in Asia and the Pacific generate the resources needed to implement the Sustainable Development Goals. This report provides information on current tax administration practices in the region to help governments identify opportunities to strengthen their tax systems. It analyzes the administrative frameworks, practices, and performance of revenue bodies in 34 economies. The analysis was largely based on survey data gathered by the Asian Development Bank in collaboration with the Organisation for Economic Co-operation and Development and the International Monetary Fund.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access A Comparative Analysis of Tax Administration in Asia and the Pacific by in PDF and/or ePUB format, as well as other popular books in Derecho & Derecho fiscal. We have over one million books available in our catalogue for you to explore.

Information

Topic

DerechoSubtopic

Derecho fiscalV. Managing Taxpayer Compliance

This chapter discusses a range of approaches adopted by revenue bodies in managing taxpayer compliance: (i) enterprise risk management (ERM); (ii) compliance risk management (CRM); (iii) steps in the CRM process; (iv) innovative and emerging technologies; and (v) taxpayer segmentation. The ADB governance brief on Improving Tax Compliance (https://www.adb.org/publications/improving-tax-compliance) provides further detailed information.

A. Enterprise Risk Management

Revenue bodies, like other organizations, are unlikely to have all the resources they need to fully address all the risks they face. Choices will have to be made about which risks must be mitigated, and to what extent, and which risks can be tolerated. A well-conceived risk management approach allows organizations, including revenue bodies, to make informed and defensible choices about how they will manage risks to their operations and how they will deploy their limited resources.

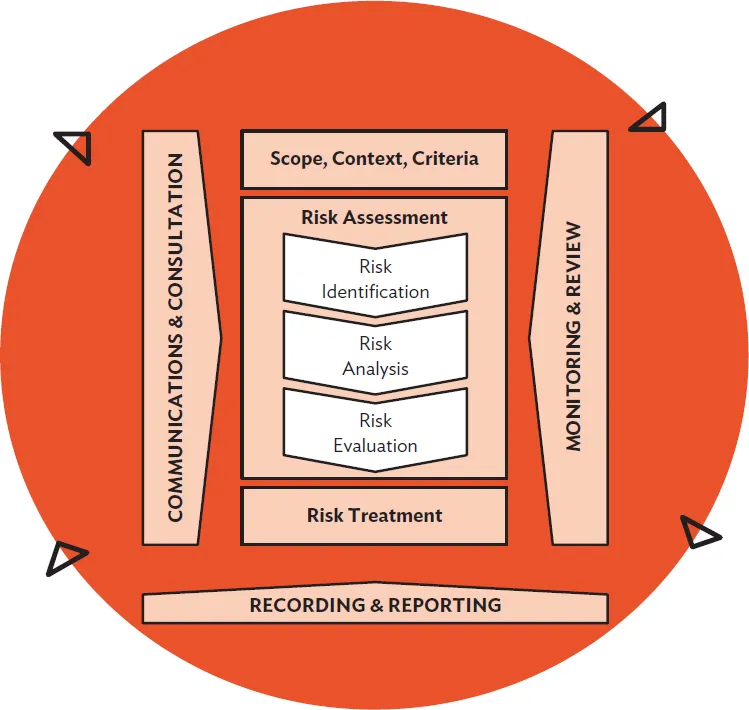

An enterprise-wide risk management framework provides a systematic approach, which, if followed, will enable organizations to (i) make a comprehensive evaluation of all risks that could keep them from achieving their goals and objectives and thus hinder their success, including risks to key assets; (ii) gauge the severity of those risks, the likelihood of their occurrence, and the anticipated consequences; and (iii) develop and implement well-designed mitigation strategies commensurate with the levels of risk presented, and consistent with the nature of the operations and the risk appetite of the organization. A standardized approach, such as that outlined in the International Organization for Standardization (ISO) Risk Management Guidelines (2018),38 provides: a reliable and tested framework, a common agreed terminology, and a comprehensive implementation process. Figure 5.1 outlines this standard process of developing and implementing a risk management approach across an organization.

