![]()

Part I

The investment lifecycle

This section of the book details all the ownership phases for a hotel investor, outlining ownership issues, buying criteria, development and construction parameters, as well as the oft-forgotten phase: the exit.

The intention is to allow all those involved in the hospitality industry to review the typical phases of the investment lifecycle, as well as allowing potential developers, purchasers, owners or sellers to review the individual chapters of direct interest to them.

The first chapter provides an introduction to hotels and resorts, providing commentary on who invests in such properties, as well as why they invest.

The second chapter provides an ‘ownership guide’, outlining the various types of ownership of such properties, including the various legal agreements common in the industry. In addition, it reviews ‘asset management’ in terms of the hospitality industry.

The third chapter provides a ‘buyers’ guide’, which discusses what makes a good buy, including risk versus reward, in terms of pricing and yield selection.

The fourth chapter is the ‘development guide’ and outlines the ‘development road map’, discusses the need for a feasibility study, outlines the main criteria involved in operator selection and discusses the key components involved in designing a hotel or resort.

The fifth chapter comprises the ‘construction guide’ and outlines how to identify, understand and manage the risk inherent in the construction process.

Finally, Part I concludes with a chapter dealing with disposal. The ‘selling guide’ explains the disposal process, discusses enhancing value and advises on how to maximise the price achieved during the sale.

![]()

1

Introduction to hotels, resorts and leisure property buyers

What is a hotel/resort?

This book is primarily about the hospitality industry and covers hotels, resorts and associated leisure properties. As such, it is important to define what we mean by these terms. Probably the easiest place to start with is ‘hotel’, as the vast majority of people think they already know what a hotel is. According to the Oxford English Dictionary, a hotel is ‘an establishment providing accommodation, meals, and other services for travellers and tourists, by the night’. Wikipedia, on the other hand, defines a hotel as ‘an establishment that provides lodging paid on a short-term basis’. As you can see from these two sources there is not a consistent definition of what a hotel actually is, with the Oxford English Dictionary definition talking more about full-service hotels, while Wikipedia uses a ‘short-term’ definition, which excludes the whole of the extended-stay part of the market.

What is agreed by all is that a hotel provides a bed for a guest to stay for the night (or longer). That bed can be in a shared room or a private room, with or without an exclusive bathroom, and with or without breakfast or other food options. The hotel could have meeting spaces, leisure facilities, car parking and other facilities. It could be of a luxury standard, or provide only the most basic letting accommodation. The letting period can be for a number of hours or for an extended period. These are all differences between various market segments and not things that define a hotel.

A hotel is not a private apartment let for over six months at a time (effectively a long-term contract), although hotel rooms can be let for periods longer than this time. A ‘couch-share’ is not a hotel room either, albeit this relatively new market is having an impact on the profitability in some segments of the hotel market.

A resort differs slightly from a hotel, insofar as it usually has more facilities than a stand-alone hotel. These facilities provide part of the attraction to guests, and are an integral part of why the booking is made. Most resorts will have various standards of accommodation available to guests, along with a variety of facilities, for example, swimming pools, restaurants, bars, tennis courts, a golf course, a spa, a beach bar or a conference centre.

The importance of hotels

Since the 1960s, hotels have been becoming more and more important as economic drivers across the world. The US hospitality industry has typically led the way with Europe, then Asia and South America, following, and, in recent years, with Africa following on strongly. The increase in supply has been dramatic but for the most part it has been market-led, as a change in the economic environment has generated a greater demand for hotel rooms across large parts of the world.

There are many reasons why the hotel industry is important to the wider economy.

Changing dynamic of demand

As business has required people to move further and further afield, the provision of hotel accommodation has been essential to the smooth running of the worldwide economy. International conglomerates requiring places where staff can meet up, accommodation for travelling sales people, convenient accommodation for inconveniently timed flights, conference hotels for networking events, places to stay while visiting friends and family or luxury resorts to unwind for a well-earned holiday have all enhanced demand for hotels.

Arguably, as an economy changes its structure from a primary economy (farming and mining) to a secondary economy (manufacturing), through to a tertiary (service-led) economy, the level of demand for hotel accommodation has increased throughout the cycle. Indeed, eventually, as the economies mature, there are examples where people are staying in a hotel purely for the experience of staying there, rather than for any practical reason.

As an investment class

The size of the worldwide hotel industry is estimated to have increased significantly over the last 100 years, and continues to grow at different rates in different regions. According to STR Global, in the ten years up to 2014, the number of hotel bedrooms grew by 1.03 per cent in the Americas, 3.61 per cent in Asia-Pacific, 1.02 per cent in Europe and 2.68 per cent in the Middle East and Africa.

