![]()

1

The Big Picture

In 2005, Kerry Emanuel, a professor of atmospheric science at MIT, published a controversial paper in Nature linking global warming with the rising intensity of hurricanes (Emanuel, 2005). The paper relied on historical records showing that the intensity of Atlantic storms had nearly doubled in 30 years. What caught people's attention, however, was not this alarming statistic, but rather that it was released just three weeks before Hurricane Katrina displaced 1 million people and left an estimated 1836 dead.

For hurricane watchers, 2005 was indeed a year for the record books. A startling number of hurricanes hit the Gulf of Mexico, causing over US$100 billion in damages. The 2004 hurricane season was a bit less horrific in terms of raw numbers, but what it lacked in quantity, it made up for in oddity. The year was marked by an event some believed to be a scientific impossibility – a hurricane in the southern Atlantic Ocean. For over 40 years, weather satellites circling the globe had seen hurricanes and cyclones in the northern Atlantic and on both sides of the equator in the Pacific, but never in the southern Atlantic – until 2004. On 28 March 2004, Hurricane Catarina slammed into Brazil, suggesting that recent weather patterns are starkly different from those of the 20th century.

What is going on? Are these freak occurrences or signs of something bigger? In 2008, Kerry Emanuel again sought answers to these questions. This time, however, the team of scientists he led used a completely different approach. Instead of using historical records, they worked with Global Circulation Models that scientists around the world now use to forecast the effects of climate change under different conditions. The models, says Emanuel, do not explain the real world pattern perfectly, but they do show one thing without a doubt: ‘The idea that there is no connection between hurricanes and global warming, that's not supported’ (Emanuel et al, 2008).

While there is no level of data or anecdote that that will satisfy hardened sceptics, many scientists now believe, like Emanuel, that the increasing intensity of storms over the Atlantic is merely a symptom of a bigger problem: global climate change. As the Earth's average temperature grows warmer, they say, atmospheric and oceanic patterns are beginning to shift, fuelling increased storms and unusual weather events.

Temperatures at the planet's surface increased by an estimated 1.4 degrees Fahrenheit (°F) (0.8 degrees Celsius (°C)) between 1900 and 2005. The past decade was the hottest on record during the last 150 years, with 2005 being the warmest year on record during that time (NASA, 2007).

Again, sceptics argue that this is part of the natural variability in the Earth's temperature, but the majority of scientists now agree that it is more likely due to increased concentrations of heat-trapping greenhouse gases (GHGs) in the atmosphere. The US National Oceanic and Atmospheric Administration (NOAA) reported that carbon dioxide (CO2), the most common GHG, is increasing at ever faster rates. Between 1970 and 2000, CO2 concentrations rose at an average annual rate of 1.5 parts per million (ppm). That average has ticked upward to 2.1ppm since 2000, and in 2007 the mean growth rate was 2.14ppm. Atmospheric CO2 levels are now higher than they have been for at least the last 650,000 years (NOAA, 2008).

Box 1.1 A look at the science

Prior to the industrial revolution of the 18th and 19th centuries, the atmospheric concentration of CO2 was approximately 280 parts per million (ppm). Today, the atmospheric concentration of CO2 has risen to 387 ppm (NOAA, 2008), largely because of anthropogenic emissions from the burning of fossil fuels used in transportation, agriculture, energy generation and the production of everyday materials. The loss of natural carbon sinks (places where carbon is pulled out of the atmosphere and trapped either in geological formations or in biological organisms) – on land and in the ocean – is also contributing to increased levels of CO2 in the atmosphere.

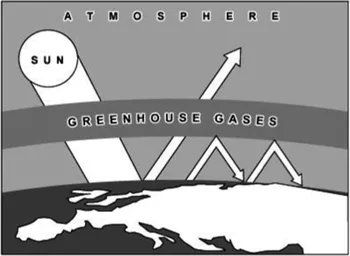

The rapid rise in concentration of CO2 in the atmosphere concerns scientists because CO2 is a greenhouse gas. GHGs allow sunlight to enter the atmosphere, but they keep the heat released from the Earth's surface from getting back out.

While recent trends show a gradual warming trend of the Earth's surface, some scientists fear future climate change will not be linear. ‘The Earth's system’, says Wallace Broecker, Newberry Professor of Earth and Environmental Sciences at Columbia University, ‘has sort of proven that if it's given small nudges, it can take large leaps. By tripling the amount of carbon dioxide in the atmosphere, we are giving the system a huge nudge’ (Hawn, 2004).

The ‘large leaps’ to which Broecker refers are better known as ‘abrupt climate changes’ in the world of science. Over the course of thousands of years, such changes have left geological records of themselves in ice cores and stalagmites. These records show that past temperature swings on our planet have been as large as 18°F (7.8°C) and have occurred over time scales as short as two years.

Using the analogy of a car moving along an unknown road at night, Klaus Lackner, a geophysicist at Columbia University, argues that our incomplete understanding of the natural system is no excuse for delaying action: ‘We sort of vaguely see in the headlights a sharp turn. There are two possibilities.

Figure 1.1 The greenhouse effect

Source: Pew Center on Global Climate Change, 2001

You can say: “I'm going to ignore that and keep going at 90 miles an hour because you cannot prove to me that the curve is not banked and therefore I might make it” … or you can put on the brakes’ (Hawn, 2004).

