![]()

Chapter 1

Introduction to the financial system

1.1 Introduction

We begin our study of the UK financial system with an introduction to the role of a financial system in an economy. The financial system is at the heart of the economy, supplying finance, enabling transfers of payments and enabling agents to manage risk. In the UK economy, which has an international financial system, that system also provides many jobs, and makes a significant contribution to the output of the country and the balance of payments. We start the introduction with a very simple model of an economy and then extend the analysis throughout the rest of this and the next chapter. A second objective is to establish some of the basic financial concepts which will be drawn upon throughout this book

1.2 The role of the financial system

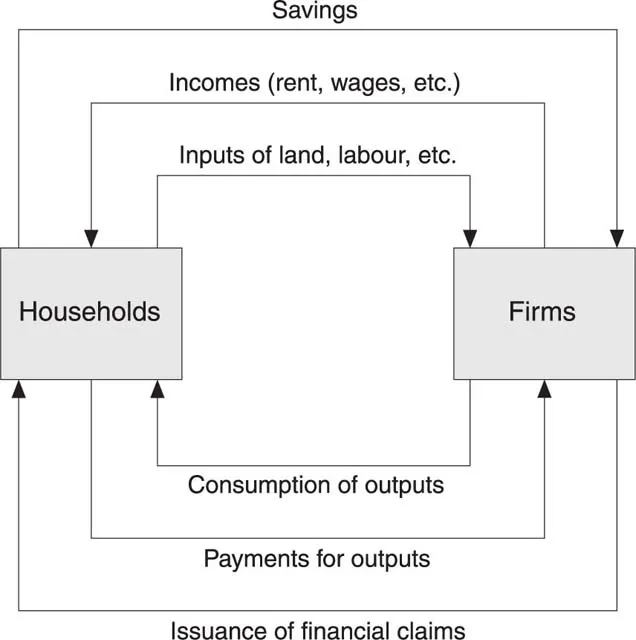

To help us to understand the role played by a financial system in a mature economy such as that of the UK we start by constructing a simplified model of an economy. In this model the economy is divided into two distinct groups or sectors. The first is the household sector, which is assumed to be the ultimate owner of all the resources of the economy. In the early stages of development of an economy the household unit would have undertaken production of any goods consumed. As economies have developed, a form of specialisation has generally taken place so that the proximate ownership and control of much of the productive resources of the economy, such as land, buildings and machinery, have been vested in units making up the second sector, which we call the firms sector. We will examine the financial relationships between these two sectors later. In our simple model it is the firms sector which organises the production of goods and services in the economy. In exchange for these goods and services, households hire out their resources of land, labour and so on. At this stage we ignore the role of the government and we assume that the economy is closed, so that there is no exchange of goods and services with other economies. The real flows in this simple economy are set out in the inner loop of figure 1.1.

Figure 1.1 The circular flow of income, expenditure and finance

In this simple economy it would not be an easy task for households to attempt to satisfy their wants. The greater the number of commodities available in the economy, the greater would be the task. This can be seen by considering the choices open to households. Households can consume the commodities they own, they can exchange these commodities for commodities owned by other households, or they can use these commodities as inputs to create new commodities. In the last situation the household would have to hire out the commodities to an existing firm in exchange for the firm’s output or alternatively create a new firm. In the case of exchanging commodities with other households there would clearly be many difficulties. For a successful transaction to take place between two parties in such a barter economy, it is necessary for each of the two parties to want simultaneously that which the other party is offering to exchange. This requirement is termed ‘double coincidence of wants’. There would be considerable costs involved both in searching for a suitable party with which to trade and also in reaching an agreement over the terms of the trade. Such costs would limit the amount of trade taking place and would eventually lead to pressure for general agreement to use a single commodity as a standard unit of exchange, into which all other commodities can be converted. The commodity used as the unit of exchange is known as money and various commodities have been used as money over time, including cowrie shells, cattle, gold, silver and cigarettes. The main criterion for the development of a commodity as money is that it is generally acceptable in exchange for other commodities. With the development of money, the act of sale can be separated from the act of purchase.

