- 666 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Derivatives Markets

About this book

Derivatives Markets is a thorough and well-presented textbook that offers readers an introduction to derivatives instruments, with a gentle introduction to mathematical finance, and provides a working knowledge of derivatives to a wide area of market participants.

This new and accessible book provides a lucid, down-to-earth, theoretically rigorous but applied introduction to derivatives. Many insights have been discovered since the seminal work in the 1970s and the text provides a bridge to and incorporates them. It develops the skill sets needed to both understand and to intelligently use derivatives. These skill sets are developed in part by using concept checks that test the reader's understanding of the material as it is presented.

The text discusses some fairly sophisticated topics not usually discussed in introductory derivatives texts. For example, real-world electronic market trading platforms such as CME's Globex. On the theory side, a much needed and detailed discussion of what risk-neutral valuation really means in the context of the dynamics of the hedge portfolio.

The text is a balanced, logical presentation of the major derivatives classes including forward and futures contracts in Part I, swaps in Part II, and options in Part III. The material is unified by providing a modern conceptual framework and exploiting the no-arbitrage relationships between the different derivatives classes.

Some of the elements explained in detail in the text are:

- Hedging, Basis Risk, Spreading, and Spread Basis Risk

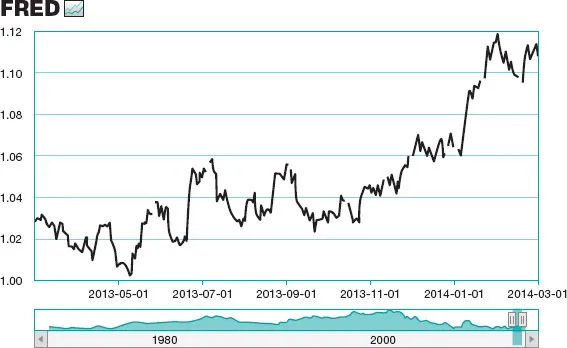

- Financial Futures Contracts, their Underlying Instruments, Hedging and Speculating

- OTC Markets and Swaps

- Option Strategies: Hedging and Speculating

- Risk-Neutral Valuation and the Binomial Option Pricing Model

- Equivalent Martingale Measures: The Modern Approach to Option Pricing

- Option Pricing in Continuous Time: from Bachelier to Black-Scholes and Beyond.

Professor Goldenberg's clear and concise explanations and end-of-chapter problems, guide the reader through the derivatives markets, developing the reader's skill sets needed in order to incorporate and manage derivatives in a corporate or risk management setting. This textbook is for students, both undergraduate and postgraduate, as well as for those with an interest in how and why these markets work and thrive.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

| CHAPTER 1 |

SPOT, FORWARD, AND FUTURES CONTRACTING |

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Table of Contents

- List of figures

- List of tables

- Preface

- Acknowledgments

- PART 1 Forward Contracts and Futures Contracts

- PART 2 Trading Structures Based on Forward Contracts

- PART 3 Options

- Index

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app