Noting that there could be an oil slick and no bank to the road, Lackner says the good news is that we have the technology to put on the brakes. He adds, however, that if we want to stabilize the amount of CO2 in the atmosphere at double the natural level (roughly 500ppm, which still might leave us with an ice-free Arctic Ocean), we have to start now (Hawn, 2004). The most recent report from the Intergovernmental Panel on Climate Change (IPCC) concluded that ‘green-house gas emissions at or above current rates would cause further warming and induce many changes in the global climate system during the 21st century that would very likely be larger than those observed during the 20th century’ (IPCC, 2007).

Market theory

To start towards stabilized levels of atmospheric CO2, climate policy makers argue that we not only need to prime the research pump behind clean energy technologies and emission reductions strategies; we must also generate the market pull for them.

Enter the global carbon market. Many think markets for emissions reductions are among the most innovative and cost-effective means society has of creating a market pull for new clean energy technologies while, at the same time, putting a price on pollution and thereby providing incentives for people to emit less.

The theory is that carbon markets are able to achieve this magic because they help channel resources towards the most cost-effective means of reducing greenhouse gas emissions. At the same time, they punish (monetarily) those who emit more than an established quota, and reward (again, monetarily) those who emit less. In so doing, they encourage people to emit less and change the economics of energy technologies, making technologies that emit less carbon more competitive vis-à-vis their carbon-intensive counterparts.

There is other magic at work as well. By turning units of pollution into units of property, the system makes it possible to exchange pollution from CapeTown with pollution from Cape Cod. If business managers find reducing their company's emissions too costly, they can buy excess reductions from a facility where reductions are less expensive. The bigger the market, the theory goes, the greater the likelihood that efficiencies will be found.

By aggregating information about the value of carbon allowances, the market is sending signals to potential polluters. In a world where pollution has no price, the default decision will always be to pollute, but in a world where pollution has a financial cost, the decision is no longer easy. In today's European emissions market, for instance, emitting 1 tonne of CO

2 has in the past cost polluters anywhere from

7.02 up to

32.85. Polluters suddenly must consider a new suite of options: do they accept the cost of added pollution, change fuel mixes or simply conserve energy?

Once markets take shape, emitters have a variety of options available to them. If they believe they can reduce emissions cheaply by changing production processes or experimenting with new technologies, they have an incentive to do so. If they believe they can change their production process, but that this will take time, emitters can purchase credits up front in the hope that they will be able to make them back through the use of emission reductions technologies down the line. If, on the other hand, emitters believe they will emit more in the long run, they can buy credits now (or options on credits once secondary markets develop) for use later. In short, the system enables the trading of emissions across temporal as well as geographic boundaries – a basic benefit of markets.

The market-based approach also allows other, third party players such as speculators to enter the fray. By agreeing to take on market risks in exchange for possible paybacks, speculators assume the risks that others are either unwilling or unable to shoulder. Other interested parties in addition to speculators can also get involved. If, for example, an environmental group wants to see emissions decrease below a regulated target, they can raise money to buy and retire emissions allowances. This drives up the cost of emissions and can force utilities to become more efficient.

It is, of course, important to note that some people dispute the net gain of this approach, and others feel that markets allow companies to ‘greenwash’ previously tarnished environmental reputations without changing their behaviour in important ways. ‘Carbon offsets are based on fictitious carbon accounting, and can by themselves not make a company carbon neutral,’ argues Larry Lohmann of The Corner House, a UK-based non-governmental organization (NGO). ‘The practice of offsetting is slowing down innovation at home and abroad and diverting attention away from the root causes of climate change’ (Wright, 2006).

This debate notwithstanding, experimentation with environmental markets is now widespread. Ever since the US established the first large-scale environmental market (to regulate emissions of gases that lead to acid rain) in 1995, we have seen environmental markets emerging in everything from wetlands to woodpeckers.

Carbon markets

The term ‘carbon market’ refers to the buying and selling of emissions credits that have been either distributed by a regulatory body or generated by GHG emissions reductions projects, respectively. Six GHGs are generally included in ‘carbon’ markets: carbon dioxide, methane, nitrous oxide, sulphur hexafluoride, hydrofluorocarbons and perfluorocarbons.

GHG emissions reductions are traded in the form of carbon credits, which represent the reduction of GHGs equal to 1 metric ton (tonne) of carbon dioxide equivalent (tCO2e), the most common GHG. A group of scientists associated with the IPCC has determined the global warming potential (GWP) of each gas in terms of its equivalent in tonnes of carbon dioxide (tCO2e) over the course of 100 years. For example, the GHG methane has a GWP roughly 23 times greater than CO2, hence 1 tonne of methane equals about 23 tCO2e. Likewise, other gases have different equivalences in terms of tCO2e, with some of them (perfluorocarbons) worth thousands of tonnes of CO2e.

Carbon credits can be accrued through two different types of transactions. In project-based transactions, emissions credits are the result of emissions reductions achieved by a specific carbon offset project. Allowance-based transactions involve the trading of issued allowances (also known as permits) created and allocated by regul...