We can now introduce money into our simple economy so that households are paid in money for the resources they hire out to firms and in turn households use that money to purchase the outputs of firms. The middle circuit in figure 1.1 denotes these monetary flows and are the flows corresponding to the real flows of goods and services occurring in the opposite direction. We should note that by aggregating all firms into one sector we are considering flows taking place only between firms and households and are therefore ignoring the considerable flows which take place between firms. That is to say, we are considering only inter-sector flows and ignoring intra-sector flows.

In this simple economy any expenditure in excess of current income by a household or a firm could occur only if the household or firm had accumulated money balances by not spending all of its income received in past periods. This is clearly a constraint on economic development, since firms need to invest, that is, replace, maintain or add to existing real assets such as buildings and machinery. As the economy becomes more sophisticated, investment requires larger amounts of accumulated funds. Various expedients were developed to enable firms to overcome such constraints. For example, partnerships were formed so that accumulated savings could be pooled. The next major stage in the development of financing arrangements came with borrowing. Those households which did not spend all of their current income on consumption, that is, saved some of their income, could lend these funds to firms, which in turn could use these funds to finance investment. In exchange for these funds, firms would issue claims, which are effectively sophisticated IOUs, which promise some benefits to the lender of funds at some date or dates in the future. The nature of financial claims and the various types of claims in existence are discussed in the next section.

The ability to finance investment through borrowing undoubtedly encourages economic development and the existence of financial claims also stimulates household saving. The investment and saving flows in our simple economy are represented by the outer loop of figure 1.1. The non-spending of income (or saving) by households can be regarded as a leakage of funds from the circular flow of income and expenditure captured in the middle loop of figure 1.1. This household saving, though, finds its way into firms’ investment and firms’ investment involves the purchase of capital equipment from other firms, so the leaked funds are injected back into the circuit.

We can now see one of the main roles of a financial system, which is to provide the mechanisms by which funds can be transferred from those with surplus funds to those who wish to borrow. In other words, the financial system acts as an intermediary between surplus and deficit units. In terms of figure 1.1, this function is represented by the outer loop. It is clear therefore that the financial system plays an important role in the allocation of funds to their most efficient use among competing demands. In a market system such as the UK financial system, this allocation is achieved through the price mechanism, with the various prices being set within the relevant financial markets, which are themselves part of the financial system. The existence of financial markets also enables wealth holders to alter the composition of their portfolios. A second role for a financial system is to provide the mechanisms for the middle money flows, that is, the payments mechanism. Further functions of a financial system, which will be explored throughout this book, are the provision of risk management services through insurance and derivatives, as well as the provision of special financial services such as pension services.

We examine in the next section the nature of the financial claims which underlie these flows.

1.3 Financial claims

A financial claim can be defined as a claim to the payment of a sum of money at some future date or dates. A borrower of funds issues a financial claim in return for the funds. The lender of funds holds the borrower’s financial claim and is said to hold a financial asset. The issuer of the claim is said to have a financial liability. By definition therefore the sum of financial assets in existence will exactly equal the sum of liabilities in this closed economy. To take an example, a bank deposit is a sum of money lent by an individual or company to a bank. The deposit is therefore a liability of the borrower of funds, which is the bank. The depositor holds a financial asset, that is, a financial claim on the bank. Another term commonly used to denote a financial claim is a financial instrument.

The existence of a wide variety of financial instruments in a mature financial system, such as the UK system, can be explained by reference to consumer theory. Traditional consumer theory explains the demand for a commodity in terms of utility and a budget constraint, with the implication that a particular good can be identified as separate from other goods. In contrast Lancaster (1966) argues that:

(i) all goods possess objective characteristics, properties or attributes;

(ii) these characteristics form the object of consumer choice.

In the same way, a financial instrument can be considered to be a ‘bundle’ of different characteristics. Because individual agents place different emphasis on the various characteristics, a wide range of financial instruments is supplied. It is now necessary to examine the different characteristics possessed by financial instruments. The most important of these are risk, liquidity, real value certainty, expected return, term to maturity, currency denomination and divisibility.

1.3.1 Characteristics of financial claims

Risk

Risk is a fundamental concept in finance and it is one to which we will return many times throughout the book. What follows is a brief introduction to the nature of financial risk.

When we...