eBook - ePub

Financial Management in the Public Sector

Tools, Applications and Cases

This is a test

- 216 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Book details

Book preview

Table of contents

Citations

About This Book

The new edition of this popular book provides a step-by-step guide on how to use financial management and budgeting tools in the public sector. The book features a practical, case-study approach, and includes plentiful exercises and examples. It is designed as a textbook for courses on public financial management or public budgeting that focus on the application of budgeting and financial management tools. Public service professionals will also benefit from this handy primer.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Financial Management in the Public Sector by Xiaohu (Shawn) Wang in PDF and/or ePUB format, as well as other popular books in Business & Management. We have over one million books available in our catalogue for you to explore.

PART I

TOOLS FOR FINANCIAL PLANNING

1 Revenue Forecasting

LEARNING OBJECTIVES

After studying this chapter, you should be able to:

- Use forecasting tools presented in this chapter

- Determine the forecast accuracy

- Apply the most accurate tool for forecasting

Why forecast revenue? Revenue forecasting helps financial planning. Because revenue determines service capacity, accurate revenue forecasting allows for a good understanding of an organization’s ability to provide services. Forecasting is also a process through which managers learn about their communities and organizations. For example, how much of a community’s resources can be used to provide services in demand? How capable is the organization of collecting these resources? A poor forecast—a large gap between the forecast and actual revenues—warrants a close look at a community’s resource potentials and an organization’s revenue collection efforts.

Who does forecasting? It is often the responsibility of budget offices or central management offices. Sometimes, individual agencies that have their own resources, such as businesslike enterprise functions in many governments, also forecast their revenues.

What forecasting tools are available? A variety of qualitative and quantitative tools are used in revenue forecasting. The Delphi technique is perhaps the most popular qualitative tool. It is a process in which a group of experts are individually questioned about their perceptions of future events that will affect the revenue flows. Each expert gives a forecasting figure and presents a rationale, and then an outside party summarizes these forecasts and rationales and comes back to the experts with more questions. The process continues until a collective forecast is reached.

Quantitative forecast tools vary from simple smoothing techniques to sophisticated causal modeling. It should be noted that mathematical sophistication is not a guarantee of forecast accuracy. In this chapter we introduce quantitative tools that are simple to understand and easy and inexpensive to use. They are also the proper techniques for most revenue sources in governments.

CONCEPTS AND THE TOOL

Before forecasting, several things need to be determined. First, the forecast subject—what is being forecast—must be decided. Is a tax, a fee, or a user charge being forecast? Is the forecast for the whole organization/jurisdiction, or just a part of it? Second, a forecast horizon—the length of the forecast—must be established. Should the revenue be projected for the next month, the next year, or the next five years?

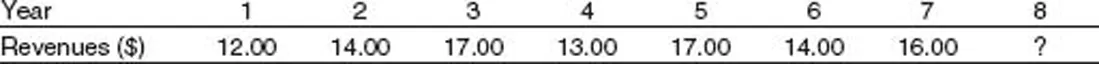

Third, the forecaster must become familiar with forecasting techniques in order to select one that is proper for the forecasting need. This selection involves a comparison of the forecast accuracies of different techniques in order to choose the most accurate one. In this chapter, we study several forecasting techniques that have proven effective, simple to understand, and inexpensive to apply. They are simple moving average (SMA), exponential smoothing (EXS), transformation moving average (TMA), regression against time, and a quasi-causal technique. We can use Microsoft® Excel™ spreadsheet software to help us in these calculations. Excel is a spreadsheet program that can be used to perform quantitative and financial calculations. It is very popular and easy to use. Appendix A of this book provides an introduction to the program. If you are still not comfortable with it, take a look at an introductory manual of the software. You should be ready in no time. First, let us look at an example. The historical revenue information for a hypothetical organization over the last seven years is shown in Table 1.1. Using this information, forecast the revenue of the eighth year.

Forecasting Example One

SIMPLE MOVING AVERAGE (SMA)

Using the simple moving average (SMA) technique, we calculate the arithmetic average of revenues in previous forecast periods (“years” in this case) and use it as the forecast. To do so, we need first to determine the number of forecast periods in calculation. Let us say that we want an average of the previous five years, then the forecast for the eighth year is (17.00 + 13.00 + 17.00 + 14.00 + 16.00)/5 = 15.40. Similarly, a six-year average is (14.00 + 17.00 + 13.00 + 17.00 + 14.00 + 16.00)/6 = 15.17.

SMA is very simple to understand and easy to use. But it has a major drawback—it weighs all previous revenues equally in averaging. In other words, it treats the revenue from ten years ago as if it is as important as last year’s revenue. Common sense says that we should place more weight on the more recent revenue. It is like predicting the outcome of a ball game. A team’s more recent performance should carry more weight in prediction. A team that won recently is the favorite to win again. But that is not the case for SMA. SMA assigns the same weight to all data in averaging. In the above example, each figure in the five-year average is assigned a weight factor of one-fifth. We will come back to this point later in this chapter.

Excel Screen 1.1 Simple Moving Average

We can use Excel to calculate SMA. The following is the Excel programming to calculate SMA.

| Step 1: | Open up a new Excel file. Notice that a sheet is designed for data input in columns and rows. Columns are named by letter; rows are named by number. A particular cell can be located by using a letter and a number such as A1, B2, and so forth. Now, input the revenue data in Column A as shown in Excel Screen 1.1. |

| Step 2: | Load the Data Analysis ToolPak if you have not done so (see Appendix A for loading the ToolPak). |

| Step 3: | Click the “Data Analysis” command in the “Analysis Group” on the “Data” tab if you use Excel 2007 or Excel 2010. If you use Excel 2003, click “Data Analysis” in the “Tools” menu. |

| Step 4: | Select “Moving Average” in the “Data Analysis” window. |

| Step 5: | In the “Input Range,” input $A$1:$A$7 (i.e., selecting Cell 1 through Cell 7 in Column A), as shown in Excel Screen 1.1. |

| Step 6: | Enter 5 in “Interval,” as we used ... |

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Table of Contents

- List of Illustrations

- Preface and Acknowledgments

- Part I. Tools for Financial Planning

- Part II. Tools for Financial Implementation

- Part III. Tools for Financial Reporting and Analysis

- Appendix A: Introduction to Microsoft Office Excel

- Appendix B: Exercise Answers

- Glossary

- Index

- About the Author