This enterprise risk management (ERM) approach, outlined in ISO 31000:2018, is designed to lead the organization through a systematic, repeatable process to comprehensively identify and quantify all the risks that could keep the organization from achieving its goals and objectives. The organization must then decide, at a senior level, and having regard to the nature of its operations, what level of risk can be tolerated (risk appetite) in various areas of its activities. The extent to which risks need to be mitigated is guided both by the assessed severity of the risk, and by this risk appetite analysis.

Examples of enterprise risks are

• interruptions or failure of IT systems;

• financial mismanagement, including fraud and corruption;

Figure 5.1: ISO Risk Management Process

ISO = International Organization for Standardization.

Source: ISO 31000:2018 Risk Management Guidelines.

• human resource gaps, including insufficient or inadequately qualified staff, and risks to staff well-being, health and safety;

• failure to achieve core organizational business goals (for revenue bodies, this is known as compliance risk); and

• infrastructure vulnerabilities, such as power failures, fires, and data losses.

The case study laid out in this section and the next may help explain both ERM and how it relates to compliance risk management (CRM). It describes the approach taken by the Australian Taxation Office (ATO), in two parts: Part 1 outlines how the ATO aligns enterprise risk analysis with the organization’s high-level goals, while Part 2 deals with the application of CRM.

Case Study (Part 1): The Australian Taxation Office—Aligning Enterprise Risks with Strategic Goals and Objectives

In its corporate plan for 2018–2019, the ATO lays out five perspectives or views on its business, and then identifies nine strategic objectives to support the delivery of its organizational goals, across each of these five perspectives. The ATO ERM framework summarized in Box 5.1 is presented within the context of these same five perspectives and nine strategic objectives. The ATO ERM framework details the strategic risk focus areas, which are then used to frame further, more detailed risk analysis, including a breakdown of the nine strategic objectives into operational-level risks. For each of these risks, the ATO has developed specific risk mitigation strategies, designed to manage each of the risks down to levels acceptable to the organization, as determined by the approved risk appetite for each key area.

Box 5.1: Enterprise Risk Management Approach of the Australian Taxation Office

Actively identifying and managing risk is inherent to the achievement of our objectives as an organization.

We have well-established systems of risk oversight and management that align with the Commonwealth Risk Management Policy and supports our compliance with section 16 of the Public Governance, Performance and Accountability Act 2013.

Australian Taxation Office risk appetite

As an organization, we recognize that positive engagement with risk is necessary to make the most of opportunities, deal with threats, foster innovation, and to build a strong risk culture throughout the ATO. This means:

• Where there is a clear opportunity to realize benefits, and risks can be controlled to acceptable levels, we are willing to accept a higher level of risk.

• Where we are less certain the benefits will be realized, or risks are unable to be controlled to acceptable levels, we have a lower appetite for risk.

Our strategic risk focus is aligned to our objectives and guides risk management activity across the organization:

Government

• G1: Ensuring that people pay the right amount, and that our administration of the system is fair and effective.

• G2: Ensuring our approach is streamlined, integrated, future focused and considers a whole-of-system view.

Client

• C1: Ensuring our products, services and systems support a consistent client experience end-to-end.

• C2: Ensuring we maintain productive and future focused stakeholder relationships to deliver on common objectives.

Workforce

• W1: Ensuring we build our future-ready workforce, while still meeting our current needs.

• W2: Ensuring the experience we give our staff complements the client experience and can be delivered within the context of our budget and employment framework.

Operational

• O1: Ensuring we develop a targeted and effective data analytics and insights capability.

• O2: Ensuring our systems and services are reliable, and clearly aligned with business needs, while innovating with the changing environment.

Financial

• F1: Ensuring we develop a more agile, integrated and consistent approach to what we prioritize and where we invest.