As an employer

Hotels employ a wide range of people across all segments of society, from professional staff to unskilled labour, thereby providing opportunities for the local population to enhance their economic standing through hard work and training. As the size of the hotel market increases, so does its impact on direct job creation. In addition, it generates secondary employment in complementary industries (for example, laundry services, taxi services, etc.). It is estimated that for every direct job created in the hotel industry, an additional eight jobs are sustained through indirect means (taxi drivers, waiters and chefs, bar staff, laundry workers, staff at suppliers, etc.), ensuring that hotels are one of the most effective ways to enhance employment prospects in the local area.

Earning foreign currency

Many hotels cater to non-domestic guests and have the ability to earn much needed foreign currency, helping governments balance their foreign exchange revenues.

Generating taxable revenues

A hotel generates significant amounts of taxable revenue for the tax authority if it is well located. Income tax from the staff, company tax on the profit of the business, property tax, licence fees and capital gains tax (when the property is sold) are the key taxes, making hotels a key contributor to local and national revenues.

As a place to do business

One of the first steps for most newly developing countries is to develop a quality hotel, as without one there is limited opportunity to attract international developers and investors into the country to discuss business opportunities.

Enhancing the status of a country in the eyes of the world

A quality hotel can help enhance the perception of a country to other nationalities who know little about that country.

What actually is real estate?

Hotels, resorts and leisure properties are all real-estate investments. Real estate (sometimes called ‘real property’ or even just ‘property’) consists of land and/or buildings. The capital value attached to the real estate as an investment is directly linked to the transferability of the ownership interest in the property. If an interest in land and/or a building cannot be transferred to another party, then there is essentially no capital value attached to that interest, although the use of the site might be worth something to the current occupier.

All around the world there are many ways to hold real estate and, in simple terms, the less restrictions on the ownership of the land, the more that particular interest in the land is worth. Land law varies but in essence, the more you can do with the land, the longer it is owned for and the easier it is transferred, the more it will be worth.

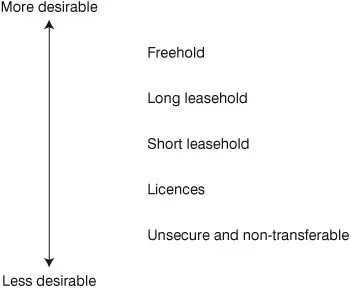

As such, freehold title is usually preferred by most investors to leasehold title, which in turn is considered to be more desirable than commonhold land and licences.

Figure 1.1 Desirability of tenure

Land law varies across the world but essentially, leasehold title transfers the right to exclusively use the property for a specific period and over that period of ownership, restrictions can be placed upon the use and enjoyment of the land and/or buildings.

Commonhold is relatively prevalent for residential properties in Australia and the US, but in terms of resorts, it tends only to be seen when looking at mixed-use resorts where timeshare or fractional ownership has been introduced. Commonhold effectively replicates freehold title for multi-occupancy buildings where traditionally only leasehold title would have been possible.

Licences, on the other hand, allow for the use of a property/building on a non-exclusive basis, which generally means that it has limited transferability (and therefore value).

In terms of a hotel investment, the ‘property’ being transferred is effectively the land, the building(s) and the operational business (or the benefits of an operational lease).

Appeal of real estate as an investment

In simple terms, an investment is somewhere that money is placed to either protect the capital invested or to earn a return, or ideally both. Real estate is one class of investment that can provide both an income (rent received) as well as capital growth. Other investment options are extensive and include items as diverse as government bonds, savings accounts, art, fine wines, stocks and shares.

An investor will choose where to invest their money based upon the specific criteria of that investment and how the options suit their particular requirements. In general, it is true to say that the less risky the investment, the lower the investment returns, and the balance between risk and reward is usually a key investment consideration.

Property has been a very popular investment for a long time because it is considered an area where, in the long term, capital values should rise due to the limitations on supply and perceived long-term increases in demand. Certainly in the UK, residential properties have seen substantial rises in capital value over the last 100 years, led by the increased demand for properties. This is partly down to population increase, partly down to the breakdown of traditional family units and partly down to the increasing availability of borrowing facilities. At the same time, there has been a lower increase in the supply of such properties due to a number of factors, not least various planning restrictions and lack of available land.

Pension funds and other investment institutions have invested in real estate to diversify their investment portfolios. The overall percentage of money invested in property by such a fund varies year on year, based upon the current thinking of the requirements for such investment vehicles. Traditionally though, such investment tended to be limited to retail, commercial and industrial property investments as they were seen as safer than other asset classes and there was a strong and measurable market.

Investment characteristics of real property

Real property has some key attributes that define its relative attractiveness to various different types of investors. Below they are divided into what are generally seen as positive attributes and negative attributes.

Positive attributes

Security

The relatively consistent demand, along with the perception that ‘wealthy’ people own real estate, ensures it has a consistent popularity as an investme...