![]()

Chapter 1

Introduction

Orsolya Lelkes / Holly Sutherland

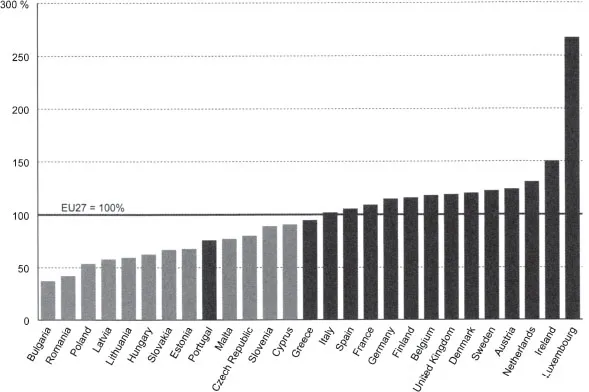

Ten countries joined the European Union in 2004 and two more in 2007. They added greatly to the diversity of the enlarged EU in terms of income levels, as illustrated in Figure 1.1. GDP per capita in Bulgaria and Romania in 2007 was only 40–45% of the EU-27 average, even when adjusted for price differences across countries. Slovenia and Cyprus had the highest level of incomes of the New Member States, close to the EU average and the level of Greece. The relative levels of GDP, however, are not the whole story. Households are directly affected by the level and changes of their incomes, rather than that of the GDP, which has other components as well (e.g. profits).1

The new counties also exhibit different structures of income distribution and pose a variety of economic and social challenges, and brought with them into the EU a wide range of approaches to systems of welfare and redistribution in the form of taxes and benefits (see Ward et al., 2009). On the one hand the ten New Member States from Eastern Europe (Bulgaria, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Romania, Slovakia and Slovenia) have a common history of transition from communist systems, while at the same time having distinctive histories both before and since the transition. On the other hand, the two countries of Southern Europe (Malta and Cyprus) share more with the Southern countries from the “old” EU-15 while, arguably, being at an earlier stage of development. Such an enlargement poses great challenges both for the analysis of European redistributive systems and for policy development. It also offers opportunities. Not only is there now simply a much larger field of study, but also opportunities are opening up for improving analytical capacity within countries and policy learning between countries.

Figure 1.1: GDP per capita in Purchasing Power Standards (PPS), 2007 (EU-27 = 100)

Source: Eurostat on-line database. Date of access: 20 April 2009.

At the same time, the use of comparative evidence based on tax-benefit microsimulation models is in its infancy. While microsimulation models are increasingly used for assessing the impact of policies in individual countries (e.g. Gupta and Harding 2007, Zaidi et al. 2009) and across EU-15 countries using EUROMOD (e.g. Bargain 2006, and see the EUROMOD Working Paper series2), there has been only sporadic evidence so far on the New Member States.3 Such evidence rarely takes a comparative perspective. Nevertheless, with respect to EUROMOD, Atkinson et al. (2002) have emphasized its key role in monitoring and forecasting, and highlighted its virtue in separating the impact of policy parameters from those of changing external circumstances (p. 183). Recently, the EU Task-Force on Child Poverty and Child Well-Being has encouraged Member States and the Commission “to invest inter alia in microsimulation models to support the assessment of the impact of policy measures on the situation of children and their families” (2008:134, emphasis in original).

Against this background this book offers an assessment of income redistribution in the New Member States in the context of Europe as a whole. It explores the impact of tax and benefit systems on individuals’ incomes and work incentives. The special feature of Part II of this book is that the chapters are based on analysis using the multi-country tax-benefit microsimulation model EUROMOD, which has been extended to cover four of the New Member States, thus allowing a systematic and consistent comparison of these countries (Estonia, Hungary, Poland and Slovenia) with those of the “old” EU-15.

This enlargement of EUROMOD was made possible by a European Commission financed project on “Improving the Capacity and Usability of EUROMOD (I-CUE)”. As well as beginning the extension of EUROMOD by adding four new countries, the I-CUE project also paved the way for the addition of the remaining countries by networking with teams of experts, some of whom were already developing their own national tax-benefit models.

Part III of this book presents analysis based on national tax-benefit models for Cyprus and Lithuania, presenting innovative studies that demonstrate the power of the microsimulation method for policy analysis.

An unplanned but most welcome outcome of the I-CUE project was that after identifying potential national experts in the New Member States and explaining the benefits of EUROMOD, some of them have started to develop their own tax-benefit models, tailored to their specific national needs. Similarly, joint work often resulted in research output on issues that had not yet been explored in the specific country. The longer experience of tax-benefit microsimulation in most of the EU-15 could provide important insights for researchers from the New Member States. On the other hand, the policy approaches from the transition countries can have salience in the old Europe. Examples include the lessons drawn from experience of flat tax schemes and the greater reliance on indirect taxes.

One by-product of the I-CUE collaboration was the promotion of the use of tax-benefit microsimulation for informing policy-making and policy-relevant research. This involved serious consideration of the barriers that prevent policy-makers making the most of the tools and expertise on offer. How to maximize the return on the cost of developing models in the future is one of the issues considered in the final chapter of this book.

Another achievement involved making some first steps in using such methods for policy learning across countries. Among the many “What if” questions that EUROMOD can address are those involving implementing common policies in several countries or the import of alternative policies from other countries to test their impact. Here, for example, we explore the introduction of three alternative flat tax schemes in Estonia, Hungary and Slovenia. An experiment w...