Source: Australian Taxation Office website (www.ato.gov.au, accessed 20 February 2019).

B. Compliance Risk Management

The core business of regulatory agencies is maximizing compliance with the laws they administer. Many revenue bodies turn to their ERM framework to guide this work and provide methodological structure to the approach. Although the risk management techniques used in ERM are relevant, revenue bodies have long recognized that taxpayer CRM is a specialized activity, best supported by processes that are designed specifically for that purpose. Responding to this need, in 2004 the OECD published a guidance note on approaches to managing and improving taxpayer compliance.39 The CRM process discussed in this publication seeks to support revenue bodies in their goal to maximize taxpayers’ voluntary compliance by promoting approaches designed to address the underlying causes of noncompliance. By addressing the underlying causes of noncompliance, rather than simply treating the observed symptoms, revenue bodies seek to achieve longer-lasting impact.

The CRM process sets out a series of steps for identifying, assessing, and prioritizing systemic compliance risks, so that treatments informed by an understanding of the risk itself and the drivers of the observed behaviors can be developed. Ongoing monitoring of the impact of treatments enables improvements to be made throughout implementation. Evaluation of the impact on voluntary compliance, against the core compliance obligations (correct registration, on-time filing, correct reporting, and on-time payment), provides an assessment of the effectiveness of those treatments. Figure 5.2 summarizes the recommended process, which may be applied similarly across the tax system or to revenue types, business segments, industry sectors, or specific risk categories.

This approach to CRM is designed to operate at the system, segment, sector, and risk category level, and is generally not focused at the case level. Although case selection and risk treatment at the individual taxpayer level are important parts of compliance risk mitigation, they represent only one element of the broad range of activities required in a comprehensive CRM approach. CRM is not about case selection or the application of case-level interventions.

It is widely recognized that revenue bodies must focus on improving taxpayers’ voluntary compliance, as this is the only affordable and sustainable approach available. It is also generally agreed that voluntary compliance is best supported through an approach designed to deal with the underlying causes of noncompliance, as well as with the incidents of noncompliance identified. Therefore, the ultimate goal of any compliance intervention is to strengthen voluntary compliance. In a self-assessment system, this means understanding and treating system vulnerabilities and developing a range of approaches to influence taxpayer compliance behavior more effectively. System vulnerabilities, sometimes referred to as risk categories, may include (i) aggressive tax planning; (ii) operations outside the tax system (underground or shadow economy); (iii) base erosion/profit shifting; (iv) e-commerce; and (v) preferential tax regimes.

Part 2 of the ATO case study outlines the principal features of the process adopted by the ATO when developing strategies and plans for addressing the various compliance risk categories it has identified.

Case Study (Part 2): Australian Taxation Office—Compliance Risk Management

The ATO ERM framework (see Case Study, Part 1) includes the broad risk to taxpayer compliance captured under the Government perspective or focus area. It is expressed in the following terms:

G1: Ensuring that people pay the right amount and that our administration of the system is fair and effective.

The ATO approach then follows a series of steps designed to determine the priority risks to be treated and the extent of treatment required to reduce the risk to an acceptable level. The result of these steps is the development of a compliance improvement program, to be implemented in order to manage all the priority compliance risk categories. These steps are summarized in Box 5.2.

Enterprise and Compliance Risk Management in Asia and the Pacific

Revenue bodies were asked ...

Table of contents

- Front Cover

- Title Page

- Copyright

- Contents

- Tables, Figures, and Boxes

- Acknowledgments

- Executive Summary

- Abbreviations

- I. Introduction

- II. Tax Revenues and Tax Structures

- III. Institutions, Governance, and Organization

- IV. Use of Modern Technology in Tax Administration

- V. Managing Taxpayer Compliance

- VI. Legislated Administrative Frameworks

- VII. Tax Administration Operations

- VIII. Human Resource Management

- IX. Financial Resources For National Tax Administration

- Appendixes

- References

- Footnotes

- Back Cover